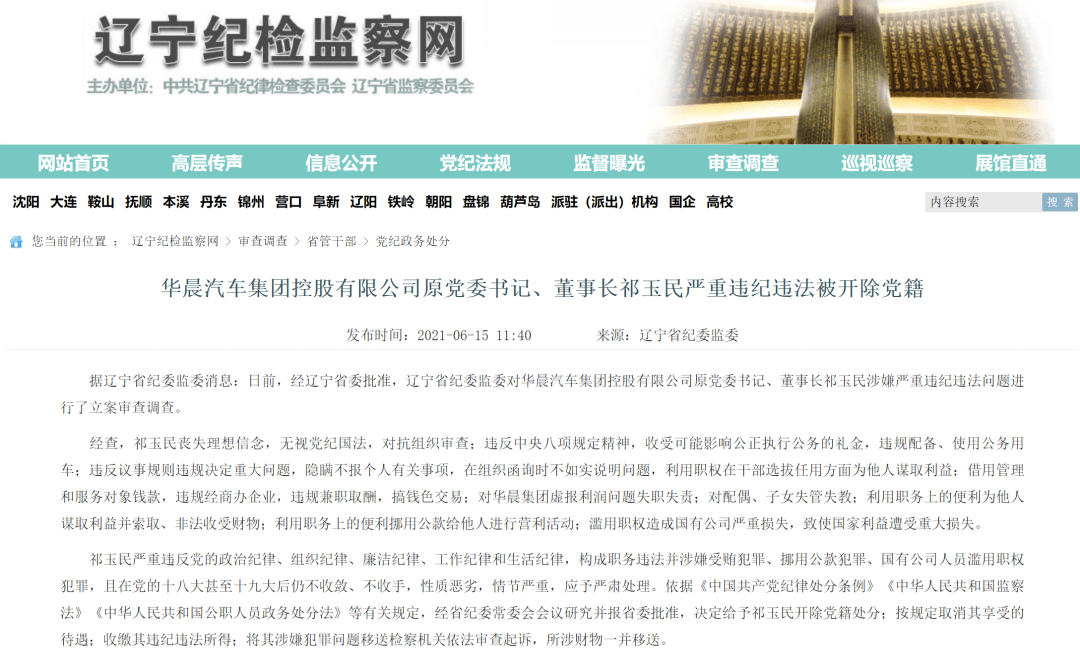

On June 15, according to the Liaoning Provincial Commission for Discipline Inspection: A few days ago, with the approval of the Liaoning Provincial Party Committee, the Liaoning Provincial Commission for Discipline InspectionQi Yumin, the former party secretary and chairman of Brilliance Automobile Group Holdings Co., Ltd., has been investigated and investigated on suspicion of serious violations of discipline and law.

Expelled from the party after more than two years of retirement

According to Liaoning Provincial Commission for Discipline InspectionAccording to the report, after investigation, Qi Yumin lost his ideals and beliefs. Ignore party discipline and state laws and oppose organizational censorshipViolating the spirit of the eight central regulations, accepting gift money that may affect the fair execution of official duties, arranging and using official vehicles in violation of regulations; violating the rules of procedure and violating regulations to determine major issues, concealing personal matters, and failing to truthfully explain the issues when organizing letter inquiries. Use power to seek benefits for others in the selection and appointment of cadres;Borrow money from management and service targets, run business in violation of regulations, get paid for part-time jobs in violation of regulations, and engage in money-and-color transactions; Dereliction of duty and responsibility for the false reporting of profit issues of Brilliance Group; dereliction of control and education of spouses and children; use of the convenience of the position to seek benefits for others and request and illegally accept property;Use the convenience of the position to embezzle public funds to others for profit-making activities; Abuse of power has caused serious losses to state-owned companies and caused heavy losses to national interests.

Qi Yumin seriously violated the party’s political discipline, organizational discipline, integrity discipline, work discipline, and life discipline, constituted a violation of the law and was suspected of crimes of bribery, embezzlement of public funds, and abuse of power by state-owned company personnel. They still do not converge or close their hands after the university, their nature is bad, and the circumstances are serious. They should be dealt with seriously. In accordance with the “Chinese Communist Party Disciplinary Sanctions Regulations”, “The Supervision Law of the People’s Republic of China”, “The Law of the People’s Republic of China on Governmental Sanctions of Public Officials” and other relevant regulations, the Provincial Disciplinary Committee Standing Committee meeting researched and reported to the Provincial Party Committee for approval, and decided to give Qi Yumin expelled from the party; Cancel the treatment they enjoy in accordance with the regulations; collect their income from violations of discipline and law; transfer their suspected crimes to the procuratorial organ for review and prosecution in accordance with the law, and transfer the property involved together.

On December 4 last year, the Central Commission for Discipline Inspection and the State Supervision Commission issued a notice stating that according to the Liaoning Provincial Commission for Discipline Inspection, the former party secretary and chairman of Brilliance Automobile Group Holdings Co., Ltd. (hereinafter referred to as “Brilliance Group”) Qi Yumin was suspected of serious violations of discipline and law. , Is currently undergoing disciplinary review and supervision and investigation.

According to the official resume, Qi Yumin was born in January 1959. After graduating from Shaanxi Institute of Mechanical Engineering in 1982, he joined Dalian Heavy Machinery Factory and served as deputy director and director of the Economic Planning Department. In 1995, he served as the deputy director of Dazhong Group Corporation. Manager, served as general manager of Dazhong Group Corporation in 1998.

In 2000, Qi Yumin served as chairman and general manager of Dalian Heavy Industry Group Co., Ltd., and the following year as chairman and general manager of Dalian Heavy Industry Lifting Group Co., Ltd. In 2004, Qi Yumin served as the deputy mayor of Dalian.

At the end of December 2005, Qi Yumin was transferred to Brilliance Group as the party secretary and chairman of the board. Many years later, Qi Yumin said frankly in an interview with the media, “It was sudden, very tragic, ignorant and helpless to get the transfer order.” It is reported that the Brilliance Group at the time was still in the aftershocks of the Yangrong incident. The middle-level lost dealers fled and suffered serious losses. Qi Yumin, who arrived at that time, was once regarded as the “fire-fighting captain.”

Qi Yumin (Image source: Visual China)

After that, Qi Yumin cashed out on the capital market through Brilliance’s capital operation team, realizing the supplement to Brilliance’s capital. According to the Securities Daily, Qi Yumin clearly stated in an exclusive interview at the company’s 10th anniversary meeting: “Brilliance Auto’s development over the years has mostly relied on its own financing. Therefore, the financing capabilities of the capital market and Brilliance’s capital The multi-channel financing of development by the market is the key support for the development of independent brands.”

Qi Yumin also allowed Brilliance to obtain technical support through cooperation with BMW.

The industry generally believes that in the ten years of cooperation with BMW, Brilliance can not only lie down and make money, but also actually taste the sweetness of “using the market for technology”.However, Brilliance, whose development capability is too weak, has been unable to digest BMW’s technology, and its sales in its independent sector have also been declining, and its market share has been shrinking..

According to the Beijing News, in 2015, Brilliance Zhonghua’s small SUV Zhonghua V3 was officially launched. At that time, Qi Yumin set a goal: China V3 will be a pattern changer in China’s small SUV market;He repeatedly stated, “Before I retire, I must make Brilliance into the Fortune 500.”However, China V3 did not realize Qi Yumin’s sustenance. In 2017 and 2018, the sales of China V3 declined year after year, with annual sales of 36,000 and 12,500, respectively, down 52% and 65.27% year-on-year..

Finally, on October 11, 2018, at the 15th anniversary celebration of BMW Brilliance, Brilliance Group and BMW Group jointly announced that Brilliance Group intends to sell 25% of the shares in BMW Brilliance to BMW Group by 2022, the transaction price is RMB 29 billion yuan,BMW Brilliance will become the first vehicle joint venture company controlled by a foreign party. This has caused Qi Yumin to suffer from public controversy.

Qi Yumin later revealed when he was a guest on CCTV that the prerequisite for BMW’s negotiations at the time was a 75% share ratio, and everything could be discussed, but the share ratio could not be discussed. As a result, Brilliance had to negotiate two agreements with the other party: First, to make the pie of the joint venture bigger, at least to double it, “otherwise it would be meaningless to liberalize the equity ratio.” In addition, the shareholders of both parties have to obtain greater economic benefits,”Three and a half years later, Brilliance has changed from 50 to 25, but the benefits of 25 must be greater than the current 50.”.

On April 1, 2019, when he retired from Brilliance Group, Qi Yumin said with emotion, “The past was cleared, love and hate are at will, I hope Brilliance will always be well”. But now, Qi Yumin and Brilliance are both running counter to the vision.

Brilliance Group went bankrupt and reorganized last year

According to the official website of Brilliance Group, the company has 4 listed companies (Brilliance China Automotive Holdings Co., Ltd., Shanghai Shenhua Holdings Co., Ltd., Jinbei Automobile Co., Ltd., and Xinchen China Power Holdings Co., Ltd.), and more than 160 wholly-owned, holding and shareholding companies the company. There are 47,000 employees,Total assets exceed 190 billion yuan.

Last year, Brilliance had many operating problems. Since July last year,Brilliance Group was caught in a debt turmoil, was exposed to 100 billion yuan in debt, and many equity shares were frozen. In August, Dagong International and Oriental Jincheng successively included Brilliance Group and its multiple bonds on the rating watch list. In September, both Orient Jincheng and Dagong International downgraded Brilliance Group’s main credit rating, among which Dongfang Jincheng downgraded to AA+ and Dagong International directly downgraded it to AA. On October 16, Oriental Jincheng once again downgraded Brilliance Group’s main credit rating to AA-. On October 21, Dagong International downgraded the main credit rating of Brilliance Group to A+.

On November 16 of that year, Brilliance Group disclosed thatThe company has constituted a total debt default amount of 6.5 billion yuan and overdue interest amount of 144 million yuan. Due to the shortage of corporate funds, the renewal credit approval has not been completed, resulting in failure to repay. Then on November 20, the Shenyang Intermediate People’s Court ruled to accept the creditor personality Zhizhi Automobile Technology Co., Ltd.’s application for reorganization of Brilliance Group.Brilliance Group officially entered the bankruptcy reorganization process.

The court’s ruling stated that the assets of Brilliance Group were insufficient to pay off all its debts, and that it had bankruptcy reasons stipulated in the Corporate Bankruptcy Law. But at the same time, the group has the value and possibility of salvation, and the necessity and feasibility of reorganization.

For driving to this position, according to the relevant person in charge of the Liaoning Provincial SASAC,Brilliance Group’s long-term poor operation and management, its own brands have been in a state of loss, and the debt ratio remains high. Since 2018, the Liaoning Provincial Government and relevant departments have been working hard to help Brilliance Group solve its cash flow problems, but its debt problems have been accumulated. This year, affected by the new crown pneumonia epidemic, the operating conditions of Brilliance Group’s own brands have further deteriorated, and long-term accumulated debt problems have erupted. According to the semi-annual report of Brilliance Group this year, the total liabilities at the group level are 52.376 billion yuan, the debt-to-asset ratio exceeds 110%, and the financing capacity is lost. In order to solve the debt problem, the relevant parties established the Brilliance Group Bank Debt Committee to seek debt reconciliation, but failed.

On the day that Brilliance Group officially entered the bankruptcy and reorganization process, the China Securities Regulatory Commission stated,Special inspections have been carried out on Brilliance Automobile Group in accordance with the law, the administrative supervision measures of issuing warning letters have been taken against Brilliance Group, and it has been decided to file an investigation for suspected violations of information disclosure., Conduct simultaneous inspections of intermediaries involved in the Brilliance Group’s bonds, and strictly investigate and deal with violations of laws and regulations.

Edit| Sun Zhicheng Xiao Yong

Proofreading| Lu Xiangyong

Daily Economic News Comprehensive public information, CCTV news, Beijing News, Securities Daily, etc.

You must log in to post a comment.