In the growing e-car business, competition from western companies is fierce – but Chinese manufacturers are catching up. A few even venture to Germany.

From Steffen Wurzel, ARD studio Shanghai A battery factory in Changshu, just under 100 kilometers north of Shanghai. The Chinese e-car company Aiways has the batteries for their electric SUV called U5 assembled here. Robots put the individual parts together on a conveyor belt. The battery packs have a capacity of up to 63 kWh, which means that Aiways cars can travel 400 kilometers according to the manufacturer. Only a few workers stand on the conveyor belt. Most of the work steps run automatically, explains senior engineer Wu Lunbin. “It currently takes nine minutes and 44 seconds to make a battery pack for a car,” he says. “But we will continue to expand our production capacity, that will further increase the pace.”

Lots of bankruptcies and takeovers

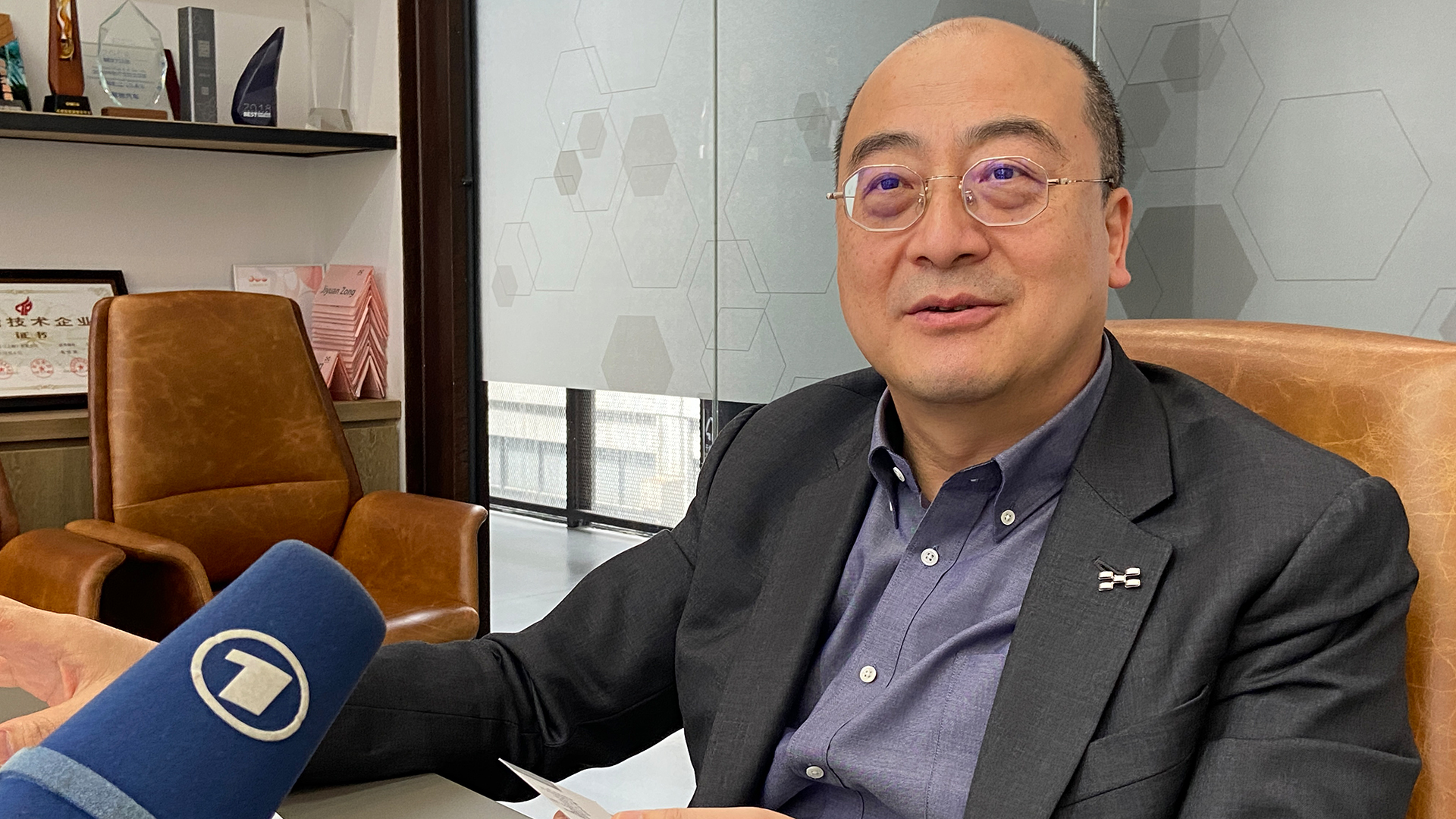

In addition to Aiways, the other Chinese electric car start-ups are also self-confident. Of the original hundreds of small companies, around ten have remained after bankruptcies and takeovers, which have now actually brought market-ready electric cars onto the streets. They are called, for example, Li Auto, Xiaopeng, World Champion and Nio . Even if the sales figures of these companies are still very low compared to the established, international large car brands: The e-car start-ups have shaken up the car market in China, says Zeng Zhilin, founder of the Shanghai management consultancy LMC Automotive. “These e-car start-ups are digital through and through. They are brave and dare to sell their cars and use new technologies,” says Zeng. “E-car start-ups like Nio combine classic car technology and new software in a way that traditional corporations cannot.”

“Most difficult market ever”

In the affluent cities along the Chinese coast, the hip electric SUVs from the startup companies are already part of the normal street scene. So far, only a few have dared to go abroad, more precisely to Europe. The Shanghai company Aiways, for example, is trying. It also sells its off-road electric sedans in Germany for just under 30,000 euros if you include the state e-car bonus. “We want to start our business from Europe because that is the most difficult market ever,” says Aiways company founder Fu Qiang. “If we survive in Europe, we can do it anywhere. And with that we show our customers within China: Look here, we have what it takes to sell our products in Europe – we build high-quality cars.”

Cooperation with workshop chain

For inspections and repairs, Aiways customers are referred to the nationwide active workshop chain Auto -teile-Unger, ATU for short, explains Aiways company founder Fu Qiang. “ATU has enough locations in Germany. They don’t need any new equipment or new mechanics for our cars. The only thing they need is precise instructions on how our cars are serviced.” As far as the number of new cars produced is concerned, the e-car start-ups are catching up, but they are still far behind the established, large car manufacturers. Aiways plans to sell at least 10,000 cars outside of China this year. For comparison: the Volkswagen Group sold around 4.2 million cars last year – in China alone.

You must log in to post a comment.