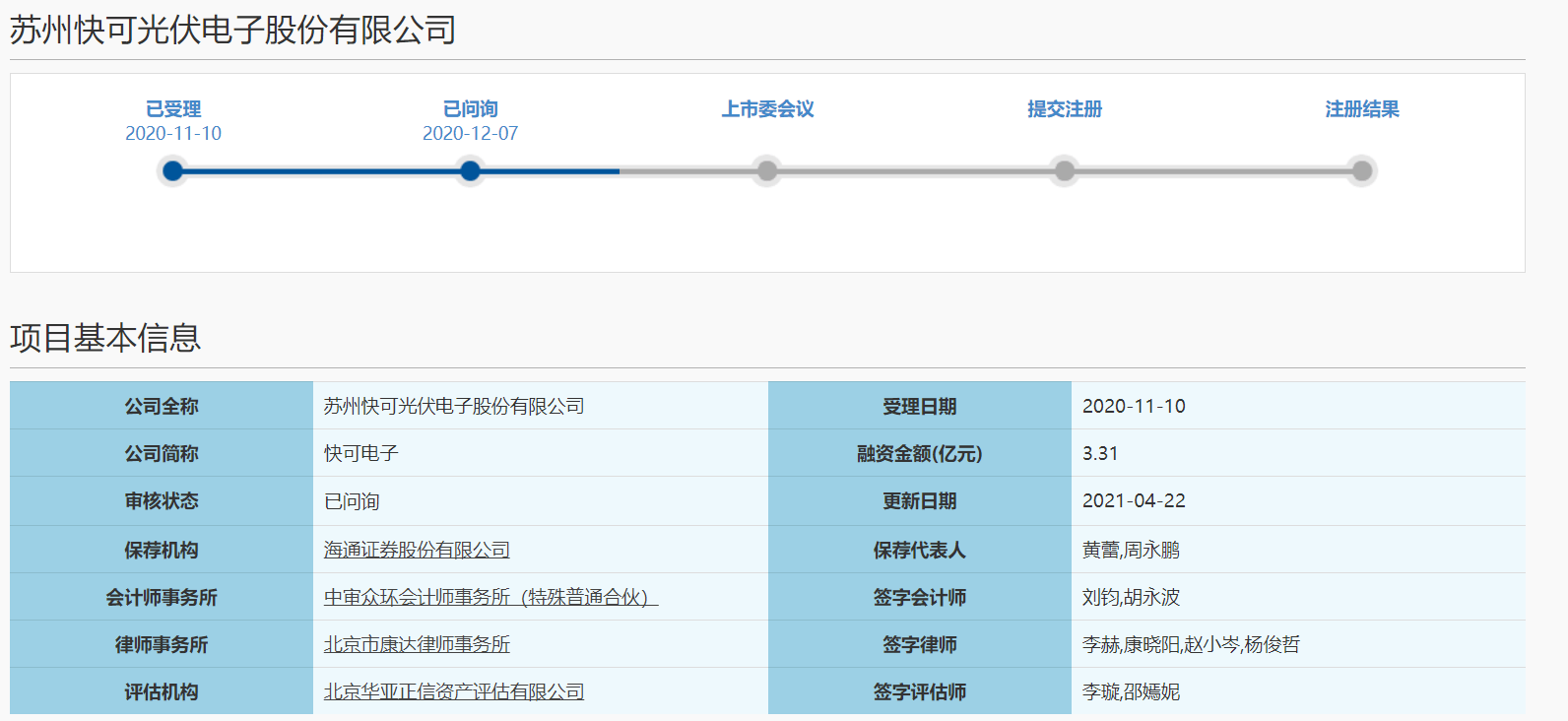

On April 23, Capital State learned that Suzhou Kuaike Photovoltaic Electronics Co., Ltd. (hereinafter referred to as “Quaike Electronics”) responded to the second round of inquiries about the IPO of the Science and Technology Innovation Board.

Image source: Shanghai Stock Exchange official website

In the second round of inquiries on the Science and Technology Innovation Board, the Shanghai Stock Exchange is mainly concerned with the disclosure and verification of company shareholders’ information, R&D expenses and science and technology attributes, legal compliance of overseas subsidiaries, market space and industry development direction, industry policies and trade policies, and customers There are 14 questions in total.

Specifically, the Shanghai Stock Exchange requires Kuaike’s e-sponsor and issuer’s lawyers to verify and explain: (1) Whether there are any stock holdings in the issuer’s historical evolution, and if so, whether it is legally dismissed, whether to verify and disclose the reason for its formation and evolution. Circumstances, dissolution process, whether there are disputes or potential disputes, etc.; (2) Whether the issuer’s disclosure of shareholder information is true, accurate and complete.

Kuaike Electronic Reply: After consulting the issuer’s industrial and commercial registration information, the questionnaire issued by the shareholder, the letter of commitment, the shareholder’s capital contribution or payment certificate, the bank flow of the major shareholder during the reporting period, and the shareholder Fuende Xingyu’s fundraising account collection details and interviews The relevant shareholders of the issuer confirm that there is no proxy holding of shares in the issuer’s history. As of this issuance, the issuer is 48 million yuan, and the issuer has experienced 2 capital increases and 3 equity transfers.

After verification, the issuer’s capital increase and equity transfer in the aforementioned historical evolution did not exist on behalf of stock holdings, and the shares were clear and clear, and there were no disputes or potential disputes.

Regarding the surprise share purchase, the Shanghai Stock Exchange requires the sponsor and the issuer’s lawyers to verify and explain: whether new shareholders have been added through capital increase, share transfer, etc. within 12 months before the declaration; if so, whether to verify and disclose the basics of the new shareholders in the prospectus The circumstances, reasons for the share purchase, share price and pricing basis, whether the new shareholder has an associated relationship with other shareholders, directors, supervisors, and senior management of the issuer, the new shareholder and the intermediary institution of the issuance and its principals, senior management, and economic Whether there is an affiliated relationship between the office staff, whether there is a situation of holding shares on behalf of the new shareholders, etc.

Kuaike Electronic responded that according to the issuer’s industrial and commercial registration information, capital increase agreement, capital contribution or transfer payment voucher, the issuer submitted an application for this issuance and listing to Shanghai in November 2020. Since May 2017, Chengdu Hongtai Yinke will hold Since the issuer’s equity was transferred to Chengdu Fuende Xingyu, the issuer has not changed, that is, no new shareholders have been added in the 12 months before the issuer’s declaration.

After verification, the sponsor and the issuer’s lawyers believe that: the issuer has not added any new shareholders within 12 months before the declaration.

Regarding the abnormal share price, the SSE requires the sponsor and the issuer’s lawyers to verify and explain: (1) The background and reasons for the shareholder’s shareholding, form of shareholding, source of funds, payment method, share price and pricing basis; (2) Historical evolution of the issuer Whether there is an obvious abnormality in the shareholder’s share price; (3) If so, please follow the fourth and fifth provisions of the “Guidelines for the Application of Supervisory Rules-Information Disclosure of Shareholders of Companies Applying for Initial Listings” (hereinafter referred to as the “Guidelines”). The specific circumstances of the thorough inspection; (4) If no, please explain the sufficient reasons and objective basis for determining that the share price is fair.

Kuaike Electronic responded that the background and reasons for the previous shareholder’s share purchases in the history of the issuer are reasonable, and the share price is fair and there is no obvious abnormality.

Regarding R&D expenses and technological innovation attributes, the Shanghai Stock Exchange requires the issuer to explain: the reason and rationality of the issuer’s R&D expenses and the proportion of revenues that are quite different from those of the same industry; the reason for the rapid increase in the number of R&D projects during the reporting period, and the R&D expenses of each project According to the latest audit report, state the issuer’s total R&D investment in 2018-2020 and the proportion of its operating income, and whether the issuer’s indicators still meet the relevant indicators of the “Science Innovation Attribute Evaluation Guidelines (Trial)” Request etc.

Kuaike Electronics responded that during the reporting period, with the continuous innovation of photovoltaic module technology and the application of high-efficiency and high-power panels, in order to ensure the company’s product competitiveness and product performance to meet the needs of module customers, the company needs to maintain product upgrades and forward-looking research Continuous investment has increased R&D investment year by year. During the reporting period, the company’s R&D expense ratio was higher than that of companies in the same industry, mainly due to the following:

(1) The product structure is different. According to publicly disclosed data by companies in the same industry, the main products of companies in the same industry are photovoltaic junction boxes. The company is committed to the research and development and production of bypass protection and connection integrated products. In addition to junction boxes, the main products also include component connection core components photovoltaics Connectors, in order to ensure the safe and stable connection of photovoltaic modules, it is necessary to keep the product performance of the photovoltaic junction box and the connector improved simultaneously, so there are more R&D projects involved and higher R&D investment;

(2) The direction and scope of research and development are broader. In addition to the general-purpose junction box and connector, the company’s research and development focus is earlier involved in the research and development of intelligent junction boxes among domestic companies in the same industry, especially MPPT efficiency optimization and fire shutdown intelligent junction boxes. In addition, the company’s R&D center also actively develops related product research and development, expands the company’s product line, and invests in the research and development of photovoltaic combiner boxes, energy storage connectors, PVT cogeneration and other products, so the research and development expenses are relatively high.

(3) Difference in business scale. In each period of the reporting period, the absolute amount of research and development expenses of Tongling shares was higher than that of the company. The average operating income of Tongling shares and the company from 2018 to 2019 were 792 million yuan and 329 million yuan, respectively. Their revenue scale was significantly higher than that of the company. Its research and development expenses account for a relatively low proportion of revenue.

In each period of the reporting period, the number of R&D projects being implemented by the company are 5, 8, and 14, respectively. The number of R&D projects has increased rapidly, mainly due to the rapid technological upgrading of the photovoltaic industry. The company has continued to increase in order to maintain market competitiveness. Large R&D investment, R&D projects include not only the improvement and upgrading of existing product performance and production process improvements based on market feedback, but also forward-looking research based on judgments on industry development trends, so the number of R&D projects has increased rapidly.

Regarding the properties of science and technology innovation, the cumulative R&D investment in the last three years is 64,384,300 yuan, exceeding 60 million yuan; the cumulative R&D investment in the last three years accounts for 5.54% of the cumulative operating income, which is more than 5%, the total R&D investment and the three-year cumulative R&D investment The proportion of cumulative operating income meets the relevant indicator requirements of the “Guidelines for the Evaluation of Attributes of Science and Technology Innovation (Trial)”.

As of the date of issuance of this reply, the issuer and its subsidiaries have obtained 10 invention patents, of which 8 are related to the main business, which are used in the company’s daily business activities and form main business income, and the ownership of the patent is clear, and there is no right Restrictions or litigation disputes. The number of invention patents related to the issuer and its main business meets the requirements of the “Guidelines for the Evaluation of Attributes of Science and Technology Innovation (Trial)”.

The issuer’s operating income scale and the compound growth rate of operating income in the last three years meet the requirements of the “Guidelines for the Evaluation of Science and Technology Innovation Attributes (Trial)”.

You must log in to post a comment.