Produced | Sohu Technology

Author | Liang Changjun

Edit | Yang Jin

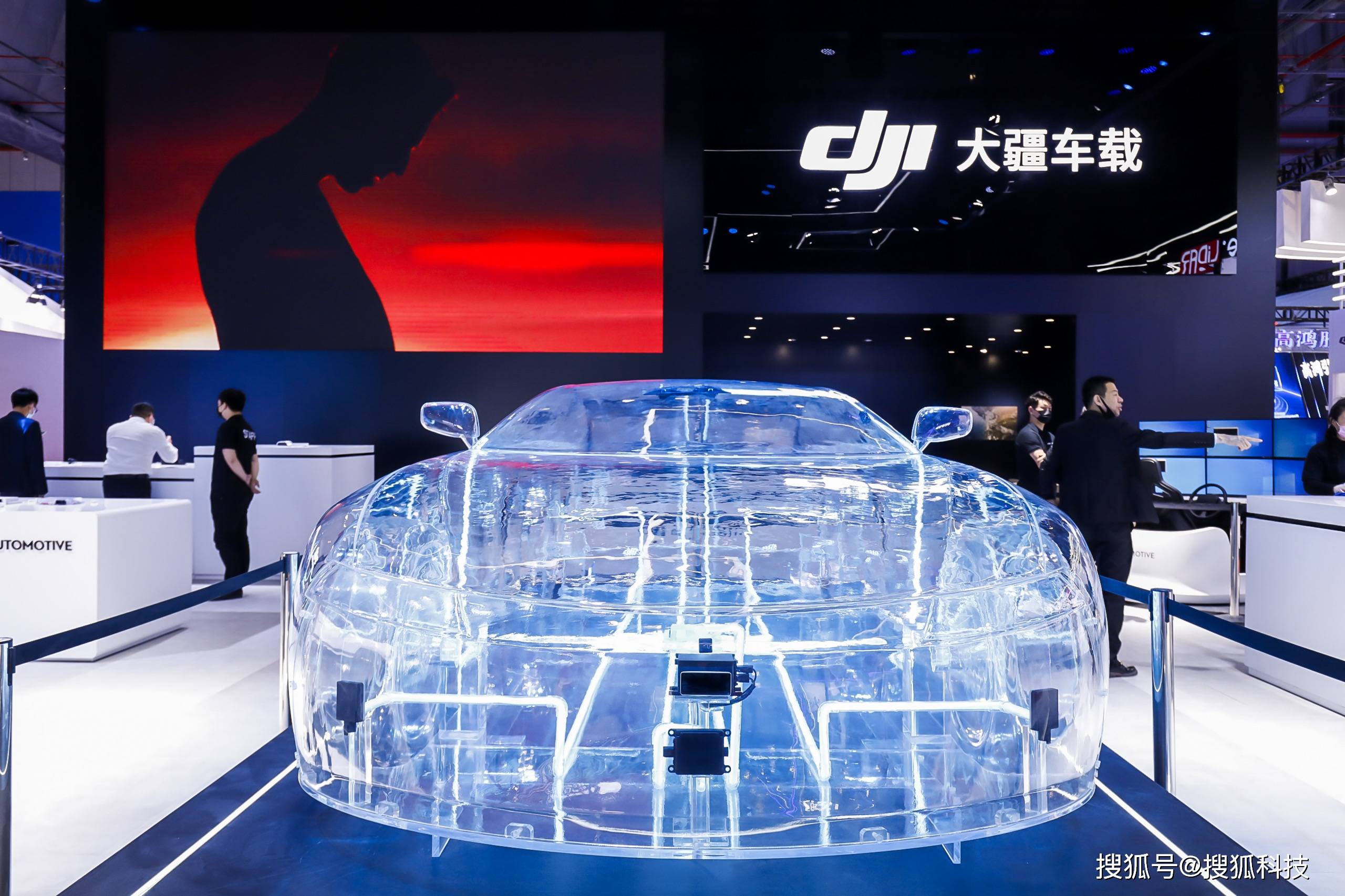

The mystery of the global drone giant DJI’s “car building” has surfaced. At the Shanghai Auto Show that opened on April 19, in addition to the hotly debated rights protection of Tesla owners and the explosive Huawei autopilot, DJI also showed its muscles in autopilot. But unlike Huawei’s call for the absolute number one autonomous driving technology, DJI’s layout in this new field is still as low-key as its founder.

Compared with Huawei and Baidu, which bet on L4 autonomous driving, DJI Automotive is taking a road of “upgrading and fighting monsters”. It gradually advances from L2, L2+ to L3 and L4, which are more difficult to land, which is pragmatic and conservative. Some insiders told Sohu Technology that DJI will not forcefully pursue high-level autonomous driving technology, and will pay more attention to the continuity of the scene.

There is no doubt that the track of autonomous driving is large enough and competition will become more and more fierce, but it will still take time for large-scale commercialization to land. With the emergence of a ceiling in the drone market, DJI’s new battle for outward expansion has just begun.

From drone to smart car

In recent years, news of DJI’s entry into autonomous driving and even car-making has been reported from time to time, but DJI has never let go of it. Until recently, on April 12, DJI officially released its intelligent driving business brand DJI Automotive. But DJI is not about building cars, but researching, producing and selling intelligent driving systems and their core components.

Sohu Technology learned from DJI insiders that DJI has established a pre-research team since 2016 to study whether DJI’s proven space intelligence technologies (sensing, positioning, decision-making, navigation, control, etc.) on drones can be applied. In a broader field, the direction of smart cars will be determined at the end of 2016. In mid-2017, the software and hardware of the on-board system will be initialized after R&D and experiments, and it will enter the formal development stage.

In 2018, DJI obtained the first batch of test licenses for intelligent connected vehicles in Shenzhen, and began to conduct normalized and large-scale tests. In 2019, DJI officially established an automotive business unit to clarify the positioning of DJI’s automotive brand and Tier 1 supplier (Tier 1). In December of the same year, the first automotive-grade intelligent manufacturing center was built, and technology began to transform into products.

It can be said that DJI is one of the first technology companies in the world to enter the research and development of autonomous driving. “But even if it has cooperated with car companies, it is still in a state of confidentiality. Most of the colleagues in the company are not aware of the existence of DJI Vehicles.” The aforementioned DJI insider said.

After five years of low-key layout, DJI’s automotive team currently has 700 people, including more than 500 core R&D personnel, 87% of which are masters and doctors, and has more than 1,000 patents in the automotive field. According to public data, DJI has invested more than 4 billion yuan in research and development in the fields of chips, sensors, lidar, and vehicle-assisted driving systems.

From the point of view, DJI can be regarded as catching up with the wave of intelligent autos. The chaos of the market has begun, and it is still expected to get a share of the pie. It is understood that at present, DJI’s in-vehicle business mainly launches 7 solutions with different configurations for smart driving and smart parking.

Specifically, it includes intelligent driving D80/D80+ covering the speed range of 0 to 80 km/h, suitable for urban expressways; intelligent driving D130/D130+ covering the speed range of 0 to 130 km/h, suitable for expressways and urban rapids road. Intelligent parking includes three scenarios: assisted parking, memory parking for the last 100 meters, and autonomous parking for the last 1 km. The corresponding solutions are P5, P100 and P1000.

From the perspective of perception configuration, D80 is equipped with 1 camera, 5 millimeter wave radars and 12 ultrasonic radars, D130 is equipped with 6 cameras, 5 millimeter wave radars and 12 ultrasonic radars, and is equipped with driving behavior recognition early warning cameras (DMS). It can then support the driver to get rid of it. At the same time, without upgrading the hardware, the D80 and D130 can open assisted driving functions for unstructured roads in urban areas.

D80+ and D130+ are equivalent to the Plus version of D80 and D130. Among them, D80+ adds 5 cameras and a set of lidar based on the D80 sensing solution, and D130+ adds 1 camera and a set of lidar on the basis of D130, both It can support the driver to take his eyes off.

In the smart parking scenario, the three solutions launched by DJI are equipped with 5 cameras, 1 millimeter wave radar and 12 ultrasonic radars. The main difference lies in whether it is equipped with lidar; among them, P1000 needs to be equipped with lidar, which can achieve medium-length Distance autonomous parking and autonomous calling.

Focus on L2+ and L3

From the perspective of DJI’s layout, for the industry’s controversial autonomous driving technology route, DJI did not choose to stand in line. Instead, it placed bets on pure vision and lidar-led routes. OEMs can choose according to their own needs. It is similar to the technical route strategy adopted by Baidu.

In the field of intelligent driving, the outside world often divides the technical level of enterprises by the level of autonomous driving. However, Xie Tiandi, director of public relations at DJI, told Sohu Technology that DJI has not tested or released a plan based on the SAE (International Society of Automata Engineers) classification of autonomous driving.

He believes that SAE is actually a hierarchical model based on “responsibility division”. This is not a sufficient condition to measure the autonomous driving system. There are many tracks covered by autonomous driving, and the difficulty, investment, scene, and market size of each track , Business models are different, and the constraints are also different. It is very inadequate to use the simple classification of L0-L5 to talk about the entire industry.

However, Sohu Technology has noticed that in the intelligent driving and intelligent parking system function tables announced by DJI, the automatic driving level is indicated. For example, intelligent driving D80 and D130 correspond to L2+ level automatic driving, and D80+ and D130+ correspond to Level 3, smart parking covers levels L2, L2+/L3, and L4. In this regard, DJI said that as a solution provider, it provides functional expectations, but the actual installation will still be customized and rated according to the needs of the host manufacturer.

It can also be seen that DJI is currently focusing on L2+ and L3 autonomous driving, while Huawei and Baidu have all launched L4 autonomous driving solutions and are accelerating commercial progress. However, some media reports said that there is actually a team in the DJI vehicle team that is engaged in cutting-edge R&D for L4 autonomous driving technology.

In fact, DJI adopts the ODD (designed operating area) technical strategy for autonomous driving functions and scenarios. The more continuous the ODD, the smoother the functions will be used. For example, D80/D80+, D130/D130+ have specific speed and area restrictions, and the smart parking solution is also aimed at scenes at different distances.

“A reasonable solution for autonomous driving requires facing reality on the one hand and not directly pursuing the so-called high level of technology. If the continuity of some scenes is difficult to achieve, the driver should be led instead of outputting poor automatic driving. Experience, this is better than the experience and safety that people think that the car can drive automatically, but have to stare at any time and take over at any time.” The aforementioned DJI insider said, but on the other hand, it must be “hard and rigid”. When the car enters a scene where the continuity of autonomous driving can be pursued, the continuity needs to be improved to the extreme, so that consumers can truly get the liberation of attention.

This is also DJI’s technical thinking. Only an autonomous driving system that balances the matrix of functional experience, safety, and cost can have the conditions to talk about advancement. To this end, DJI has also self-developed and produced a number of core components, including monocular and binocular cameras, DMS, domain controllers and their middleware, and driving behavior recognition and early warning systems. The company’s engineer team currently has 200 people.

However, DJI is not fully All-in. For example, the lidar is provided by Lanwo Technology. This is a lidar company incubated internally by DJI. Last year, it launched two products for L3/L4 autonomous driving at a price of only It is 6499 yuan and 9000 yuan, which has obvious cost advantages compared with other lidars that cost tens of thousands or even more than 100,000. It has been mass-produced and launched in Xiaopeng Motors.

In addition, satellite navigation systems and high-precision maps are also provided by suppliers. It can be seen that, while ensuring reliability, DJI’s in-vehicle solution intends to reduce dependence on external data sources such as high-cost sensors, V2X infrastructure, and high-precision maps. This is different from Huawei’s layout, and it also determines the different business strategies of the two.

Mass production will be launched within the year

DJI Intelligent Driving has a clear timetable for commercialization. Sohu Technology has learned from DJI that the D80 and D130 are expected to be mass-produced this year, while the D80+ and D130+ will have to wait until 2024; the P100 will be mass-produced next year. Compared with Huawei, Baidu, and new automakers, the process has been much slower.

At the Shanghai Auto Show, DJI also officially announced its first partner, which will join hands with SAIC-GM-Wuling to create “people’s intelligent driving”. The intelligent driving solution provided by DJI Automotive will be the first to be applied to BAOJUN brand models under SAIC-GM-Wuling, and will be mass-produced and launched within the year.

It is understood that the cooperation between the two parties is not a parts procurement model, but is based on a large number of R&D tests and road tests to jointly promote the implementation of a complete set of intelligent driving systems. This also means that DJI Automotive has taken a key step towards commercialization, and Volkswagen is also cooperating with DJI. Volkswagen Group (China) CEO Feng Sihan disclosed for the first time at the beginning of the year that it is cooperating with DJI in the field of visual information processing to develop autonomous driving based on various road scenes, and plans to carry it on the car from 2023 to 2024.

Xie Tiandi told Sohu Technology that DJI Automotive will be open to the entire automotive industry and will not distinguish or exclude the low-end and high-end markets. But in terms of specific strategies, at least for now, DJI has adopted a way of advancing from low-end to high-end autonomous driving, and low-end brands to mid-to-high end. The landing of high-level autonomous driving will take longer to verify, and commercialization will be more difficult. The consulting company Gartner reported that it will take more than 10 years for L4 autonomous driving technology to fully mature.

However, some people believe that DJI is somewhat conservative. Although it may become a strong opponent of Huawei, it has not shown similar ambitions. However, the more critical issue at present is how can DJI persuade more car companies to adopt its own autonomous driving program when the process is somewhat backward.

At the same time, this is also an extremely critical step for DJI, which has a bottleneck in the drone market, which means whether it can create a second growth curve after drones.

In the past decade or so, DJI has gradually become a global drone giant, occupying more than 80% of the global market share and ranking first among global civilian drone companies. However, after announcing that its revenue reached nearly 17.6 billion yuan in 2017, DJI has not released any performance data. Public information shows that its performance growth rate in the first half of last year has dropped from over 60% to 30%.

At the same time, DJI is also facing the unfavorable situation of intensified competition and external suppression, and there has been no obvious breakthrough in the application of drones in the industry. DJI founder Wang Tao said as early as 2016 that the consumer drone market is about to be saturated, and DJI’s revenue will reach 20 billion yuan and it will peak, but this revenue is difficult to support DJI’s US$10 billion valuation.

This may have also greatly promoted DJI’s determination to deploy autonomous driving early. Obviously, it also values the prospects of this track-with a trillion-scale potential, and China is expected to become the world’s largest autonomous driving market. DJI’s expansion under anxiety is somewhat similar to Huawei, whose mobile phone business was reluctantly suppressed and started selling cars.

In addition, for DJI, whose public valuation has reached 100 billion yuan, new stories are also needed to support future valuations. Investors have repeatedly urged DJI to go public. DJI has been listed on the market many times before, but DJI has never recognized it.

At the Shanghai Auto Show, Wang Yunpeng, general manager of Baidu’s Autonomous Driving Technology Department, said in an interview: “Our bragging rights have become cool afterwards.” For this new wave of car intelligence that has just kicked off, various new The gathering of old forces, how capable the low-key DJI can be, and whether it can replicate its status as a giant in the field of drones requires more verification.

You must log in to post a comment.