Produced | Sohu Think Tank

Edit | Yuan Changyou

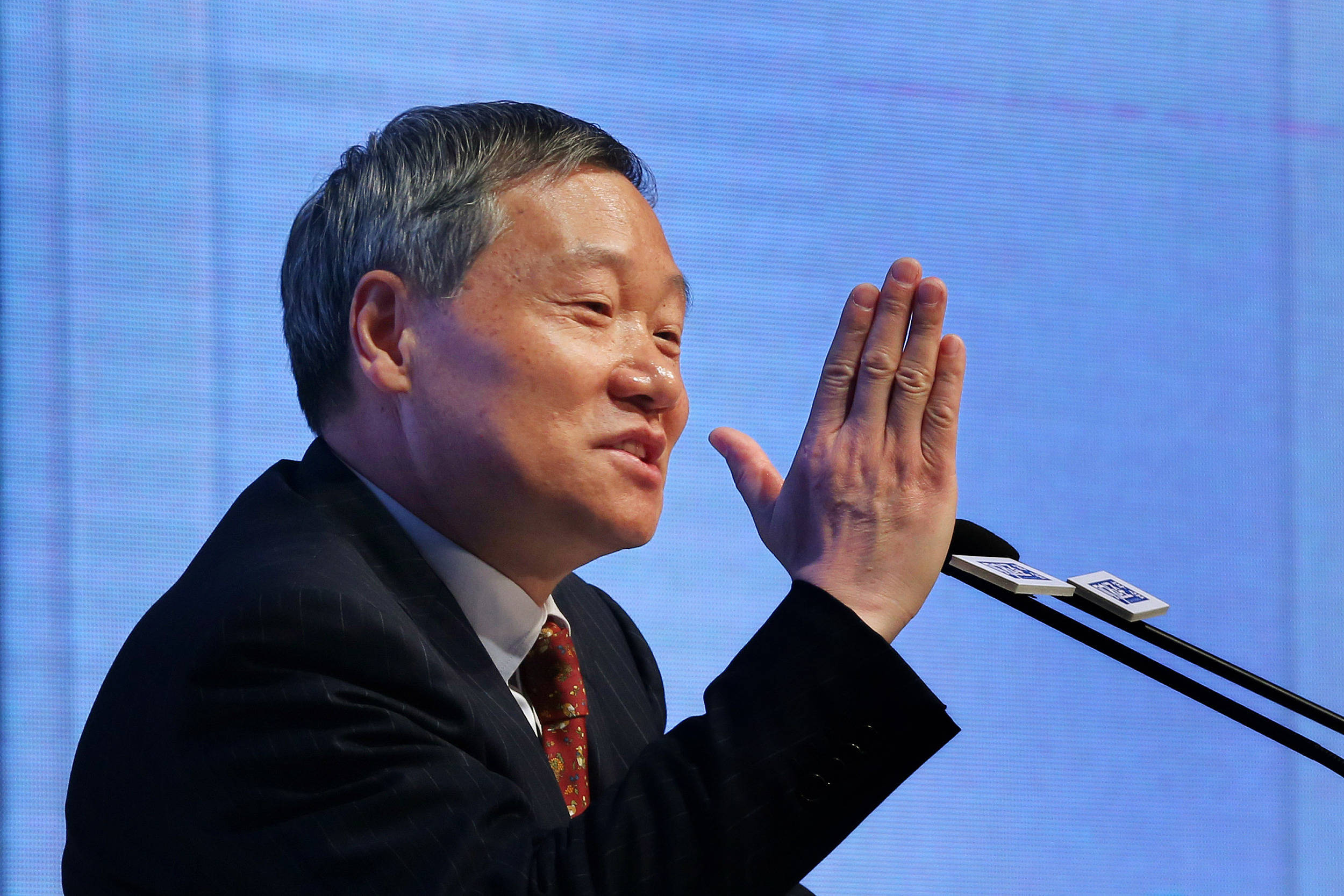

Xiao Gang, a member of the National Committee of the Chinese People’s Political Consultative Conference and former chairman of the China Securities Regulatory Commission, recently stated in the “National Wealth Lecture Hall” program that in the future, the proportion of financial assets in residents’ wealth will become higher and higher, and the capital market should become a carrier of wealth appreciation.

Xiao Gang said that in the past we mainly relied on indirect financing and used bank leverage to mobilize savings to support technological innovation and manufacturing investment. However, in the historical stage of building an innovative country, the development of direct financing, especially equity financing, has become an inevitable trend. The next step in the reform of the financial market should focus on expanding the role of direct financing, especially equity financing, in supporting technological innovation and industrial transformation and upgrading.

“Science and technology innovation requires a large scale of investment, a long investment cycle, and high investment risk. Many innovations ultimately fail. In this case, the use of bank credit may put a heavy burden on innovation entities. Bank borrowing is corporate debt and needs to repay the principal and interest, which will inhibit the enthusiasm of innovation entities. Direct financing, especially equity financing, fits the characteristics of innovation well.”

The development of the equity investment market requires reforms in many aspects. First of all, Xiao Gang said that many private equity investment funds currently invest in mid- to late-stage projects, while technological innovation often requires strong support for early-stage projects, which requires more long-term and patient capital. Therefore, it is necessary to introduce more incentive policies to attract capital investment in early-stage, technological projects to promote technological innovation.

Second, he said that the current comprehensive reform of the exchange market has achieved obvious results, but further reforms are needed to expand the proportion of equity financing. For example, the NEEQ has achieved initial results in last year’s reforms. It mainly serves private and innovative small and medium-sized enterprises. The development potential after the reform is worth looking forward to.

Regarding the over-the-counter trading and over-the-counter markets of securities companies, Xiao Gang emphasized that in the past we paid more attention to on-exchange and standardized trading, but in fact, there are over-the-counter markets that need to be standardized. “In the past, there were many problems in the OTC market, such as non-standardization, information asymmetry and opacity, lack of trust mechanisms, etc. However, with the help of financial technology, such as blockchain, big data, artificial intelligence and other technologies, it was combined with OTC transactions. It may make up for the shortcomings in the over-the-counter market in the past.”

Xiao Gang believes that the current share of financial assets in residents’ wealth is still low. With the reform and development of the equity investment market, the proportion of financial assets in the wealth of residents will become higher and higher in the future, and there will be a trend of “financialization of wealth”. Resident assets will no longer consist of real estate, but will have more financial instruments. In the future, the capital market should provide richer products and become a carrier for the appreciation of residents’ wealth, so that investors can obtain more property income.

[Sohu Think Tank: Gather the wisdom of scholars and entrepreneurs to get the pulse of economic trends. If you are interested in contributing or contacting on-site reports, interviews, and program cooperation matters, please send an email to zhikucaijing@sohu.com]

You must log in to post a comment.