(Original title: What happened? Just now, the core of the fund rushed wildly: “Mao Index” soared by 380 billion, and “Yanmao” performance exploded! Foreign investors bought aggressively, and the style of A-shares changed again?)

In today’s morning, the Mao Index rose sharply, with the highest intraday increase of 2.65%, and the morning closing rose by 2.05%. The market value increased by about 380 billion in half a day based on market value! Some funds are heavily involved in the performance of white horse stocks.

Among them, “Yan Mao” Aier Ophthalmology surged over 11.74%, and its net profit in the first quarter increased by more than 5 times; the “big four” liquor also surged, Luzhou Laojiao rose by 2.67%, Kweichow Moutai rose by 2.21%, and Wuliangye rose by 2.12 %, Yanghe shares rose 1.73%.

The sci-tech innovation board “demon stocks” hit the daily limit again in the hot scene of biology, which has risen by more than 300% this month.

In addition, carbon-neutral concept stocks rose in the early trading, with Shouhang Hi-Tech, Chengbang Co., Ltd., and West China Energy trading at their daily limit.

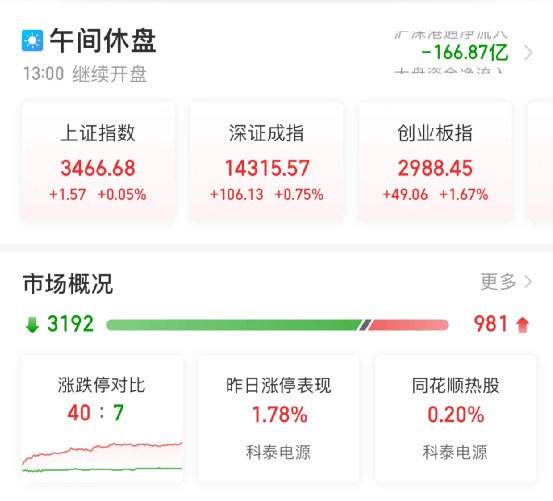

In early trading today, the market as a whole was weak and volatile, and individual stocks diverged around quarterly performance. As of midday, the Shanghai Composite Index rose 0.05% and the Shenzhen Component Index rose 0.75%. The turnover of the two cities was 499.33 billion yuan. 981 stocks rose and 3192 stocks fell. The index rose more than 2% at one time and regained its 3,000-point mark. .

Beijing Capital (Foreign Investment) bought 5.318 billion yuan in the morning

On the disk, the medical industry, solid-state batteries, genetically modified, automotive chips, gallium nitride and other sectors led the gains. Online travel, medical beauty, digital currency, dairy, and blind box economy led the decline.

The national carbon market welcomes heavy news

Carbon neutral concept stocks soar

Carbon neutral concept stocks rose in the early trading, with the daily limit of Shouhang Hi-Tech, Chengbang, and West China Energy, and Changyuan Power, Sinoma Energy Conservation, Yuanda Environmental Protection, China Southern Power, and Taiwan Nuclear Power all hit the high.

According to Xinhua News Agency, last night (April 22), President Xi Jinping delivered a speech entitled “Together to Build a Community of Human and Natural Life” at the “Leaders’ Climate Summit”. It mentioned a series of new measures that China is going to take, including incorporating carbon peaking and carbon neutrality into the overall layout of ecological civilization construction. It is formulating a carbon peaking action plan, carrying out carbon peaking actions extensively and in-depth, and supporting places and places where conditions permit. Key industries and key enterprises are the first to reach their peaks.

At the same time, China will strictly control coal power projects, strictly control the growth of coal consumption during the “14th Five-Year Plan” period, and gradually reduce it during the “15th Five-Year Plan” period. In addition, China has decided to accept the “Montreal Protocol” Kigali Amendment, strengthen the control of non-carbon dioxide greenhouse gases, and will also initiate online trading on the national carbon market. In addition, the national carbon market will issue registration transaction settlement rules as soon as possible, and will formulate implementation plans for peaking carbon in coal, power, steel and other industries.

The rise of Mao Index has increased its market value by about 380 billion!

“Eye Mao” and “Baijiu Mao” soared

The Mao Index rose sharply in the morning today, with the highest intraday increase of 2.65%, and the morning closing rose by 2.05%. The market value increased by about 380 billion in half a day based on market value! Some funds are heavily involved in the performance of white horse stocks.

Among them, the medical Whitehorse has strengthened across the board, and Aier Ophthalmology has expanded to 11.74%. Aier Ophthalmology announced last night that the company achieved operating income of 3.511 billion yuan in the first quarter, an increase of 113.9% year-on-year; net profit was 484 million yuan, an increase of 509.88% year-on-year. The net profit for the whole year of 2020 will be 1.724 billion yuan, a year-on-year increase of 25.01%. It is planned to send 1.5 yuan for 10 to 3 transfers. In addition, Mindray Medical rose 5.97%, WuXi AppTec rose 5.58%, Tongce Medical and Pien Tze Huang also rose.

It is worth noting that the “big four” liquors rose sharply in early trading today. Luzhou Laojiao rose by 2.67%, Kweichow Moutai rose by 2.21%, Wuliangye rose by 2.12%, and Yanghe shares rose by 1.73%. The remaining liquor stocks performed relatively weakly.

The sci-tech innovation board demon stock hot scene biology once again closed the board

This month has risen more than 300%

In terms of individual stocks, the sci-tech innovation board “demon stocks” hit the daily limit again in the market, which has risen by more than 300% this month. As of midday, Hotview Bio was up 19.22%.

In addition, stocks that saw their performance rose sharply, such as O.R.G., rose more than 8% in early trading. Origen announced on the evening of April 22 that the company achieved operating income of 3.072 billion yuan in the first quarter, a year-on-year increase of 64%; net profit was 296 million yuan, a year-on-year increase of 572.51%; basic earnings per share were 0.12 yuan.

Gigabit hit its daily limit in early trading. It was announced last night that it intends to transfer 3.37% of Xiamen Celadon Digital Technology to three companies including Tencent Ventures, totaling more than 300 million yuan.

China Diving shares continued to lower the limit at the opening today, which is a 20% limit for four consecutive days. The stock has fallen by as much as 62% in the past 5 trading days. CICC stated that although the “mid-term adjustments” may continue, considering that the current market has limited room to continue downward, it suggests that some valuations have been adjusted more and the industry’s long-term growth sectors are expected to be deployed in advance. As of midday, China Diving shares fell 5.77%.

You must log in to post a comment.