Every edit: Wang Xin

Biden’s “rich man tax” levy plan has brought a heavy blow to speculators of cryptocurrency assets.

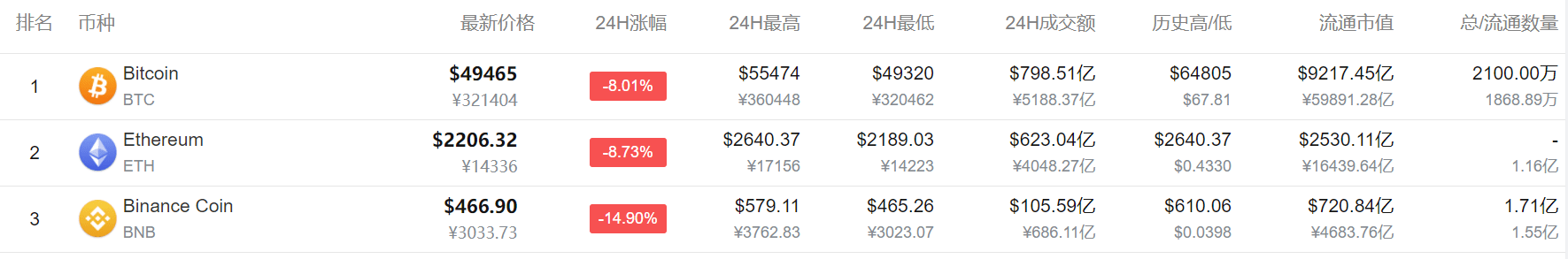

On April 23, cryptocurrencies plunged one after another. Bitcoin fell by more than 8%, Ethereum fell by 10%, Ripple fell by more than 17%, and Litecoin fell by more than 16%.

On the 23rd, Bitcoin fell below $50,000 per coin, the first time since March 8. It then further fell to 49465 US dollars per piece, a 24-hour drop of more than 8%.

At 0:00 on the 22nd, the price of Bitcoin was still at a high level of $56,000 per coin. In the early morning range of the 23rd, with the news of the tax increase plan, Bitcoin fell sharply. From April 22 to press time,Bitcoin has successively fallen below the six integer barriers of 55000, 54000, 53000, 52000, 51000, and 50000, and has fallen by more than US$6,000 in 24 hours.

According to Bitcoin Home Network,In the past 24 hours, a total of about 457,500 people liquidated their positions, and the liquidated capital was as high as US$3.211 billion, which is equivalent to about 20.86 billion yuan..

According to CBN News, foreign media reports that Biden plans to propose to nearly double the capital gains tax rate for the wealthy to 39.6%. Together with the existing investment income surcharge, it means that investors have the highest federal capital gains tax rate. Will reach 43.4%.

Image source: Visual China

According to sources, the capital gains tax rate for people with an annual income of not less than US$1 million will be raised to 39.6%, far exceeding the current basic tax rate of 20%. Coupled with the 3.8% investment income tax rate to fund Obamacare, the capital gains tax level is higher than the highest salary tax rate.

For people with an annual income of $1 million in high-tax states, the capital gains tax rate may exceed 50%. In New York State, the state and federal total capital gains tax rate may be as high as 52.22%. For California, it may be 56.7%.

U.S. investors who invest in crypto assets (these assets have risen by about 80% since December last year), if they sell cryptocurrencies after holding them for more than a year, they already face the risk of capital gains tax. The Internal Revenue Service has also increased its taxation on the sale of encrypted assets.

Source: Daily Economic News, Comprehensive Market News, Bitcoin Home Network, China Business News

(Every time this article is posted on the App for transmission

You must log in to post a comment.