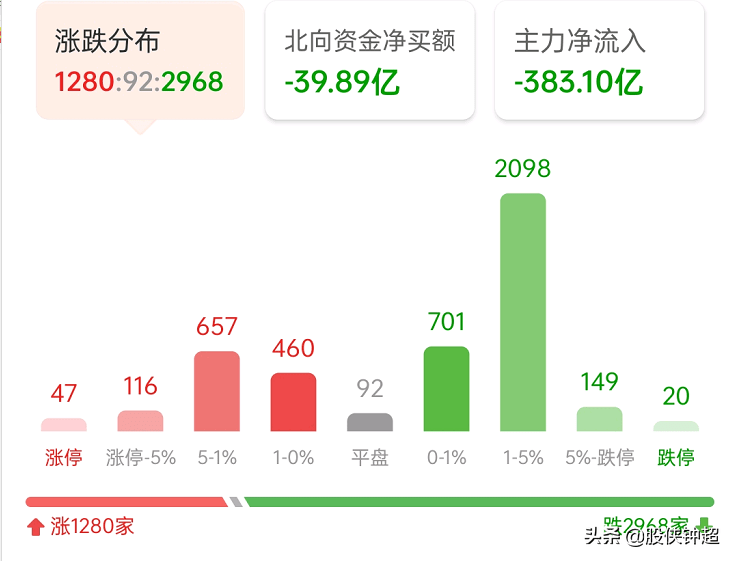

This morning’s trend market made retail investors uneasy, because today’s A-share trend appeared, one opened high and moved low, and there was a time-sharing in the intraday, after the rapid dive of the level, a continuous passivation and sideways narrow began to appear. Among the shocks, the most sad thing for retail investors is that the iron and steel nonferrous Hongmeng concept, which has been relatively strong in the early stage, has seen a sharp decline today. This is the reason for the sharp dive in today’s dominant market. Then why did they suddenly kill? What signals are implied? Let me have a good chat with everyone.

First, why did A shares suddenly fall sharply today? What happened in the plate?

- It is today that the types of basic metal types have fallen sharply, and we have to find the reason from the futures market. As we all know, the stock market reflects the need for price increases, and the price increase depends on the price of the futures market. However, some time ago, Commodity prices continue to rebound, hitting historical highs or new highs in recent years, triggering market speculation on the performance of related metal-type companies, triggering a substantial rebound in stocks, and many metal-type companies in the last three years. The monthly rebound space has reached more than 50%, and even more than several times the rebound space. In the recent period of time, under the trend of continuous suppression of commodity prices, commodity prices continue to fall sharply today, and commodity prices The most direct impact of the crash is the metal-type product company. Therefore, today, the metal-type company has experienced a sharp decline, which triggered the retreat of the second-tier blue chip stocks in the intraday session. This led to a substantial dive in the Shanghai Stock Exchange index. Is the most direct reason.

-

In this round of commodity boom, the main reason is that if the inflation of the U.S. dollar triggers the market through the rise in commodity prices, nitrification and inflation, and just today, the Bank of Russia began to sell U.S. dollars in large quantities. Today, the People’s Bank of China raised the reserve requirement for foreign exchange deposits from 5% to 7%, both in response to the US dollar. Both news detonated at the same time, triggering market concerns. This is the most fundamental reason for the decline in commodity prices today. The decline in commodity prices directly affected the metal-type related companies in the A-share market. This is a chain reaction effect. The decline in bulk commodities has become a trend, and the decline in related companies has also formed a trend, but we We all know that these metal types belong to the second-tier blue chip stocks. Although they have a certain impact on the trend of the A-share market, as long as they do not experience a sharp decline or collapse, the impact on the A-shares is still particularly limited. Therefore, after a wave of time-sharing rapid diving appeared in the intraday market, it is obvious that the ChiNext index has stabilized first and rebounded. Similarly, the Shanghai Composite Index has also experienced a second bottoming at the time-sharing level, so the impact is still limited. The market The market will return to normal.

Second, today’s decline does not mean the end of the market. From the perspective of traders, this is an opportunity!

- In the recent period of time, I have been repeatedly emphasizing the military industry and brokerage companies, especially the brokerage sector. I think that there was a rise and fall last Friday, forming a K-line pattern of fairy guidance in the K-line pattern. Therefore, for the second For new brokerage stocks, today’s intraday time-sharing level quickly dives, but it is an opportunity. For the military industry sector, there was an intraday market decline last Friday, but it is obvious that after the decline is ushered in a larger level of rebound. Today the market has become the dominant military industry sector. For the military industry sector, I have always emphasized certainty. It is necessary to have a mid-line thinking. For opportunities in this sector, it is showing a mid-line rebound. After all, the performance of the military sector will continue to explode this year. Compared with the current stock price, there is still a lot of room. , So the decline is more of an opportunity.

-

For the Shanghai Composite Index, the level of the Shanghai Composite Index dropped rapidly at midday, but we can take a look at the trading volume this morning. The Shanghai Composite Index alone is as high as nearly 300 billion yuan, which is already at the level of the sky. You have to know that it has been maintained at around 250 billion yuan some time ago, and the trading volume in just one morning is as high as nearly 300 billion yuan. So what does it mean to increase the trading volume? It means that the market’s trading activity has increased, and trading activity has increased, which means there is an opportunity. Everyone knows that the stock market is driven by funds. If the market continues to maintain a low-volume trading volume, then the market will not have any chance at all. We all know that the judgment of a market depends on the increase in trading volume, and today’s volume of the most recent day volume level is created, which means that the market will continue to explode, so you must believe that my current decline is an opportunity. Don’t miss it.

- Finally, I want to tell everyone that since I saw more A shares on May 14th, I have always emphasized that this wave of market is a wave of mid-line opportunities. I also especially emphasized the Shanghai Composite Index. The gap left on May 25 is a definite gap in the market. The market has just formed, and it is certain that it will not usher in a big skyrocket immediately. The market will definitely be divided into three stages. The first is a gap with a certain start-up of the gap, which means that the market is determined, and a mid-line level rebound is to be formed. The second gap represents an explosive gap, which means that the market will start one. It continues to explode, and the volume of transactions continues to grow. At this time, it is a market with a money-making effect, and this market is often very tempting. The third is the exhaustion gap. When the market has the third gap, it often means that the market is over. The reason is that every time the Shanghai Composite Index has three gaps, it will often Within a week, a top structure is formed, a sideways shock is formed at a high position, or a huge decline occurs.

And now the Shanghai Composite Index is only in the evolution after the first gap, and the current trading volume is still very small. Although the volume is constantly increasing, although the market is moving forward in constant volatility, the market trend is still , So isn’t it an opportunity to call back at this time? Why do you want to be like rabbits? Run away! You must remember that you are a human being, and what you have to do is to pay attention to the bargain, not just run at the bottom.

You must log in to post a comment.