Wirecard scandal What’s left of the U committee

As of: 06/22/2021 9:16 a.m.

A year ago, the financial services provider Wirecard went bankrupt. A U-Committee of the Bundestag tried to find out why controllers and supervision failed. The committee has now completed its work.

From Tobias Betz, ARD capital studio

Head of authorities fired, insider trading uncovered: A reform should turn Germany’s financial supervision inside out. The committee of inquiry into the Wirecard scandal has initiated a lot. More than 100 witnesses were questioned and thousands of documents turned over.

Florian Toncar did this for the FDP: The investigative committee had come to a clear conclusion. “We made it very clear that the Wirecard case was not a natural disaster that no one could have foreseen or averted,” he says. There were hints and people who warned early on. The disturbing thing about the Wirecard case is that all of this could have happened with the eyes of sight and under the inspectors’ radar.

BaFin seal of approval?

The central accusation of the opposition: The Federal Financial Services Agency (BaFin) did not investigate early indications of possible irregularities at Wirecard. Instead, according to experts, the authority made fatal misjudgments.

05/07/2021

Wirecard scandal Duped by the “Hansdampf”?

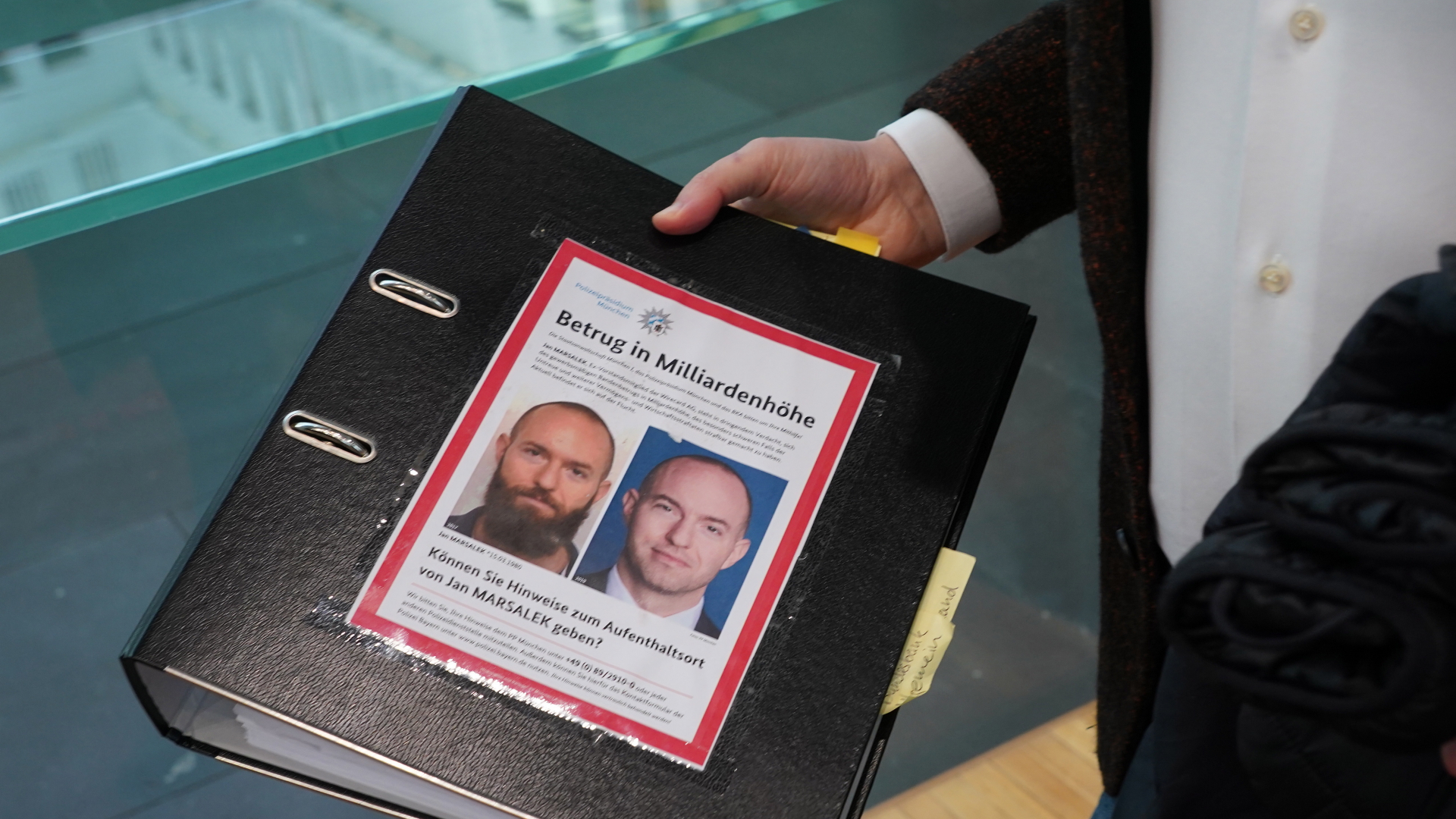

Jan Marsalek, the former Wirecard board member who went into hiding, is once again omnipresent in the investigative committee.

BaFin was convinced that Wirecard was being blackmailed. That is why the authorities imposed a ban on the short sale of Wirecard shares in February 2019. BaFin had never before issued such a speculation ban with a single share. Many market participants understood this signal as a kind of seal of approval: You can trust Wirecard, the company is clean!

Many small investors then got on board. When the rumors that had been circulating for years about inflated balance sheets at Wirecard turned out to be true in June 2020, the share price plummeted. Wirecard was broke. Many small investors lost everything.

The minister and the chancellor had to testify

Since then, the public prosecutor has been investigating, among other things, gang fraud. Former board members were arrested and one of them, Jan Marsalek, is still on the run to this day. Because the control authorities are subordinate to ministries, the opposition’s criticism was directed at the government, says Lisa Paus, who sits on the committee of inquiry for the Greens. “Wirecard was also an auditor scandal. The supervision was under the economics minister Peter Altmaier,” says Paus. Above all, Wirecard is a broad supervisory scandal overall. “The financial supervision was under the SPD finance minister Olaf Scholz.”

03/26/2021

Wirecard scandal BaFin boss admits omissions

According to BaFin boss Hufeld, the financial supervisory authority should have communicated better before the Wirecard collapse.

Ministers Scholz and Altmaier had to testify in the committee of inquiry. Chancellor Angela Merkel was also questioned for hours. None of them admitted mistakes. On the other hand, the work of the investigative committee certainly increased the pressure on the Federal Finance Minister to completely reform the financial supervisory authority BaFin, which is subordinate to him, including a change at the top of BaFin.

Bankers lost their reputations

Financial expert Fabio De Masi from the Left Party is certain that the results of the committee of inquiry are not only politically interesting: “The auditors’ mistakes will play a role in class actions by small investors,” he says. Never before have so many heads rolled at the head of authorities in such a short time.

Exclusive January 18, 2021

Wirecard Mail exchange burdens ex-boss Braun

Was ex-Wirecard boss Braun guilty of market manipulation?

Authority managers, bankers, analysts, fund managers and BaFin employees – they lost their jobs, their bonuses, their reputation. These are the first concrete effects of the committee of inquiry into the Wirecard scandal. The witness chair on the investigative committee was therefore soon more feared by some than the dock in a criminal court

You must log in to post a comment.