Text | Rule of Law Weekend reporter Liu Xiping

Chief Editor | Answer Di

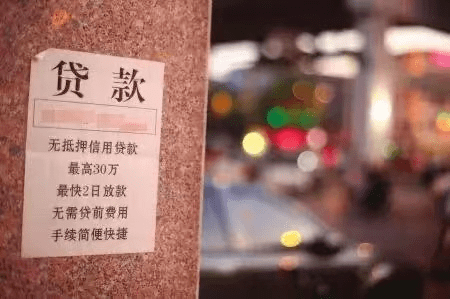

Low fee rate, fast loan, low interest rate, up to 10,000 yuan loan…

This is a publicity advertisement once launched by the two online loan platforms “186 Kuaidai” and “Honeysuckle”. The two online loan apps were launched by two technology companies in Nanjing, Jiangsu Province.

On February 24, 2021, the Intermediate People’s Court of Leshan City, Sichuan Province made a second-instance judgment on a “routine loan” case. Meng Fanjian and others used a self-developed online loan platform to implement “routine loans” to unspecified groups of society in cash loans. For fraud and infringement of citizens’ personal information, he was sentenced to fixed-term imprisonment ranging from 14 years to six months.

The reporter’s investigation found that in 2019, the CCTV 315 evening party exposed the chaos of the “714 Anti-aircraft Artillery” platform, pointing out that it “needs money but not life”, and the “714 Antiaircraft Artillery” began to enter the public eye. This kind of online loan method with extremely short borrowing cycle and extremely high interest rate introduced by Meng Fanjian and others is the “714 high artillery” model.

How does the “714 high artillery” collect money? What kind of industrial chain is derived from it? Following the verdict of the second instance in the case of Meng Fanjian and others suspected of defrauding and infringing on citizens’ personal information, the chain of property acquisition under the “714 Anti-aircraft Artillery” cyber violence slowly surfaced.

Developed online loan APP to implement “routine loan”

Establishing a technology company, developing an online loan APP platform, and then recruiting personnel to implement the online loan business, this is Meng Fanjian’s “entrepreneurial plan.”

Meng Fanjian, 31, is a native of Nanjing. After graduating from university, he took a fancy to the “business opportunities” that online loans bring huge profits. He successively established Nanjing Flash Information Technology Co., Ltd. and Nanjing Cell Information Technology Co., Ltd. to engage in online lending business. . His goal is to lend to unspecified groups of society through the “714 high artillery” model.

Industry insiders introduced to reporters that the “714 Gao Pao” online loan platform usually uses high loan quotas, unsecured, and fast lending conditions as bait, and uses false propaganda to induce borrowers to borrow on the platform, but it does not apply before lending. Clearly inform the borrower of the actual amount of the loan. After the borrower has completed all the information entry, uploaded the address book, and paid high fees, then inform the borrower that the borrower can only borrow a lower amount for various reasons, and the initial publicity The amount of high loans varies widely.

Online lending must first build a lending platform. At the beginning of the establishment of a technology company, Meng Fanjian could only purchase some online lending apps, such as “Lightning Flower”, “Heart Enjoy Wallet”, and “Xiao Li Feida (“) due to weak technical capabilities. App lends money such as “Reducing Demons and Eliminating Demons)” and “Borrow Money Spend”. Later, with the growth of the company, Meng Fanjian and others began to recruit technical forces to develop their own online loan APP.

After college graduates, Zhai Wanpeng, Li Da and others joined Meng Fanjian’s company and set up a technology development department to research and develop online loan apps. Soon, they developed 11 online loan apps such as “180 Quick Loan” and “Borrow Money”. Later, due to more complaints, the two apps of “180 Kuaidai” and “Borrow Money” were renamed “186 Kuaidai” and “Honeysuckle”.

It is reported that the two online loan APPs, “186 Quick Loan” and “Honeysuckle”, use the propaganda content of “low rates, fast loans, low interest rates, and a maximum loan of 10,000 yuan” to lure victims into loans, and then deduct service fees and The name of the interest maliciously reduces the loan amount, and the false loan agreement signed with the victim is much higher than the actual loan. The victim’s actual amount is only 56.4%-65.8% of the loan amount. The loan period is 6-7 days. The more reloans, the more often, The higher the loan amount, the higher the service fee, which causes the borrower to continue to build up debt.

Service fee is close to 40% of loan amount

In an accidental opportunity, Yang saw the “186 Quick Loan” promotional advertisement. The words “Quick payment, no mortgage, low interest, and rapid review” in the advertisement made Yang deeply impressed.

In 2019, Yang’s father needed money to treat his illness. Because he was not well-off, Yang couldn’t pay his father’s medical expenses, so he thought of “186 fast loan.”

Therefore, Yang filled in the relevant information on the “186 Kuaidai” APP as required, and successively made 11 loans on the “180 Kuaidai”, with a total loan of 35,000 yuan, but the actual receipt was only 20,000 yuan.

“The first loan was deducted more than 600 yuan. The collection staff said it was a service fee, but did not say what specific services were provided, and did not provide substantive services.” Yang said that the loan service fee has almost reached 40% of the loan amount.

In September 2019, Zeng and “180 Kuaidai” signed the “Personal Loan Service Agreement”, agreeing that Zeng had a loan amount of 4,000 yuan, a contract period of 6 days, a service fee of 1,360 yuan, an interest of 235.2 yuan, and the loan date was September 2019 On the 7th, the repayment date is September 12, 2019.

Zeng revealed that online loan platform service fee items are “various”, including mobile APP download, real-name authentication, operator authentication, third-party interface, big data risk control interface, bank card four-factor authentication interface, update verification fee, and matching service fee , Account management fees, platform maintenance fees, etc.

“This online loan platform also has a lot of penalties for overdue payments. If the payment is not repaid before 24:00 on the day of repayment, it will be regarded as overdue. Starting from the day after the repayment day, an overdue fee of 120 yuan will be charged first, and then the contract amount will be charged daily 2 % Penalty interest.” Zeng said.

From August 16th to September 7th, 2019, Mr. Zeng had a total of 5 loans, the total loan amount was 15,300 yuan, and the actual receipt was 9,208.32 yuan. The first two loan cycles were 7 days, and the last three loan cycles were 6 days. Each repayment Later, the loan amount will increase, and the corresponding service fee will also increase.

Also in the “180 Quick Loan” loan is Gao. He borrowed 2,000 yuan for the first time and received less than 1,300 yuan, the second loan was 2,400 yuan, and the received amount was less than 1,500 yuan, and the third loan was 2,900 yuan, and the received amount was 1,700 yuan. In the 7th day of the cycle, starting on the 6th day, he received a call for collection.

“The service fee has been deducted when the money arrives, and it is almost 40% of the loan amount, but the service fee specifically includes what is not stated, and no substantial services are provided.” Gao said.

The court found that when Meng Fanjian and others established two companies, the registered capital totaled 4.65 million yuan. One year later, the illegal proceeds from fraud crimes reached more than 8.9 million yuan.

The usual “explosive address book” violent collection

Some victims revealed that after the borrower is deeply trapped in the “routine” overdue, such companies will use offline violence or “soft violence” to collect debts, requiring the victims to repay the inflated debts, and to the victims and their relatives and friends through channels such as phone calls, WeChat, and SMS. Insulting, intimidating, harassing, and threatening to use non-repayment will affect credit investigation, blow up the borrower’s address book, send out private information in groups, and send insulting messages, forcing the victim to repay the so-called “debt” and seriously affecting the work of the borrower And life.

Then, how do these online lending platforms obtain personal information such as the borrower’s address book?

The criminal gang members explained to the court that there are three ways to obtain information in the online loan APP software. One is to obtain permission during the software installation, including the SMS records, call records, address book, and location information saved in the mobile phone; The second is through the SDK provided by SenseTime. The permission of the camera is obtained during installation. After the user scans the face and ID card according to the software prompts, the photos will be uploaded to the SenseTime backend, and their face and identity will be processed by their backend. After the information is compared and confirmed, it is fed back to the backend of the company’s software; the third method is to use the methods and parameters provided by Yicheng to crawl all the historical calls of the user according to the mobile phone number, operator service password, and dynamic password filled in by the user on the software interface And SMS information, including the SMS and call content that the user has deleted, as well as the detailed analysis report of the call and SMS, and the number of calls and the number of SMS. E-City’s “crawler” will not prompt the user for permission when crawling user information, nor will it tell the user the purpose of filling in the operator’s service password and dynamic password and the data that can be obtained.

The victim Gao confirmed that when applying for an online loan, he must provide his mobile phone operator’s password and check the permissions of mobile applications, such as address books, call records, and SMS records. When making a loan, you must check a loan agreement before proceeding to the next step.

For some overdue loans, Meng Fanjian and others will outsource the collection of overdue loans to a professional collection company for collection. According to the stolen personal information, these collection personnel adopt various forms to collect collections, and the “explosive address book” has become their usual collection method. Some borrowers have a tendency to commit suicide under deep pressure.

Wan had borrowed more than 20,000 yuan on online loan platforms such as “186 Kuaidai”, but was unable to repay, and the collection officer threatened her on the phone. Wan couldn’t bear the pressure and committed suicide. Fortunately, he was sent to the hospital in time and Wan was rescued. come.

In September 2019, the victim Gao also received many collection calls from Daqing, Heilongjiang, saying that his daughter Zhao owed money online and went to his home to kill Zhao without paying the money. Zhao committed suicide by taking medicine because of loan collection. Gao finally had to use the money to help Zhao pay off the loan on the online loan platform.

END

Visual Editor | Wang Shuo Ma Rongrong

Click here to add a little star for me ⭐️⭐️

You must log in to post a comment.