Earlier, the author pointed out in the article “Mountain Securities Dividend Potential ETF (515570.SH): An Index Fund with Both Value and Growth” that, compared with large-cap indexes, the Shan Securities Dividend Potential ETF has created a better market performance.

The market performance of constituent stocks directly affects the net value of the fund, so it is a good angle to study a fund from the composition of constituent stocks. Next, let’s take a look at the constituent stocks of the Shanzheng Dividend Potential ETF? And what are the characteristics of these constituent stocks?

1. Constituent stocks are concentrated in consumer and other sectors, 80% of the constituent stocks will achieve positive returns in 2020

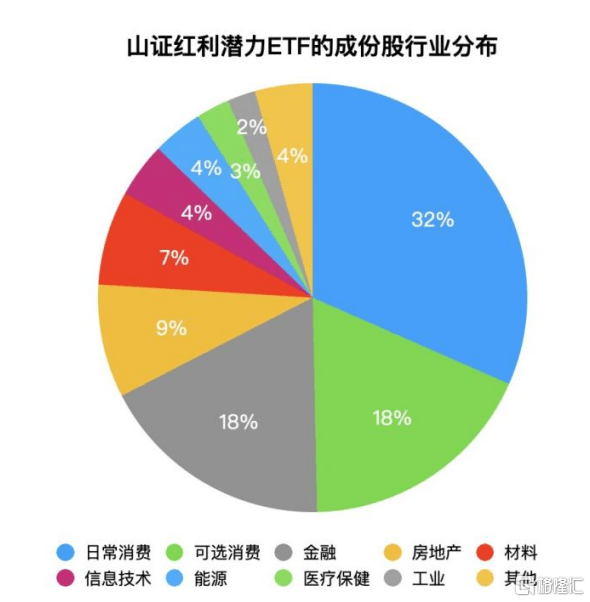

From the perspective of industry distribution, the 50 component stocks of the Shanzheng Dividend Potential ETF are mainly concentrated in the fields of daily consumption, optional consumption, finance, real estate and materials. Among them, daily consumption and optional consumption accounted for approximately 32% and 18% respectively, and the total accounted for approximately 50%. The proportion of consumer stocks reaching half is related to the screening indicators of the Shanzheng Dividend Potential ETF. The consumer industry generally has a higher return on net assets, which can better meet the fund’s requirements for related indicators.

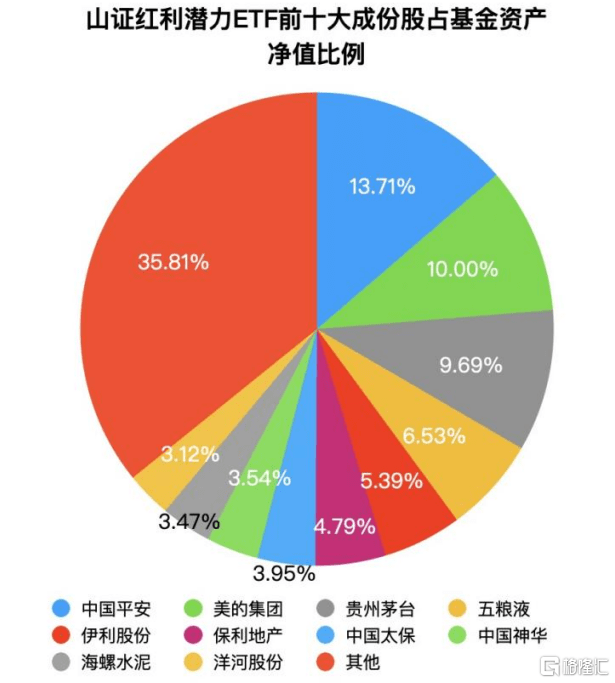

From the perspective of the top ten constituent stocks, as of the end of 2020, the top ten constituent stocks of the Shanzheng Dividend Potential ETF are Ping An of China, Midea Group, Kweichow Moutai, Wuliangye, Yili, Poly Real Estate, China Pacific Insurance, China Shenhua, Conch Cement He Yanghe shares accounted for approximately 13.71%, 10.00%, 9.69%, 6.53%, 5.39%, 4.79%, 3.95%, 3.54%, 3.47 and 3.12% of the fund’s net asset value, respectively. The total weight of the top ten constituent stocks reached approximately 64%, and the total weight of other constituent stocks accounted for approximately 36%

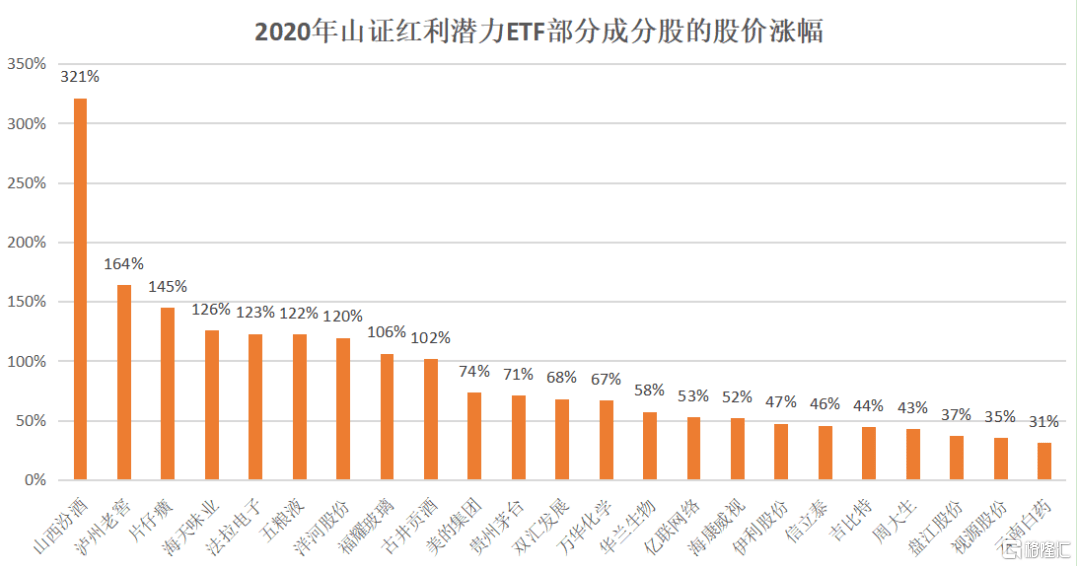

It is worth noting that in 2020, 40 of the 50 constituent stocks of the Shanzheng Dividend Potential ETF have received positive returns, accounting for up to 80%.

Thanks to the continuously high liquor market, many liquor stocks held by the Shanzheng Dividend Potential ETF in 2020 have achieved excellent market performance, including Kweichow Moutai, Wuliangye, Luzhou Laojiao, Shanxi Fenjiu and so on. Among them, Shanxi Fenjiu’s stock price rose 321% last year, Luzhou Laojiao’s annual growth rate reached 164%, Wuliangye’s annual growth rate reached 122%, and Kweichow Moutai’s annual growth rate reached 71%.

In addition, Midea Group, Haitian Flavor, Shuanghui Development, Hualan Bio, Gigabit, and Farah Electronics, which are held by Shanzheng Dividend Potential ETF, also recorded good market performance. For example, Midea Group’s share price rose 74% last year, Haitian Flavor’s share price rose 126% last year, and Farah Electronics’ share price rose 123% last year.

2. Multiple index screening, annual adjustments to ensure that the constituent stocks are all high-quality companies

The Shanzheng Dividend Potential ETF tracks the yield of the China Securities Dividend Potential Index. The investment style is a balanced market. The constituent stocks with a market value of more than 100 billion account for 42%. The constituent stocks span the Shanghai and Shenzhen stock markets and are representative of the market. The 50 constituent stocks of the fund are all high-quality stocks. These companies have established leading market positions in their respective industries, with strong competitiveness and stable performance, showing large market capitalization, high return on equity, low turnover rate, low volatility and high Growth characteristics.

In order to select high-quality constituent stocks with growth potential, the Shanzheng Dividend Potential ETF has increased the requirements for corporate profitability indicators and growth capabilities on the basis of the original screening of the dividend potential index. Therefore, the Shanzheng Dividend Potential ETF has achieved Market performance that is better than the broader market index and better than the index being tracked brings stable and considerable investment returns to investors.

According to Wind data, compared with the Shanghai and Shenzhen 300 constituent stocks and all A shares, the dividend potential index constituent stocks have higher average return on equity and earnings per share in the past three years, that is, the index reflecting the company’s profitability is superior. Not only that, compared with the Shanghai and Shenzhen 300 constituent stocks and all A shares, the dividend potential index constituent stocks have higher revenue growth and net profit growth in the past three years, that is, the index reflecting the company’s growth ability is superior.

It should be noted that these constituent stocks of the fund are not static. The constituent stocks of the dividend potential index will be re-ranked and adjusted once a year according to the quality factor. This ensures that the companies in the portfolio basket will always be the best companies in the market, making the index Continue to perform well. For example, on December 16, 2019, the component stocks of the Dividend Potential Index underwent a substantial adjustment, including good companies such as Haitian Weiye, Gigabit, and excluding Chaohongji, Guoguang Stock, and Jiangzhong Medicine. Industry and other companies.

3. The fall in valuation of constituent stocks highlights investment advantages

After the overall adjustment after the Spring Festival, the valuation advantages of many leading companies in the industry have begun to become prominent. For example, Kweichow Moutai, a major stock of the Shanzheng Dividend Potential ETF, had a price-earnings ratio (TTM) of more than 73 times this year, and has now fallen to around 54 times. Another major stock, Midea Group, is no exception. Its price-to-earnings ratio (TTM) has changed from It fell from about 30 times to about 22 times. As of April 15, 2021, the median stock-to-earnings ratio (TTM) of the fund’s 50 constituents is about 23 times, and the median price-to-book ratio is about 4 times.

From an investment point of view, these high-quality companies have no problems in their operations, but stock prices have adjusted due to short-term market fluctuations. As their valuations fall, the company’s investment attractiveness has increased. In addition, these constituent stocks themselves have high cash dividends and have great potential for future dividends. When the market adjusts, the dividend rate will rise. They are good dividend-receiving stocks. For example, among the constituent stocks of Shanzheng’s dividend potential ETF, China Fortune Fortune, Wen’s shares, Daqin Railway, China Merchants Shekou, China Shenhua, Gemdale Group, Poly Real Estate and other companies have dividend rates above 5%.

In summary, the constituent stocks of the Shanzheng Dividend Potential ETF are all high-performance benchmarks, which can reflect value and growth. The market performed well last year. Now that the overall valuation is more reasonable after the valuation declines, and the high dividend rate lays a safety margin, this index fund is suitable for investors with low risk appetite and long-term financial planning.

You must log in to post a comment.