In the 2008 financial crisis, in order to boost the country’s economy, the United States passed the crisis on to other countries through quantitative easing (QE) and reduction. Today, the United States is repeating its old tricks. After announcing unlimited “money printing,” the United States has released new signals within a day.

In the early morning of Thursday (April 15), Beijing time, Fed Powell stated in a speech at the Washington Economic Club that the US economy is at an “inflection point” of accelerating growth and hopes that the inflation rate will be moderately higher than 2% for a period of time. To the market’s surprise, he also said that before raising interest rates, the Fed will gradually reduce the scale of bond purchases (cutting QE).

Powell said that the time to reduce QE may be much earlier than the time when the Fed considers raising interest rates . He also said that although the Fed has not yet voted on this, it is a guideline. For the current market, this is undoubtedly a “blockbuster”, because any discussion about reducing QE now will cause a high degree of market tension.

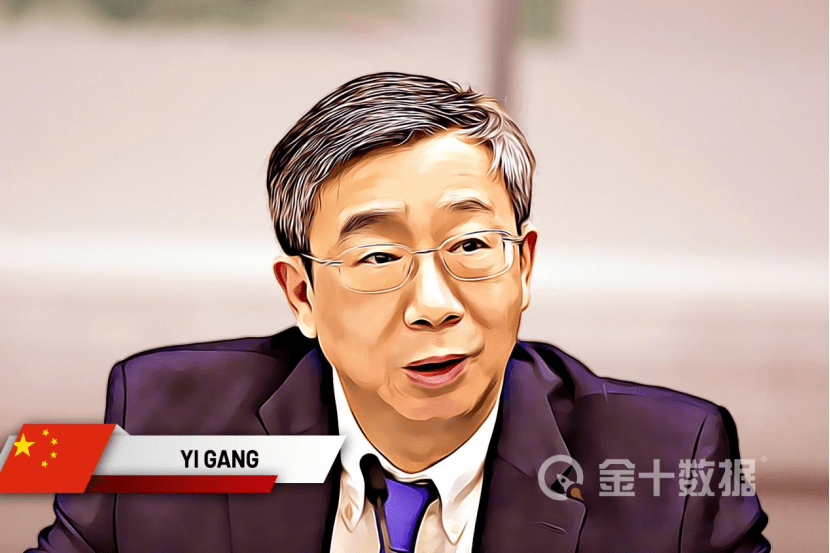

At the time when the Fed’s wind direction is changing, the Chinese central bank seems to be going the other way. China’s latest announcement on Thursday shows that on April 15, 2021, the central bank will carry out 150 billion yuan of medium-term lending facilities (MLF, commonly known as “spicy powder”) operations (including the expiration of MLF on April 15 and TMLF on April 25). Continued), in addition, a 10 billion yuan reverse repurchase operation was also carried out.

As there are 10 billion yuan of reverse repurchase and 100 billion yuan of MLF due today, China’s daily operations, from a full-scale perspective, have achieved a net investment of 50 billion yuan. What does this mean? In fact, both reverse repurchase and MLF are essentially tools for the central bank to provide liquidity to the market.

Therefore, the goal of this action is actually to maintain a reasonable abundance of liquidity in the banking system. In fact, it has been stated before that the current currency adjustment of the Federal Reserve has little impact on China. Judging from the actions in the day, the toolbox of the Central Bank of China is still very sufficient.

Text | Questions by Lu Shuoyi | Figures by Zeng Yunzi | Wenxiang Lu | Lu Shuoyi

You must log in to post a comment.