Every reporter: Wu Ruofan Every editor: Wei Wenyi

On March 30, Hongyang Real Estate (01996.HK) held an online performance conference as scheduled. Board Chairman Zeng Huansha led Executive Director and President Yuan Chun, Executive Director and Vice President Lei Weibin, and Chief Financial Officer Shen Guangping To attend a meeting. However, compared with previous years, there are fewer familiar faces on the podium.

On the day of the performance meeting, Hongyang Real Estate was exposed to the news of layoffs of 30%: the resignation of senior executives in multiple business lines, causing shocks in multiple departments; multiple departments need to determine the optimization list and complete the process before March 31. And the main reason for the layoffs is that Hongyang has reduced costs and increased efficiency due to lack of profitability.

The “Daily Business News” reporter verified this with Hongyang Real Estate, and the other party denied the rumors of layoffs.

Hongyang Real Estate delivered a relatively dazzling performance in 2020: revenue increased by about 32.9% year-on-year, gross profit increased by about 18.2% year-on-year, net profit increased by 13.4% year-on-year, and net profit attributable to parent increased by 13.2% year-on-year. In addition, contracted sales increased by 32.8% year-on-year, continuing to hit a record high.

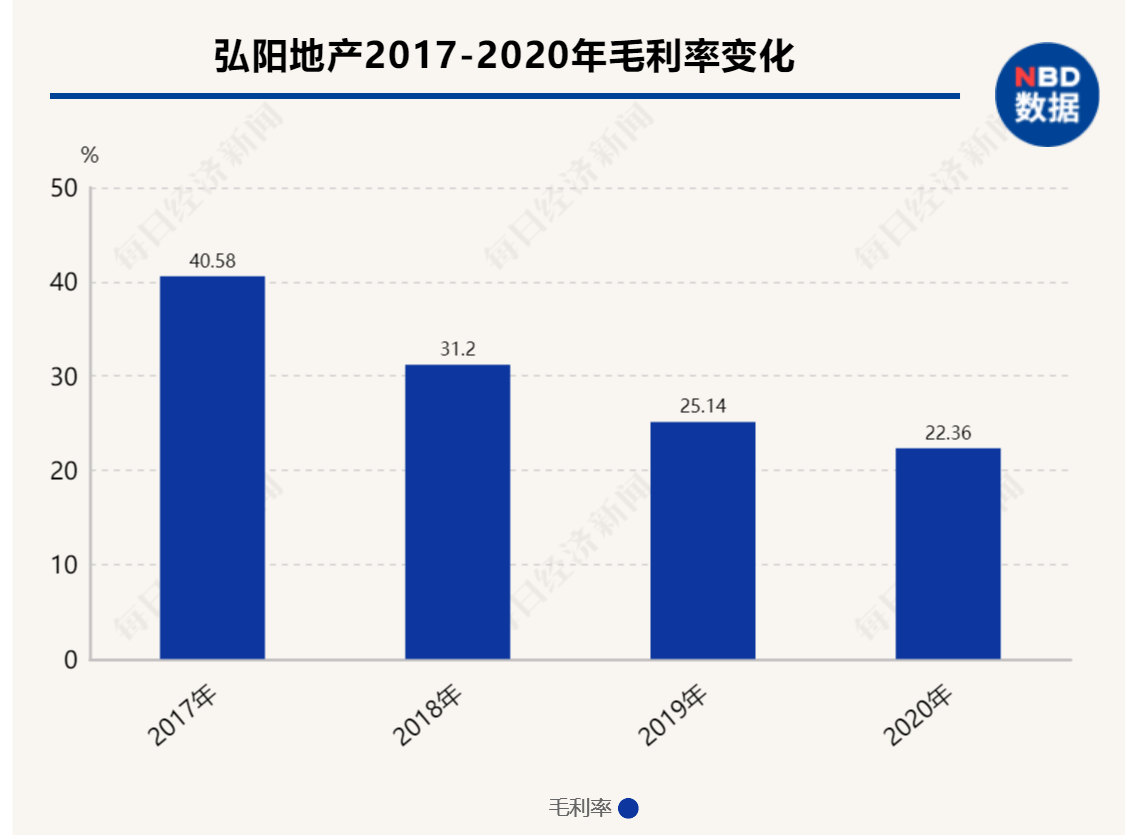

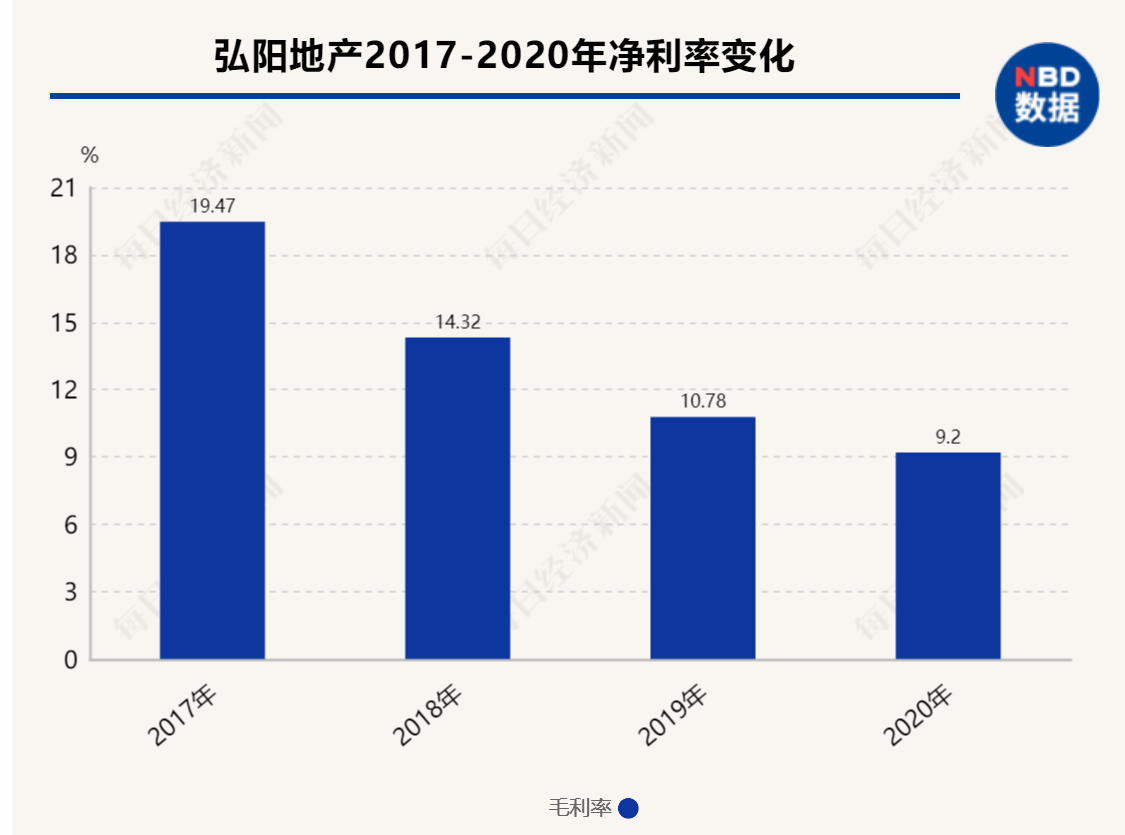

However, Hongyang Real Estate’s gross profit margin has dropped by about 2.7 percentage points from 2019, and its net profit margin has also dropped to 9.2% from 10.78% in 2019. The reporter’s inquiry found that the two project indicators of Hongyang Real Estate’s gross profit margin and net profit margin have fallen for 4 consecutive years.

Yuan Chun also said at the performance meeting that in the future, it will be more necessary to practice internal skills to improve the profitability of Hongyang Real Estate.

“Hundred Billion” plan stranded

But there are many hidden worries behind the seemingly dazzling performance.

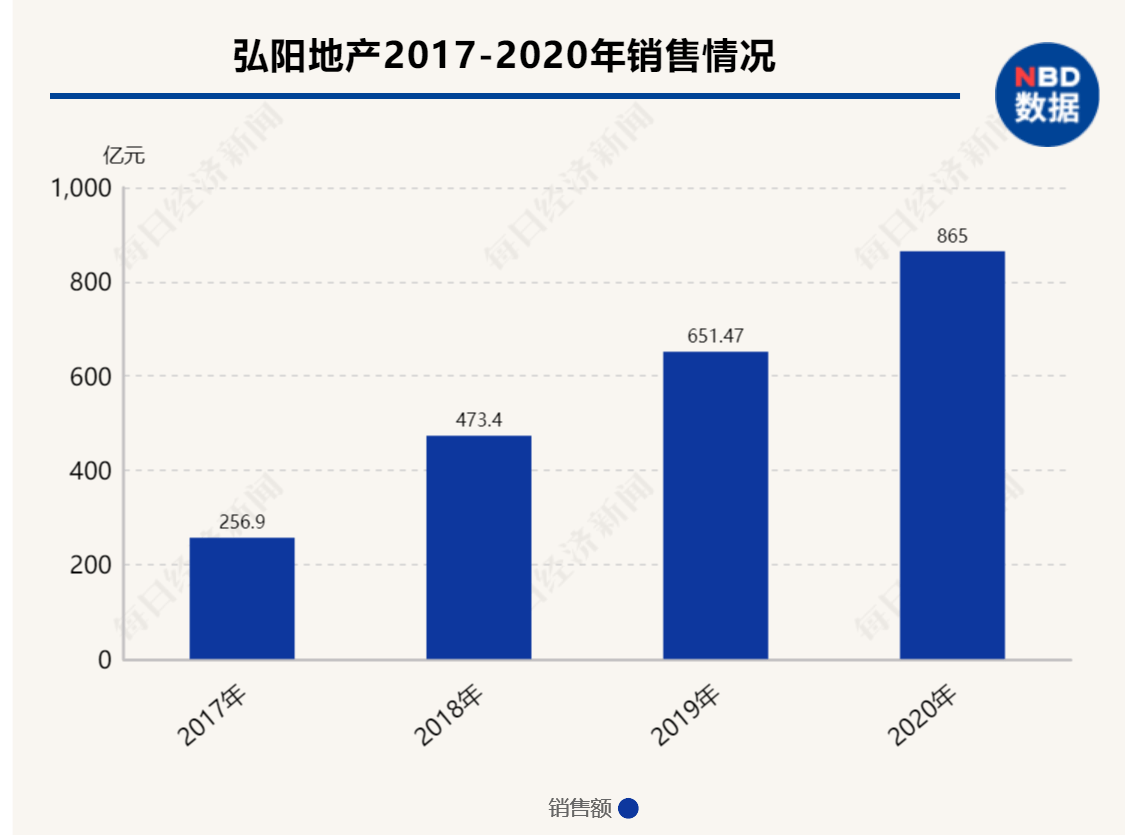

In 2017, Zeng Huansha set a “three-year 100 billion” plan, but at the end of 2020, the sales rating was 86.5 billion yuan, which is still quite far from the “100 billion” target.

Among them, the Yangtze River Delta contributed 80% of Hongyang’s sales, and Jiangsu’s sales alone reached 45.9 billion yuan. From the perspective of city level and energy level, the sales of new first-tier and second-tier cities accounted for 82.5%, which also led to the year-on-year increase in the average sales price of Hongyang (an increase of 10% to 14,622 yuan/square meter).

Perhaps because the sales growth in 2020 is not as good as expected, the management did not take the initiative to mention the sales target for 2021. If calculated on the basis of Hongyang Real Estate’s sales of 140 billion yuan in 2021 and the industry’s average sale rate of 60%, Hongyang Real Estate’s sales may reach 84 billion yuan.

But the premise is that it is necessary to guarantee the contracted payment return rate of 88% and above. Once the return rate drops, the current sales value that can be carried forward will also decrease, and Hongyang Real Estate may face the embarrassment of a decline in sales.

With a compound growth rate of 30% in the past three years, Hongyang has still failed to enter the “100 billion” threshold. However, at the performance meeting, the management of Hongyang Real Estate seemed to have changed their views on scale development.

“Under the background of the return of profitability and scale in the real estate industry, profitability is the foundation for the survival of the company.” Yuan Chun said at the performance meeting that for the current Hongyang, scale is not the first. A certain scale is necessary, but in the face of the current industry structure, there is no profit, and no matter how big the company is, it does not make sense.

4 consecutive declines in gross profit margin and net profit margin

It is true that profit is the core meaning of an enterprise, and this is also the biggest problem facing Hongyang Real Estate.

A reporter from the “Daily Economic News” found that the gross profit margin of Hongyang Real Estate from 2017 to 2020 was 40.58%, 31.25%, 25.14%, and 22.36%, which had declined for 4 consecutive years; the net profit margin was 19.47%, 14.32%, and 10.78, respectively. %, 9.2%, have fallen to single digits in 2020, and are far lower than the average net interest rate of 14.29% of the 50 typical listed real estate companies in 2019.

An industry insider who did not want to be named told the “Daily Economic News” reporter that the core problem facing Hongyang is that it has expanded rapidly in the past three years and has taken a lot of high-cost land. On the one hand, it has expanded its leverage and made great strides in order to add new goods. Value sacrifices profits, leading to low core profits carried forward in the report.

Looking back, it can be seen that Hongyang Real Estate began to expand in 2018. At that time, the changes in the policy of limiting land prices and housing prices have already appeared. The speed of real estate sales has slowed down, coupled with the increase in financial costs, which further swallowed profits.

“After 2020, under the new “three red lines” financing regulations, real estate companies need to lower their leverage in a short period of time to avoid continued business deterioration. For Hongyang Real Estate, it is even more necessary to reduce the pressure because its debt scale and leverage have already been used. Close to the extreme.” The above-mentioned industry insider said.

Delay in business

Commercial is regarded by many real estate companies as a means to boost profits, and Hongyang has also vigorously proposed a “commercial round”, and Hongyang Real Estate, which was born in a commercial store, seems to have such genes.

But the reality is that Hongyang’s reliance on residential development business has never been reduced. The annual report shows that in 2020, the operating income of Hongyang Real Estate is 20.159 billion yuan, of which 19.616 billion yuan for real estate development, accounting for more than 97%.

In fact, as early as the 2019 performance meeting, the management of Hongyang also specifically mentioned the business plan. However, in the 2020 performance meeting, there has been almost no mention of the part of heavy-asset commercial real estate.

“The main reason for the fading out of business is the low quality of operation.” A person familiar with the matter told the “Daily Business News” to tell reporters that the reason for Hongyang’s business is inseparable from the linkage with housing to obtain land. The actual operation quality of Hongyang Plaza, Home Furnishing Expo Center and other businesses is not high.

“For a business to operate well, it must first have a strong brand and strong enough IP to have the capital to hook up. Hongyang wants to learn from Xincheng, Wanda and Red Star Macalline, but it has not been in place. On the one hand, it is because its own cash flow is not enough. Sufficient, and the financing cost is not low enough. On the one hand, the brand premium and product standardization are not enough to gain a foothold in cities with strong competitors.” The above-mentioned insiders bluntly said that it is already very difficult for ordinary enterprises to obtain land by business, and Hongyang does not dare to do so. Shen does not have much advantage in the face of powerful opponents in second- and third-tier cities.

Therefore, there is only one way for Hongyang Real Estate: sinking and deep ploughing. Hongyang is also aware of this problem. At the performance meeting, Zeng Huansha positioned its development strategy in 2021 as “to expand Jiangsu, cultivate the metropolitan area, and strengthen the central city”.

Focus on quality growth in the future

In-depth cultivation and thoroughness test the company’s refined management capabilities. This is the weakness of Hongyang, which relies on high turnover and high leverage.

Zhang Bo, Dean of 58 Anju Guest House Property Research Institute, told the reporter of “Daily Economic News” that the logic of scale is no longer feasible. Real estate companies must reduce their debts and adjust their balance sheets. They must change their thinking and refine operations. This is an inevitable choice.

But back to the manufacturing logic, the refined management of small real estate companies, that is, reducing costs and increasing efficiency is difficult to increase significantly in a short time. Because real estate is not a technology industry, and real estate companies don’t have much technology investment, they can only work hard on “cost reduction”.

“Hongyang announced the news of 30% layoffs on the day of the performance meeting. I don’t think it is surprising that reducing costs will inevitably lead to layoffs and cost control actions.” Zhang Bo said bluntly, relying on this “hard landing” method to reduce costs, trying to reduce costs. Increasing revenue is not long-term.

The reporter noted that since the end of last year, Hongyang executives have changed frequently. Executive President Zhang Liang, President Jiang Daqiang, and General Manager Han Cunlei of the Capital Management Center have left one after another.

In Zhang Bo’s view, Hongyang Real Estate should change its investment thinking. It should not only guard the second and third tier cities. The sinking may also force some goods-to-land ratios and profits. At the same time, it must also strengthen land acquisition and mergers and acquisitions. In addition to the main business, opportunistic investments must also be made to ensure profitability. In addition, focusing on one’s own waterway, making premiums and differentiation in products, these are the long-term solutions and are also the top priority of Hongyang.

Yuan Chun also said at the performance meeting, “Hongyang has entered the stage of the top 50 in the industry, and quality growth is more important in the future. Next, we will focus on core competitiveness and steady and quality growth.”

Daily economic news

You must log in to post a comment.