Community group buying small players and property groups, can they compete with big factories?

Text|Wang Yaqi

Edit | Ask

There are more and more ways to buy vegetables.

Grocery store owners, fruit stall owners and even the staff of the express delivery station, three steps one person five steps one shop, there are always acquaintances around you enthusiastically to Amway: enter my group, order online and buy food, you will be able to come to me tomorrow Here to get the goods.

In the fiercely competitive 1.0 stage, Internet giants entered the game, competing for speed. Grabbing group leaders, occupying outlets, carrying traffic and capital into the originally relatively closed community consumption scene, and when users have the first experience, the next stage, the focus of competition becomes the development of consumption habits, and it is better to use Efficiency and experience to meet demand.

As the “indigenous people” of the community, real estate companies with rich wealth do not want to let go of this fat, and want to get a piece of the pie.

Real estate company not willing to be robbed of business

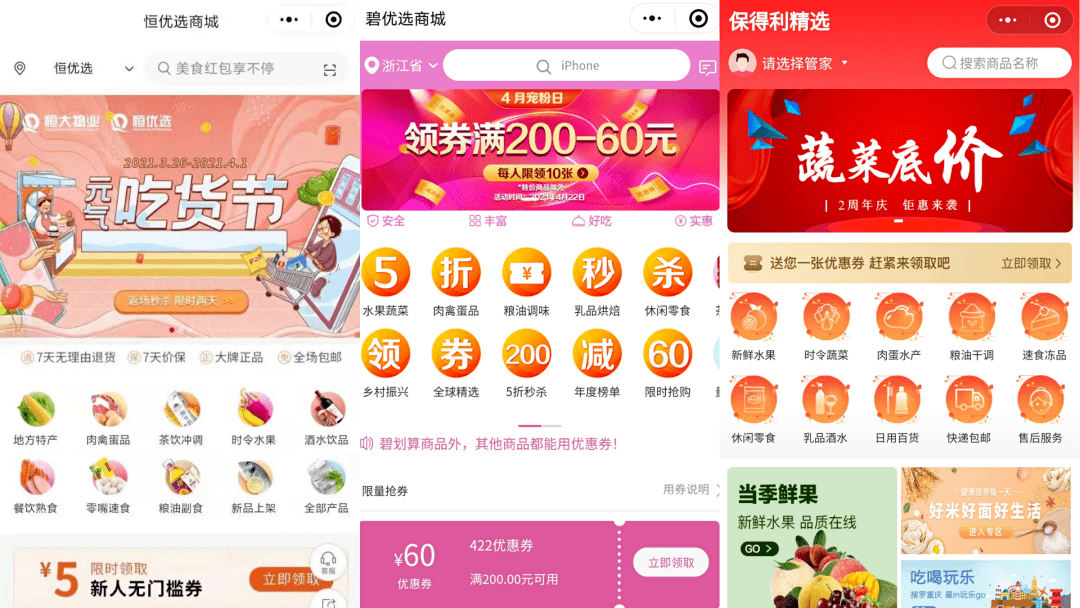

Take the Hengyou Mini Program as an example. There are 9 sections of local specialties, meat, poultry and eggs, tea brewing, seasonal fruits, alcoholic beverages, cooked food, snacks, cereals and non-staple foods, and new products on the shelves, with approximately 270 SKUs. However, there are not many fresh products. Seasonal fruits, meat, poultry, eggs, milk, and cooked food add up to only 26 SKUs, accounting for less than 10%.

If the category is not vertical enough, then make up the span. It not only provides three meals a day, but also covers various application scenarios of household consumption. For example, Hengyouyou also has tourism products such as a five-day, four-night tour in Zhangjiajie, Hunan, and a four-day, three-night tour in Guilin. Biyouyou also sells small home appliances, rice cookers, mobile phones, data cables, and Baodeli’s selection as well as tissues and laundry detergent. , Masks and other daily necessities.

The prices of commodities are generally higher than those of Dodo and Meituan. In Duoduobuying, the price of 30 native eggs is 13.98 yuan. For newcomers, 4 fresh eggs per cent are the magic weapon for drainage. But in Biyou, the price of 30 eggs is 39.05 yuan.

This is easy to understand. The customers of real estate companies are mainly the owners. The selling of vegetables is ultimately for word-of-mouth services. The goods are cheap but the quality is average. What hurts the owners’ trust in the brand. In the past few years, real estate companies have been trying to put various labels on their brands to increase consumer awareness. The agricultural field, which represents the original ecology and healthy lifestyle, is a key direction of their exploration.

As early as 2012, Greentown Property had done vegetable sales through the cooperation of investment promotion and vegetable suppliers. Wanda directly built a 5,700 acres of organic agricultural park in Beijing, which was self-harvesting and self-selling, as well as agriculture developed by Vanke and China Resources. A characteristic town with unique agricultural, forestry, animal husbandry and fishery products. Country Garden has a wider range of business flows. In 2016, it launched the community store “Phoenix Optimal”, selling a variety of rice, grains and oils. At its peak, there were more than 1,300 stores across the country.

Looking at the financial reports of major property companies, in addition to property fees, the growth rate of community value-added service income is a highlight that all companies have emphasized when they publish their report cards. In 2020, Evergrande Real Estate achieved revenue of approximately 10.51 billion yuan, of which property management service income was approximately 6.322 billion yuan, a year-on-year increase of approximately 37.1%, and community value-added service income was approximately 1.264 billion yuan, a year-on-year increase of approximately 120.6%.

Small community group buying players who survive in the cracks

One question is, why didn’t the property management company choose to directly cooperate with major manufacturers such as Duoduo Mai Cai and Meituan Mai Cai? Take Yi Xiaoxian as an example. The property is responsible for building a new group in the community, and it is the leader of the group. All operations and delivery actions are completed by Yi Xiaoxian. The property only needs to connect with the owner and be a “delivery tool person”. The tool person can be the community security or property management.

The property does not need to allocate too much time and energy, and at the same time it can also have an advantage in income distribution.

Zhang Teng told “e-commerce online”, “Usually our product gross profit is around 20 points. All our sales are allocated to the property. Only 12 points of profit are taken, and the remaining 8 points are reserved for the property. The financial report of the property company is a dazzling GMV. When cooperating with major manufacturers, GMV is basically attributed to the platform. It is impossible to give the property, and the property can only receive a commission. We can even develop a small program for the property. The name of the program can still be XX property.”

On the one hand, it makes the financial report of the property company look better. On the other hand, the user’s resources can still be in the hands of the property. This is the key. At present, Yi Xiaoxian has entered more than 10 communities through the property owner and is expected to cover hundreds of communities in Changzhou by the end of the year.

Taking the 1,200-household Xiangyilanqiao community as an example, the first month’s sales are about 15,000 yuan, of which the customer conversion rate is about 30%, and the average monthly customer unit price is 42 yuan. An industry insider revealed to “E-commerce Online” that the top platforms such as Meituan and Duoduo are in Changzhou, and the average daily turnover of a community is about 20,000 yuan, and the mode of property cooperation is already close to this average value.

Where is the confidence of Baotuan PK Dachang

Zhang Teng described it as a “rigid flow.” At present, most of the group leaders selected by the platform are the owners of supermarkets and fruit shops around the community. These stalls are close enough, but users still need to take a detour to pick up the goods. The security guard of the property company is the head of the team, no matter who it is, you need to enter from the gate of the community, and you will get the goods when you enter.

The conversion rate of this kind of rigid traffic is very impressive. Pan Jun, chairman of the property’s first “Color Life”, revealed in an interview that their membership conversion rate is 7 times that of traditional community shops.

But in the long run, for real estate and property companies, this is more like a transitional strategy-the party that controls the flow must also want to hold the supply chain and operations in its hands, which means that there is no need to monetize the flow. The income is divided out again.

Favorites

Report

You must log in to post a comment.