China Fund News Taylor

After the wind and rain, the real grass is still the most fragrant. According to the latest data, in January, the world’s largest Chinese equity fund, which reduced its holdings in Moutai, played high selling and buying low, and bought it again!

The world’s largest Chinese equity fund increased its holdings of Moutai in March!

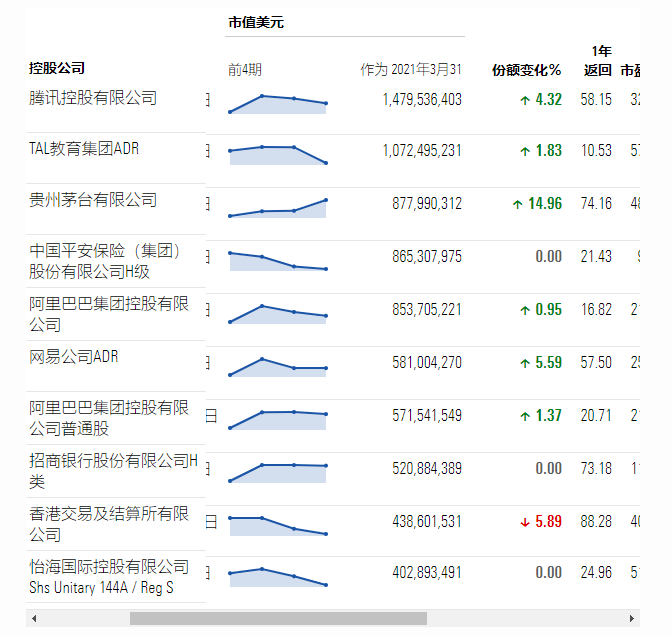

According to the latest data from Morningstar’s official website, the world’s largest Chinese equity fund “UBS (Luxembourg) China Select Equity Fund (USD)” increased its holdings in Kweichow Moutai in March, with its share increasing by nearly 15%. As of March 31, Guizhou Moutai is the fund’s third largest stock. In addition, it has also increased its holdings in Tencent, and its heavy holdings include Ping An of China, Alibaba, and NetEase.

As of the end of March, the market value of Moutai in Kweichow held by this fund is US$877.9 billion, which is equivalent to more than RMB 5.7 billion.

You know, this fund reduced its holdings in Moutai in late January this year. At that time, it was reported that as of the end of January, Guizhou Moutai was the fund’s fifth largest holding stock. Compared with the end of 2020, the fund held Guizhou. Moutai decreased by 3.66%.

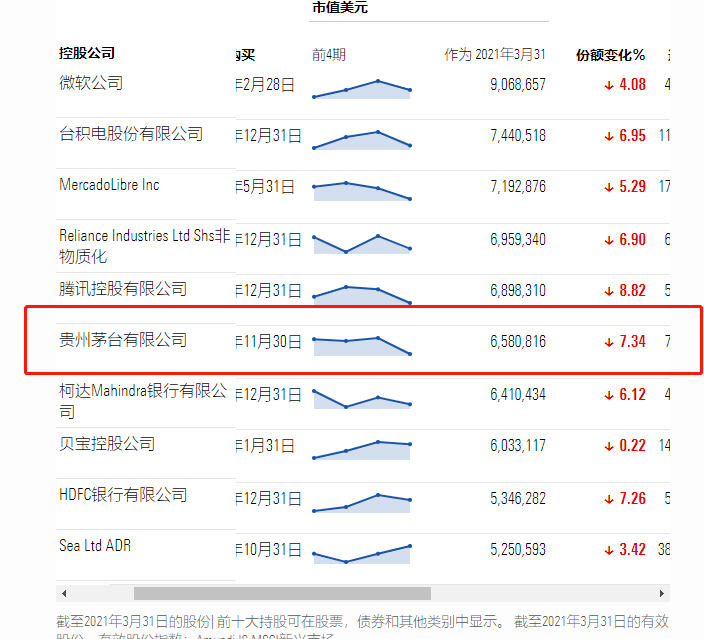

In addition to this fund, funds under the US Capital Group have reduced their holdings of Moutai at the end of 2020.

After foreign capital reduced its holdings of Moutai, various core assets have begun to fall back this year. Take Moutai as an example, it has withdrawn 23% from the high point this year.

However, it is worth noting that the capital group that holds the largest number of shares in Moutai in the world, its “New World Fund” is still reducing its holdings in Moutai in March, and Morningstar’s data shows that its share has dropped by 7%.

It seems that foreign investment also has different views on Moutai.

Shareholders: Foreign investors are doing T?

Is white wine still fragrant?

On April 8th, China Merchants Food invited several guests to discuss the valuation of liquor, which investors are more concerned about, in the form of interviews. Share how to price liquor assets and how to invest in liquor under different investment frameworks.

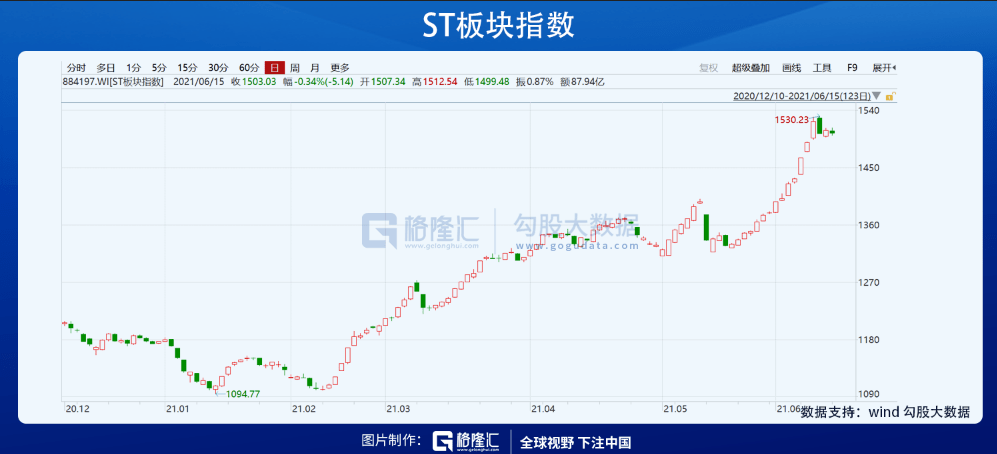

It mentioned that Huang Ruiqi, Senior Fund Manager of Allianz Global, mentioned The stock price of the liquor sector rose too fast last year, which exceeded the support provided by profit growth. The latter part mainly relied on the increase in valuation, and a more dangerous situation appeared. The stock price correction is only a matter of time. After the Spring Festival holiday, investment sentiment changed, triggering a sharp drop in stock prices. We tracked the channel and found that the fundamentals have not changed much, so we judged that the fluctuations since the beginning of the year have little to do with the basic factors, mainly due to the outflow of profitable funds brought about by the change in investment sentiment.

The valuation increase of A-share liquor stocks in the past few years is also partly due to foreign participation. Overseas institutional investors generally focus on the balance of returns and risks, so they are willing to give higher valuations to stocks with stable growth (such as food and beverages). The same situation has occurred in A shares in recent years.

As for the flow of funds, I believe that the inflow of funds into A-shares will be a long-term structural growth, because the proportion of China’s A-shares in global asset allocation is still seriously low. If you look at the current A shares, they actually only account for less than 5% of the MSCI index. Eventually, if the A shares are fully included, the proportion will be more than four or five times the current amount. Therefore, overseas investors are very clear about this. Whenever A shares fall severely, they will seize the opportunity. The stable growth sector of liquor must be given priority.

Hou Hao, manager of China Merchants China Securities Liquor Fund, said, The problem with high valuations is that any disturbance will bring changes in marginal funds, which will lead to follow-up of trend funds. This is the situation in which disturbances occur after the holiday, and the volatility caused by the follow-up of marginal funds and trend funds increases. From the perspective of the next 3-5 year cycle, this year is the starting point for many companies in the liquor industry in the 14th Five-Year Plan period. I learned at the rum party that the future development pattern and trend of the entire industry will be better. The future space looks at prices first, and prices change with changes in the level of economic development and per capita income. In terms of volume, some high-end and sub-high-end brands, especially sauce wine and companies with base wine reserves, will see obvious marginal changes in the next five years. Another major change factor, which has been discussed a lot, is the change in the price band of overtaking in the corner that may be brought about by the change in opinion leaders’ views. This point is actually hard to ignore.

U.S. stocks hit a new high

Dow rose to 34,000 points for the first time

A-share stockholders cried with envy, and US stocks hit a new high tonight.

On the 15th, US time, driven by positive economic data and earnings reports, the three major U.S. stock indexes opened higher. For the first time in history, the Dow broke through the 34,000-point mark.

The US Department of Commerce reported that US retail sales in March increased by 9.8% month-on-month, a new high since May last year, far exceeding expectations of 5.9%. According to data from the US Department of Labor, the number of people applying for unemployment benefits for the first time last week fell from 744,000 in the previous week to 576,000, a record low since the week of March 14 last year. It was better than market expectations and both helped US stocks rise.

The three major European stock markets opened higher and the European Stoxx 600 index hit a record high

On the other hand, European stock markets opened higher due to a series of March inflation data released by major European economies. As of 10:11 pm on the 15th, Beijing time, the London FTSE 100 index rose 0.68%, the Frankfurt DAX index rose 0.26%, and the Paris CAC40 index rose 0.35%.

The Pan-European Stoxx 600 Index hit a high of 438.29 points, which is more than 55% higher than the low on March 18 last year. Analysts said that because European stocks are still at a low level compared with US stocks, there is still room for further gains in European stocks. JPMorgan Chase analysis indicated that the pan-European Stoxx 600 index is expected to rise 3% this year. Bank of America analysts expect the index to rise by 7% by the end of this summer.

Just now, the National Big Fund reduced its holdings of SMIC by 100 million shares!Biden imposes new sanctions on Russia

You must log in to post a comment.