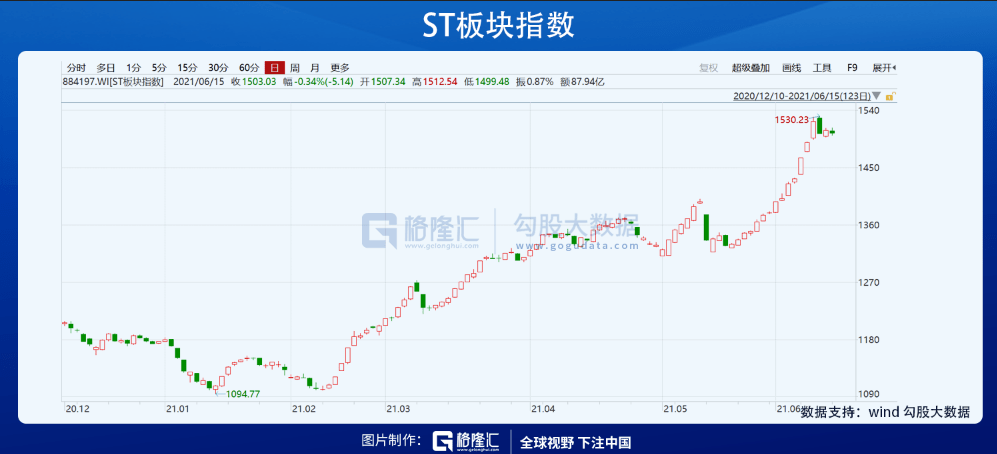

Three big mountains in the current market: liquor, new energy, and medicine have become the standard position allocation of institutions. The larger the market value and the more institutions, the tighter the group. But this year, the style of the institution has shifted partially, aiming at the small and medium market value field, and what is more, looking at ST stocks. According to the ST sector index in wind, since the low point in February this year, the cumulative increase has reached 36.28%, ranking among the top three major sectors.

From the perspective of subdivided stocks, the gains are even more amazing. Pull the timeline to look at the gains. Stocks that have doubled are everywhere. Three leading leaders: ST Shede (willing to wine), ST Zotye, and ST Rock.

And the wine industry is the leader of the ST sector’s surge. Since September last year, the company’s cumulative increase has exceeded 6 times, corresponding to a total market value of more than 70 billion.

The logic of capital speculation in the wine industry lies in two points: one is that it did not rise because the major shareholder was bad, and the valuation of the stock price plummeted after ST was underestimated. The adjustment strategy of the company’s management made the company’s performance start again, and it took off some time ago.

According to the first quarter report of 2021, the company’s operating income for the first quarter of 2021 was 1.028 billion yuan, a year-on-year increase of 154.21%; net profit was 302 million yuan, a year-on-year increase of 1031.19%. The 2020 annual report shows that the company achieved revenue of 2.704 billion yuan in 2020, a year-on-year increase of 2.02%; net profit was 581.1 million yuan, a year-on-year increase of 14.42%.

Another point is that the liquor sector continued to be sought after by funds in the second half of last year, which gave the willingness to the wine industry a good stock price environment. After all, the business model of liquor is the top class in the A-share consumer track field, enjoying a high valuation premium and institutional grouping. trend.

Therefore, under the leadership of the willing wine industry this year, the ST sector has set off a big market. The main logic is to focus on low valuations. After the bubble of group stocks is superimposed, some funds are looking for low valuations in other sectors to speculate. .

Moreover, from the recent institutional survey actions, last week, according to data, a number of ST companies received institutional research, including *ST Huaying, *ST Kodi, *ST Lion, *ST Zhongfu, ST Six companies, Senyuan and ST Xintong.

These companies focus on new energy, consumption and technology. From the perspective of ST Mengshi, one company mainly focuses on R&D, production and sales of various types of batteries. From 2017 to 2020, the net profit of *ST Mengshi is -1.39 respectively. 100 million yuan, 2.777 billion yuan, 152 million yuan, and 1.814 billion yuan. Only in 2019 due to debt restructuring exempted debt to achieve profitability, the company abbreviation was also changed from “ST Lion” to “ST Lion”.

However, since its audited net assets attributable to shareholders of listed companies at the end of the 2020 period are negative, on April 30 this year, the company once again “wears stars and hats.”

It is worth noting that the asset restructuring plan disclosed by *ST Lions in 2018 has not been completed until today, and there is still uncertainty about whether it can be successfully completed. *ST Kedi introduced that the reorganization of major shareholders is proceeding in an orderly manner; *ST Zhongfu stated that in the first quarter of 2021, due to the continuous rise in aluminum prices and the commissioning of the Guangyuan electrolytic aluminum project, the profit of the electrolytic aluminum business increased; it was also affected by the company and its subsidiaries. After entering the judicial reorganization, the suspension of interest accrual in accordance with the law affected the reduction of financial expenses and achieved profitability in the first quarter.The company’s debt restructuring is currently being carried out in an orderly manner

For ST stocks, the fundamentals of these companies are very poor. What can be seen is whether the company’s management can make substantial adjustments and changes, and then stay in the capital market, so that there is a gap in expectations, but for institutions, The survey is only to understand that if you want to build a large-scale position and buy, in fact, there is also the risk judgment of the institution itself.

Moreover, in addition to the recent attention of ST stocks by institutions, there are also several companies that have also been extensively investigated by institutions.

Survey of more than 150 institutions

According to Wind data, in the past week, more than 370 institutions including securities companies and fund companies investigated 124 A-share listed companies, covering dozens of subdivisions such as chemicals, machinery, electronic equipment, electronic components, and construction engineering.

Among them, Tuopu Group and Hairong Technology have received surveys from more than 150 institutions. However, these two companies have increased by more than 30%.

As a Tesla concept star stock, Tuopu Group is mainly engaged in the research and development, production and sales of rubber shock absorption products and sound insulation products in the field of automotive NVH (vibration, noise reduction and comfort control).

The technology and R&D level in the automotive NVH field ranks in the forefront of the country. It is one of the few domestic NVH parts suppliers with the ability to synchronize the research and development of the entire vehicle, and it is also the earliest domestic independent entry into the global vehicle supporting parts procurement system Brand auto parts manufacturer.

The latest performance shows that in the first quarter, revenue was 2.426 billion yuan, a year-on-year increase of 100.8%, profit attributable to the parent was 246 million yuan, a year-on-year increase of 116.4%, and net profit attributable to the parent after deduction was 240 million yuan, a year-on-year increase of 122.9%.

New orders promote performance, and the Tier0.5 cooperation model has already cooperated with new leading car-building forces such as RIVIAN, Xiaopeng, Weilai, and Ideal.

Hairong Technology is a professional company integrating R&D, production and sales of raw materials in the baking industry, including dozens of high-quality food raw materials in three categories, including non-dairy cream, non-dairy cream containing milk fat, jam, and chocolate. It already has two production bases in Shanghai, China and New Delhi, India. The current stock price corresponds to PE54.8 times.

In 2020, the total operating income will be 572 million yuan, a decrease of 2.04% year-on-year. In 2021, the total operating income will be 157 million yuan, +43.91% year-on-year; the net profit attributable to the parent in 2020 will be 87 million yuan, an increase of 13.18% year-on-year. In 2021, Q1 will be returned to the parent Net profit was 16 million yuan, a year-on-year increase of 323.76%; in 2020, net profit attributable to the parent after deduction was 83 million yuan, a year-on-year increase of 10.92%.

In terms of the market outlook, institutions have different views. Take Industrial Securities as an example: the world staged a “value stock bull market”. The Chinese market need not worry too much. A large amount of liquidity is still accumulated in the currency and bond markets, and global funds flow to the stock market. It also flows to emerging markets, of which China has benefited the most. Valuation is down and profitability is up. We continue to be optimistic about the main line of global recovery. It is recommended that the short-term performance is quickly implemented, rather than telling stories and speculating in expected industries and individual stocks.

In terms of specific directions, Industrial Securities recommends grasping three main lines: the first is the global recovery with rising volume and price of mid-upstream cyclical manufactured products; the second is the service-oriented consumption that has gradually recovered from the epidemic; the third is the main line of carbon neutrality.

You must log in to post a comment.