Image source: Photograph

Reporter | Zhao Yangge Reporter | Zhao Yangge Longda Meat (002726.SZ) has more than doubled its performance in 2020, while ST Yunsheng (600767.SH) has only turned losses into profits, and will even be transferred out, two listed companies controlled by the “Yijun Family” Platform, now it can be described as the two heavens of ice and fire. In fact, the “Yijun family” Dai Xuebin and Dong Xiang took charge of ST Yunsheng even earlier. They have spent a lot of effort in the past five years, but they did not produce satisfactory results in the end. After the annual report, there are two consecutive limits On the evening of April 19, ST Yunsheng disclosed its 2020 annual report. The annual report disclosed that ST Yunsheng’s operating income in 2020 was only 48.673 million yuan, compared with 132 million yuan in 2019, which was a sharp decline of 63.26% year-on-year; the net profit attributable to shareholders of listed companies was 9.6395 million yuan, which turned losses into profits compared with 2019. Net profit is still 1.385 million yuan, and basic earnings per share are 0.028 yuan.  ST Yunsheng is mainly engaged in medical information business, medical service business and medical circulation business. ST Yunsheng stated that the main reason for the decrease in operating income was that the company’s medical circulation business income recognition principle was adjusted from the gross method to the net method in the current period with reference to the implementation of the new income standards, and revenue decreased by 51,594,500 yuan from the previous year; in addition, the company’s current revenue The completion of the business sale of Rongda Information during the period, a year-on-year decrease in revenue of 32.75 million yuan; and the change in net profit was due to the company’s timely stop loss and sale of poorly operated businesses, which reduced operating losses and impairment losses by approximately 46,895,100 yuan year-on-year.

ST Yunsheng is mainly engaged in medical information business, medical service business and medical circulation business. ST Yunsheng stated that the main reason for the decrease in operating income was that the company’s medical circulation business income recognition principle was adjusted from the gross method to the net method in the current period with reference to the implementation of the new income standards, and revenue decreased by 51,594,500 yuan from the previous year; in addition, the company’s current revenue The completion of the business sale of Rongda Information during the period, a year-on-year decrease in revenue of 32.75 million yuan; and the change in net profit was due to the company’s timely stop loss and sale of poorly operated businesses, which reduced operating losses and impairment losses by approximately 46,895,100 yuan year-on-year.

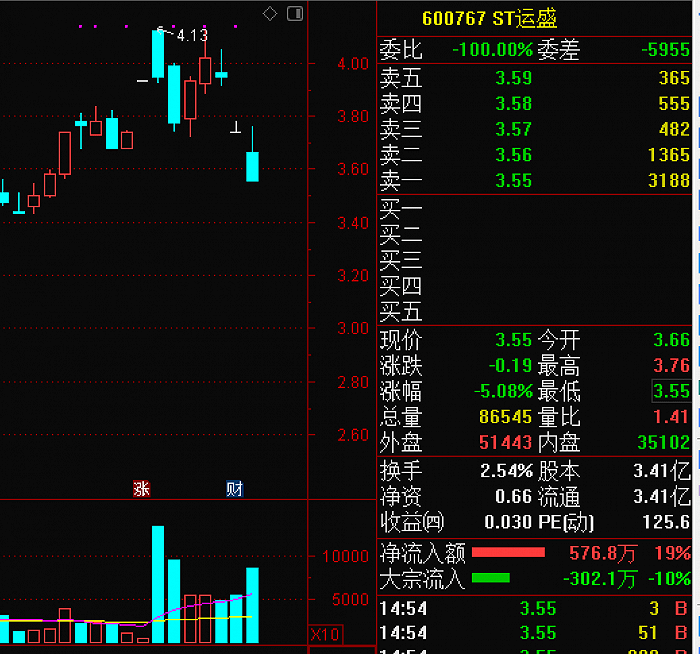

The data that turned losses into profits is arguably a good thing for ST Yunsheng, but on the first trading day (April 20) when the annual report was released, ST Yunsheng seemed to be overdrafted and opened with a lower limit. The final drop was 5.08% and changed hands. The rate is 1.59%. The lower limit lasted until April 21. From the disk perspective, this “seeing the light and death” lower limit seems to be a sign. There was a lot of selling pressure on April 13 and April 14. The selling pressure on April 13 forced the ST Yunsheng on the daily limit to abruptly. However, the selling pressure on April 14 pushed ST Yunsheng’s stock price to the down limit.

Source: Tongdaxin

On April 22 and 23, ST Yunsheng’s share price has eased slightly, but it remains to be seen whether it will stop the decline.

“Yijun Department” opted out

It needs to be pointed out that this may be the last annual report under the rule of the “Yijun family” Dai Xuebin and Dong Xiang.

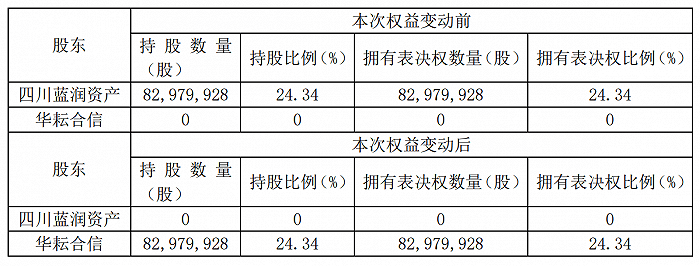

According to public information, Sichuan Lanrun Asset Management Co., Ltd. (hereinafter referred to as Sichuan Lanrun Assets), the controlling shareholder of ST Yunsheng, intends to transfer the office to Huayun Hexin (Hainan) Investment Partnership (Limited Partnership) (hereinafter referred to as Huayun Hexin) Holds 24.34% of ST Yunsheng’s shares; at the same time, from the date when Huayun Hexin and Sichuan Lanrun Assets signed the “Share Transfer Agreement” to the date when the “Share Transfer Agreement” was cancelled in accordance with the contract or the underlying shares completed the share delivery, Sichuan Lanrun Assets has irrevocably entrusted all the voting rights corresponding to the 8,299,929,280 shares of Yunsheng Medical that it holds in its unrestricted circulation to Huayun Hexin.

If the transfer is completed, Sichuan Lanrun Assets will no longer hold the company’s shares, Huayun Hexin will become the company’s controlling shareholder, and the company’s actual controller will be changed from the “Yijun family” Dai Xuebin and Dong Xiang to Weng Songlin. It is reported that the transfer price is 600 million yuan, and Huayun Hexin said that the funds came from its own funds.

Source: Announcement

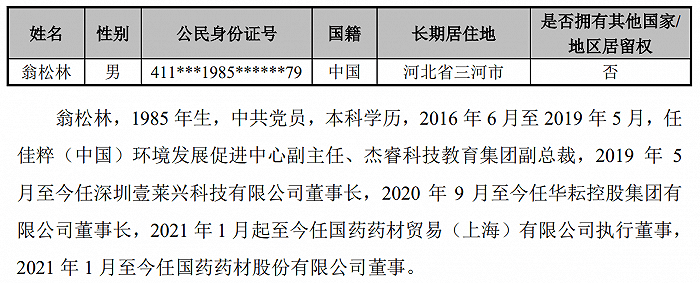

According to data, Huayun Hexin was established on March 31, 2021. It was obviously set up for the transfer, and it did not carry out actual business itself. Weng Songlin was born in 1985. From June 2016 to May 2019, he served as the deputy director of Jiacui (China) Environmental Development Promotion Center and the vice president of Jierui Technology Education Group. From May 2019 to present, he has served as the chairman of Shenzhen Yilaixing Technology Co., Ltd. He has been the chairman of Huayun Holding Group Co., Ltd. since September 2020, executive director of Sinopharm Trading (Shanghai) Co., Ltd. since January 2021, and director of Sinopharm Co., Ltd. since January 2021.

Source: Announcement

Source: Announcement

It is shown in the equity change book that Huayun Hexin obtained control of the listed company, aiming to make full use of its resource integration and capital management capabilities, and through continuous resource allocation and optimization and adjustment of business structure, to comprehensively enhance the sustainability of the listed company , To promote the long-term, healthy and sustainable development of listed companies, and strive to build listed companies into high-quality listing platforms. Although Huayun Hexin plans to help listed companies continue to develop in the fields of medical services, medical technology, etc., Huayun Hexin has not sold or merged the assets and businesses of listed companies and their subsidiaries for the time being in the next 12 months. , There is no plan for joint venture or cooperation with others, and there is no reorganization plan for the listed company to purchase or replace assets.

According to the announcement, this transfer requires the compliance review of the Shanghai Stock Exchange and the procedures for the transfer of shares in the Shanghai Branch of China Deng Company. Therefore, the transfer of the underlying shares will take some time to complete.

Take a loss at a consideration of 600 million

Sichuan Lanrun Assets under the “Yijun Department” acquired 53.51 million shares of ST Yunsheng held by Kyushu Investment in June 2016, at a cost of 840 million yuan, and became ST Yunsheng’s largest shareholder. After several times of increase in holdings, only to hit the current ratio of 24.33% held, the control is stable. Now the resale price is set at 600 million yuan, and it has done a loss-making business in the past few years.

Source: Sky Eye Check

In less than 5 years, the effort of the “Yijun Family” is not only the above.

Public information shows that Lan Run has borrowed money from listed companies to supplement liquidity for turnover; in 2017, it also started to dispose of ST Yunsheng; it also introduced Redstone International to sign strategic investment agreements; and it has acquired assets after 2018. The targets include Shaanxi Runze Pharmaceutical Company, Jiaozuo Yuntaishan Pharmaceutical Co., Ltd., Jiangxi Qingchun Kangyuan Pharmaceutical Co., Ltd., Shanghai International Pharmaceutical Trade Co., Ltd., Jingde Honglin Health Industry Development Co., Ltd., etc.

However, although the “Yijun system” has paid something, it has been lingering on the question that the controlling party has no relevant core assets that can match ST Yunsheng. In terms of performance, ST Yunsheng has always been stuck in the shell war. The net profit in 2017 was 4,422,200 yuan, the net profit in 2018 was 20,408,300 yuan, the net profit in 2019 was -70,288,300 yuan, and the net profit in 2020 was 9,639,500 yuan; the non-net profits for the four years were -34,763,300 yuan and 4,637,200 yuan respectively. , -79,840,900 yuan and 1,385,800 yuan. For example, in 2017, the controlling party was once an emergency aid pool, and the related party purchased two assets of the company, so that the listed company recorded an investment income and helped it turn losses into profits that year.

Due to poor performance, the stock price continued to be sluggish. In June 2016, ST Yunsheng was still around 15 yuan. Just one year later, the stock price fell to around 6 yuan. After several years, on January 14, 2021, ST Yunsheng even set a new low of 2.45 yuan. As of the close of the market on April 22, 2021, the stock price closed at 3.61 yuan.

The center of gravity or the dragon big meat

Perhaps the attention of the “Yijun system” is not on ST Yunsheng, but on another listed company platform: Longda Meat.

The “Yijun Family” entering the Dragon Meat Food took place in 2018. In June of that year, Lanrun Investment Holding Group Co., Ltd. (now Lanrun Development Holding Group Co., Ltd.) spent 761 million yuan in real money to acquire 75.6 million shares of Longda Meat; in August, Lanrun spent more money 1.21 billion yuan, an additional 10% of the chips. In 2019, Lanrun made another big investment, investing 1.23 billion yuan. At that time, the proportion of holding Longda meat was increased to 29.92%, and the total cost was about 3.2 billion yuan. In addition, some shareholders’ Reduction of holdings will make the position of “Yijun Family” in Longda Meat Food even more stable. At present, Lanrun Development Holding Group Co., Ltd. holds 29.51% of Longda Meat, with 294 million shares.

After a few years of dormancy, taking advantage of the industry’s east wind, Longda Meat recorded an operating income of 24.102 billion yuan in 2020, a year-on-year increase of 43.27%. The net profit that year was 906 million yuan, which was an increase of 276.06%. The deduction of non-net profit was also around 900 million yuan, a year-on-year increase of 291.04%. At present, Longda Meat has formed a “whole industry chain” business development model with slaughter and fine processing and meat products as the core, and pig breeding and import trade as supporting facilities. As of the end of 2020, the company’s actual slaughtering capacity was 10 million heads/year. In 2020, the company has slaughtered 4.065 million pigs, and its service targets include Yum System, McDonald’s System, Hormel (China), Shanghai Meilin, Haidilao, General Mills, Master Kong, Yihai Kerry, Ting Hsin International, etc. In addition, Longda Meat also has a meat product section with a production capacity of 60,000 tons per year. As for breeding, as of the end of 2020, Longda’s meat breeding production capacity is 600,000 heads/year. In 2020, the company will produce 318,500 pigs for slaughter.

According to Longda Meat’s description, in terms of slaughter layout, the company has successively expanded slaughter plants in Guanyun, Jiangsu, Anda, Heilongjiang, and Tongliao, Inner Mongolia through investment and construction and equity acquisitions; in terms of meat product layout, the company has successively expanded its slaughter plants in Laiyang, Shandong, Guanyun, Jiangsu, Anda in Heilongjiang and Rushan in Shandong have invested in the construction of deep-processing plants for meat products, accelerating the national layout. However, it is worth noting that Longda Meat’s cash flow from operating activities in 2019 and 2019 was -107 million yuan and 1.371 billion yuan, and the financial tension during the period was beyond words. Cash flow from operating activities in 2020 is 1.325 billion yuan. As of the end of 2020, Longda Meat has short-term loans of 1.937 billion yuan and monetary funds of 2.397 billion yuan.

On the other hand, according to the 2020 annual report, of the 294 million shares held by Lan Run Development Holding Group Co., Ltd., 233 million shares are under pledge, accounting for nearly 80%.

You must log in to post a comment.