Text | Edited by Yang Yafei | Qiao Qian

“Here (IAPM) will open a Manner soon, on the third floor, next to Starbucks.” Alex told 36Kr.

Alex used to be in charge of shopping mall investment in Shanghai, and iapm is the place where he hangs out almost every day. When this mall in Puxi’s most prosperous business district opened seven years ago, three Starbucks were brought in at once. “This is a very traditional “Starbucks-style layout”-there are three in one opening, one on the fifth floor, one on the B2 floor, and one in the office on the second floor. “Alex said.

Over the years, Alex has witnessed the dazzling new coffee brands such as Seesaw, Greybox, Peet’s, Arabica, squeezed in step by step. But it seems too early to say which one has the opportunity to challenge Starbucks’ position.

Until the emergence of Manner coffee.

With the new store to be opened on the third floor and the old store previously opened on the LG1 floor, the two Manners have become “horns” and have launched a flanking attack on Starbucks.

A bigger war has been fought at the capital level.

36 Krypton once reported that at the end of 2020, this coffee brand, which was established in 2015 and started as a 2-square-meter stall, completed a round of financing with a valuation of 1 billion US dollars. In just two months, Manner was exposed again 13 New valuation of 100 million U.S. dollars. The shareholder lineup includes Capital Today under the helm of the “Queen of Venture Capital” Xu Xin, private equity fund H Capital initiated by former Tiger Fund global partner Chen Xiaohong, hedge fund Coatue and Singapore sovereign investment fund Temasek.

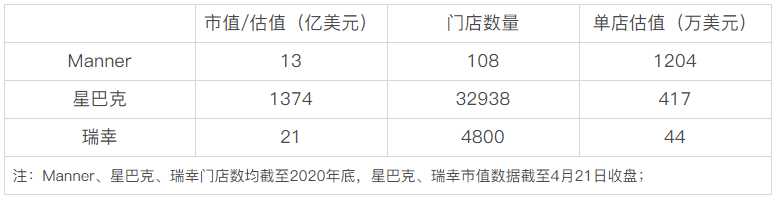

Amazingly, as of the end of 2020, Manner has only 108 stores nationwide. This means that the average single store valuation given to Manner by investors is as high as 12 million U.S. dollars.

What does this number represent? Starbucks, which has more than 30,000 stores around the world, is worth 4.17 million U.S. dollars, which is only one third of Manner based on yesterday’s closing market value. Luckin, which is still trading in the US stock pink sheet market, has a market value of 2.1 billion U.S. dollars, with 4,800 stores. According to store calculations, the value of a single store is only 440,000 US dollars.

36 krypton finishing

This obviously stirred the nerves of more entrepreneurs and investors. For a specialty coffee brand called M stand that is closer to Starbucks, only 10 stores in the A round of financing have received a valuation of 700 million yuan. Some FA bluntly said to 36氪, “M stand is the valuation required by Manner.”

In March of this year, ByteDance’s investment department was reported to invest in Manner, but the actual situation is that they did not even get in touch with it. A consumer investor in Shanghai who had been in contact with Manner told 36 krypton that what Manner told them was “no financing.”

The gaze from the peers is even hotter. “I don’t understand, there are a lot of envy and hatred.” A coffee industry founder commented on Manner. According to 36 krypton, Luckin even established a “Manner Research Group”.

The myth continues. Some investors firmly believe that Manner is Starbucks’ biggest potential rival in China, on the grounds that “single-store profitability is extremely strong.” There are even more rumors in the market that a first-line organization has offered Manner a valuation of US$3 billion.

Why is Manner so valuable? After interviewing many former Manner employees, coffee entrepreneurs, traders and investors, 36 krypton found some answers.

On the third floor of iapm in Shanghai, Manner’s enclosure appeared next to Starbucks. Photographed at 36Kr

The secret of “cheap and delicious”

This is an “atypical” specialty coffee brand.

In the past, specialty coffee is slightly more expensive than Starbucks, but “cheap price” is the most intuitive perception of Manner by many people.

The price of Manner classic coffee is mostly between 10 yuan and 25 yuan, of which espresso coffee and American coffee are 10 yuan and 15 yuan respectively. Latte, white, cappuccino, and mocha vary according to the specifications, and the unit price is 15 yuan. Between -25 yuan, hand-brewed coffee and cold brew coffee are respectively 20 yuan and 25 yuan, and your own cup is 5 yuan off.

The price of coffee is nothing new. Luckin used to make commercial coffee about 15 yuan in the past. The three and a half meals that are popular online are priced lower, but the former is in the form of discount coupon subsidies (that is, it does not really reduce the “pricing” ”), the latter is instant specialty coffee, which is two different business models from selling freshly ground coffee in offline stores.

Since its birth in 2015, Manner has always maintained the “fast food price” of specialty coffee. Some media have interpreted this as “suicidal” pricing, and has always retained the original product structure, namely pure coffee (black coffee), milk coffee and hand-made coffee. There are three types of coffee, and some fixed new products will be launched in the “secret menu” of all stores every quarter.

Standard menu and secret menu in Manner store, 36氪 photo

Why can the price be so low? A large part of the secret lies in the “single-store model is extremely streamlined”-Starbucks is the “third space”, Manner does the opposite, taking the chain store route.

When it was founded by Han Yulong and his wife in 2015, the first store was only 2 square meters in size. It used to be the window of the clothing store next door, and it was a window-style coffee shop. In other words, Manner minimized the rent and decoration costs in a cup of specialty coffee.

Manner’s first store on Nanyang Road, Jing’an District, Shanghai, is only 2 square meters in size. According to Manner official

“The (coffee) big store model is Starbucks, and the small store model is Manner.” A Shanghai consumer investor told 36Kr that Starbucks’ coffee cost is not high, and consumers buy their third space. Manner eliminated this part and minimized the single-store model. The investor believes that “for a new brand to be a small-store model, we first need to consider whether we can make it through Manner.”

Manner focuses on two types of people, namely coffee users and young white-collar workers.

The former is an important background for Manner’s rise in Shanghai. According to incomplete statistics, this city has more than 8,000 coffee shops, and it is China’s well-deserved “coffee capital” with a huge coffee consumer group.

At the same time, Manner is targeting office workers and prefers shopping malls and the CBD. “Either open in the office building or downstairs in the shopping mall. Even if you choose to open in the mall, you will open it close to the office building.” Former Manner employee in charge of store operations Jing Hua said.

It is also about telling the story of office coffee, Manner provides a different solution from Ruixing.

Since its inception, Manner has never done takeaways, only offering a small program self-pickup option. “There will definitely not be a takeaway business this year,” Jinghua judged. On the one hand, coffee delivery has an impact on quality. On the other hand, Manner’s cost structure is already relatively extreme and it is not suitable for further takeaway business. In addition to the store business, Manner currently only opens a flagship store in Taoxi, selling coffee beans, hanging ears and brand peripheral products roasted by its Nantong roasting plant.

Another detail is that Manner stores usually do not have seats, even if there are seats, it is not comfortable. It can be seen that Manner does not want consumers to order a cup of coffee and sit down, but wants white-collar workers to buy a cup in the morning or at noon. office.

Manner Shanghai Nanyang 1931 store, photo at 36 krypton

In addition, Manner hardly does marketing to stimulate sales, and the only exception is the 5 yuan discount for bringing a cup. There is also a clever “variant” of this marketing strategy: every time a new store opens, Manner will launch a “bring your own cup for free coffee” activity three days before opening to attract potential people around, and according to the third day of bringing your own cup The number of coffee drinkers is used to estimate the number of potential daily cups sold in the store.

While subtracting product prices, SKUs, and stores, Manner added them elsewhere.

To make a cup of coffee on the market, it consumes about 18 -20 grams of coffee powder. The best seller in the past is milk coffee, which tastes relatively weak. A coffee entrepreneur who is familiar with the founder Han Yulong told 36 krypton that Manner’s approach was to directly increase it to 25 grams.

The obvious increase in concentration allows consumers to form a new understanding of milk coffee, so that when they drink other coffee, they will feel that the taste is very weak. This statement was also confirmed by internal employees. In addition, another data learned by 36Kr is that about 65% of Manner consumers will choose milk coffee.

The “addition” of coffee powder does not significantly increase the cost. Specialty coffee green bean trader Lu Yang told 36 krypton that even if a cup of latte, the cost of coffee powder used is very low, “almost negligible.”

Lu Yang calculated an account for 36 krypton. The price of 1 kg of high-quality coffee beans sold at Manner’s Taobao factory store was about 100 yuan. The cost of packaging, roasting, and operation was reduced, and the cost of 1 kg of cooked beans was 90 yuan. For 50 cups of beans per kilogram, 20 grams of flour is only worth 1.8 yuan. “The cost of coffee beans is not as expensive as milk. For a latte that sells for 20 yuan, the cost of milk may account for 5 yuan.”

In addition, most cafes use 2-3 coffee beans for blending. There is a doorway here that if the blending is proper, the flavors of different origins can be expressed and the richness of flavors can be enhanced. Otherwise, it will be worse.

Manner is no exception. Most of its coffee beans are blended from 3-4 coffee beans from different origins. Three of them have relatively low overall prices, and the flavor and taste are also ordinary, which keeps the cost down. Only one mandheling has an obvious overall flavor, and it relies on the beans to increase the taste of the whole cup of coffee.

However, Lu Yang also believes that the beans used by Manner are not actually “premium”. It just uses the concept of specialty coffee to avoid leaving consumers with the impression of “low price = cheap”.

After the price was lowered, the amount of cups went up straight along with it, which made Manner a hit.

According to 36 krypton, Manner’s first Ruiou department store and Shanghai shopping mall have monthly sales of 450,000 yuan and 400,000 yuan respectively. If a single cup is calculated at 17.5 yuan, it is equivalent to an average of 800 cups per day. The basic status of the coffee industry in first-tier cities is that 300 to 400 cups per day is already a good result.

“Manner’s reproducibility is very strong, and the model is basically very mature.” Liao Ming, the founder of PAC, who has studied the coffee industry in depth, told 36 krypton that Manner’s single store is small, the store decoration is simple and rude, the equipment is very uniform, and he is willing to accept some Good-quality second-hand equipment greatly reduces the initial investment. In addition, due to the low price, the amount of cups will be very high, “enough to cover the initial investment, the model is very benign.”

Break through the chain problem

The rise of specialty coffee has been in China for several years, especially in Shanghai, where there are many scattered small brands. Manner’s special contribution to the industry is to solve the chain problem of specialty coffee.

In the five and a half years since its establishment, Manner has generally experienced three stages of development:

- From October 2015 to October 2018, the founders, Han Yulong and his wife, started their own businesses, and the speed of opening stores was not fast. A total of about 7 stores were opened, mainly counter or window stores;

From October 2018 to May 2020, after the capital entered today, the expansion speeded up, and the store was upgraded to around 20-30%. Especially starting in the second half of 2019, the expansion speeded up in an all-round way;

Since June 2020, the store area has expanded to 50 square meters, and bakery workshops and light meal shops have been added to new stores with more than 200 square meters.

It is worth mentioning that the latest two rounds of financing, including H Capital, Coatue, Temasek and other large institutions, took place just after the third phase. It is not so much that capital is paying for Manner as it is for the scale of Chinese specialty coffee chains.

Compared with commercial coffees such as Starbucks and Luckin, specialty coffee is more difficult to standardize.

Specialty coffee refers to higher-quality coffee beans, as well as the diversified presentation of the flavors of coffee beans. “Many people today emphasize the’ambience’ when talking about coffee, ignoring the taste and flavor of the coffee itself.” There is “coffee world”. Peet’s, a specialty coffee brand known as “The Master”, wrote on its official website.

The presentation of such high-quality and diverse flavors relies on the interaction of multiple dimensions. In the words of specialty coffee green bean trader Lu Yang, “Ingredients accounted for 6 points, baking accounted for 3 points, and brewing extraction accounted for 1 point.”

Manner has deliberately controlled the “coffee industry chain” since its inception. A widely circulated story in the coffee circle is that all the beans in the initial store were roasted by Han Yulong himself. 36 Krypton learned that after the capital entered today, Manner also set up a roasting factory with the operating entity “Nantong Yinhe Trading Co., Ltd.” in 2019 to provide raw materials and coffee equipment. According to 36Kr, the current utilization rate of the plant is only about 1/3, which is enough to supply 1,000-1,500 stores if it is fully used.

This approach helped Manner stabilize production capacity and quality, but to achieve real scale, it is necessary to pass the last “hurdle” of brewing and extraction standardization.

Different from the fully automatic coffee machines used by Starbucks and Luckin, most specialty coffees use semi-automatic coffee machines, and Manner is no exception. The store is equipped with La marzocco Italian semi-automatic coffee machines. In theory, semi-automatic coffee machines can make better coffee.

“Semi-automatic coffee machines are mainly used for specialty coffee. The stores are limited and the beans used every day are different. Baristas can use them flexibly.” Jin Xin, general manager of EVOCA Greater China, a professional coffee machine manufacturer, told 36 krypton that under extreme conditions, There is a big difference between the semi-automatic coffee machine and the fully automatic coffee machine. “We say that it is a combination of man and machine.” In contrast, the fully automatic coffee machine mainly solves the problem of the stability of the product and can be set up at one time. Parameters, quickly produced nationwide.

Jinxin believes that to use semi-automatic coffee machines in large quantities, there is a necessary prerequisite-investing a lot of money and energy in barista and back-end training.

Manner’s method is simple and rude. 36 Krypton learned that before the epidemic, Manner only recruited experienced baristas, and he started recruiting Xiaobai baristas after the epidemic. The training cycles of these two types of employees are quite different. Little white baristas usually need to train for 3-4 weeks or even 2 months, while experienced baristas can quickly start their jobs in 3 days.

The price for this is a huge manpower expenditure. Former Manner employee Liu Yuqi told 36 krypton that Manner spent a lot of effort on the training of standard specialty coffee, and the salary of baristas is not low, which is 1,000-2,000 yuan higher than that of ordinary coffee shops. “Manner’s little white baristas earn about 5,000 yuan a month, skilled hands 7,000-8,000 yuan, and store managers 10,000 yuan.” This digging method directly pushed up the salary level of the Shanghai coffee chain market, making peers feel more pressure.

Not only that, Manner’s high salary has additional conditions. Sometimes it is necessary to sign a competition agreement, requiring the other party not to work in the coffee industry within one year after leaving. As compensation, a monthly compensation will be given to the barista during the period.

“In the past, there was no competition agreement in the coffee industry. It is normal for experienced baristas to flow back and forth. Only Manner does this.” An entrepreneur of a coffee training studio told 36Kr.

Manner’s mind couldn’t be more clear-to ensure product differentiation by controlling people, and then create brand barriers. Although doing so will push up costs.

After calculation, Manner’s labor cost accounts for about 15% of the cost of a single store, which is almost the same as the cost of rent (12%-15%), which is very different from the common perception that rent is the cost of a coffee shop. Manner also tried to adjust the semi-automatic coffee machine to fully automatic, but has not found the ideal equipment.

In the eyes of capital, the cost of the barista is small, but the ability to scale is large. With the help of capital, Manner did solve the problem of scale in a short period of time, and allowed them to succeed in Shanghai, the city with the most intense coffee competition in China. Among all 108 stores by the end of 2020, the vast majority of stores are from this city.

“From Shanghai to China”

Now Manner has entered a period of rapid expansion. This year, it plans to open 200 new stores, increase the total number of stores to 300, and focus on the three cities of Shanghai, Beijing and Shenzhen, and further spread across the country.

In fact, since 2019, Manner has successively entered first-tier and new first-tier cities such as Suzhou, Chengdu, Beijing, and Shenzhen, but the business results have been uneven. 36 Krypton learned that after a year of climbing period, the stores in Beijing and Shenzhen have basically stabilized at around 10,000 yuan per day, but the sales of the stores in Suzhou and Chengdu have failed to achieve this performance.

A set of data may explain this phenomenon. Deloitte mentioned in the “White Paper on China’s Fresh Coffee Industry” that among consumers who have developed coffee drinking habits, the number of cups per capita of coffee consumption in China’s first-tier cities is 326 cups per year, reaching the level of mature markets such as the United States, Japan and South Korea, and second-tier cities There is still a certain gap, the corresponding cup number is 261 cups.

However, even if it only spreads in the three cities of Shanghai, Beijing and Shenzhen, it is enough to support Manner to take off the “Shanghai Internet Red Brand” hat and join the “national coffee chain brand” camp.

A better sign is that more shopping malls are throwing olive branches at specialty coffee brands.

This change in attitude has a background-Starbucks’ “exclusive agreement” is losing its effectiveness. “(Starbucks’) exclusive clauses have come in two forms. The oldest batch has almost seven or eight years of contracts. The exclusivity clarifies that old brands like Pacific Coffee are not within the scope of new brands; the other is for Brands on the same floor and the main business type of coffee.” Yu Junjie, director of commercial real estate investment from a provincial capital city, told 36Kr.

But he turned to say that the exclusive clause is an overlord clause, which itself is not protected by national laws, “it’s just a mutual constraint on face.” Shopping malls have a hard time, and new brands are needed to drive the flow of customers. The matter of “giving face” is naturally loosened. Yu Junjie’s investment team is also looking for specialty coffee brands that are convenient to take away.

For cross-city expansion, Manner’s landing in Shanghai’s high-end shopping malls has become very critical. “Can a brand enter a shopping mall? In addition to bringing its own topic and meeting rent requirements, it also has to have benchmark stores in other cities and commercial entities.”

Manner’s low prices also made high-end shopping malls difficult at first. Due to the low customer unit price, the landlord is worried about whether the minimum rent can be guaranteed, but also worried that the introduction will affect the business of the same type of brand in the mall.

Manner’s response is to change the store image and make some bigger “flagship stores”. They launched large red-based stores in the first store of iapm and the Grand Gateway Henglong store. After iapm established a foothold, they have successively launched new store types, and added fine hand-made coffee up to 198 yuan, changing their cheap image.

Entering high-end shopping malls distinguished Manner successfully from other “cheap coffee” brands.

Outside of Manner’s halo, China’s coffee chain market has become very lively.

Luckin has come back to life and announced on April 15 that it has completed $250 million in financing for debt restructuring and settlement with the SEC; in addition, Canadian national coffee brand Tim Hortons China also completed two rounds in May 2020 and February 2021. The goal of financing is to cultivate China into its second largest market.

Optimistic new brands are still looking for opportunities to break through: M stand’s goal within the year is to update from the current more than 10 stores to 80 to 100 or so; Algebraist algebraists plan to increase the number of directly operated stores from the current 30 by the end of the year. The number of homes increased to 100.

But pessimistic voices believe that the window period is already closing. “Nowadays, many consumer products have very high valuations. They belong to the A round and A+ round stages, but they have already obtained the C round and D round valuations.” An investor who looks at consumption told 36 krypton, which makes many top brands have The high capital barriers are “almost impossible to replicate again.”

(In the text, Alex, Yu Junjie, Liu Yuqi, Jinghua, and Lu Yang are all pseudonyms)

You must log in to post a comment.