Now Gree Electric is an international home appliance enterprise integrating R&D, production, sales and service. It has three brands: Gree, TOSOT, and Jinghong. It mainly deals in household air conditioners, central air conditioners, air energy water heaters, mobile phones, household appliances, Refrigerators and other products. In 2019, it ranked 414th among the world’s top 500 companies, and ranked 37th among the top 500 Chinese manufacturing companies. At present, Gree Electric has more than 150 million global users, and has 8 production bases in Zhuhai, Brazil, Pakistan, and Vietnam, and more than 80,000 employees.

Gree, founded in Zhuhai in 1991, has now become an aircraft carrier in China’s air-conditioning industry. But just a dozen years ago, Gree faced the danger of being sold to the Americans. Thinking of it, it makes people sweat.

In July 2005, the media suddenly exposed the news that “Carrier will acquire Gree Electric.” Although the Zhuhai State-owned Assets Supervision and Administration Commission quickly came forward to refute the rumors, the matter was definitely not groundless. “At that time, an official from the State-owned Assets Supervision and Administration Commission of Zhuhai who was interviewed by the “Chinese Entrepreneur” said: “Almost all companies that can come have come. Who doesn’t want to get Gree.” ”

At that time, Gree Electric’s restructuring was entering a very sensitive stage, and the Zhuhai municipal government was also hesitant about how to choose. Gree’s restructuring work began in 2003. Although Gree Group held 58.66% of Gree Electric’s equity, the restructuring work was still directly managed by the municipal government.

At that time, the Zhuhai Municipal Government had different opinions on how Gree should restructure. The party headed by the Secretary of the Municipal Party Committee at the time advocated introducing a major shareholder for Gree Electric. As long as the major shareholder can ensure that Gree Electric will remain in Zhuhai, it will be fine even if it is bought by foreign capital. The other faction is opposed to the shareholding of Gree Electric. Sold to foreign investors.

The party that agreed to sell Gree to foreign investors used the example of Shenzhen Water Group’s restructuring as a magic weapon. Two years ahead, Shenzhen sold its 45% stake in Shenzhen Water Affairs Group to the French Veolia Water Group at a price of US$400 million, and the restructuring was a success. Many people from the Zhuhai Municipal Party Committee and Municipal Government were very interested in this experience in Shenzhen. If a Fortune 500 company can be introduced to buy Gree, this will be a highlight for the political achievements of the ruling party, and it can also change Zhuhai’s backwardness in attracting foreign investment in the province at that time.

Soon after the news of Gree Electric’s equity transfer came out, a large number of foreign companies flocked to it. Companies that have expressed strong interest in equity transfers include internationally renowned companies such as American Carrier and Japan’s Daikin. Through a period of inspection, the Zhuhai Municipal Government has been more active towards the American Carrier Group, the company founded by the inventor of air-conditioning Willis Carrier, but these details have always been kept secret from Gree’s senior management.

In July 2005, when the Carrier Group launched an investigation before the acquisition of Gree, the Zhuhai Municipal Government revealed the acquisition plan to Gree’s management. The shock and resistance of then chairman Zhu Jianghong and general manager Dong Mingzhu can be imagined. .

In the life and death of Gree Electric, Dong Mingzhu showed the demeanor of an “Iron Lady”. She directed the staff to prevent the investigators of the Carrier Group from entering Gree’s gate, and she immediately went to Guangzhou to find Zhang Dejiang, then Secretary of the Provincial Party Committee, and told Secretary Zhang the pros and cons of the “national brand” of Gree being sold.

In Secretary Zhang’s office, Dong Mingzhu burst into tears: “Although American Carrier is a Fortune 500 company in the world, if we sell them to them, our domestic products are gone! Gree is small, but it has a future!” When it comes to excitement, she even said Slapped the table.

The result of this three-hour battle based on reason is that Secretary Zhang sent a provincial investigation team to investigate the acquisition of Gree Electric.

In fact, 2005 was a year of great strides for Gree Electric. Gree was the only representative of the home appliance industry on the “Top 500 Taxpayers in China” and “Top 500 Taxpayers of China’s Listed Companies” announced by the State Administration of Taxation in the first year. . Compared with the annual production capacity of 20,000 units when the company was founded, it has doubled by 140 times.

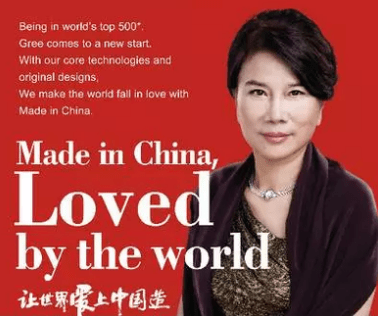

Dong Mingzhu is an ambitious woman. She has said in public many times: “We hope Gree can become a global brand. South Korea can cultivate a global brand like Samsung. Doesn’t China have the ambition to cultivate its own brand?” Under her leadership, Gree Electric took the lead in successfully developing With the “centrifuge” technology, it has completely independent intellectual property rights.

Dong Mingzhu is very supportive of the corporate restructuring, but she is not willing to sell Gree to Americans one hundred and twenty. Although Carrier has strong capital and leading technology, as well as a global sales network, she believes that this has no meaning to the improvement of Gree’s competitiveness. As she said in front of the secretary of the provincial party committee: “Gree has no shortage of funds, technology, and global sales network. Gree does not have a penny loan in the bank, and has good financing and technical capabilities. Gree’s global sales network is not inferior to that of Americans.”

At that time, Gree was about to reach the top of the home appliance industry. If it was acquired by the Americans, what would be waiting for Gree, Dong Mingzhu knew very well. Wasn’t Kelon also “the world’s best SME”? What happened after being acquired?

Dong Mingzhu is very clear that if Carrier acquires Gree, it will reverse the decline of foreign air-conditioning manufacturers in the Chinese market and become a strong oligarch in the Chinese air-conditioning market overnight. Once the acquisition is successful, Carrier can OEM production, greatly reduce costs, and deliver its products to every corner of the Chinese market through Gree’s blood vessels.

Regarding the restructuring, Dong Mingzhu’s plan is for Gree Electric to strive for a pilot “full-tradable share reform” and reduce state-owned shares to the public. This is also a key share reform project in Guangdong Province. However, some leaders in Zhuhai at the time were hesitant to “share reform” and insisted on selling Gree.

This is the moment of survival for a national brand. In order to succeed in the acquisition, the Carrier Group made a private promise to Dong Mingzhu: After the acquisition of Gree, she will continue to serve as the general manager, with an annual salary of 80 million yuan. Dong Mingzhu’s answer was eloquent: “I won’t agree with an annual salary of 800 million yuan!”

Everyone, what is the concept of an annual salary of 80 million in 2005? Even today, Dong Mingzhu’s annual salary is not two million, and 80 million is an astronomical figure for her. But Dong Mingzhu was not overthrown by sugar-coated shells, she wanted to turn the tide.

With the support of the main leaders of the province, the Zhuhai governing officials who advocated the introduction of foreign capital were removed, and Carrier’s plan to acquire Gree was aborted. The agreement to transfer equity has become Gree Electric’s choice.

Gree’s secretary of the board of directors said: “Entering the equity division platform, the pricing of state-owned assets is completely market-oriented, and the opportunity for cheap sales is immediately reduced. Gradually reducing state-owned shares through the secondary market can completely avoid the fate of foreign acquisitions.

In September 2006, Dong Mingzhu was appointed as a director of Gree Group, and then took over as chairman in 2012. Gree Electric has completely entered the “Dong Mingzhu era”. In this year, Gree Electric’s sales exceeded the 100 billion mark, becoming the first company in my country’s home appliance industry to rely on a single product to exceed the 100 billion mark in sales. Her oath of “recreating a Gree in five years” was also fulfilled.

Let’s go back and take a look at the American company that is preparing to acquire Gree!

On November 15, 2011, Midea Electric completed the acquisition of a 51% stake in Carrier’s air-conditioning business in Latin America and took over the air-conditioning business of Carrier in Latin America. Fang Hongbo, Chairman and President of Midea Electric pointed out: Holding the control of Carrier’s Latin American air-conditioning business is one of Midea’s global strategies. After the completion of this merger, Midea’s overseas manufacturing capabilities will be further strengthened.

In the announcement of the acquisition of Carrier, Midea Electric said: “In the long run, the global air-conditioning market will gradually evolve into a duopoly of Gree and Midea.” But Midea also admits that from the perspective of air-conditioning projects, Gree Bi Midea’s internationalization The process is one step faster. In recent years, the proportion of Gree’s own brand exports is much higher than that of Midea, and its influence has basically been established in overseas markets, especially European and American markets.

Gree people will never forget Dong Mingzhu’s generous statement on the board of directors: “The annual salary that Carrier offered me is too tempting, but I can’t accept it. Because the acquisition means Gree’s failure! Carrier is the world today. Fortune 500, but Gree will be tomorrow’s top 500! Give me 20 years, wouldn’t it be better for us to build the Fortune 500 ourselves?”

You must log in to post a comment.