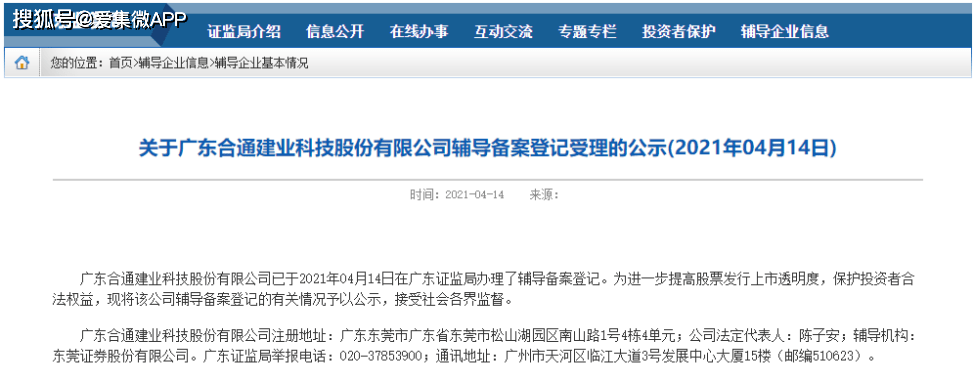

Jiwei Net News On April 14, the Guangdong Supervision Bureau disclosed an announcement on the acceptance of counseling and registration of Guangdong Hetong Jianye Technology Co., Ltd. (hereinafter referred to as Hetong Technology). It has completed the registration of counseling with the Guangdong Securities Regulatory Bureau on April 14. The counseling agency is Dongguan Securities.

According to the official website, Hetong Technology was founded in 2002 and is a national high-tech enterprise specializing in the production of PCB printed circuit boards and one of the top 100 enterprises in China’s printed circuit industry. It has the production technology capability to produce high-precision, high-density single-sided, double-sided, multi-layer circuit boards and LED light strip boards, carbon oil boards, aluminum substrates and new energy automobile boards.

It is understood that Hetong Technology is a NEEQ delisted company. Its operating income in 2020 was 321 million yuan, a year-on-year increase of 15.85%; the net profit attributable to shareholders of listed companies was 41.497 million yuan, a year-on-year increase of 38.28%; the deducted non-net profit attributable to shareholders of listed companies was 140.83 million yuan, a year-on-year decrease of 37.71% .

From the perspective of the three main businesses of Tonghe Technology, the new energy vehicle industry achieved revenue of 85.671 million yuan, an increase of 18.02% year-on-year, and a gross profit margin of 19.71%; the power industry achieved revenue of 99,587,400 yuan, an increase of 19.42% year-on-year, gross The interest rate was 38.91%; the military industry and other industries achieved revenue of 113 million yuan, an increase of 3.11% year-on-year, and the gross profit rate was 61.83%.

Tonghe Technology stated that despite the adverse effects of the new crown epidemic in 2020, the company’s management team mobilized all positive factors to give full play to its own marketing promotion and technology research and development advantages to realize the three strategic areas of smart grid, new energy vehicles and military equipment The overall growth of operating income. Specifically include: overall planning, clear goals, focus on business, focus on the market and products, increase investment in key links, and enhance core competitiveness; mergers and acquisitions and integration, play a synergistic effect, and enhance the company’s product competitiveness and market share in the field of military equipment ; Initiate refinancing to provide new growth momentum for the company’s long-term development. (Proofreading/Lee)

You must log in to post a comment.