Speaking of live streaming,Zhang Dayi can be regarded as the predecessors of Li Jiaqi and Wei Ya, and is known as China’s “first-generation Internet celebrities”. The company behind her, Ruhan Holdings, was also known as “the first Chinese Internet celebrity stock” when it went public in April 2019.

Only two years after listing on the US capital market, Ruhan Holdings is about to delist.

Before the market on April 21, Eastern Time, Ruhan announced that it had completed the privatization transaction and the company was delisted from the Nasdaq immediately. As a well-known MCN company, Ruhan Holdings chose to delist soon after it went public, which aroused widespread concern.

Complete privatization and delisting

On April 22, Ruhan Holdings announced that in accordance with the agreement and merger plan announced on February 3, 2021, Ruhan Holdings and RUNION Mergersub Limited (hereinafter referred to as “Merger Sub”) have completed the merger. RUNION Holding Limited is the target company of Ruhan Holdings, and Merger Sub is a wholly-owned subsidiary of RUNION Holding Limited. After the merger, Ruhan Holdings completed the delisting of US stocks and became a wholly-owned subsidiary of the parent company.

At present, Ruhan Holdings has suspended its trading of American depositary shares on NASDAQ at the close of trading on April 20, 2021 (New York time). The company has also requested Nasdaq to submit a form to the U.S. Securities and Exchange Commission (SEC) explaining the delisting from Nasdaq and the cancellation of the company’s registered securities.

On April 3, 2019, Ruhan Holdings completed an IPO on Nasdaq with an issue price of US$12.5.But it broke at the opening,Quote $11.5, As of the day’s close, fell 37.2% to 7.78 US dollars, with a market value of 649 million US dollars.

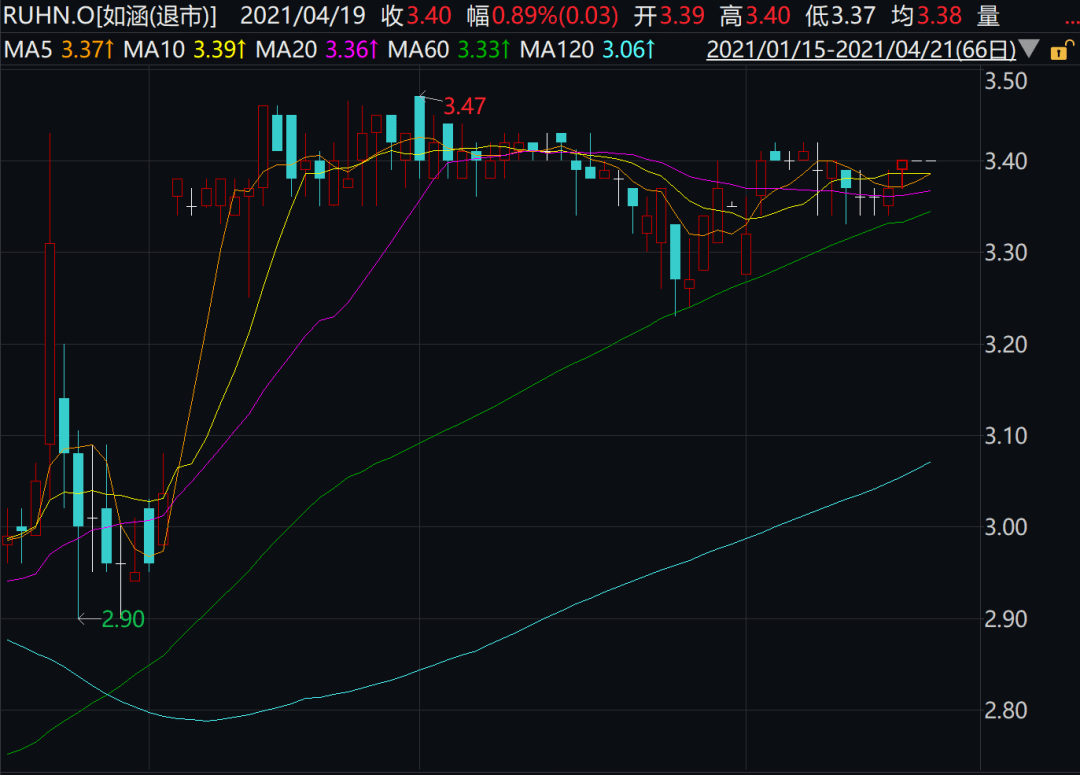

At present, Ruhan has been suspended on Nasdaq, April 19 is the last trading day before the suspension.It closed at US$3.4, a 72.8% reduction from the issue price, and the total market value was US$281 million.

On November 25, 2020, Ruhan announced that it had received a privatization offer from the company’s three founders, Feng Min, Sun Lei, and Shen Chao (buyer group). According to the offer,The buyer group proposes to privatize at a price of 3.4 US dollars per ADS.This price is higher than Ruhan’s stock price at that time, but much lower than the IPO issue price.

According to wind data, as of February 3, 2021,Feng Min holds 25.75% Equity, Sun Lei holdsHaveWith 12.84% of the equity, Shen Chao holds 5.64% of the equity, and the three of them hold a total of 44.23%.

Ruhan Chairman Feng Min Picture source: every photo by reporter Zhang Jian (data map)

On February 3, 2021, Ruhan issued an announcement stating that it had signed a privatization agreement. According to the agreement,The buyer’s group will acquire all out-of-stock shares at a price of US$0.7 per share (or US$3.5 per ADS) in cash.

The price of this privatization agreement,72% reduction from the issue price. Regardless of dividends and other circumstances, investors who participated in the subscription during the IPO held a floating loss of more than 70%.

Over-reliance on head influencers

According to Wind data, from fiscal year 2019 (April 2018 to March 2019) to fiscal year 2020, Ruhan Holdings’ revenue was 1.093 billion yuan and 1.296 billion yuan, but its net profit has been at a loss.

Wind data shows that from fiscal year 2019 (April 2018 to March 2019) to fiscal year 2020, Ruhan Holdings’ gross profit margins for sales were 31.28% and 37.79%, respectively; however, the company’s net sales margins were always negative, respectively. -7.77%, -7.55%.

According to Ruhan Holdings’ financial report for the second quarter of fiscal 2021 (corresponding to the third quarter of 2020), the company’s total revenue for the quarter was 248.5 million yuan, a year-on-year decline of 9%; net profit was a loss of 31.2 million yuan.

Behind this, Ruhan Holdings has never created another top-flow internet celebrity.

According to public information, from 2018 to 2020,Ruhan Holdings’ head internet celebrity Zhang Dayi’s stores contribute more than half of the company’s revenue. The side effect of this structure is that when the top artist faces major negative news, the company will suffer losses together.

In April 2020, Zhang Dayi’s negative incident was exposed. Ruhan stated in previous documents that the incident had a significant adverse impact on the company’s reputation, business, and ADS transaction prices.

According to the financial report of Ruhan Holdings, as of September 30, 2020, the number of the company’s contracted Internet celebrities increased from 146 in the same period of the previous year to 180, and the total number of fans increased from 188.8 million in the same period of the previous year to 295.3 million. The number of head influencers increased from 5 to 8 in the same period last year, and shoulder and waist influencers increased to 45.

However, the service revenue generated by the 8-bit top influencers in the platform mode only accounts for 28% of the total service revenue, None of the newly added internet celebrities contributed 10% of their revenue.

Miss the live broadcast

In addition to relying too much on top-flow internet celebrities, missing the live broadcast may be another mistake of Ruhan Holdings.

In the early days, Zhang Dayi used Weibo to promote and serve as a Taobao traffic portal. On Double Eleven in 2016, Zhang Dayi’s store broke into the second place in the Taobao women’s clothing category, with a transaction volume exceeding 100 million. At the same time as Zhang Dayi, there are also traditional Internet celebrities such as Sydney and Yu momo. At that time, Taobao even made a documentary called “Internet Celebrity” specifically for her.

In fact, Zhang Dayi started very early in the field of live e-commerce. At the Taobao Live Festival in 2016, she drove 20 million transactions in two hours, and the number of viewers exceeded 410,000, setting a record. At that time, Taobao Live was only established for 100 days.

After the Double Eleven live broadcast in 2016, Zhang Dayi said in an interview with The Economic Observer: “It’s a bit tired. The long live broadcast mode of competition will cause everyone to be aesthetically tired. I think after Double 12, this mode will change. Because the conversion rate of live broadcast is decreasing.” In the same year, Wei Ya stepped onto the live broadcast stage.

Image source: Data map taken by reporter Zhang Jian

By the Double Eleven in 2019, the number of viewers who squeezed into the live broadcast rooms of Wei Ya and Li Jiaqi exceeded 40 million and 30 million, respectively, while the number of people in Zhang Dayi’s live broadcast room was 10 million; Wei Ya’s live broadcast sales exceeded 2.7 billion yuan, and Li Jiaqi’s Sales exceeded 1 billion yuan, while the personal brand turnover of Zhang Dayi’s Taobao store during the same period was 340 million yuan.

Double Eleven in 2020,Li Jiaqi and Wei Ya’s live broadcast sales reached 7.06 billion yuan and 8.76 billion yuan, respectively, while Zhang Dayi’s data was only 240 million yuan..

In essence, Zhang Dayi is not a “carrying anchor”. She has her own store and produces her own branded products. Ruhan also supports her with a huge factory and supply chain system.She is a “seller anchor + shop owner”, Appearing in the live camera is also to promote the products of their own stores, it is difficult to reverse their thinking to help other brands’ sales.

On the other hand, Li Jiaqi and Wei Ya are cooperating with multiple brands, and at most they produce some co-branded models. This model is obviously “much lighter” than Zhang Dayi’s online celebrity store.

One thing that cannot be denied is that the era of graphics and text with Zhang Dayi as the mainstream has passed. Guosen Securities Research Report pointed out: “Internet celebrity delivery methods are constantly advancing to a more efficient mode, from early graphic dissemination to current short video/live broadcast, etc., Drove the growth of batch after batch of Internet celebrity KOLs, and at the same time increased the difficulty of continuous operation of Internet celebrities. ”

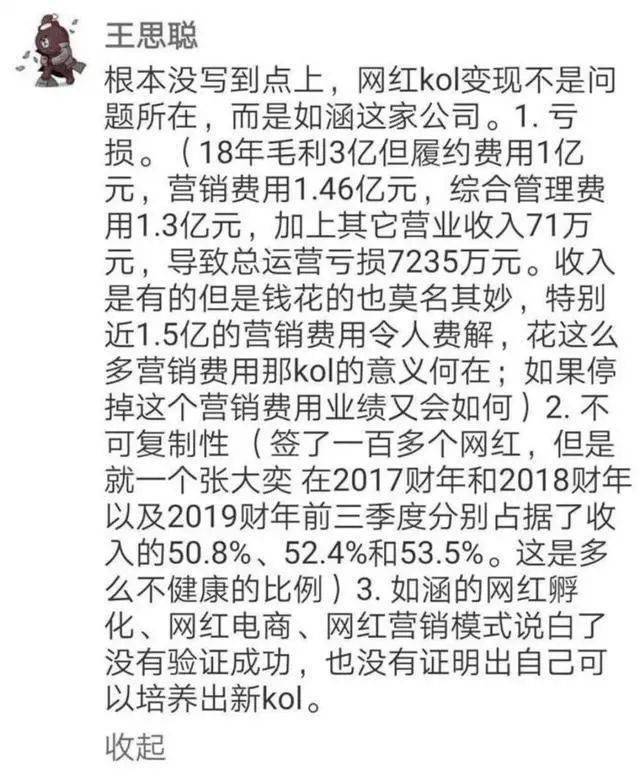

It is worth noting that as early as when Ruhan Holdings broke out on the first day of listing, Wang Sicong once commented: “There are three problems with Ruhan’s business model: first, the large amount of marketing expenses is puzzling; second, it relies too much on top brand. Red Zhang Dayi; third, no new internet celebrities have been cultivated, and the internet celebrity marketing model has not been successfully verified.

Edit| Sun Zhicheng Wang Jiaqi

Proofreading| Lu Xiangyong

Daily Economic News Comprehensive Every Economics App, China Business News, Red Star News, etc.

Daily economic news

You must log in to post a comment.