China Business Daily/China Business Network (by reporter Zhou Ziying/Picture) The listing of Huazhi Liquor Bank means that the era when there are no liquor circulation companies in A-shares is over. Since then, it has also attracted much attention to who will buy the second share of the A-share alcohol circulation industry. Since the beginning of this year, Baichuan Mingpin Supply Chain Co., Ltd. (hereinafter referred to as Baichuan Mingpin) and Jiuxian.com have successively started the listing process. What are the advantages and disadvantages of the two, and who is more likely to become the second share of A-share alcoholic beverages?

Seek to go public one after another

There are a total of 19 liquor-listed companies on the A-share market, and their stock prices are “steadily rising”, but there has been no liquor circulation company. The listing of Huazhi Liquor opened a new journey in the liquor circulation industry. In the past two months, Baichuan Famous Brands and Jiuxian.com have hit A shares to make this drama even more interesting.

On the evening of April 8th, the official website of the China Securities Regulatory Commission disclosed the prospectus of Jiuxian.com, which planned to issue 99 million shares on the Growth Enterprise Market and raise 1 billion yuan for the construction of three projects including smart warehousing and to supplement operating funds.

More than two months ago, the official website of the China Securities Regulatory Commission showed that Baichuan famous products have been filed and counseled with the Anhui Securities Regulatory Bureau and intend to apply for listing on the GEM. It is understood that Baichuan Mingpin and Huaan Securities signed the “Initial Public Offering Counseling Agreement between Baichuan Mingpin Supply Chain Co., Ltd. and Huaan Securities Co., Ltd.”.

Jin Yufeng, managing partner of Centaline Fund, told a reporter from China Business Daily that the shortage of funds for liquor circulation companies is the consensus of the industry, and the core demand for supplementary operating funds or most corporate financing. Liquor industry analyst Cai Xuefei also told reporters that in my country’s liquor industry chain, the circulation links have always lacked the right to speak and upstream bargaining power. They need to rely on low prices and scale advantages to improve their competitiveness. Contribute to the realization of large-scale expansion.

In fact, capital is optimistic about the alcohol circulation industry that has already begun. In December 2020, Jiu Xiaoer, a liquor delivery platform in the same city, announced the completion of Series A financing. The investors were Tencent and Sequoia Capital. Subsequently, Baode shares announced the acquisition of approximately 90% of the shares of Mingpin Family, and signed a gambling agreement, Mingpin Family’s “backdoor listing” dream has finally come true.

In Cai Xuefei’s view, the cooperation between capital and liquor circulation channels is nothing more than getting what they need. Capital is able to enter the wine market and extend its reach to the field of consumer consumption; and wine circulation companies can quickly realize the capitalization process and enhance their competitiveness after obtaining financial support.

The “past and present” of the two

What is the history of the two liquor circulation companies that have revealed their A-share listing ambitions? It is understood that Baichuan Famous Brand, established in 1997, is an out-and-out “veteran” in the liquor circulation industry, and its founder, Jia Guangqing, is also an industry leader. Its biggest highlight is the “thigh” of Pang Wuliangye. According to insiders, Baichuan Famous Brand started as a Wuliangye distributor and is a platform provider of Wuliangol products in six provinces in East China. Wuliangol’s revenue accounts for nearly 50% of Baichuan Famous Products’ revenue. In 2018, Wuliangye Co., Ltd. will increase by 1.853 billion yuan, and Jia Guangqing has become one of Wuliangye’s shareholders.

Is Baichuan Famous’s seeking to go public this time to achieve national expansion, and can its own resources match it? Jin Yufeng speculated that it would be of little significance for Baichuan Famous Brands to continue to cultivate the region or expand nationwide. And because it has a high reputation in the Wuliangye system and the national distributor circle, if it expands nationally, it will have a better guarantee of resources.

But Jiuxian.com is different. It is understood that Jiuxian.com was established in 2009, specializing in the Internet retail of alcoholic beverages, and tried to expand offline in 2014. In 2015, Jiuxian.com successfully landed on the New Third Board, but its performance suffered successive losses. It was eventually delisted in 2017 because it failed to release the financial report in time.

What’s interesting is that Jiuxian.com intends to issue 99 million shares of stock this time, accounting for 24.15% of the total share capital, and raise 1 billion yuan. Based on this calculation, Jiuxian.com was valued at about 4.14 billion yuan at this time, which is an impairment of about 36% compared with the 6.5 billion valuation when it was listed on the New Third Board in 2015.

Jin Yufeng revealed that the list of Chinese unicorn companies in 2018 released by the Foresight Industry Research Institute previously showed that 1919 ranked 150th with a valuation of US$1.077 billion, but there was no Jiuxian.com among the 203 unicorns on the list. It can be seen that its valuation has fallen a lot from the 6.5 billion yuan when it went public in 2015. Jin Yufeng believes that after 1919, the valuation of Alibaba’s investment of 2 billion yuan has become about 7 billion yuan, but Jiuxian.com has raised a total of 1.8 billion yuan, and the current valuation is still only about 4.1 billion yuan. This shows that the market is not optimistic about the business model of Jiuxian.com.

More importantly, the capital shortage of liquor circulation companies has been exposed on Jiuxian.com. The prospectus shows that from 2018 to 2020, Jiuxian.com’s asset-liability ratios were 67.04%, 74.12%, and 70.32%. In 2018 and 2019, the average asset-liability ratio of the liquor circulation industry was 44.65% and 45.51% (data for 2020 has not yet been released).

Jin Yufeng said frankly that the asset-liability ratio of Jiuxian.com is close to the red line of 70%, of which current liabilities are 1.599 billion yuan. It shows that its equity financing is too difficult, the original business expansion and new business development can only rely on debt financing.

Who is more favored by the capital market

One is a long-established wine merchant in the region, and the other is a national wine platform based on online chains. Nowadays, who is more likely to win the favor of the capital market when fighting on the same stage?

From the performance point of view, in 2019, Baichuan famous product revenue was 3.738 billion yuan, and the net profit was 319 million yuan; in the same period, Jiuxian.com’s revenue was 2.997 billion yuan, and the net profit was 81.66117 million yuan. Although Jiuxian.com is a national brand, its scale is slightly lower.

From the perspective of channels, Jin Yufeng revealed that Baichuan Brands has a strong and complete distribution system in East China. Jiuxian.com is slightly embarrassed. With the weakening of online dividends and high customer acquisition costs, the first-mover advantage of online traffic that it originally relied on no longer exists.

Jiuxian.com has also conducted live broadcast exploration. Since March 2020, Jiuxian.com has repeatedly tested live broadcast on the Douyin platform through “Jiuxian.com Lafige (Lafige)”. However, a reporter from China Business Daily found that the price of its Douyin products sold was quite different from the price of the official flagship store on the JD platform Jiuxian.com.

For example, the price of Wuliangye Golden VIP Wine 52% (480ml) Douyin is 1299 yuan, and the price of Jingdong flagship store is 109 yuan; the price of Remy Martin 40% XO Cognac (700ml) Douyin is 1699 yuan, and the price of Jingdong flagship store is 109 yuan. 1499 yuan; 52 degrees art is willing to pay tribute to the Sino-French series Landing (500ml) Douyin price is 458 yuan, Jingdong flagship store price is 598 yuan.

More importantly, the new retail road of Jiuxian.com’s offline expansion is not smooth. A franchisee of Jiuxian.com in Beijing revealed to a reporter from China Business Daily that the company has strict requirements on franchisees. On the one hand, the company requires franchisees to purchase 100% of the goods from the company, and does not give franchisees any power to purchase from outside; on the other hand, the company often requires franchisees to purchase many self-sold products of the company, but the sales of these products are not ideal.

Franchisees such as Huazhi Liquor and China Liquor Chain have all revealed to reporters from China Business Daily that the company requires franchisees to purchase about 80% of their products from the company, and about 20% of their products can be sourced from outside. In addition, Huazhi Liquor sometimes purchases products from franchisees in reverse.

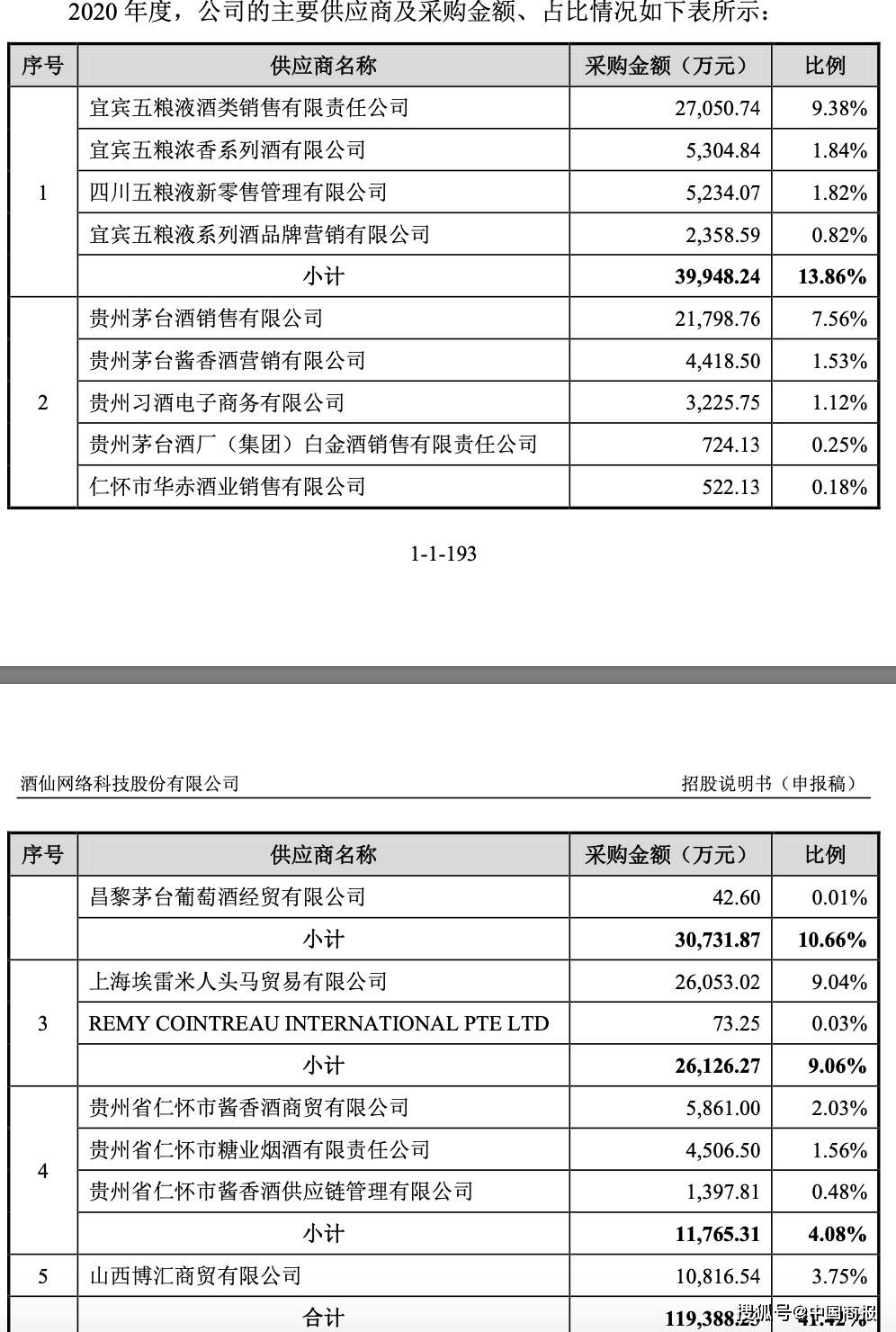

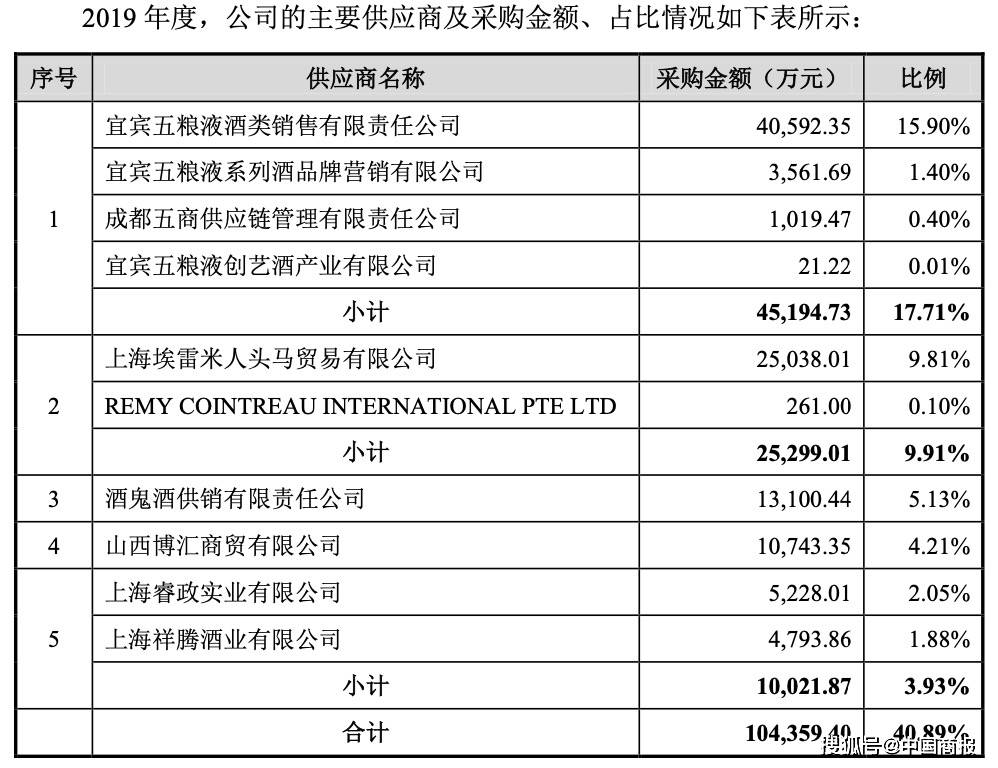

From the perspective of upstream product resources, Baichuan’s famous products can be used as the “thigh” of Wuliangye. The Jiuxian.com prospectus shows that in 2020, Jiuxian.com will purchase a total of 399 million yuan in products from Wuliangye Group and its subsidiaries, accounting for 13.86% of its total purchases; and 307 million yuan in purchases from Maotai Group and its subsidiaries, accounting for 10.66% . In other words, in 2020, the purchase amount of Jiuxian.com from the Maotai and Wuliangye groups accounted for about 1/4 of the total purchase amount, or less than Baichuan famous products.

In addition, the cooperation between Jiuxian.com and wine “big factories” is not solid enough. The prospectus shows that the Maotai Group is not seen in the list of the top five suppliers of Jiuxian.com in 2018 and 2019. In fact, in previous years, Jiuxian.com was “blocked” by Moutai Group and Langjiu Group.

Jin Yufeng believes that the difference between Baichuan Famous Brands and Jiuxian.com’s model is too great, and it is difficult to compare horizontally. Just look at Jiuxian.com, the imagination of its impact on the market is insufficient, and the business model lacks bright spots.

You must log in to post a comment.