China Fund News reporter Li Zhi

“Awakened” after being criticized? Yonghui Supermarket, which frequently “turns over” food safety, apologized late at night.

Yonghui Supermarket apologized late at night:

Self-examination and self-correction, deep reflection

On the evening of April 15th, Yonghui Supermarket issued an apology announcement regarding food safety issues, stating that the company would sincerely apologize to consumers, investors and regulatory authorities for the food safety issues that occurred. The management self-examined the incident. Self-correction and deep reflection.

The company will conduct a comprehensive inspection of the supermarket food safety system and process, improve the construction of the governance system, strictly follow the relevant requirements of the national food safety laws and regulations for supermarket operators, and perform inspections on the purchase and purchase of the suppliers’ legal qualifications and claims Ticket information; strengthen the upstream supply chain management, conduct a comprehensive random inspection of commodities, especially fresh products, and improve the sense of responsibility of the department.

As a Minsheng supermarket, Yonghui Supermarket will take food safety as its own responsibility, continuously improve the self-inspection system, and enhance the management’s awareness of social responsibility. The company will continue to advance the rectification work, evaluate the relevant impact, and perform the information disclosure obligation in accordance with the corresponding regulations.

Xinhua Net Review:

So perfunctory, how does Yonghui Supermarket “Yonghui”?

Previously, according to People’s Daily Online, in the first quarter of this year, Yonghui Supermarket had a total of 15 batches of unqualified food in many stores in Fuzhou, Putian, Longyan and other places. Among the 15 batches of unqualified food in Yonghui Supermarket, aquatic products such as grass carp, ice squid, and crab were unqualified for 8 times.

However, Mr. Zhang, the secretary of Yonghui Supermarket, defended in response: “Yonghui Supermarket self-tests more than 3,000 batches every day. During 90 days of a quarter, nearly 300,000 tests, 15 batches of substandards appeared. , Don’t you say too much?” This response angered netizens, and Mr. Dong personally posted this topic on the hot search, which immediately attracted the attention of all parties.

On April 15th, Xinhuanet commented that, so perfunctory, how does Yonghui Supermarket “Yonghui”?

As an old supermarket with the reputation of “people’s livelihood supermarket and people’s Yonghui”, Yonghui Supermarket carries the trust and expectations of too many consumers. However, the results of the random inspection showed that 15 batches of food in Yonghui Supermarket’s multiple stores were unqualified, which is indeed unacceptable and disturbing for consumers.

According to reports, of the 15 batches of food that failed the random inspection, many of them were found to be ofloxacin and enrofloxacin as unqualified. According to the risk warning issued by the Fujian Provincial Market Supervision Administration, eating foods with ofloxacin detected may cause dizziness, headache, poor sleep, gastrointestinal irritation and other symptoms.

The Xinhua Internet Review pointed out that deliberately avoiding food safety issues that consumers really care about, deliberately vague concepts, use a bunch of numbers to respond to concerns, and treat major issues such as food safety with a light attitude. Yonghui Supermarket is so perfunctory and justified. Dissatisfaction is also alarming. How many products that have not been sampled are unqualified? Can people rest assured to buy and buy?

In fact, this is not the first time that Yonghui Supermarket has “turned over” due to food safety issues. Since 2018, Yonghui Supermarket has repeatedly detected problematic foods and has been notified by the market supervision bureaus in many places. Only since April this year, Yonghui Supermarket has been on the “black list” of the local market supervision and administration bureau several times. Such records, coupled with a perfunctory attitude towards problems, inevitably put a question mark on the management and product quality of the supermarket.

“Yong, forever, forever; glory, brilliance, and glory. The word “Yonghui” entrusts the founders of the company’s expectations for the eternal glory of this business. And Yonghui Supermarket wants “Yonghui”, please protect it first Consumers’ physical and mental health, in the face of substandard products, must self-check loopholes regardless of the proportion.” Xinhuanet commented.

In this regard, Yonghui Supermarket stated that the company has paid great attention to it and has set up a special self-examination team. The company sincerely apologizes to consumers, investors and regulatory authorities for the food safety issues that have arisen.

Yonghui Supermarket “crazy” expands stores

Unstable net profit performance

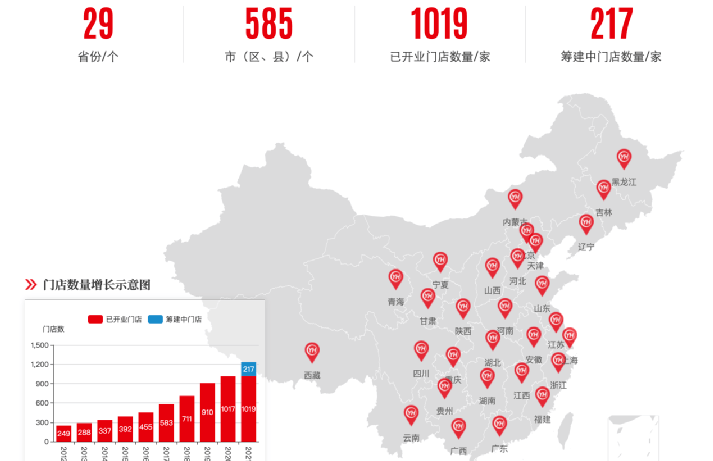

According to data from Yonghui’s official website, as of now, Yonghui Supermarket has 1,019 stores in 585 cities in 29 provinces, and the number of stores under construction is 217. Among them, in the third quarter of 2020, Yonghui Supermarket opened 27 new stores and 24 new signed stores. At present, Yonghui has opened stores plus 1,236 stores under construction, which is equivalent to five times the number in 2012.

Previously, the president of Yonghui Supermarket had stated that the expansion trend will not change in 2020 and the goal is to open 150 stores.

Yonghui Supermarket is frequently exposed to food safety issues. Is it because the company’s internal management is neglected? Or is it caused by crazy store expansion? How has the business situation been in recent years?

According to its three-quarter report, the company achieved operating income of 72.67 billion yuan in the first three quarters of 2020, a year-on-year increase of 14.36%; net profit attributable to the parent was 2.028 billion yuan, a year-on-year increase of 31.86%. Among them, the company’s revenue in the third quarter was 22.154 billion yuan, and the net profit attributable to the parent was 175 million yuan. Compared with the previous two quarters, the company’s third-quarter revenue fell by 0.95%, which slowed the growth rate of revenue in the first three quarters to 14.36%.

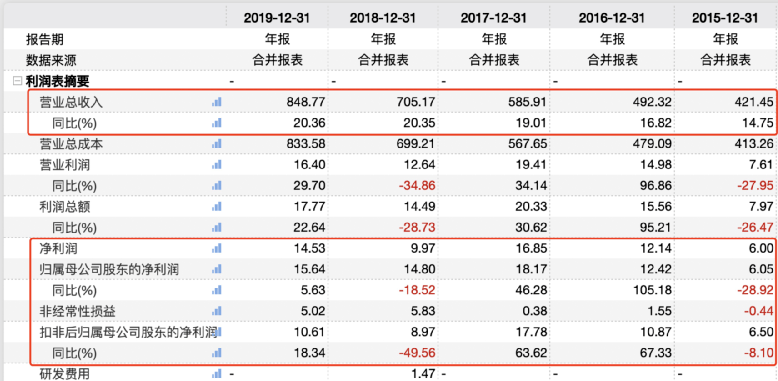

However, from a long-term perspective, although Yonghui Supermarket’s total revenue increased from 2015 to 2019, the company’s net profit performance was unstable. In 2015 and 2018, Yonghui’s net profit attributable to the parent company fell by 28.92% and 18.52% year-on-year. In response, Yonghui once said that it was due to a sharp drop in investment income.

As of now, Yonghui Supermarket has not yet announced its 2020 results. However, due to the pressure in the third quarter, CITIC Securities estimates that in the third quarter of 2020, Yonghui Supermarket’s same-store sales fell by about 10% year-on-year, and the revenue side showed negative growth. Previously, Huafu Securities combined Yonghui Supermarket’s revenue growth rate and the current fierce market competition to give the company a target price of 8.1 yuan. The first coverage is given a “prudential recommendation” rating.

Yonghui Supermarket’s share price performance is sluggish

The higher point has fallen by 83%

In addition, the company’s repurchase and the chairman’s continuous increase in holdings have also attracted investors’ attention. On April 13, Yonghui Supermarket announced that as of April 12, 2021, the company had repurchased a total of 286 million shares through a centralized bidding transaction, accounting for 3% of the company’s total share capital, and the lowest price for repurchase transactions was 6.66 yuan per share. , The highest price is 8.14 yuan per share, and the total amount of funds paid is 2.112 billion yuan.

In addition, on March 30, Yonghui Supermarket stated that the company received a notification letter from the company’s chairman, Mr. Zhang Xuansong, informing him that after the change in equity, Mr. Zhang Xuansong and his concerted parties had increased their holdings of approximately 68.42 million shares of the company, accounting for 0.72% of the company’s total share capital.

On February 1, Zhang Xuansong, chairman of Yonghui Supermarket, once stated that he planned to increase his holdings of 75 million to 150 million A shares of the company’s A shares through the Shanghai Stock Exchange system within the next six months, at a price not exceeding 9 yuan. The purpose of this increase in shareholding is to maintain the stability of the company’s stock price, safeguard the legitimate rights and interests of all shareholders of the company, and is also based on confidence in the company’s future sustainable development and recognition of the company’s long-term investment value.

But this wave of holdings seems to have failed to boost the enthusiasm of investors. Since the beginning of this year, the stock has fallen by more than 10%. The current share price is at 6.43 yuan, and the latest total market value is 61.19 billion yuan. The current stock price has fallen by more than 83% compared with the high point set shortly after its listing, and the market value has evaporated 297.6 billion yuan.

Editor: Captain

You must log in to post a comment.