ACB News “Australia Finance Online”, June 18 On Friday, the ASX200 index rose 9.9 points to 7368.9 points to close, an increase of 0.1%. This week the index rose 56.6 points, an increase of 0.8%.

(Picture source: “Aohua Finance Online”)

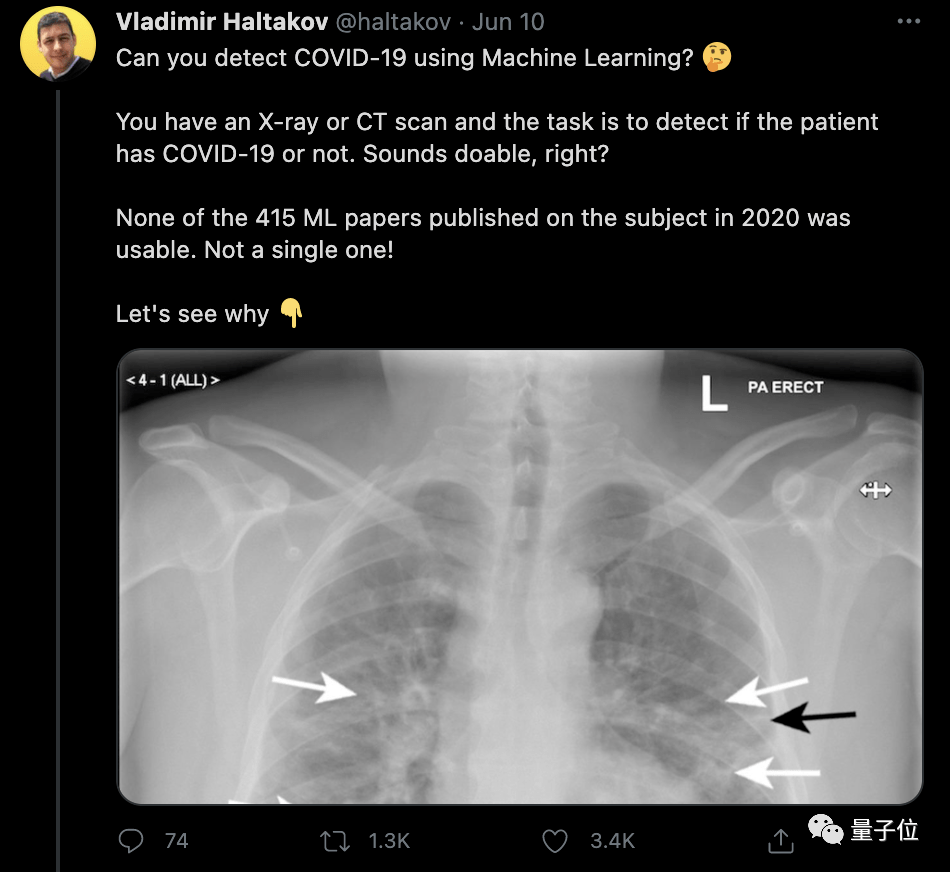

ASX200 Today’s chart

The turnover of ASX stocks reached 5 billion shares today, a slight increase from yesterday, and the turnover reached 14.3 billion Australian dollars, a substantial increase from yesterday. 749 stocks rose, 608 fell, and 435 closed flat.

The Australian dollar fell all the way from 76.42 US cents last night to the lowest of 75.40 US cents and then consolidated around 75.50 US cents. This afternoon, it fell sharply and rapidly again, reaching as low as 75.11 US cents and then rebounding. As of press time, it rebounded to 75.41 cents.

From the perspective of the disk, the rebound in the technology sector helped the Australian stock market to rise for the fifth consecutive week. company news: As far as this week is concerned, the four major banks collectively closed up. Among them, Commonwealth Bank’s share price climbed 2.3% to 103.69 Australian dollars, Westpac rose 2.2% to 26.88 Australian dollars, National Bank and ANZ Bank recorded gains of 1.5% and 2.6%, respectively. The plate closed at 26.87 Australian dollars and 28.98 Australian dollars respectively. The technology sector performed the best this week. The sector’s performance at the beginning of the year was disappointing, but the trend was strong throughout June. In this sector, the “buy first, pay later” giant Afterpay’s share price soared 10.5% to 114.40 Australian dollars, while its competitor Zip soared 13.8% to 8.14 Australian dollars. Accounting software company Xero and web-as-a-service company Megaport saw gains of 6.1% and 9.1% respectively, closing prices at A$142.25 and A$17.60 respectively. The health care sector also performed well this week. Among them, blood products giant CSL’s share price climbed 3% to 305.52 Australian dollars, respiratory equipment manufacturer ResMed soared 12.5% to 31.91 Australian dollars, medical company Sonic Healthcare soared 6.2% to 37.81 Australian dollars, cochlear implant production. Cochlear rose 4.8% to 246.72 Australian dollars, medical imaging company Pro Medicus and biotechnology company Mesoblast saw huge increases of 10.9% and 7.9%, respectively, to close at 55.81 Australian dollars and 2.32 Australian dollars. Major miner stocks led the decline this week, as the Fed’s unexpected hawkish stance hit commodity prices this week. In this sector, BHP Billiton shares fell 5% to A$123.47, Rio Tinto fell 1.2% to A$123.47, FMG and South32 saw declines of 3.4% and 5.8%, respectively, with closing prices of A$22.42 and A$2.78 respectively. Gold mining stocks are one of the worst-performing sectors this week, because the price of gold plummeted after the Federal Reserve meeting. In this sector, Newcrest fell 8.4% to 25.96 Australian dollars, Northern Star fell 13.9% to 9.90 Australian dollars, Evolution fell 8.1% to 4.67 Australian dollars, Ramelius and Westgold saw declines of 7.9% and 8.5% respectively, and closed at the end. 1.75 Australian dollars and 2.05 Australian dollars. Supermarket giant Coles’ shares fell 1.9% to A$16.36. Previously, the company announced an additional A$300 million investment in fiscal year 2022 to accelerate the automation of its distribution centers. Coal giant Whitehaven Coal’s shares plunged 9% to A$1.91. Previously, the company lowered its production forecast, saying that coal production this fiscal year will be lower than previously expected. Reference: Australian Financial Review Disclaimer: This article is a financial observation and commentary and does not constitute any investment advice. Please ask professionals for trading operations or investment decisions. (Solemnly declare: ACB News “Australia Finance Online” reserves all copyrights for articles marked as original. Please indicate the source in any form of reprint.) More information 1 The Fed expects to raise interest rates, the Australian index will fall, most sectors have fallen by more than 1%, and technology stocks have risen against the market 2 China’s release of bulk commodity inventories, miner stocks and pressure on bank stocks, strong market and new highs 3 The Australian Index hit a record high driven by U.S. stocks, many stocks set new records, and technology stocks continued to rebound 4 This week, the market continues its strong new high. The technology sector is struggling to catch up with travel stocks, disappointing 5 The Australian index rose above 7,300 for the first time, and the real estate sector led the gains and the energy sector was weak 6 U.S. stocks are unreliable, and the Australian index declines, technology stocks fall, and miner stocks rise against the market

You must log in to post a comment.