ACB News “Australia Finance Online” April 22nd On Thursday, the ASX200 index rose 58 points to 7055.4 points to close, an increase of 0.8%. The common stock index rose 53 points to close at 7312 points, or 0.7%.

(Picture source: “Aohua Finance Online”)

From the disk observation, the Australian stock market ended its two consecutive days of decline today. From the perspective of sectors, all sectors generally rebounded, getting rid of the impact of the sharp drop in the e-commerce group Redbubble.

ASX200 Today’s chart

Today, the exchange volume of ASX stocks reached 5 billion shares, and the turnover reached 7.2 billion Australian dollars. The price and volume were significantly reduced compared with yesterday. 724 stocks rose, 614 fell, and 415 closed flat.

The Australian dollar fell to 77.00 US cents yesterday and then rebounded, and today it is consolidating around 77.50 US cents. As of press time, the highest is 77.65 cents and the lowest is 77.39 cents.

To a certain extent, the difference between the above two benchmark indexes was caused by the sharp decline of Redbubble. Redbubble is a component of the common stock index, but has not yet been included in the ASX200 index. The company announced today that the CEO hopes to sacrifice profits to stimulate revenue. This move caused investor dissatisfaction, causing the stock to plummet 23% to 4.24 Australian dollars, the lowest closing price since November last year.

company news:

In terms of sector performance, the medical sector led the gains with a 1.7% increase, followed closely by the information technology sector, which rebounded after weakening on Wednesday. Among the 11 major sectors, only two experienced declines. Among them, the energy sector fell by 0.7%, and the utility sector declined slightly.

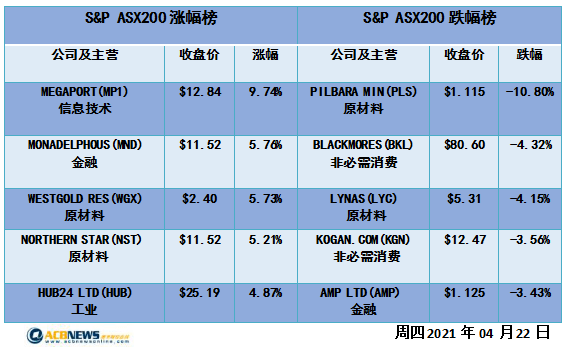

In terms of individual stocks, Megaport, a network-as-a-service (NaaS) service provider, performed the best today, with its stock soaring 9.7% to A$12.84, a two-month high. The company’s first quarter results show that it is expected to achieve its revenue target for this fiscal year. Royal Bank of Canada (RBC) analysts said that thanks to the support of new customers, including two large media customers, the company is expected to achieve about A$80 million in revenue this fiscal year.

Construction and engineering company Monadelphous was the second-best performing stock today, with its share price rising 5.8% to A$11.93. This was followed by resources company Westgold Resources, whose share price climbed 5.7% to A$2.40, a new high since January.

Mining company Pilbara performed the worst among the ASX200 stocks, dropping 10.8% to 1.15 Australian dollars today. Macquarie analysts said the company’s third-quarter performance indicators were mixed. Spodumene production was 7% higher than market expectations, but shipments were blocked and sales were 9% lower than expected.

Security Group (AMP), which changed its CEO this month, also performed poorly. The stock fell 3.4% today and closed at A$1.12.

After the sudden resignation of CEO Brett Redman, the energy group AGL’s share price fell by nearly 2.9% to A$8.80, a record low since 2004.

The share price of Lynas, a leading rare earth company, fell continuously, and today fell again sharply by 4.2% to A$5.31, the lowest level since February.

Reference: Australian Financial Review

Disclaimer: This article is a financial observation commentary and does not constitute any investment advice. Please ask professionals for trading operations or investment decisions.

(Solemnly declare: ACB News “Australia Finance Online” reserves all copyrights for articles marked as original. Please indicate the source in any form of reprint.)

More information

1 The global stock market underperformed, the Australian market continued to decline, the financial sector led the decline, and Nuix plunged by more than 15%

2 Investors profit-taking, the market erases the three-day gains, raw materials and financial sectors lead the decline, the market is not pessimistic

3 The Australian Index is once again close to historical highs, new highs are in sight, bank stocks are sought after, energy stocks are weak

4 This week, the broader market rose, technology stocks led the gains, and the Australian index hit a new record high after the epidemic is just around the corner

5 The employment data is stronger than expected, the Australian index will rise again, and the raw material sector is trending strongly. The historical high is not far away.

6 The economy is expected to be optimistic, and the market will hit another 7000 points. Technology stocks soared. Many stocks hit record highs.

You must log in to post a comment.