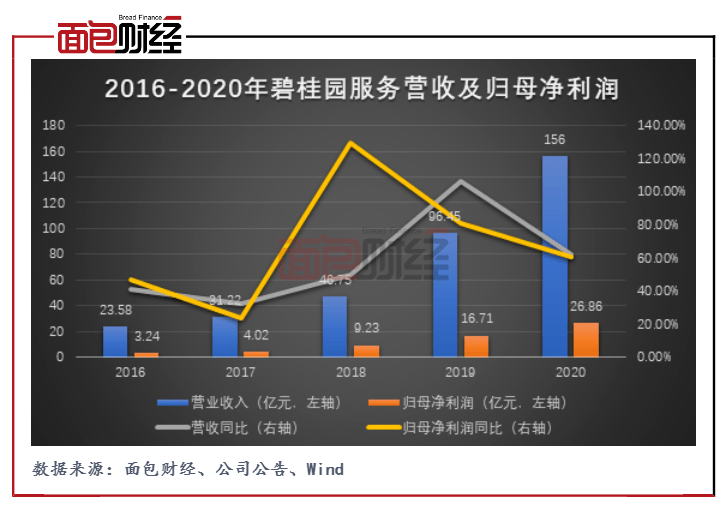

Recently, Country Garden Services released its 2020 annual report. The annual report shows that the company’s operating income in 2020 was 15.6 billion yuan, a year-on-year increase of 61.75%; the net profit attributable to the parent was 2.686 billion yuan, a year-on-year increase of 60.78%.

Benefiting from multiple mergers and acquisitions business expansion and scale improvement, Country Garden’s performance continued to rise, but the company’s revenue growth rate fell for the first time in three years, and the growth rate of net profit attributable to the parent company declined for two consecutive years. In addition, subject to the integration of mergers and acquisitions, the company’s urban service business gross profit margin has also declined.

Since the company went public in 2018, Country Garden Services’ stock price has risen more than 8 times. As of April 22, the company’s total market value reached 231.38 billion Hong Kong dollars, surpassing the parent company Country Garden. As a “first listed property company”, behind the frequent acquisitions of Country Garden Services, it is not difficult to see that scale is still the core demand for the development of property companies at this stage, and the property management industry may enter the peak of mergers and acquisitions in the future.

Although mergers and acquisitions are an effective way to accelerate expansion, this kind of performance growth brought about by acquisitions cannot be replicated. Under the sustained rapid growth in recent years, for Country Garden’s services, which have formed a relatively high base in various indicators, how to maintain “quality” while pursuing “quantity” is a bigger problem.

It is worth noting that the major shareholder of Country Garden Services JPMorgan Chase & Co. and the company’s president Li Changjiang have successively reduced their holdings of Country Garden Services stocks since 2021, and the two have reduced their holdings by more than 10 million shares in total.

Scale expansion, performance growth, revenue and profit growth slowdown

During the reporting period, in addition to the “three supply and one industry” business, Country Garden’s service property contract management area reached 821 million square meters, an increase of 136 million square meters from the end of 2019; the property charge management area reached 377 million square meters, which was newer than the end of 2019 An increase of 101 million square meters. As of December 31, 2020, the company managed a total of 3277 properties, a year-on-year increase of 36.26%.

Benefited from the expansion of the scale of property management, the company’s performance continued to rise, but the growth rate has slowed down. The annual report shows that the company’s operating income in 2020 was 15.6 billion yuan, a year-on-year increase of 61.75%; the net profit attributable to the parent was 2.686 billion yuan, a year-on-year increase of 60.78%. Among them, the company’s revenue growth rate fell for the first time in three years, and the revenue growth rate fell by about 40% year-on-year; the net profit growth rate attributable to the parent fell by about 20% year-on-year, which has been declining for two consecutive years.

The proportion of revenue from basic property management services declines and focuses on businesses outside the concept of traditional real estate

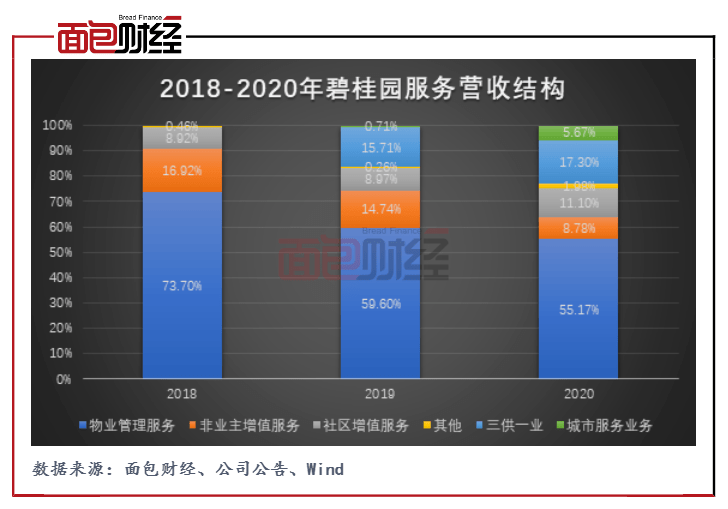

From the perspective of changes in the revenue structure in the past three years, property management services are the main source of income for Country Garden services. In the past three years, the proportion of revenue from this business has exceeded 50%, but the proportion has been declining year by year, from 73.7% in 2018 to 55.17% in 2020.

Among them, income from properties developed by Country Garden Group accounted for approximately 72% of total property management service income, and income from properties developed by independent third-party developers accounted for 28% of total property management service income, an increase of 3.7% from the same period last year and compared with 2018 An increase of 16.6%. In the company’s total new contract area, brand expansion accounted for 53.3%, while the area from the Country Garden system accounted for 35.1%. The company’s dependence on the parent company’s residential incremental market has decreased.

In addition, Country Garden Services has developed many businesses beyond the traditional concept of real estate, including commercial asset operations, urban services, community group purchases, community media, house leasing, insurance brokerage, etc.

The annual report shows that the company’s urban service business has increased significantly. The company’s urban service business revenue increased from 68 million yuan in 2019 to 884 million yuan in 2020, with a revenue share of 5.67% (approximately 0.71% in the same period in 2019), an increase of 1192.5%, mainly due to business growth brought about by acquisitions To.

In 2020, the company’s community value-added service revenue will be 1.731 billion yuan, and the total revenue will account for 11.1%. The amount of revenue will increase by 100.10% year-on-year, becoming the company’s second largest revenue growth point. Among them, the company’s value-added service innovation business revenue increased by 268.6% year-on-year, and community media service revenue increased by 273.6% year-on-year.

It is worth noting that the company’s revenue from non-owner value-added services has declined. Revenue from this business dropped from 1.422 billion yuan in 2019 to 1.370 billion yuan in 2020, a year-on-year decline of about 3.7%. The company stated that it was mainly due to the change in the consulting service business model in this service.

Mergers and acquisitions “double-edged sword”: urban service gross margin declines due to accelerated expansion, adding more than 3 billion goodwill

In response to high-performance plans and high-growth demands, Country Garden Services has made multiple mergers and acquisitions in the past year, with the intention of increasing scale and expanding its business.

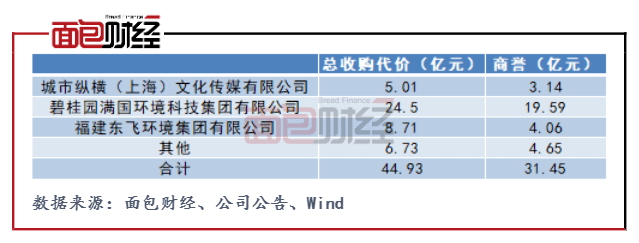

According to data, in September 2020, the company acquired 65% of the equity of City Zongheng (Shanghai) Culture Media Co., Ltd. (hereinafter referred to as “City Zongheng”) to increase its community media service business. In October of the same year, the company acquired 70% of the equity of Country Garden Manguo Environmental Technology Group Co., Ltd. (hereinafter referred to as “Manguo”) and 60% of Fujian Dongfei Environmental Group Co., Ltd. (hereinafter referred to as “Dongfei”), a leading company in the sanitation industry. Equity. In addition, the company also acquired Wenjin International Insurance Brokers Co., Ltd. (hereinafter referred to as “Wenjin Insurance Brokers”) and several other property management companies.

Since 2021, Country Garden’s service has continued to increase its size on the material enterprise track. On April 13, Country Garden Services announced the acquisition of four commercial management subsidiaries of Country Garden Holdings for 20 million yuan. On April 19, the company spent over 4 billion yuan to complete the acquisition of 71.17% shares of Blu-ray Garbo Services.

It is worth noting that although mergers and acquisitions are an effective way to accelerate expansion, this kind of performance growth brought about by acquisitions cannot be replicated. In addition, subject to third-party acquisitions and acquisitions of the target asset quality, the future profitability of property companies will also be affected. Data shows that with the company’s overall gross profit margin growth, the company’s gross margins in community value-added services, “three supplies and one industry” business, and urban service segments all declined. Among them, due to the low gross profit margin of the Manchuria and Dongfei businesses acquired during the year, the gross profit margin of the company’s urban service segment decreased from 38.7% in 2019 to 32.5%.

In addition, due to multiple acquisitions of Country Garden Services in 2020, the company’s new intangible assets will reach 4.672 billion yuan, including 3.145 billion yuan in new goodwill. If the performance of the acquired target in the later period is not as good as expected, Country Garden Services will have a certain risk of goodwill impairment.

Increase in income tax rate affects profits, important shareholders successively reduce their holdings

In 2020, the income tax rate of Country Garden’s main subsidiary of Country Garden Services will be changed from the preferential tax rate of 15% in the same period of the previous year to 25%. Corporate income tax expenses rose from 358 million yuan in 2019 to 933 million yuan, a year-on-year increase of approximately 160.84%. If the 25% income tax rate continues in the future, the profitability index of Country Garden Services will also be under pressure as the scale grows.

In addition, WIND data shows that since the beginning of this year, all shareholders have reduced their holdings of 11.508 million shares of the company. Among them, President Li Changjiang reduced his holdings of 240,000 shares on April 1, with an average price of about 80 Hong Kong dollars per share; the third largest shareholder JPMorgan Chase & Co. successively reduced their holdings of 11.2608 million shares. In the past year, Li Changjiang has reduced his holdings of 2.12 million shares, and has cashed out approximately HK$87,277,400.

The actions of leading companies are the vane of industry development. From the annual report of Country Garden Services, it can be seen that the current mergers, acquisitions, outsourcing and multi-format simultaneous development are still the new trends of the current property management industry, and the industry may enter the era of great integration in the future.

Disclaimer: This article is for information sharing only and does not constitute any investment advice to anyone.

Copyright statement: The copyright of this work belongs to Bread Finance, and it is not allowed to reprint, extract or use other methods to use this work without authorization.

You must log in to post a comment.