(Original title: Fryer! GDP growth 18.3%! Just now, liquor stocks went crazy! Huawei’s black technology crushed Tesla, and the stock price immediately rose to the limit! This science and technology board also became popular, rising by more than 130% in 5 days!)

Today’s A shares are very lively. Last night, the overseas indexes were all hitting new highs. After the news of today’s GDP came out, A shares almost plunged, but as of the close of noon, they stabilized.

China’s GDP in the first quarter was 24.931 trillion yuan

Year-on-year increase of 18.3%

Today (April 16), the State Council Information Office held a press conference to introduce the operation of the national economy in the first quarter of 2021.

According to preliminary calculations, the gross domestic product in the first quarter was 24,931 billion yuan, a year-on-year increase of 18.3% at comparable prices, an increase of 0.6% from the fourth quarter of 2020, an increase of 10.3% from the first quarter of 2019, and an average increase of 5.0% over the two years.

View by industry:

- The added value of the primary industry was 1,133.2 billion yuan, an increase of 8.1% year-on-year, and an average growth rate of 2.3% over the two years;

- The added value of the secondary industry was 9262.3 billion yuan, a year-on-year increase of 24.4%, and an average growth rate of 6.0% in two years;

- The added value of the tertiary industry was 1,45355 billion yuan, an increase of 15.6% year-on-year, and an average growth rate of 4.7% over the two years.

On the one hand, the gross domestic product in the first quarter increased by 18.3% year-on-year, which was affected by incomparable factors such as the lower base of the previous year and the increase in employee working days during the New Year; An increase of 5.0% indicates that my country’s economy has recovered steadily.

The Shanghai stock index fluctuated up 0.46% and returned to above 3400 points

After the news of GDP came out, A-shares once plunged, but quickly regained their gains. As of the close, the Shanghai Composite Index rose 0.46% to 3,114.74 points, the Shenzhen Component Index fell slightly by 0.05%, and the ChiNext Index fell 0.71%; the two markets The total turnover was 418.1 billion yuan; the net inflow of northbound funds was 2.321 billion yuan.Large and small cap stocks diverged in early trading, and the ChiNext index fell more than 1% during the session, mainly dragged down by some heavyweight stocks such as Ningde Times

On the disk, the winemaking sector rose strongly, with the daily limit of Kuaijishan, Laobaigan wine, Yilite, and highland barley wine; the coal sector rose sharply, and the Liaoning Energy and Jinkong Coal Industry daily limit; media entertainment, tourism, real estate, software, insurance, gas , Automotive and other sectors are strong; digital currency, infant and child concepts, intellectual property rights, online games, new crown detection and other topics are active.

Huawei’s autonomous driving is finally here

Two auto stocks have strong daily limit!

Wherever Huawei goes, there will be a daily limit!

On the 16th, BAIC Blue Valley (600733.SH) opened higher and moved higher. It has now been strongly closed at 12.51 yuan. Its share price has hit a new high for more than two and a half years, with a total market value of 43.7 billion yuan.

In addition, Changan Automobile also has a daily limit, the stock price closed at 15.81 yuan per share, and the daily limit was over 300,000 lots.

What happened behind? It turned out that on April 15th, the HI version of the BAIC New Energy Polar Fox Alpha S model equipped with Huawei’s autonomous driving technology had a public test ride in Shanghai. This was also the first public test ride of Huawei’s autonomous driving technology in the world.

It is understood that the driving conditions of the on-site test vehicles are relatively stable, and the urban commuting can be achieved without intervention and automatic driving in situations such as traffic lights start and stop, unprotected left turn, avoid intersection vehicles, courteous pedestrians, and change lanes.

Prior to the Huawei Global Analyst Conference, Xu Zhijun, the rotating chairman of Huawei, said that Huawei will continue to increase investment in smart car software to realize the intelligence, automation, and electrification of the automotive industry. Xu Zhijun emphasized that Huawei’s positioning in the automotive field is an incremental component supplier in the intelligent networked automotive field.

Xu Zhijun said that Huawei’s decision not to build cars and to help car companies build good cars was a matter of years of discussion. This strategy has not changed so far. Huawei will choose partners to empower car companies. Huawei has currently cooperated with three partners to launch three brands of smart cars. First, BAIC New Energy has built the ARCFOX Polar Fox brand. Starting in the fourth quarter of this year, a series of vehicles will be launched on the market in the future; the other are Chongqing Changan and Guangzhou Automobile. However, the names of the two brands have not yet been determined. Among them, the extremely fox brand jointly created by Huawei and BAIC New Energy will launch a series of models starting in the fourth quarter of this year. Related models will be marked with HI LOGO on the body, HI stands for Huawei Inside. Vehicles marked with HI LOGO are equipped with Huawei’s high-end autonomous driving system and all Huawei smart car solutions.

“The R&D team told me that Huawei’s autonomous driving can achieve 1,000 kilometers of autonomous driving without intervention in the urban area.” Xu Zhijun said.

Come and watch the video.

A bunch of netizens commented at the bottom: awesome!

Over 130% in 5 days

This sci-tech innovation board stock is on fire

On April 16, Hotview Bio once again rose by its daily limit, with an increase of 20%, to 120.34 yuan.

On the news, Hotview Bio is expected to achieve a net profit of 560 million yuan to 660 million yuan attributable to the owners of the parent company in the first quarter, an increase of 109125.67% to 128630.25% year-on-year, ranking first in the pre-increased shares of the two cities.

Hotview Biotech has become the king of pre-increasing in the first quarter. First, the base number in the first quarter of 2020 is relatively small. Second, in the first quarter of 2021, the company’s two rapid detection reagents for new crown antigens were certified by the German Federal Institute of Medicines and Medical Devices on March 2 and 22 respectively for home free testing. They can be used in German supermarkets and pharmacies. , Internet stores and other sales, leading to explosive growth of the company’s foreign trade orders.

Regarding the reasons for the growth in performance, Hotview Bio said that in the first quarter of 2021, the company’s new coronavirus 2019n-CoV antigen detection kit (front nasal cavity) and new coronavirus 2019n-CoV antigen detection kit (saliva) two new types of coronavirus Viral antigen rapid detection reagent products were certified by the German Federal Institute of Pharmaceuticals and Medical Devices (BfArM) for home free testing on March 2 and 22 respectively, and can be sold in German supermarkets, pharmacies, and Internet stores. This led to the explosive growth of the company’s foreign trade orders.

Since April, Hotview Bio has continued to rise. So far, the cumulative increase has exceeded 170%. Among them, from April 13th to 15th, three consecutive daily limits were obtained.

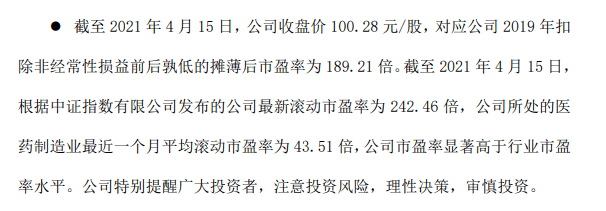

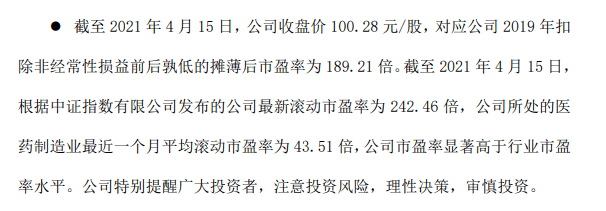

The company issued a risk warning on the evening of the 15th, saying that as of April 15, the company’s closing price was 100.28 yuan per share, corresponding to the company’s 2019 deducted non-recurring gains and losses, which is the lowest diluted P/E ratio of 189.21 times. As of April 15, 2021, according to the company’s latest rolling price-earnings ratio released by China Securities Index Co., Ltd., the company’s pharmaceutical manufacturing industry has an average rolling price-earnings ratio of 43.51 times in the most recent month. The company’s price-earnings ratio is significantly higher than the industry price-earnings ratio. . The company especially reminds investors to pay attention to investment risks, make rational decisions and invest prudently.

On March 2 and March 22, 2021, the company obtained the new coronavirus 2019n-CoV antigen detection kit (front nasal cavity) and new Coronavirus 2019n-CoV Antigen Detection Kit (Saliva) Two new coronavirus antigen rapid detection reagent products, which are special approvals, are valid for three months, and the certification is valid until June 2 and June 20, 2021, respectively. The risk that the certification cannot be successfully renewed after the validity period expires.

Second child + medical beauty concept blessing

This company has ten daily limit!

On the 16th, the blonde rabbi set its daily limit again. In just a dozen days, it was already the tenth daily limit, with a skyrocketing over 1160%.

Why is it so fierce? On the evening of April 14, the Central Bank issued a working paper “Awareness and Countermeasures for my country’s Demographic Transition”, which pointed out that my country is about to transition from stage III to stage IV of population transformation, and the main contradiction facing China has changed from population expansion to The demographic dividend is about to disappear and the aging and declining birth rate crisis is approaching. The countermeasures are: comprehensively liberalize and vigorously encourage childbirth, and effectively solve the difficulties women encounter in pregnancy, childbirth, nursery school, and school; attach importance to savings and investment; promote pension reform; promote education and technological progress, and establish basic social insurance System, control housing prices, attach importance to mothers and children’s education, attach importance to basic education, and attach importance to science and engineering education.

Gold Rabbi is engaged in the design, research and development, production and sales of mid-to-high-end maternal and child consumer products, which is tinged with the dual concept of “second child + medical beauty”.

On the evening of April 14, Gold Rabbi released the 2020 annual results bulletin. The total operating income was about 313 million yuan, a year-on-year decrease of 28.69%; the net profit attributable to shareholders of listed companies was about 32.29 million yuan, a year-on-year decrease of 30.71%; basic per share The revenue was RMB 0.09, a year-on-year decrease of 30.77%.

At the same time, Gold Rabbi expects the net profit attributable to shareholders of listed companies in the first quarter of 2021 to be 5 million to 7.5 million yuan, a year-on-year increase of 567.29% to 900.93%.

Gold Rabbi disclosed the risk warning of stock trading on the evening of April 15, saying that although the maternal and child market has a bright future, the company is also facing the risk of intensified industry competition. Whether the future performance improvement can meet the company’s expectation of transformation and upgrading development still exists. Certain uncertainty. The company’s investment in the Han Fei project is based on its development strategy and business layout. There are still many uncertainties in whether the cooperation can smoothly cooperate with each other and achieve the goal of mutual promotion.

Liquor stocks are also going crazy!

Today’s liquor stocks are picking up collectively, and the liquor index has soared by nearly 5%! Yilite, Qinghai Barley Wine, and Old Baigan Wine have their daily limit. Shuijingfang rose 8% and approached a historical high. Jinhui Wine and ST were willing to rise sharply.

Last Friday evening, Shuijingfang announced its foreign investment in sauces and wines and an announcement on its first-quarter performance increase. The forecast for the first quarter shows that in the first quarter of 2021, Shuijingfang expects to achieve an increase of approximately 510 million yuan in operating income compared with the same period of the previous year, an increase of approximately 70.2% year-on-year; the net profit attributable to shareholders of listed companies has increased by approximately 228 million compared with the same period last year. , An increase of approximately 119.7% year-on-year. At the same time, Shuijingfang announced the establishment of a joint venture of Guizhou Shuijingfang Guowei Liquor Co., Ltd. (tentative name). The joint venture project aims to “create a new series of well-known brands of first-line sauce-flavor liquor.”

And ST is willing to become the first ST stock in the history of A-shares to break 100 yuan. ST is willing to continue to increase its performance in recent years. Net profit has increased from 7.128 million yuan in 2015 to 508 million yuan in 2019, an increase of more than 70 times, with a compound annual growth rate of close to 200%, and a profit of 311 million yuan for the third quarter of 2020. Continue Maintain year-on-year growth.

The reason why ST is willing to wear a cap is not because of general performance losses, but because of shareholders’ funds. On August 20, 2020, Xide Liquor Industry revealed that the company’s controlling shareholder Tianyang Holdings and its related parties occupied the company’s principal of 440 million yuan through non-operating funds of Pengshan Liquor Industry in Pengxi County, Sichuan Province, and the capital occupied interest of 34.86 million yuan. .

On the last day of 2020, Yuyuan, a listed company under the Fosun Group, bid for a 70% stake in Tuopai Shede Group (indirectly holding 29.9% of the company) through a judicial auction for 4.53 billion yuan. The actual controller of the company is Shehong County. The government became Guo Guangchang, and Fosun successfully entered ST and was willing.

On the one hand, the gross domestic product in the first quarter increased by 18.3% year-on-year, which was affected by incomparable factors such as the lower base of the previous year and the increase in employee working days during the New Year; An increase of 5.0% indicates that my country’s economy has recovered steadily.

The Shanghai stock index fluctuated up 0.46% and returned to above 3400 points

After the news of GDP came out, A-shares once plunged, but quickly regained their gains. As of the close, the Shanghai Composite Index rose 0.46% to 3,114.74 points, the Shenzhen Component Index fell slightly by 0.05%, and the ChiNext Index fell 0.71%; the two markets The total turnover was 418.1 billion yuan; the net inflow of northbound funds was 2.321 billion yuan.Large and small cap stocks diverged in early trading, and the ChiNext index fell by more than 1% during the session, mainly dragged down by some heavyweight stocks such as Ningde Times

On the disk, the winemaking sector rose strongly, with the daily limit of Kuaijishan, Laobaigan wine, Yilite, and highland barley wine; the coal sector rose sharply, and the Liaoning Energy and Jinkong Coal Industry daily limit; media entertainment, tourism, real estate, software, insurance, gas , Automotive and other sectors are strong; digital currency, infant and child concepts, intellectual property rights, online games, new crown detection and other topics are active.

Huawei’s autonomous driving is finally here

Two auto stocks have strong daily limit!

Wherever Huawei goes, there will be a daily limit!

On the 16th, BAIC Blue Valley (600733.SH) opened higher and moved higher. It has now been strongly closed at 12.51 yuan. Its share price has hit a new high for more than two and a half years, with a total market value of 43.7 billion yuan.

In addition, Changan Automobile also has a daily limit, the stock price closed at 15.81 yuan per share, and the daily limit was over 300,000 lots.

What happened behind? It turned out that on April 15th, the HI version of the BAIC New Energy Polar Fox Alpha S model equipped with Huawei’s autonomous driving technology had a public test ride in Shanghai. This was also the first public test ride of Huawei’s autonomous driving technology in the world.

It is understood that the driving conditions of the on-site test vehicles are relatively stable, and the urban commuting can be achieved without intervention and automatic driving in situations such as traffic lights start and stop, unprotected left turn, avoid intersection vehicles, courteous pedestrians, and change lanes.

Prior to the Huawei Global Analyst Conference, Xu Zhijun, the rotating chairman of Huawei, said that Huawei will continue to increase investment in smart car software to realize the intelligence, automation, and electrification of the automotive industry. Xu Zhijun emphasized that Huawei’s positioning in the automotive field is an incremental component supplier in the intelligent networked automotive field.

Xu Zhijun said that Huawei’s decision not to build cars and to help car companies build good cars was a matter of years of discussion. This strategy has not changed so far. Huawei will choose partners to empower car companies. Huawei has currently cooperated with three partners to launch three brands of smart cars. First, BAIC New Energy has built the ARCFOX Polar Fox brand. Starting in the fourth quarter of this year, a series of vehicles will be launched on the market in the future; the other are Chongqing Changan and Guangzhou Automobile. However, the names of the two brands have not yet been determined. Among them, the extremely fox brand jointly created by Huawei and BAIC New Energy will launch a series of models starting in the fourth quarter of this year. The car body of the relevant model will be marked with HI LOGO, HI stands for Huawei Inside. Vehicles marked with HI LOGO are equipped with Huawei’s high-end autonomous driving system and all Huawei smart car solutions.

“The R&D team told me that Huawei’s autonomous driving can achieve 1,000 kilometers of autonomous driving without intervention in the urban area.” Xu Zhijun said.

Come and watch the video.

A bunch of netizens commented at the bottom: awesome!

Over 130% in 5 days

This sci-tech innovation board stock is on fire

On April 16, Hotview Bio once again rose by its daily limit, with an increase of 20%, to 120.34 yuan.

On the news, Hotview Bio is expected to achieve a net profit of 560 million yuan to 660 million yuan attributable to the owners of the parent company in the first quarter, an increase of 109125.67% to 128630.25% year-on-year, ranking first in the pre-increased shares of the two cities.

Hotview Biotech has become the king of pre-increasing in the first quarter. First, the base number in the first quarter of 2020 is relatively small. Second, in the first quarter of 2021, the company’s two rapid detection reagents for new crown antigens were certified by the German Federal Institute of Medicines and Medical Devices on March 2 and 22 respectively for home free testing. They can be used in German supermarkets and pharmacies. , Internet stores and other sales, leading to explosive growth of the company’s foreign trade orders.

Regarding the reasons for the growth in performance, Hotview Bio said that in the first quarter of 2021, the company’s new coronavirus 2019n-CoV antigen detection kit (anterior nasal cavity) and new coronavirus 2019n-CoV antigen detection kit (saliva) two new types of coronavirus Viral antigen rapid detection reagent products were certified by the German Federal Institute of Medicines and Medical Devices (BfArM) for home free testing on March 2 and 22, respectively, and can be sold in German supermarkets, pharmacies, and Internet stores. This led to the explosive growth of the company’s foreign trade orders.

Since April, Hotview Bio has continued to rise. So far, the cumulative increase has exceeded 170%. Among them, from April 13th to 15th, three consecutive daily limits were obtained.

The company issued a risk warning on the evening of the 15th, saying that as of April 15, the company’s closing price was 100.28 yuan per share, corresponding to the company’s 2019 deducted non-recurring gains and losses, which is the lowest diluted P/E ratio of 189.21 times. As of April 15, 2021, according to the company’s latest rolling price-earnings ratio released by China Securities Index Co., Ltd., the company’s pharmaceutical manufacturing industry has an average rolling price-earnings ratio of 43.51 times in the most recent month. The company’s price-earnings ratio is significantly higher than the industry price-earnings ratio. . The company especially reminds investors to pay attention to investment risks, make rational decisions and invest prudently.

On March 2 and March 22, 2021, the company obtained the new coronavirus 2019n-CoV antigen detection kit (front nasal cavity) and new Coronavirus 2019n-CoV Antigen Detection Kit (Saliva) Two new coronavirus antigen rapid detection reagent products, which are special approvals, are valid for three months, and the certification is valid until June 2 and June 20, 2021, respectively. The risk that the certification cannot be successfully renewed after the validity period expires.

Second child + medical beauty concept blessing

This company has ten daily limit!

On the 16th, the blonde rabbi set its daily limit again. In just a dozen days, it was already the tenth daily limit, with a skyrocketing over 1160%.

Why is it so fierce? On the evening of April 14, the Central Bank issued a working paper “Awareness and Countermeasures for my country’s Demographic Transition”, which pointed out that my country is about to transition from stage III to stage IV of population transformation, and the main contradiction facing China has changed from population expansion to The demographic dividend is about to disappear and the aging and declining birth rate crisis is approaching. The countermeasures are: comprehensively liberalize and vigorously encourage childbirth, and effectively solve the difficulties women encounter in pregnancy, childbirth, nursery school, and school; attach importance to savings and investment; promote pension reform; promote education and technological progress, and establish basic social insurance System, control housing prices, attach importance to mothers and children’s education, attach importance to basic education, and attach importance to science and engineering education.

Gold Rabbi is engaged in the design, research and development, production and sales of mid-to-high-end maternal and child consumer products, which is tinged with the dual concept of “second child + medical beauty”.

On the evening of April 14, Gold Rabbi released the 2020 annual results bulletin. The total operating income was about 313 million yuan, a year-on-year decrease of 28.69%; the net profit attributable to shareholders of listed companies was about 32.29 million yuan, a year-on-year decrease of 30.71%; basic per share The revenue was RMB 0.09, a year-on-year decrease of 30.77%.

At the same time, Gold Rabbi expects the net profit attributable to shareholders of listed companies in the first quarter of 2021 to be 5 million to 7.5 million yuan, a year-on-year increase of 567.29% to 900.93%.

Gold Rabbi disclosed the risk warning of stock trading on the evening of April 15, saying that although the maternal and child market has a bright future, the company is also facing the risk of intensified industry competition. Whether the future performance improvement can meet the company’s expectation of transformation and upgrading development still exists. Certain uncertainty. The company’s investment in the Han Fei project is based on its development strategy and business layout. There are still many uncertainties in whether the cooperation can smoothly cooperate with each other and achieve the goal of mutual promotion.

Liquor stocks are also going crazy!

Today’s liquor stocks are picking up collectively, and the liquor index has soared by nearly 5%! Yilite, Qinghai Barley Wine, and Old Baigan Wine have their daily limit. Shuijingfang rose 8% and approached a historical high. Jinhui Wine and ST were willing to rise sharply.

Last Friday evening, Shuijingfang announced its foreign investment in sauces and wines and an announcement on its first-quarter performance increase. The forecast for the first quarter shows that in the first quarter of 2021, Shuijingfang expects to achieve an increase of approximately 510 million yuan in operating income compared with the same period of the previous year, an increase of approximately 70.2% year-on-year; the net profit attributable to shareholders of listed companies has increased by approximately 228 million compared with the same period last year. , An increase of approximately 119.7% year-on-year. At the same time, Shuijingfang announced the establishment of a joint venture of Guizhou Shuijingfang Guowei Liquor Co., Ltd. (tentative name). The joint venture project aims to “create a new series of well-known brands of first-line sauce-flavor liquor.”

And ST is willing to become the first ST stock in the history of A-shares to break 100 yuan. ST is willing to continue to increase its performance in recent years. Net profit has increased from 7.128 million yuan in 2015 to 508 million yuan in 2019, an increase of more than 70 times, with a compound annual growth rate of close to 200%, and a profit of 311 million yuan for the third quarter of 2020. Continue Maintain year-on-year growth.

The reason why ST is willing to wear a cap is not because of general performance losses, but because of shareholders’ funds. On August 20, 2020, Xide Liquor Industry revealed that the company’s controlling shareholder Tianyang Holdings and its related parties occupied the company’s principal of 440 million yuan through non-operating funds of Pengshan Liquor Industry in Pengxi County, Sichuan Province, and the capital occupied interest of 34.86 million yuan. .

On the last day of 2020, Yuyuan, a listed company under the Fosun Group, bid for a 70% stake in Tuopai Shede Group (indirectly holding 29.9% of the company) through a judicial auction for 4.53 billion yuan. The actual controller of the company is Shehong County. The government became Guo Guangchang, and Fosun successfully entered ST and was willing.

You must log in to post a comment.