This article was originally created by the “Suning Institute of Finance” and the author is Huang Dazhi, a researcher at the Suning Institute of Finance

The Forbes Global Rich List, which includes the rankings of the rich in various countries, attracts the eyes of the world and arouses heated discussions from all walks of life when it is announced every year. People marvel at the total wealth of the billionaires, and lament the speed at which the wealth of the rich has increased in value.

In the history of the Forbes rich list for 40 to 50 years, elites from all walks of life have been on the list. There have been capitalists, bankers, oil tycoons, real estate companies, manufacturers, retailers, and Entrepreneurs… But among these billionaires, only those who are on the list by investing in the stocks of other companies are extremely rare. Among them, the most prestigious person is Buffett, who is known as the “stock god”.

However, in the history of the US securities market for more than two hundred years, another investment legend, Shelby Kalom Davis, also ranked on the Forbes rich list for investment.

20 times in 5 years, “Davis double click” and triple profit

According to the popular saying now, Davis’s investment career started after the “mid-life crisis.” Davis, who has just entered the field of securities investment, is 38 years old. He has no personal investment experience before graduating from history.

At this time, Davis had less than three years of insurance industry supervision experience with investment-related knowledge. A draft called “Facing America in the 1940s” to reflect on the causes of the Great Depression, a section of financial editors working experience.

Leaving his post as a civil servant in the New York State Government, with a loan of $50,000 from his wife Catherine, Davis started a life that was not lost to the investment legend of Warren Buffett.

Three years of insurance industry supervision experience has given Davis a deep understanding of insurance companies, so he strongly recommends insurance stocks to investors just after he went to sea. But at this time, the insurance industry in the United States is basically not favored by any investors, and the trading seats that Davis bought are naturally bleak.

It is not difficult to understand that at this time (1947) the United States had not fully recovered from the war. The war caused “overall moral deficiencies”, the demobilized American soldiers caused an extremely high crime rate, and insurance companies faced countless compensations, coupled with concerns about nuclear damage and a major explosion in the near future. , Which exacerbated investors’ worries about the investment value of insurance companies. It is difficult for investors to accept such an insurance company that is strictly regulated and may face huge claims.

Precisely because of this, insurance stocks are at an absolute historical low at this time, and the P/E ratio of insurance companies is less than 4 times. Davis, who failed to promote insurance stocks to investors, bought these insurance stocks with money borrowed from his wife.

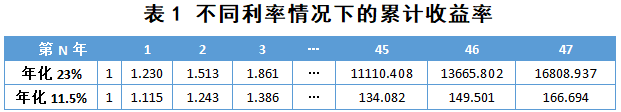

With the recovery of the US economy after the war, the yields of insurance companies’ investment portfolios continued to rise, and the increase in people’s income also brought huge demand for insurance, and insurance stocks finally ushered in the spring. ( Related recommended reading: Are current insurance stocks suitable for bargain hunting? ) Only five years later, Davis, who first entered the securities market, became a millionaire relying on insurance stocks, with a book profit of more than 20 times. The key lies in the triple profit including the “Davis double-click”. Stock price = price-to-earnings ratio × earnings per share. Davis bought insurance stocks at a price-earnings ratio of less than 4 times. Assuming that the earnings per share at this time is 1 yuan, as the insurance company’s investment income increases and earnings improve, the earnings per share increase to 8 yuan. The sentiment of the bull market will increase the risk appetite of investors. By the end of the 1950s, the insurance stock market earnings ratio reached 12-20 times. At a price-earnings ratio of only 16 times, the price of insurance stocks has increased by as much as 32 times. This spiral of earnings and valuation is called “Davis Double Click” by Davis. Not only that, insurance companies generally have good dividends, which are higher than twice the yield of Treasury bonds, which brings the second largest profit to Davis’s investment portfolio. The most important point is the use of financing leverage, which is also the investment know-how jointly owned by Davis and Buffett. Throughout Davis’s investment career, he has almost always maintained double financial leverage, that is to say, when there is 50,000 yuan, he will raise 50,000 yuan and hold 100,000 yuan. It can be said that this is the most important factor affecting the rate of return in addition to stock picking ability. We can make a simple calculation. Without financing, the annualized rate of return is 11.5%. After 47 years, the cumulative rate of return will reach 167 times. If financing is carried out at a 1:1 ratio, the annualized rate of return will double to 23% (without considering financing costs), and the cumulative rate of return will reach nearly 17,000 times after 47 years! In other words, 1 times the financing leverage, under the action of compound interest in 47 years, has increased the cumulative yield by more than 100 times.  Looking around the world, looking for depressions of value Any industry has cycles, especially insurance. Some investors will choose to sell overvalued stocks, hold cash or invest in other industries during the bubble period, but the worry is that you will never know all industries. By the end of the 1950s, the price-earnings ratio of the Dow Jones constituent stocks had reached 18 times, which had reached the high level at that time. More than a decade of bull market dispelled any stock market skeptics, and everyone who entered the stock market became a faithful believer. American Life magazine wrote an article “The People’s Stock Market: Optimistic and Unpredictable Buying Makes Wall Street Experts Confused”. Stock critics also believe that the rise in the stock market is not obviously positive. However, whether it is rising interest rates or absolute trade deficits, or even the threat of war from the Cuban Missile Crisis, these brief retracements have not undermined investor confidence. The bull market that has lasted for more than a decade has made Davis’s insurance stocks no longer cheap. At this time, six European countries signed the “Rome Treaty” and soon after the establishment of the European Economic Community, Japan, as far away as Asia, also began its post-war economic boom. Davis’s historical background and his early travels in Europe, the Soviet Union, and the Mediterranean gave him a broad vision and began to invest overseas. Japan was the first destination for investigation. Through the journey of a securities analyst to investigate Japan, Davis and his wife completed the dual purpose of inspection of the Japanese insurance industry and family travel, and gradually bought insurance stocks that operate insurance business in Japan. . Since then, with the successful hosting of the 1964 Japanese Olympic Games and the economic take-off, Japanese stocks quickly made his wealth soar, which made him a staunch international investor. Subsequently, he began to look for investment targets on a global scale, including South Africa, Europe, the Far East, and even the Soviet Union. Before long, Davis’s insurance stocks were already a “United Nations”, and 35 insurance company stocks from the Netherlands, Germany, France, and Italy became a supplement to his holdings of Japanese stocks. By 1965, Davis’ portfolio of insurance stocks had reached $50 million. Of course, this is inseparable from the credit of leverage, including more than 20 million US dollars in financing. From 50,000 U.S. dollars in 1947 to 50 million U.S. dollars in 1965, Davis achieved a cumulative profit of 1,000 times by relying on insurance stocks that no one was optimistic about. Black Monday, others fear me greedy Any investor cannot avoid experiencing a long bear market, and this has never distinguished between stock gods and ordinary investors. The only difference is that ordinary investors lose money in a bear market, while investment gurus seize opportunities in a bear market. In the investment legend that runs through the Davis family, it has experienced 2 long bull markets, 25 adjustments, 2 severe bear markets, 1 major crash, 7 mild bear markets, and 9 recessions; the Second World War, The Cold War, the Korean War, the human landing on the moon, the oil crisis, the rise and collapse of the “Pretty Fifty”, the Vietnam War; 1 president assassination, 1 president resignation, 1 president impeachment; 34 years of interest rate rise, 18 years The interest rate has fallen… Three adjustments, including the collapse of the “Pretty Fifty”, caused Davis’s insurance stock portfolio to lose 60%, but this did not weaken its determination to continue to hold and invest in insurance stocks. The performance of “Black Monday” gave Davis, then 78, the last chance to bargain. Within one day of the closing of the “Black Monday”, Davis’s portfolio had a book loss of 125 million U.S. dollars. These assets bought at the bottom of the history helped Davis to be listed in the 1988 Forbes. “The magazine’s rich list has also become an important part of the 900 million dollars left in his lifetime. In 1994, Davis passed away, leaving behind a $900 million trust. His son Shelby and his grandson Chris threw out Davis’s original holdings and put the realised funds into other family-controlled investment funds, and their sons and grandsons continued to manage operations. From the age of 38 with a loan of 50,000 US dollars, to his death at 85, Davis left a fortune of 900 million US dollars. In 47 years, Davis used insurance stocks as the “parent mine”, with a cumulative return of 18,000 times and an annual compound interest return of 23.18%. Another legend in the investment world, “Stock God” Buffett, from 26 to 88 years old (as of 2019), 63 years of investment career annualized rate of return of 20%, 63 years accumulated 77,549 times of return (during only two Annual loss). The two have many common characteristics, including diligence and frugality even reaching the point of iron cock; both are Graham believers; both have achieved an annual growth rate of 23% to 24% (before 1994, Buffett’s portfolio The annualized income has reached more than 23%)… Of course, they also have many similar investment concepts. From this perspective, the methods are the same on the road to long-term investment success. Finally, attach ten investment principles that have always remained unchanged during Davis’s successful investment career:

Looking around the world, looking for depressions of value Any industry has cycles, especially insurance. Some investors will choose to sell overvalued stocks, hold cash or invest in other industries during the bubble period, but the worry is that you will never know all industries. By the end of the 1950s, the price-earnings ratio of the Dow Jones constituent stocks had reached 18 times, which had reached the high level at that time. More than a decade of bull market dispelled any stock market skeptics, and everyone who entered the stock market became a faithful believer. American Life magazine wrote an article “The People’s Stock Market: Optimistic and Unpredictable Buying Makes Wall Street Experts Confused”. Stock critics also believe that the rise in the stock market is not obviously positive. However, whether it is rising interest rates or absolute trade deficits, or even the threat of war from the Cuban Missile Crisis, these brief retracements have not undermined investor confidence. The bull market that has lasted for more than a decade has made Davis’s insurance stocks no longer cheap. At this time, six European countries signed the “Rome Treaty” and soon after the establishment of the European Economic Community, Japan, as far away as Asia, also began its post-war economic boom. Davis’s historical background and his early travels in Europe, the Soviet Union, and the Mediterranean gave him a broad vision and began to invest overseas. Japan was the first destination for investigation. Through the journey of a securities analyst to investigate Japan, Davis and his wife completed the dual purpose of inspection of the Japanese insurance industry and family travel, and gradually bought insurance stocks that operate insurance business in Japan. . Since then, with the successful hosting of the 1964 Japanese Olympic Games and the economic take-off, Japanese stocks quickly made his wealth soar, which made him a staunch international investor. Subsequently, he began to look for investment targets on a global scale, including South Africa, Europe, the Far East, and even the Soviet Union. Before long, Davis’s insurance stocks were already a “United Nations”, and 35 insurance company stocks from the Netherlands, Germany, France, and Italy became a supplement to his holdings of Japanese stocks. By 1965, Davis’ portfolio of insurance stocks had reached $50 million. Of course, this is inseparable from the credit of leverage, including more than 20 million US dollars in financing. From 50,000 U.S. dollars in 1947 to 50 million U.S. dollars in 1965, Davis achieved a cumulative profit of 1,000 times by relying on insurance stocks that no one was optimistic about. Black Monday, others fear me greedy Any investor cannot avoid experiencing a long bear market, and this has never distinguished between stock gods and ordinary investors. The only difference is that ordinary investors lose money in a bear market, while investment gurus seize opportunities in a bear market. In the investment legend that runs through the Davis family, it has experienced 2 long bull markets, 25 adjustments, 2 severe bear markets, 1 major crash, 7 mild bear markets, and 9 recessions; the Second World War, The Cold War, the Korean War, the human landing on the moon, the oil crisis, the rise and collapse of the “Pretty Fifty”, the Vietnam War; 1 president assassination, 1 president resignation, 1 president impeachment; 34 years of interest rate rise, 18 years The interest rate has fallen… Three adjustments, including the collapse of the “Pretty Fifty”, caused Davis’s insurance stock portfolio to lose 60%, but this did not weaken its determination to continue to hold and invest in insurance stocks. The performance of “Black Monday” gave Davis, then 78, the last chance to bargain. Within one day of the closing of the “Black Monday”, Davis’s portfolio had a book loss of 125 million U.S. dollars. These assets bought at the bottom of the history helped Davis to be listed in the 1988 Forbes. “The magazine’s rich list has also become an important part of the 900 million dollars left in his lifetime. In 1994, Davis passed away, leaving behind a $900 million trust. His son Shelby and his grandson Chris threw out Davis’s original holdings and put the realised funds into other family-controlled investment funds, and their sons and grandsons continued to manage operations. From the age of 38 with a loan of 50,000 US dollars, to his death at 85, Davis left a fortune of 900 million US dollars. In 47 years, Davis used insurance stocks as the “parent mine”, with a cumulative return of 18,000 times and an annual compound interest return of 23.18%. Another legend in the investment world, “Stock God” Buffett, from 26 to 88 years old (as of 2019), 63 years of investment career annualized rate of return of 20%, 63 years accumulated 77,549 times of return (during only two Annual loss). The two have many common characteristics, including diligence and frugality even reaching the point of iron cock; both are Graham believers; both have achieved an annual growth rate of 23% to 24% (before 1994, Buffett’s portfolio The annualized income has reached more than 23%)… Of course, they also have many similar investment concepts. From this perspective, the methods are the same on the road to long-term investment success. Finally, attach ten investment principles that have always remained unchanged during Davis’s successful investment career:

First, avoid cheap stocks; Second, avoid high-priced stocks; Third, purchase company stocks with moderate growth at a reasonable price; Fourth, wait for a reasonable price to appear; Fifth, follow the trend; Sixth, thematic investment; Seventh, let your winner continue to run; Eighth, invest in excellent management; Ninth, ignore the rearview mirror (that is, historical performance); Tenth, stick to the end. Reference materials:

John Rothchild, Davis Dynasty, published by Renmin University of China, 2018.11

Translated by Wang Zhonghua and Huang Yiyi, Benjamin Graham, Smart Investor (original 4th edition), China Posts and Telecommunications Press, 2011.07

You must log in to post a comment.