The cautious plot of the long holiday has started again, and the market has been consolidating and consolidating with heavy volume

Market review:

Yesterday, the A-share indexes closed up, with a total turnover of 1,002.263 billion yuan in the two cities, with a turnover exceeding one trillion yuan. A total of 2,157 stocks rose, 2022 stocks fell, a total of 91 stocks have a daily limit, and 36 stocks have a daily limit. Yesterday, the indexes oscillated higher and closed up. The volume and price of the two markets rose together. The turnover exceeded one trillion. The Shanghai Index stood at 3,600 points. The rapid rise of the Ningde era led the ChiNext Index to close up by 2.4%. The general leader of Hongmeng concept stocks, Runhe Software, closed the daily limit at the opening in the afternoon. Since May, it has risen nearly 270%. The leading demonstration effect is strong. The domestic software has completely exploded. More than 20 stocks rose by more than 10%, and nearly 10 stocks were closed by 20cm. Large daily limit. In addition, the shipping, Internet of Things, securities, and chip sectors rose in turn. The coal and chemical cyclical stocks that rose sharply the day before weakened, the liquor sector continued to differentiate, the first-line liquor rebounded, and the second- and third-tier and small market value liquors fell. , Huangtai Liquor Industry has a lower limit in the afternoon.

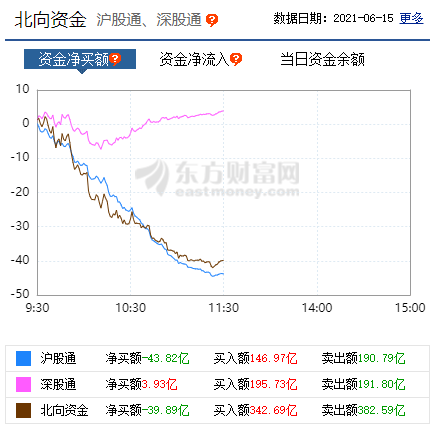

According to Wind statistics, the net outflow of major funds from Shanghai and Shenzhen stock markets was 11.932 billion yuan yesterday, which has been a net outflow for 12 consecutive trading days. The net inflow of northbound funds was 6.821 billion yuan yesterday, which has been net purchases for 3 consecutive trading days.

Today’s news:

[The three major U.S. stock indexes collectively closed up, online education and live broadcast concept stocks rose among the top] The three major US stock indexes closed up collectively. The Dow rose 0.06%, the S&P 500 rose 0.47%, and the Nasdaq rose 0.78%. Online education and live broadcast concept stocks were among the top gainers. New Oriental rose by more than 8%, Good Future rose by more than 7%, and Bilibili rose by more than 4%. The precious metals sector rose, with Keldalen Mining and Herak Mining rising more than 4%. Most of the large technology stocks rose, Amazon rose more than 2%, Google, Microsoft, Tesla rose more than 1%. The WSB concept fell sharply, the game station fell more than 27%, the AMC cinema line fell more than 13%, the anti-epidemic concept stocks fell, Aethlon Medical fell more than 36%, and United Healthcare products fell more than 3%. Today, the US dollar index is 89.99 points, and the offshore RMB is 6.38 yuan. Today, Hong Kong stocks are +0.36%, and the Nikkei Index is +0.01%.

[CentralEnlargementRecruitment:DemonstrationZoneforCommonWealthishere!TheseAsharesareexpectedtobenefit!】 The “Opinions” pointed out that by 2025, Zhejiang Province will make obvious and substantial progress in promoting high-quality development and building a demonstration zone for common prosperity. The quality and efficiency of economic development have been significantly improved, and the per capita GDP has reached the level of medium-developed economies. Or benefit local consumer (upgraded) listed companies, including Songcheng Performing Arts, Hangzhou Jiebai, Ningbo Zhongbai, Zhejiang Yongqiang, Boss Electric, Peacebird, Semir Apparel, Jiangshan Opai, Proya, Jinzi Ham, Liziyuan, Jiaxin Silk, Mankalong, etc.

[Multi-departmentaljointpublicationofrectificationandtighteningofmedicalaestheticsanddrugmanagementmanycompanieshavesubstantiallyreducedtheirholdings!Isthemedicalbeautyindustrygoingtochange?】 In 2019, the scale of my country’s medical aesthetics market reached 150 billion yuan, and its development prospects are still huge. Authoritative data shows that the turnover of medical beauty stocks this year has increased by 280% compared with last year. At the same time, some experts pointed out that it is estimated that around 2024, its scale may reach 300 billion yuan.

[Hongmeng concept has unprecedented popularity! 10 stocks rose more than 10%! Some companies take the initiative to “confess” Some companies are busy dismissing the relationship] One week after the release of the Huawei HarmonyOS 2 operating system, the market still paid unprecedented attention to HarmonyOS. On June 10, the Oriental Wealth Hongmeng Concept Index rose 8.42%, and more than 10 stocks such as Runhe Software, Kelan Software, Advanced Data Communication, and ArcherMind Technology rose by more than 10%.

[China’s broad money (M2) balance increased by 8.3% year-on-year at the end of May, estimated to be 8.1%] According to data released by the Central Bank, at the end of May, the balance of broad money (M2) was 227.55 trillion yuan, a year-on-year increase of 8.3%. The growth rate was 0.2 percentage points higher than the end of the previous month and 2.8 percentage points lower than the same period last year; the balance of narrow money (M1) was 61.68. Trillion yuan, an increase of 6.1% year-on-year, the growth rate was 0.1 and 0.7 percentage points lower than the end of last month and the same period of last year respectively; the balance of currency in circulation (M0) was 8.42 trillion yuan, an increase of 5.6% year-on-year. Net cash returned in the month was 162.6 billion yuan.

[China’sMaysocialfinancingincrementis1920billionyuanandexpectedtobe211286billionyuan] According to data released by the Central Bank, preliminary statistics show that the increase in social financing in May 2021 will be 1.92 trillion yuan, which is 1.27 trillion yuan less than the same period last year and 208.1 billion yuan more than the same period in 2019. Among them, RMB loans to the real economy increased by 1.43 trillion yuan, a year-on-year increase of 120.8 billion yuan; foreign currency loans to the real economy increased by 700 million yuan equivalent to a year-on-year increase of 45 billion yuan; entrusted loans decreased by 40.8 billion yuan, A year-on-year decrease of 13.5 billion yuan; trust loans decreased by 129.5 billion yuan, a year-on-year decrease of 95.8 billion yuan; undiscounted bank acceptances decreased by 92.6 billion yuan, a year-on-year decrease of 176.2 billion yuan; a net decrease of 133.6 billion yuan in corporate bond financing, a year-on-year decrease 421.5 billion yuan; government bond net financing was 670.1 billion yuan, a year-on-year decrease of 466.1 billion yuan; domestic equity financing of non-financial enterprises was 71.7 billion yuan, an increase of 36.4 billion yuan year-on-year.

[Didi submits IPO application in the US] Ride-hailing company Didi Chuxing applied for listing in the United States and plans to be listed on the New York Stock Exchange under the code “DIDI”. Underwriters include Goldman Sachs, Morgan Stanley, JPMorgan Chase, and China Renaissance Capital. In the first quarter of 2021, the company’s revenue was 42.2 billion yuan, net profit was 5.5 billion yuan, and adjusted EBITDA was a loss of 5.5 billion yuan. The company had 493 million LTM annual active users in the first quarter.

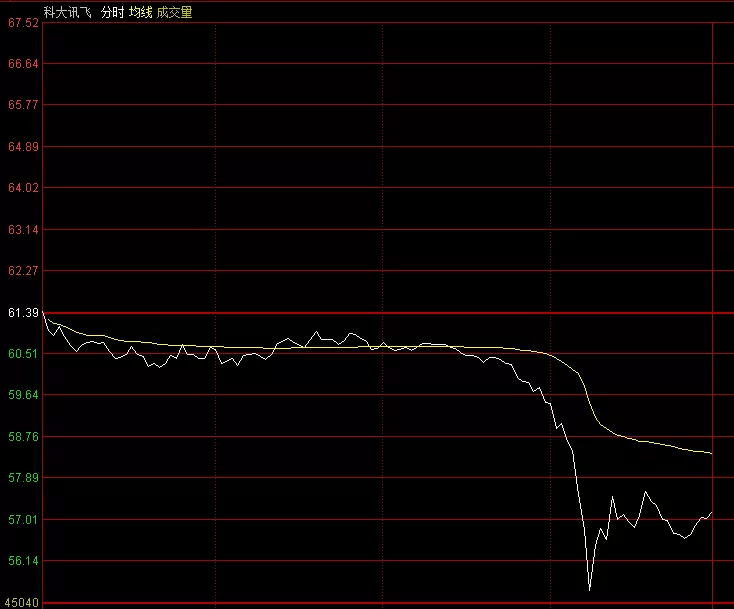

[HKUST News drops over 9% in the flying disk diving] HKUST’s news flies crashed, the stock price plunged by more than 9%, and the turnover exceeded 2 billion yuan.

【Broker Stock Exchange】 Caida Securities rose by more than 8%, and Xiangcai Securities, Nanjing Securities, Zheshang Securities, and China International Capital Corporation followed the gains.

【Virtual Reality Concept Stock Change】 Jiachuang Video on the Growth Enterprise Market has promoted its sealing board, Silk Road Vision, Yishang Display, and GQY Video. On the news, as the 5G ecosystem gradually matures, the integration of AR and industry applications is entering an explosive period. Huawei will hold a win-win future 5G+AR global online+offline summit on June 17, 2021.

[Carbon neutral concept stocks are active again] Kaier New Materials, Feida Environmental Protection’s daily limit, Huayin Power, Shenzhen Energy, Changyuan Power, Xianhe Environmental Protection, etc. have moved up. On the news, the Zhejiang Province has formulated and implemented high-standard carbon emission peaking action plans; promoted the market-oriented trading of pollution rights, energy rights, and water rights, and actively participated in the national carbon emission rights trading market.

[Software service stocks continue to strengthen, Runhe Software rose more than 15%] Runhe Software rallied more than 15%, while Sitech, Kelan Software, Zhongkesoft, Guohua Netan, etc. rose by more than 10%, while Pulian Software, Longsoft Technology, Advanced Data Communication, and Wanxing Technology rose by more than 10%.

[Zhejiang local stocks open stronger] Zhejiang Furun, Zhejiang University Insigma, Zhongwei Electronics, and Shuyuan Technology have their daily limit. Yinjiang shares, Hangzhou Gardens, Hangzhou Jiebai, Zhejiang Yongqiang and other companies have the largest gains. On the news, the Central Committee of the Communist Party of China and the State Council issued the “Opinions on Supporting Zhejiang’s High-quality Development and Building a Demonstration Zone for Common Prosperity.”

[Net inflow of northbound capital of 200 million yuan] As of the noon closing, the net inflow of northbound funds was 235 million yuan.

[The Central Bank launched a 7-day reverse repurchase operation of 10 billion yuan today to achieve zero investment and zero return] The central bank today launched a 7-day reverse repurchase operation of 10 billion yuan, with a winning interest rate of 2.2%. As today’s 10 billion yuan reverse repurchase expires, zero investment and zero return have been achieved.

[The financing balance of the two cities increased by 4.558 billion yuan] As of June 10, the Shanghai Stock Exchange’s financing balance was 840.153 billion yuan, an increase of 1.564 billion yuan from the previous trading day; the Shenzhen Stock Exchange’s financing balance was 750.935 billion yuan, an increase of 2.994 billion yuan from the previous trading day; the two cities totaled 159.188 billion yuan. An increase of 4.558 billion yuan from the previous trading day.

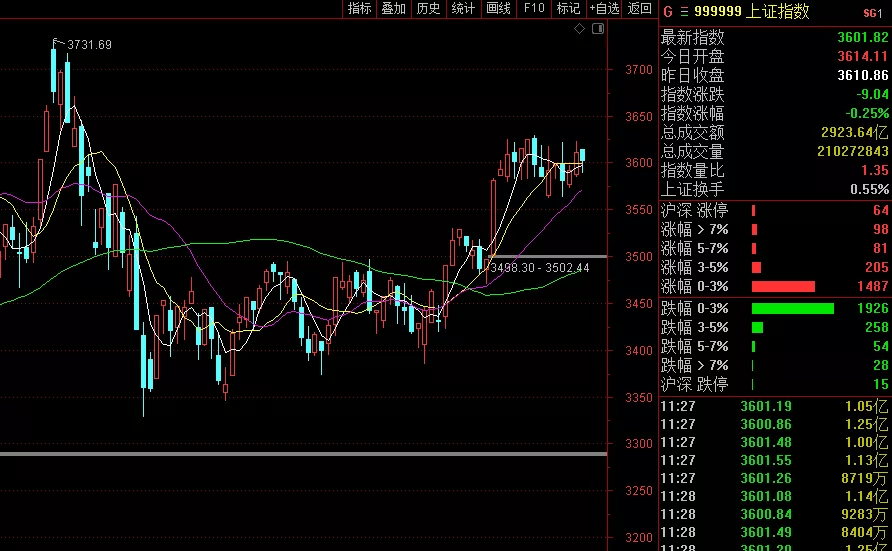

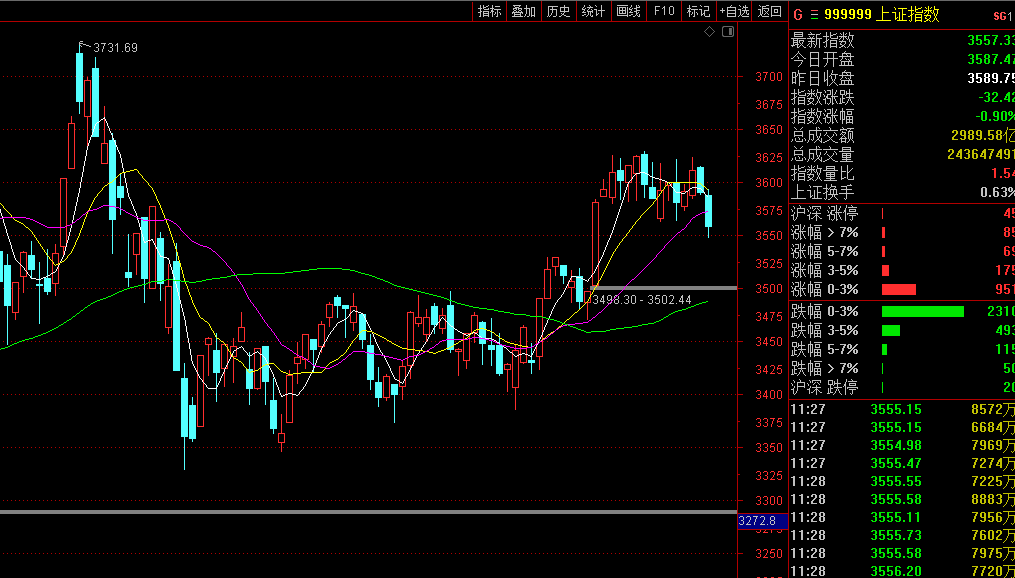

This morning, the market opened higher at 4:3614 points, which was the highest point, reached the bottom at 3589 points, and closed at 3601 points in the early afternoon. SSE 50, CSI 300, SSE Composite Index, CSI 500, Shenzhen Component Index, SME Board, ChiNext Board, and Science and Technology Innovation Board closed respectively -0.80%, -0.77%, -0.25%, -0.29%, -0.51%, -1.31%, +0.70%, -0.22%. The ratios of individual stocks were 702: 820, 1012: 1218. There were 64 stocks that rose by more than 10%, and 6 stocks fell by more than 10%. The trading volume this morning was 674.4 billion, an increase of 74.9 billion from yesterday morning.

In the early trading, the A-share indexes all fell, and the sectors continued to differentiate. Subsequently, the ChiNext index rebounded, driven by index stocks such as the China National Academy of Sciences. Liquor, salt lake lithium extraction, and semiconductor chips all pulled back. Stimulated by the good news, local stocks in Zhejiang raised their daily limit, and over 20 stocks including Ningbo Founder, Kaier New Materials, and Hangzhou Garden have their daily limit. In addition, short-term funds continued to focus on domestic software, and the market leader Runhe Software rose again by 13% in early trading. On the disk, the oil, Hongmeng concept, carbon neutral, steel and other sectors were among the top gainers, while the salt lake lithium extraction, photoresist, military, and liquor sectors were among the top decliners.

Yesterday morning, due to the general rise in the various sectors of the market, the amount of energy consumption was relatively large, and the liquor sector also experienced a dive in the afternoon. But the trend was as expected at noon, closing above 3600 points (3610 points). The rise and fall of individual stocks is better than all (1915:1871), and the trading volume exceeds one trillion (102.2 billion).

This morning, the prudent plot of the Dragon Boat Festival holiday began again, and there were differences between holding currency and stock holdings. Therefore, investors are generally more cautious. The broad market index has repeatedly fallen below 3,600 points, and individual stocks have fallen more and rose less. However, the trading volume in the morning was 74.9 billion larger than that of yesterday, and the trading volume of the stock price throughout the day was once again over one trillion.

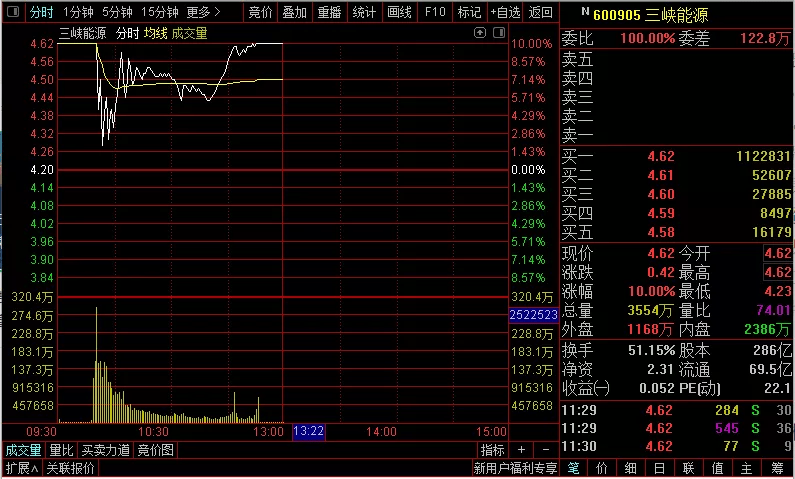

In the near future, although the market is slowly oscillating upwards, the overall move is relatively tangled, and it can only maintain the rotation of each sector. The main reason is that the expansion of new shares is too fast. There are 13 unshakable ones every week. One Three Gorges Energy will raise 22.4 billion yuan. After opening the daily limit, at least 40 to 50 billion yuan will be required to undertake. The expansion of new stocks has taken away the funds that could have been used to promote the market’s rise, causing the market to stay in place for more than a decade. This is a unique phenomenon in the A-share market in the global stock market. Therefore, it is unrealistic to expect the index to rise rapidly. The rise of some sectors must be at the cost of the decline of other sectors.

As the liquor sector continues to counterdraw and show signs of peaking, and cyclical stocks are difficult to rise due to policy regulation, the recent market has selected high-tech stocks that have been adjusted for more than a year and have oversold stock prices as the main line of the market.

Whether it is from the cost-effectiveness of high-tech stocks, or creating wealth effects through individual stocks, attracting market response and new capital to enter the market, or driving the market to slow down, or the country’s development strategy, the direction is correct. . At present, the high-tech market represented by the Hongmeng concept and the Huawei concept is just at the start-up stage, and more bull stocks will appear in the market outlook.

A new trend is that regardless of the market’s ups and downs in the near future, most of the time the capital from the north has a large net inflow, indicating that foreign investors are very optimistic about the prospects of A shares in the case of RMB appreciation, and they are more willing to play games with the 190 million stockholders unique to the world’s stock markets. . Moreover, they increasingly realize that Chinese investors do not like large market capitalization stocks, and prefer high-tech and high-growth stocks with small and medium market capitalizations. Therefore, more and more high-tech stocks are involved in A-shares by Beijing Capital.

After the Dragon Boat Festival holiday, it is already mid-June, and there are only 10 trading days before July 1. I believe this time is the time for the intensive release of national favorable policies. For example, the National People’s Congress authorized Shanghai to independently establish new Pudong regulations, such as The central government issued the “Opinions on Supporting Zhejiang’s High-quality Development and Construction of a Demonstration Zone for Common Prosperity.” The next step will be the formal promulgation of the guidance on the construction of Pudong New Area into a new round of reform and opening-up leading area (ie No. 13), and the landing of tax-free photos in Shanghai. These policies will form a greater impetus to the stock market.

Regarding the movement of liquor stocks, look at Moutai and Shuijingfang. The trend of Pudong concept stocks depends on the leader Lujiazui. Investors can repeatedly buy low and sell high in these two plates.

Afternoon attention: Can the market close above 3,600 points? Can the situation of falling more and rising less be changed? Can the trading volume exceed the maximum trading volume on June 1st of this round of 1.046.9 billion?

Three Gorges Energy sucks 16 billion blood, and the market dive pierces the five-week line

Market review:

Last Friday, the A-share indexes closed at the Yinxian line. The Shanghai Stock Exchange Index opened higher and lowered. The green market oscillated and closed down 0.58%. The ChiNext Index bottomed out and rebounded relatively strongly. The turnover of the two markets exceeded one trillion for two consecutive days. The weight trend diverged. A number of core assets such as BYD, Longji, and Yiwei Lithium Energy rose sharply, and collectives such as big finance and liquor weakened. Yanghe shares reached a heavy limit, and Kweichow Moutai’s collective bidding price fell 2.67% in late trading. Stimulated by the news, Zhejiang local stocks set off a daily limit wave at the opening of the market. Hongmeng concept stocks and domestic software continued to rise sharply. Runhe Software closed the daily limit at the end of the trading session. It has risen by about 380% since the May low. Cyclical stocks rebounded, coal and steel stocks rose in turn. Oil and gas stocks were strong throughout the day. PetroChina once soared 8%, medical aesthetics and semiconductor chip stocks weakened, autos recovered in the afternoon, and Xiaokang shares closed their daily limit.

Today’s news:

[S&P 500 Index hits a record high, Apple rose more than 2%] Overnight, the three major US stock indexes closed mixed. The S&P 500 index hit a new high. Among them, the Dow fell 0.25%, the Nasdaq rose 0.74%, and the S&P 500 rose 0.18%. Large technology stocks rose, Apple rose more than 2%, Tesla, Amazon, Facebook rose more than 1%. Large bank stocks generally fell, with Citigroup, JP Morgan Chase, Morgan Stanley, Goldman Sachs, Bank of America, and Wells Fargo all falling more than 1%. Today, the US dollar index is 90.49 points, and the offshore RMB is 6.40 yuan. Today, Hong Kong stocks are -0.71%, and Nikkei is +1.06%.

[Huawei 5G+AR Summit is about to be held and institutions are optimistic about industry chain companies for a long time] According to reports, Huawei will hold a 5G+AR summit on June 17, when it will work with global operators, regulatory agencies, partners, media, and analysts to discuss the layout and outlook of 5G+AR, and promote the prosperity of the 5G+AR ecosystem. . It is reported that Huawei’s AR innovation platform has a variety of AR open capabilities, including but not limited to AR visual positioning, AR visual navigation, AR SLAM, AR virtual and real integration, and AR remote collaboration capabilities.

[10% major adjustment of SSE 50 and other constituent stocks] According to the previous arrangements of the Shanghai Stock Exchange and China Securities Index Co., Ltd., several index stocks such as SSE 50, SSE 180, SSE 380, Kechuang 50, CSI 300, CSI 500, and CSI Hong Kong 100 have been adjusted. The above adjustments have been made. It became effective after the market closed on June 11. The number of replaced constituent stocks accounted for 1/10 of the total number of constituent stocks. The number of new sample stocks included in the stocks of the pharmaceutical and biological industries is among the top, with a greater increase in weight. The Shanghai Stock Exchange 50 Index transferred to Tongwei, Shanxi Fenjiu, Hangfa Power, Zijin Mining, and CICC this time. At the same time, five stocks including China Railway Construction, Hongta Securities, PICC, Beijing-Shanghai High-speed Railway and Goodix Technology were removed. ; The SSE 180 Index eliminated 18 stocks including Baiyun Airport, Gezhouba, Eastern Airlines, and China Chuang Yang’an, and included 18 stocks including Chongqing Beer, Hualu Hengsheng, Sinopharm, and AVIC Hi-Tech.

[The death of “China’s first shareholder” Yang Wanwan was once a symbol of China’s stock market] It was learned from Yang Huaiding’s family that Yang Huaiding, a senior investor known as “Yang Million” and “China’s First Shareholder”, died in the early morning of June 13, 2021, at the age of 71. Yang Huaiding was born in 1950, and his ancestral home is Zhenjiang, Jiangsu. He was originally an employee of Shanghai Ferroalloy Factory. In the spring of 1988, the transfer of Treasury bonds began to be piloted in 7 cities and gradually increased to 61 cities, and there was also a price difference in different places. He won the “first pot of gold” in his life by buying and selling treasury bills. Yang Huaiding has since become one of the first major securities investors in Shanghai, and is a hot and popular figure in the stock market. Because stocks earn more than one million, he is called “Yang million”, and is called “China’s first stockholder” by some media. .

[Over the past six years, the income of over 100 funds has doubled and outperformed the performance of A-shares over the same period] The data shows that except for funds that have been in operation for less than 6 years, common stocks, partial stock mixed, index type, active equity type (including common stock type, partial share mixed type, balanced mixed type, partial debt mixed type, flexible allocation type), equity The five major types of equity funds (including active and passive), since June 12, 2015, have yielded 52.18%, 39.39%, 10.3%, 48.27%, and 40.29%, respectively. The investment advantages of public funds are very obvious. Among them, the active equity funds that can best show the level of investment, since June 12, 2015, about 97.2% of the funds have outperformed the Shanghai Composite Index, and the proportion of positive returns has reached 84.5%.

[A total of 50 billion yuan of reverse repurchase and 200 billion yuan of MLF expire this week] A total of 50 billion yuan of reverse repurchase and 200 billion yuan of MLF expired this week, of which 20 billion yuan of reverse repurchase expired on Tuesday, and 10 billion yuan of reverse repurchase expired from Wednesday to Friday. On Tuesday, another 200 billion yuan of medium-term loan facility (MLF) is due.

[Chip stocks bucked the trend and strengthened, and the stock price of North China Huachuang is approaching a record high] Chip stocks bucked the trend and strengthened. Allwinner Technology rose by more than 9%, equipment leader Northern Huachuang surged 8%, and the stock price was approaching a new high against the trend. Individual stocks such as Changchuan Technology, Rockchip, Beijing Junzheng, and Jacques Technology all bucked the trend. Rise.

[Virtual reality sector continues to strengthen, many stocks rose more than 10%] The virtual reality sector continued to strengthen. GQY Video and Jiachuang Video both closed their daily limits. Digital Video rose more than 17%. Stocks such as Silk Road Vision, Crystal Optoelectronics, Su Daweige, and Yutong Optics all rose against the trend. On the news, as the 5G ecosystem gradually matures, the integration of AR and industry applications is entering an explosive period. Huawei will hold a win-win future 5G+AR global online+offline summit on June 17, 2021.

[Lithium battery stocks weakened across the board, upstream resource stocks led the decline] Lithium battery stocks weakened across the board, Tianqi Lithium once hit the limit, Shengxin Lithium Energy, Yongxing Materials, Rongjie shares and other lithium battery upstream resource stocks fell more than 4%.

[Huawei Hongmeng concept stocks fell 15% in Jiulian Technology] Huawei Hongmeng concept stocks plummeted collectively, Jiulian Technology plummeted 15%, MG Smart closed the limit, Advanced Data Communication, ArcherMind Technology, Guohua Net Security and other stocks fell one after another, and the sector leader Runhe Software fell more than 4%.

[Net outflow of northbound capital is nearly 4 billion yuan] As of the noon closing, the net outflow of northbound funds was 3.989 billion yuan.

[The financing balance of the two cities decreased by 3.908 billion yuan] As of June 11, the Shanghai Stock Exchange’s financing balance was reported at 837.408 billion yuan, a decrease of 2.745 billion yuan from the previous trading day; the Shenzhen Stock Exchange’s financing balance was reported at 749.772 billion yuan, a decrease of 1.163 billion yuan from the previous trading day; the two cities totaled 1,587,180 million yuan. This was a decrease of 3.908 billion yuan from the previous trading day.

This morning, the broad market opened lower at 2 points 3587 points, rushed higher at 3592 points, hit the bottom at 3547 points, and closed at 3557 points in the early afternoon. SSE 50, CSI 300, SSE Composite Index, CSI 500, Shenzhen Component Index, SME Board, ChiNext Board, and Science and Technology Innovation Board closed respectively -1.33%, -1.15%, -0.90%, -0.58%, -0.87%, -0.77%, -0.69%, +1.66%. The ratio of individual stocks: 369: 1222, 736: 1533, 44 stocks rose more than 10%, and 13 stocks fell more than 10%. The trading volume this morning was 660.5 billion, which was 13.9 billion less than last Friday morning.

In the early trading, the A-share indexes fell sharply. The Shanghai Composite Index fell below the bottom edge of the box and fell 0.9%, the ChiNext Index fell 0.69%, and the intraday fell 1.75%. Short-term sentiment in the market was frustrated. Nearly 3,000 stocks fell. The Shanghai Stock Exchange 50 and the Shanghai and Shenzhen 300 both fell by more than 1%, but the Science and Technology 50 Index bucked the trend and rose by 1.66% in early trading, and many stocks rose by more than 10%. In addition, lithium battery stocks weakened across the board, upstream resource stocks led the decline, Hongmeng concept stocks split, Meige Smart opened the lower limit, Runhe Software, Sitech, and Chuanzhi Education fluctuated at high levels. LED concepts, ultra-definition video, virtual reality concepts, semiconductor chips, etc. took turns to strengthen against the trend, Dafu Technology, GQY Video, Jiachuang Video, etc. closed the daily limit, North China Huachuang soared 8%, the stock price hit a record high, and the defense and military industry stocks rose. , Chenxi Airlines, Zhongfutong daily limit. On the disk, MINILED, ultra-definition video, semiconductors and components were among the top gainers, while scarce resources, steel, and paper were among the top losers.

Last Friday, the market released a huge amount of 1121.1 billion yuan, but all indexes fell. It shows that the selling pressure above 3,600 points is heavy, especially the large market capitalization stocks and liquor stocks that are organized to keep warm.

This morning, the super-cap stock Three Gorges Energy opened its daily limit for a while. Although the daily limit was blocked again in the afternoon, the turnover rate was as high as 51%, absorbing 160 funds from the market. If the stock continues to rise, more blood will be drawn.

Affected by this, with the exception of the Science and Technology Innovation Board, which continued to rise by 1.66%, the other 7 indexes fell across the board, especially when the market fell below the long-held five-week moving average of 3564 points, and closed 3557 points before noon, with a heavy volume of 660.5 billion. It is expected to return today. It is a trend of over trillions of decline. It shows that the main institutions are very resolute in taking advantage of the large volume of shipments.

Although the top ten institutions are optimistic about the upcoming bull market over the weekend, brokerage stocks will take the lead. But in the morning, the stocks of securities firms were still outrageous, and the securities ETF fell 1.19%. Although the leaders of liquor stocks, Yangshuijingfang, Shede Liquor, and Moutai were still popular, 2,755 fell, and only 1,105 stocks rose. The decliners were nearly three times the risers.

In view of the explosion of the US CPI and the difficult trend of the US main board, only technology stocks are still strong. This pattern also has an important impact on A-shares. In the future, high-tech stocks, high-growth stocks, military industry stocks, and theme stocks will play the leading role on the Science and Technology Innovation Board.

Afternoon focus: As July 1 approaches, and with the promulgation of the Pudong New Deal approaching before July 1st, can Pudong New Deal concept stocks strengthen, and can they rise together with liquor stocks and brokerage stocks? Can the number of rising stocks increase? Can the trading volume exceed 1 trillion? Can the market close to regain the five-week moving average?

You must log in to post a comment.