Author/ Ren Yafei

Source / Benben Finance (ID: daxiongfan)

SF Express in 2021 is not going well at all.

Yesterday, SF Express announced its report for the first quarter of 2021. SF Express achieved revenue of 42.620 billion yuan, a year-on-year increase of 27.07%; net loss attributable to shareholders of listed companies was 989 million yuan, compared with a profit of 907 million yuan in the same period last year, a difference of 2 billion.

As early as April 8 when SF Express announced its first-quarter results forecast, the market reacted fiercely. SF Express’s stock price plummeted on the 9th. As of yesterday, SF Express’s closing price was 63.18 yuan, and its stock price has hovered at 63 yuan in the past week. From the historically highest price of 124.06 yuan to the present, in two months, the market value of SF Express has evaporated by more than 270 billion yuan.

Where did SF Express lose its money?

The official explanation is that during the Spring Festival, 1 billion was spent on subsidizing employees, transportation capacity guarantee costs, overlapping investment costs in resources, new business expansion and pre-investment, and so on.

Faced with investors’ questions, Wang Wei took the initiative to apologize, saying that the losses were mainly due to management negligence. From an analysis point of view, the epidemic suddenly led to an increase in transportation capacity guarantee costs and employee subsidies. This is a sudden and short-term impact, but the latter two are the long-term impacts caused by SF Express’s insistence on investing in the future.

Wang Wei, chairman and general manager of SF Holdings, once said, “SF is not only targeting the 400 billion traditional express delivery market, but the 12 trillion large logistics market.” “The competition that the express industry will really face in the future will not come from peers, but A high-tech company like Google”.

Therefore, Wang Wei, who has always adhered to the long-term doctrine, has spent the past three years spending lavishly on new business development.When Binfan Finance sorted out the investment and M&A trends of SF Express and its affiliated companies, it found that only There are 38 investment projects under the name of SF Holdings. The investment speed has accelerated since 2014, and slowed down in 2019 and 2020, especially in 2018, when the number of investment reached 12.

Is it true that SF Express buys and buys so lavishly?

From now on, SF Express seems to have fallen into a kind of long-term trap. The investment is too large, the return period is too long, and the new business does not seem to bring considerable growth to SF.

01 Where did SF Express lose money?

“I didn’t manage well in the first quarter, and I was responsible for it. I was negligent in management.” On April 9, Wang Wei apologized in response to investors’ doubts about the loss of SF Express.

This is also the first performance report of negative revenue growth that SF Express has handed over since its listing. In the 2020 annual report released in March this year, SF Express has just delivered outstanding results. In 2020, SF Express achieved revenue of 154 billion yuan, an increase of 37.3% year-on-year, which was much higher than the industry’s 17.3% growth rate, and its net profit attributable to its parent was as high as 7.33 billion yuan.

Regarding the performance loss in the first quarter, SF Express stated that there are five major reasons, namely:

- Continue to increase the pre-investment of new business;

Since the fourth quarter of last year, temporary resource input has been increased to undertake the increase, which has put pressure on costs and increased capital expenditure input;

The company re-integrated the express network, express network, storage network and other resources, and there is a certain amount of resource overlap;

During the Spring Festival, subsidies for on-the-job personnel hit a record high, reaching 1 billion yuan;

The growth of the bulk order business of time-sensitive parts was lower than expected, and the gross profit of e-commerce parts was under pressure.

These 5 reasons, except for the one-time expenditure of 1 billion yuan in employee subsidies, and the decline in SF Express’s gross profit margin due to industry competition, the rest are all As a result of SF’s cost problems, these expenditures are mainly spent on SF’s new business.

SF Express’s 2020 financial report shows that as of the reporting period, SF Express invested a total of 14.155 billion yuan, accounting for about 9.2% of its revenue, nearly 1.2 billion more than last year , Including land, warehouses, sorting centers, airplanes, vehicles, information technology equipment, etc., among which sorting centers and aircraft have a relatively large investment, accounting for nearly 6 billion. In addition, investment in technology reached 4.273 billion yuan, a year-on-year increase of 16%.

Judging from Wang Wei’s favorite aircraft, in 2009, SF Airlines had only 2 aircraft. In 2012, SF Airlines’ fleet expanded to 10 aircraft. In 2016, the scale has been expanded to 30. In 2017 and 2018, SF Airlines purchased another 10 aircraft. As of February this year, SF Airlines has bought 63 aircraft, making it the domestic cargo airline with the largest fleet.

In addition, SF Express has also increased its investment in the construction of Ezhou Airport. In the first quarter of this year, three self-operated freighters were added. By the end of the year, the fleet size may reach 70. It is expected that Ezhou Airport will be put into operation next year.

In simple terms, the reason for SF Express’s loss is that the increase in investment has led to pressure on costs; the explosive growth of business volume has brought about a bottleneck in production capacity; the investment in new business has not yet achieved profitability. In addition, the expansion plan of heavy assets, It is also accompanied by certain debt risks.

And these increases in costs will hold SF Express for a long time to come. Wang Wei said that SF Express will certainly not lose any more in the second quarter, but the annual profit cannot return to the same period last year, because the battle will continue in the future and there are still many goals to be achieved in the next three years.

02 buy buy buy

If the reason for the loss is short-term investment, leading to increased costs, Wang Wei will not emphasize that the company’s annual profit cannot return to the level of the same period last year. What has SF Express bought in the past three years? how much did you spend?

Previously, Wang Wei said in an interview: “Our future will be to go into many industries, and to deepen many industries, rather than’last mile’ warehouse distribution. If this is the case, we will never deepen one industry. Using technology to upgrade this industry is the direction SF Express will take in the future.”

What SF Express has to do is to provide B2B2C integrated full-process supply chain logistics services. In February this year, SF Holdings announced that it would acquire 51.8% of Kerry Logistics at a total consideration of HK$17.56 billion. This is the latest investment in 2021.

In fact, whether it is this cooperation with Kerry Logistics or the previous cross-border exploration of e-commerce platforms, SF Express’s underlying logic has not changed, that is, to create a one-stop integrated logistics solution.

Wang Wei once publicly stated: “Today’s organizational structure and business model of the four major international express delivery giants can be used as a reference for SF Express’s future mid- and long-term development. , E-commerce distribution, etc. give another supplier’s operating mode, which may be adjusted in the near future. Therefore, we must invest resources to do a good job now.”

to this end, In recent years, SF Express has continuously made large purchases through investment and mergers and acquisitions .

Number of investment projects of SF Holdings and its affiliates from 2013 to 2020

Number of investment projects of SF Holdings and its affiliates from 2013 to 2020

According to the company’s data, As of March this year, there were 38 investment projects under the name of SF Holdings alone. In terms of time, SF Express did not make a single investment before 2013. The number of investments in 2014 was 3, the number of investments in 2015 was 7, and the number of investments in 2016 was 5. In 2017, the number of investments dropped to 2. At the peak, the number of investments was 12, accounting for nearly one-third of the number of investments. Since then, the investment speed has started to slow down again. There were 7 investments in 2019 and only 4 investments in 2020.

For example, in May 2017, UPS announced the establishment of a joint venture company with SF Holdings in Hong Kong; in March 2018, SF Holdings acquired Guangdong Xinbang Logistics for 1.7 billion yuan to increase its heavy cargo express business; in March 2018, SF Holdings issued an announcement, Hubei International Logistics Airport was approved, and the central budget, the Civil Aviation Development Fund, and the Hubei Provincial Financial Fund invested more than 8 billion yuan in total. In April 2018, 100 million US dollars led the financing of Flexport, a well-known American technology loan, to increase international business; In August 2018, we joined hands with Xia Hui, China Merchants and China Railway Corporation to increase the cold chain, shipping and railway business; in October 2018, it invested 5.5 billion in the acquisition of DHL’s supply chain business; in 2019, SF Express invested in Yiyoutong A+ Round of financing and so on.

The above are just some of the important key deployments of SF Express’s investment strategy in the past three years, and they are also frequently mentioned and familiar to everyone. In fact, in SF Express’s financial reports for the past three years, the long-term equity investment alone contains many other joint ventures or joint ventures’ investment arrangements.

Especially in 2018, China Yunda Airport Airport Ground Service Co., Ltd., Beijing Wulian Shuntong Technology Co., Ltd., Beijing Shunhe Tongxin Technology Co., Ltd., Zhejiang Kailux Technology Co., Ltd., Guangdong Shucheng Technology Co., Ltd., Xi’an Hua Joint ventures or joint ventures such as Han Airlines Passenger and Cargo Service Co., Ltd. and Qingdao Dakai Freight Forwarding Co., Ltd. have all received large amounts of new investment.

According to SF’s financial report, in 2018, all SF’s joint ventures will invest 12.159 billion yuan in new investment, and the new investment in joint ventures will be 402 million; in 2019, the new investment in SF joint ventures and joint ventures will be 105 million yuan and 179 million yuan respectively; 2020 This figure was 1.134 billion yuan and 378 million yuan respectively. In the past three years, SF Express has invested more than 14.4 billion in joint ventures and associates.

Classification of investment projects of SF Holdings and its affiliates from 2013 to 2020

Classification of investment projects of SF Holdings and its affiliates from 2013 to 2020

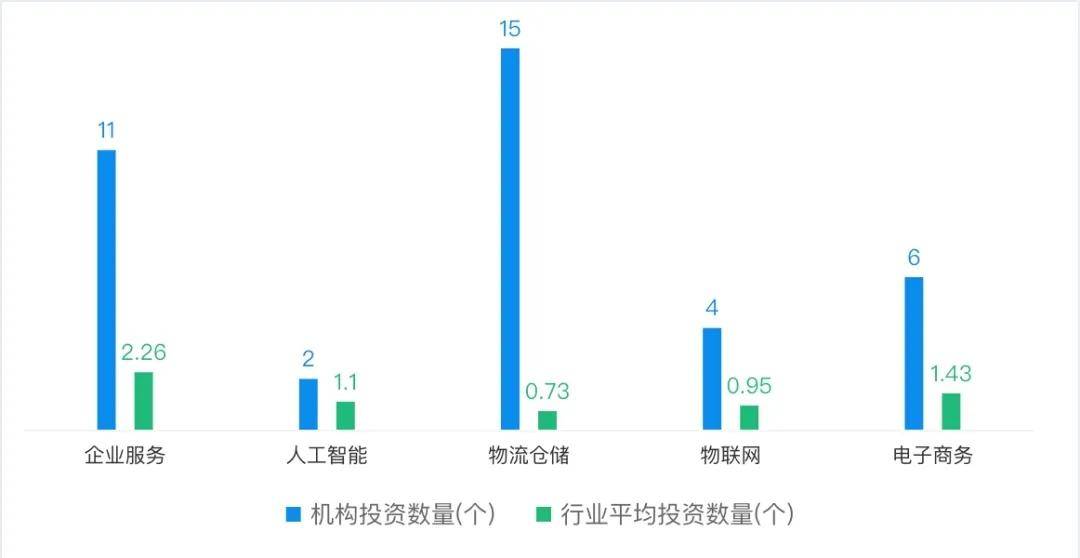

From the perspective of industry distribution, the investment of SF Holdings basically revolves around the main business Among them, the logistics and warehousing industry has the highest number of investments, reaching 15; followed by corporate services, with 11 cases; e-commerce, with 6, ranking third. Others are the Internet of Things and artificial intelligence serving the main business, with 4 and 2 investments respectively.

Among these 38 investments, they are only publicly visible investment projects under the name of SF Holdings.

At the end of 2017, Meituan Wang Xing gave an internal speech. This speech shared his views on the supply chain and 2B business: “In the recent period, my judgment is that if the next wave of Chinese Internet wants to pick up, it will be a very The important direction is driven by innovation in the supply chain and the 2B industry, so this is the supply side.”

Wang Wei once publicly stated that SF Express pays more attention to the quality of revenue and provides high-quality services to mid-to-high-end customers than its business volume share. “SF is not only targeting the 400 billion traditional express delivery market, but the 12 trillion large logistics market. market”.

But after spending a lot of money on new business, what exactly have these investment projects brought to SF Express? From the current point of view, some are still being integrated, the effect is difficult to quantify, and the time cost is a major concern. When these businesses will create value for SF Express, there is even more uncertainty.

03 SF’s dilemma

From the perspective of long-term strategy, companies occasionally have short-term losses. It is understandable that as long as the strategic requirements can be met, there will be a return one day. However, in the process of company expansion, not all losses can be attributed to strategic losses, and blindly burning money cannot burn the future. While Pinduoduo, Meituan, JD.com and other major Internet companies have succeeded, there are also a number of companies that have been eliminated, such as Eggshell, Ofo, and Ruixing Coffee.

So, what kind of loss is considered a strategic loss of a company? Take SF Express as an example, the loss in the innovative business is a strategic loss.

SF Express’s business includes: time-sensitive express delivery, economic express delivery, express delivery, cold delivery and medicine, intra-city express delivery, international, supply chain and others. Among them, time-efficient express delivery and economic express delivery belong to SF Express’s traditional business. Among them, time-efficient express delivery mainly focuses on mid-to-high-end business items, and economic express delivery mainly focuses on low-end e-commerce items.

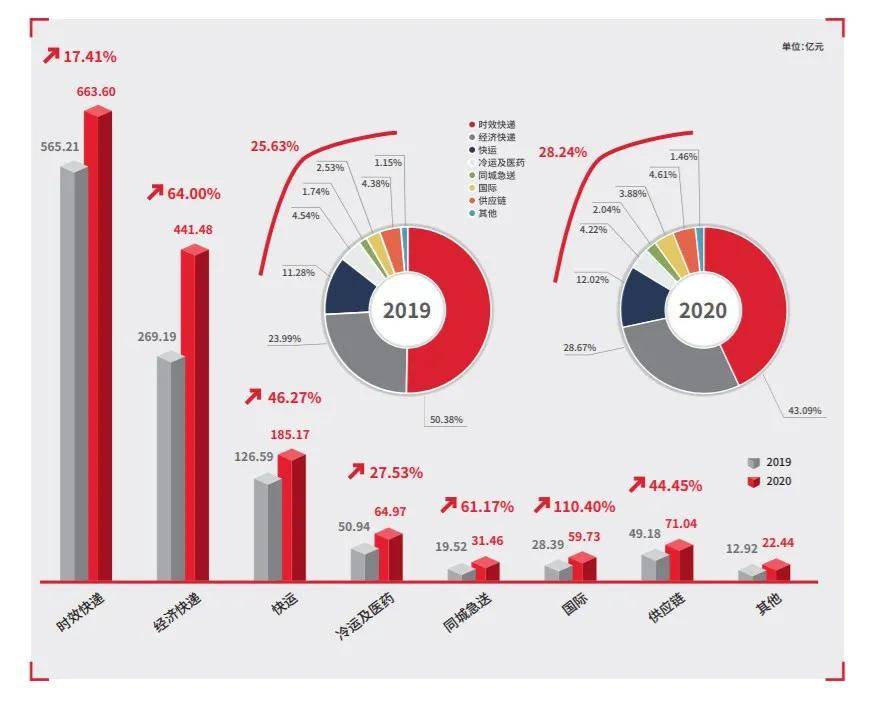

And SF Express, cold shipping and medicine, supply chain, etc. belong to SF’s new business.

From the perspective of the proportion of SF’s various business revenues in 2020, the proportions of timeliness, economy, express, cold transport and medicine, intra-city express, international, and supply chain are 43%, 28.6%, 12%, 4.2%, and 2 %, 3.9%, 4.6%, 1.46%. Compared with 2019, the proportion of revenue has clearly seen a decline in timeliness and an increase in the economy and express transportation. Among them, time-sensitive express delivery declined by more than 7%, and economic express delivery increased by nearly 5%.

On the whole, SF Express’s new business revenue accounted for 28.24% in 2020, which is an increase compared to 2019, but the growth is less than 3%. In other words, It still depends on the traditional business.

Chen Fei, director and deputy general manager of SF Holdings, also stated that although the proportion of economic items with a relatively low unit price in 2020 has exceeded the time-limited items, From the perspective of the overall revenue of the new business, the contribution to the company’s revenue is very limited.

In addition, unlike Tongda, which relies on e-commerce, SF Express’s core competitiveness is time-sensitive express delivery, and it has always been its cash cow. However, the main business of aging express delivery has also seen a growth ceiling in recent years. From 2017 to 2020, the revenue growth rate of SF Express Express was 1.40%, 14.30%, 5.93% and 17.41% respectively, with obvious fluctuations. In 2020, due to the impact of the epidemic, the growth rate will be relatively high.

Wang Wei once said that the company will not blindly burn money to do new business, but if short-term profit pressure can be exchanged for long-term competitiveness, it has the opportunity to build SF Express into an indispensable choice in the market and is willing to reduce its profit in the next 1-2 years. Rate expected.

But the problem is, SF Express has fallen into a long-term trap. The projects that have invested heavily in the past three years have not brought considerable growth to SF Express. There is also great uncertainty about whether it will bring deterministic growth in the next few years.

At present, the problem that SF Express has to solve is not only to ensure that the traditional time-sensitive express delivery maintains stable growth, but also to make breakthroughs in the areas of economy, express, cold, international, intra-city, and supply chain.

“I don’t believe in chance, why is there chance? I believe in chance because of ignorance. I suddenly win a big prize. If I don’t know why, I feel like chance. When all the factors are brought together, you can compare them. You will know that this is inevitable. What we have to do now is to use this good platform of SF Express to turn many uncertain and seemingly accidental things into inevitable in the future.”

Looking at it now, the accident in Wang Wei’s mouth becomes inevitable for SF and it still takes time.SF Express falls into the trap of long-termism

You must log in to post a comment.