World Net Business Reporter Wang Shiqi

The “war” triggered by female breasts is getting more and more intense.

More than half of the 618 e-commerce competition, some outstanding players have rushed to the front, new and old brands alternate, the most intense competition is undoubtedly underwear. According to the data of Tmall, Ubras broke 100 million in one day on sale, firmly occupying the first place, followed by bananas; toffee pie was on sale for 2 hours more than 3 days last year; last year, the Tmall store’s “Su Muscle” was launched. “Good Products” has reached the top 10 of new apparel brands in terms of turnover.

The “big brothers” like Ai Mu and Manifen performed fairly well, but looking at these aggressive new players, one can only sigh: the future is terrifying.

According to industry insiders, there are three criteria for judging whether a new brand has a firm foothold. One is whether it has opened up a brand new track; the second is whether it has achieved rapid growth; and the third is increased revenue. Behind it, can you keep the repurchase rate and net profit?

According to this standard, Ubras and toffee pie can be considered stable.

What we are curious about is, what makes Ubras stir up the situation in a market that seems to be surrounded by big names? Why is the charge of new consumer brands the first to sound the horn of victory in the fortress of women’s underwear?

Industry reshuffle triggered by “no steel ring”

Do you know who are the top three on the Tmall Double 11 underwear list in 2019?

The answer is: Antarctica, Hengyuanxiang, Uniqlo.

The first two are all in brand licensing or OEM business. Uniqlo does underwear by the way. Now 618 can sell Ubras for 100 million yuan a day. Two years ago, they were still unknown.

Today Ubras has become synonymous with “no steel ring” and “no size”. When you go to an offline underwear store, you will find that the “window models” placed in the most conspicuous position have all been gathered from sexy laces to become wide-strapless and non-steel rings.

A steel ring overwhelmed the once underwear giant.

In fact, the trend of “steel-rimless” underwear began to take shape at least five or six years ago. At that time, the sales of non-steel-rim underwear on Taobao had gradually surpassed that of rim-less underwear, but the underwear giants did not pay attention. Due to factory problems, Aimer cut off one of its non-steel-rim underwear categories in 2015. Due to the failure of Metro Beauty to keep up with the non-steel-rim underwear, due to the inability to update the technology supply in time, sales revenue declined in 2016.

After this, one step later, one step later. In 2018, Aimer also launched its own rimless underwear brand “Xihu”, but the volume is still small.

The “steel-free” revolution, which lasted for several years, finally ushered in an outbreak on the line in 2020, and the epidemic became a catalyst. This is easy to understand, home isolation can not be vacuum, a comfortable underwear without steel ring is just right.

Ubras is not actually a pioneer without steel rims, there are “inside and outside” before it. But the smart thing about Ubras is that it has transformed the concept of “no steel ring” from the exclusive for women with small breasts to universal, regardless of size.

The industry is accelerating the reshuffle, big names are under pressure, and new brands are emerging one after another.

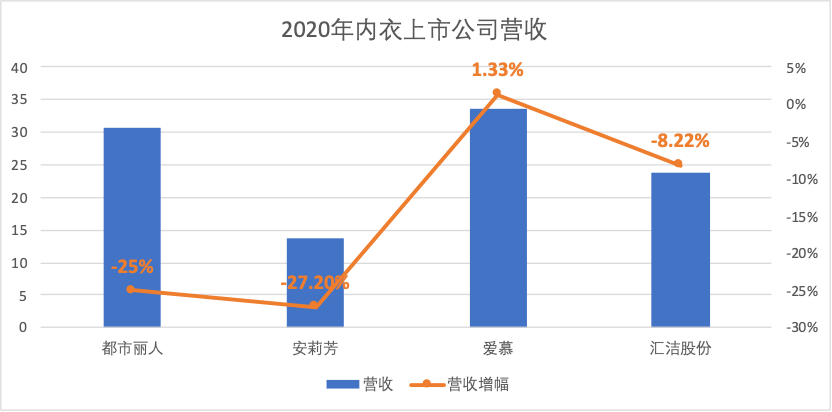

Judging from the situation of the four major Chinese underwear giants that have been listed, in 2020, in addition to the 1.33% increase in Aimer’s revenue, the revenue of Huijie (Mannifine), Metro Beauty, and Emrifang have all declined year-on-year. Among them, Metro Beauty and An Lifang both Loss.

Data comes from the financial reports of listed companies

Data comes from the financial reports of listed companies

On the other hand, new brands have accelerated their take-off.

On Tmall Double 11 in 2020, Ubras, which has been established for four years, has sales of hundreds of millions, making it the number one Tmall underwear list; at the same time, toffee pie achieved annual sales of more than 100 million yuan, a year-on-year increase of more than three times; Since its launch, Jiaonei has achieved 100% growth for three consecutive years. The GMV in 2020 is said to exceed 1 billion. After the A round of financing in November last year, the post-investment valuation was as high as 2.5 billion.

This obviously also attracted the attention of the capital market. According to data from Enniu, from 2019 to 2020, at least 8 underwear brands established after 2014 will receive financing.

Data comes from: ene cattle data

Data comes from: ene cattle data

Challenger by the sleeping lion

In addition to path dependence, there may be another reason why Aimer and Urban Beauty missed the outlet of “steel-rimless underwear”: they did not find seed users, which led to the slow implementation of market education. When the lion was asleep, the challenger was about to move.

A very interesting phenomenon is that many new consumer brands have grown up from the community.

For example, from 2016 to 2018, Ubras made a lot of advertising on WeChat public accounts, and also tried to recruit secondary agents to promote through WeChat business. Many users first learned about Ubras from female skin care and wear public accounts such as “Goddess Evolution”. Channels that big names don’t look up to have helped Ubras accumulate the first batch of accurate seed users.

Toffee pie

Toffee pie

Coincidentally, the big cup bra toffee pie sprouted from a Douban group dedicated to Bra. Until a year ago, the founder of toffee pie, Dabai, would also write a diary on Douban, telling toffee pie and his story.

“User-centric” is easier said than done.

In Banana, which mainly makes men’s underwear, the first batch of products from 2016 to 2017 has 27 models in one go, covering different price points, ingredients, design styles, and specifications. The more important function is not to sell goods, but to test models, allowing consumers Vote with money to adjust quickly. Back then, the bananas were mostly “sexy” styles. After several iterations, they became the main basic models now.

Toffee pie has also been swayed and confused in its brand positioning. One is whether to deploy a small cup bra to satisfy more users. I tried it in 2017, but it was almost autistic by fans. Before focusing on making big cup bras, toffee pie hesitated whether to make “breast-shaped underwear”. At one time, there were two sets of external promotional materials and two voices. The disagreement was so intense that Dabai began to evade the company and was bored in the gym.

It wasn’t until the firm made Chinese women’s big cup bras that toffee pie gradually opened up, and sales doubled year after year.

Different from the big brands in the past, it leaves consumers with a relatively broad brand impression, such as high-end, sexy, and professional. The current new underwear brand is focused on exploding one point and one detail, like a sharp knife, piercing the mediocre market, arousing a burst of applause, from Ubras’s steel-free rim, toffee pie big cup bra, to the present The main “Jelly Bar” of Suhada Liangpin is not as good as it is.

Suhada

Suhada

Chinese women bitter steel ring for a long time

Chinese women have long been suffering from steel rims, and a single bra has been supplied for a long time.

Having said that, it has been less than 40 years for Chinese women to take off their bellybands and put on modern underwear, while the United States has at least 100 years, and Japan’s oldest underwear brand Wacoal has a history of more than 70 years.

China’s women’s underwear market is still an “ant market.” According to Euromonitor statistics, the market concentration of the top five women’s underwear markets in China in 2019 was only 9%, while the market concentration of the top five markets in Japan, the United States, and the United Kingdom during the same period was 66%, 58%, and 19%, respectively.

Even if newcomers such as Ubras have begun to take shape, the pattern of the Chinese women’s underwear market is not completely fixed, and there are plenty of opportunities.

The economic status of Chinese women is constantly rising, and their consumption power is getting stronger and stronger. In 2017, the female labor force participation rate in China was 68.8%, slightly higher than that of the United States and Japan. Other data show that since 2008, Chinese women are more likely to receive higher education and postgraduate education than men.

This updates women’s aesthetics of underwear. From the male perspective in the past, it emphasized the sex appeal of sexual attraction, and turned to the comfort and health of the self-perspective, from “pleasant” to “pleasant self.”

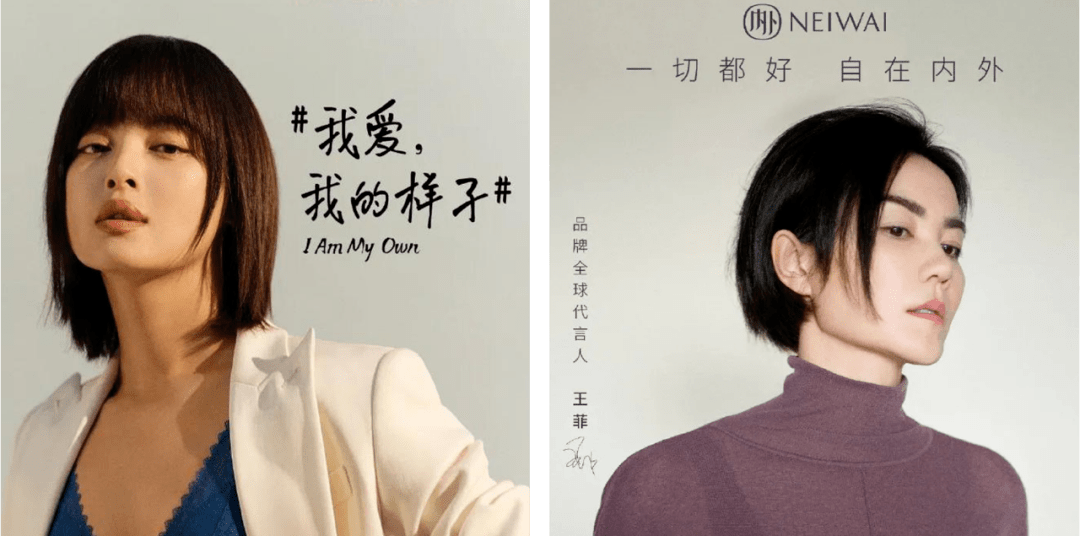

Brand spokesperson is often the personality image that the brand wants to convey to consumers. In recent years, the urban beauty has changed her spokesperson from sister Zhiling to “national girl” Guan Xiaotong. Ai Mu gave up the plump Gong Li and chose the female star Xin Zhilei who became popular with her “ambition”. She found Faye Wong inside and outside, while Ubras chose Ouyang Nana. Jiao Nei signed Zhou Dongyu. These brands even deliberately avoid the front and back warped figures, and emphasize independent and unique personality.

On the left is Xin Zhilei, the new spokesperson of Amour, and on the right is Faye Wong, the internal and external spokesperson

On the left is Xin Zhilei, the new spokesperson of Amour, and on the right is Faye Wong, the internal and external spokesperson

Increasingly personalized demand has also skyrocketed along with Chinese women’s bust and self-confidence-support is required during exercise, thin and beautiful back in summer, sometimes small breasts to show big, sometimes big breasts to show small… when the consumption scene Unlimited segmentation means that the entire market is constantly expanding. Perhaps we can boldly draw a conclusion that new brands of underwear will continue to emerge.

New brand “blitz”

Media person Hong Huang once recalled that at least six or seven years ago, when she ate with Aimu founder Zhang Rongming, she felt his “anxiety” about Internet e-commerce. Aimu took a series of measures, including opening a new price-friendly one. E-commerce specializes in supply lines, and has also opened up new categories such as home furnishings.

At that time, the online underwear market was flourishing. Tao brands “Goruier” and “Runwei”. The former started by selling international big-name bras, while the latter also switched from factory currency to self-designed, self-produced and self-sold products.

Factory direct sales, reducing intermediate links, the underwear of Ge Ruier and Runwei has a considerable price advantage, the price is about 100 yuan, the price is very high, but the design is basically copied from the big names, and there is nothing new. When offline brands collectively settled on Tmall, the cost advantage of the first batch of Taobao brands was defeated in the face of brand power.

The new underwear brands that have emerged from Tmall in the past two years are completely different. Due to the large amount of effort spent on front-end R&D and design, and the scarcity of this demand, the price has risen. Ubras, toffee pie, and so-called bras are concentrated at two or three hundred yuan, which is not much different from traditional big brands. .

From the perspective of competition, the explosion of new brands on Tmall is inevitable. Startups that are small and broad can only initiate a blitzkrieg and seize the high ground before the big brands have fully reacted. Otherwise, when the sleeping lion wakes up, the bone scum will not be able to grab it.

The blitzkrieg strategy is often based on a large amount of marketing investment to seize online channels, which is the most efficient path to burst.

Ubras spends less money on marketing as a percentage of total revenue in 2020. Looking only at e-commerce channels, Aimer’s e-commerce sales expense ratio is 15%, while Manifan’s parent company Huijie shares is 9%. If all channels are used, the sales expense ratios of Aimer and Huijie are 42% and 39% respectively, which is the same overall.

It took less than five years for Ubras to have the confidence to compete with these three to four decades of brands. But we must also see that the strength of the established giants is still strong. Thousands of offline direct/distribution stores, deep into towns, counties and townships, this new brand with omni-channel capabilities is difficult to reach in a short time. At the same time, after being hit by the “no steel ring” for a short time, they quickly followed up, relying on accumulated years of R&D and supply chain foundations, with a multi-category, multi-brand matrix to carry out defense. Judging from the data in the first quarter of this year, the revenue and profits of Aimer, An Lifang, and Huijie are all recovering.

And then, Ubras will start to expand categories, expand channels, and expand their brands. The “tough battle” after explosive growth is the test of hard power.

Editing Xu Yiting

You must log in to post a comment.