This article is from the WeChat public account: Yiyu Observation (ID: yiyuguancha), writer/big entertainer.

The long-rumored internal adjustment of Tencent’s platform and content business group (PCG) finally kicked off on April 15.

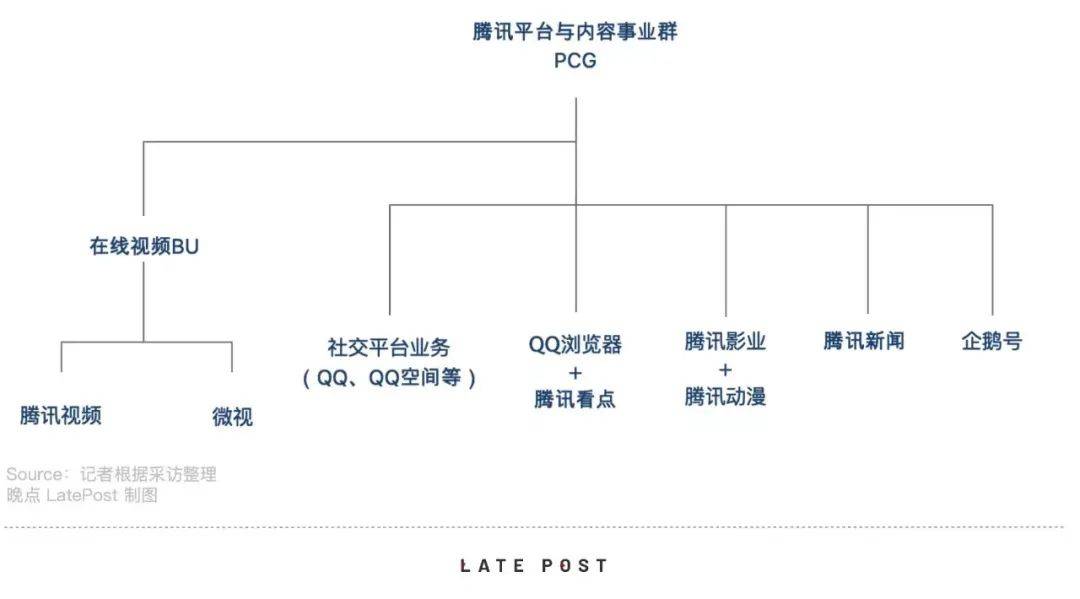

According to internal documents issued by Tencent PCG, PCG will then integrate Tencent Video, Weishi, and AppBall to form an “On-line Video Business Unit (OVB)”. Tencent Video and Weishi will remain independent. Operations, Tencent Vice President Sun Zhonghuai and Lin Songtao respectively serve as the CEO and President of the BU, and both report to Tencent COO and PCG head Ren Yuxin.

At the same time, Liang Zhu, vice president of Tencent and former head of social platform business, was transferred to CEO of Tencent Music Entertainment Group and reported to Ren Yuxin. Peng Jiaxin, the former CEO of Tencent Music, served as the group’s executive chairman. The overall business of the social platform is handed over to Yao Xiaoguang, vice president of Tencent and president of Tencent Interactive Entertainment (IEG) Tianmei Studio Group.

Chen Juhong, vice president of Tencent, is no longer in charge of Tencent’s news business, and will be transferred to other BGs, with another important appointment. The head of Tencent News will be appointed separately.

Source: LatePost

Source: LatePost

Of these, the most interesting thing is naturally Tencent’s adjustment of the video business department. This is also the first time Tencent has established a separate BU (business unit) under the BG (business group). Unlike the direct merger in the previous rumors, Tencent Video and Weishi are still operating independently, but it is clear that after being incorporated into the same business unit, the collaboration between the two parties will be further strengthened.

But for Tencent PCG, which is committed to building “China Disney”, is it really enough to simply combine the long and short video platforms to achieve the goal? Or maybe it’s just the beginning of Tencent’s major adjustments to its video streaming strategy.

With accelerated synergies, PCG may be able to recreate the “troika”

How much investment Tencent has made in the short video business is probably difficult to calculate simply by the number of products and the amount of investment, but Weishi is obviously one of the few attempts that has survived.

In the past few years, in response to Bytedance’s aggressive short video strategy, Tencent resurrected Weishi, which was once directly shut down, at the beginning of 2018, and let Lin Songtao, who led the app’s leaps and bounds, take charge of the Weishi business.

Only after more than two years of experimenting with different strategies and routes, Weishi still has not achieved the success recognized by the market and Tencent. What is even more embarrassing is that the video account created by WeChat has grown rapidly in just over a year. , Has become a real potential challenger for Douyin and Kuaishou.

At present, according to data from third-party organizations, Weishi’s DAU is between 40 million and 50 million. The video account has handed over nearly 300 million daily activities in just one year, while Kuaishou is around 300 million. Douyin is around 600 million.

Zhang Xiaolong focused on the video number in the “2021 WeChat Night”

Zhang Xiaolong focused on the video number in the “2021 WeChat Night”

Today’s Kuaishou Douyin is based on the main business of short video, and has rapidly expanded its business reach into multiple fields such as live broadcasting, e-commerce, music, film and television, and education.

According to news from the China Securities Journal on April 14, the current valuation of Bytedance, which is about to land in Hong Kong stocks, has reached 400 billion U.S. dollars; and Kuaishou, which was listed in February this year, has a market value of more than 140 billion U.S. dollars. It can be said that the business model and imagination based on short video are considerable, which is the key to why Tencent has not been able to give up short video business.

Of course, relative to these latecomers, Tencent still has video streaming giants like Tencent Video in its video content business, and to some extent, the development of short video services has indirectly compressed the living space of long videos.

A few days ago, more than 70 film and television companies, platforms and associations, including Tencent Video, iQiyi, and Youku, issued a joint statement on the protection of film and television copyright, calling on producers of short video platforms and public accounts to respect originality and protect copyright, hoping to form ” The good industry ecology of “authorize before use” is regarded as a long video platform’s declaration of war on short videos.

Popular movie content porters on Douyin

Popular movie content porters on Douyin

therefore, For Tencent PCG, internal coordination of long and short video services has become the key. We should not allow expensive long video content to be used as a wedding dress for others, but also allow short videos to maintain growth while not overwhelming the use of long video users. Time length, how to grasp the balance is even more difficult.

Probably for this reason, Tencent Video and Weishi did not fully merge, but maintained independent operations under the same business unit.

Although Weishi has not become another short video hotspot as envisaged, it does not mean that it is completely worthless. For today’s long video platform, in addition to a large amount of film and television content, relying on PUGC content to capture users in the market segment is still of great value.

This is why Tencent Video actually needs micro-vision more than ever, because behind this is exactly how to extend the capability boundary of the long video platform.

Even if it is a long video streaming media, you can’t stick to your own one-third of an acre, and proactive attack has become the trend of the industry.

Beginning in 2020, multiple platforms have launched PUGC battles. In April, iQiyi’s omnichannel omnichannel for benchmarking YouTube was launched. In July, Weibo launched the video account plan, with 500 million cash sharing to support creators. In October, Baidu launched the independent video App Baidu Kan, and focused on supporting good-looking videos. At the end of last year, Mango TV also launched the “Big Mango Project” focusing on PUGC content.

Later, the “medium video” defined by the watermelon video turned into another track that couldn’t follow. Putting aside whether “Chinese video” is a pseudo-concept for the time being, it is undeniable that PUGC video has indeed become an important content component in addition to film and television content and brainwashing short videos. This is why YouTube has always been able to maintain its attractiveness to users, and its contribution to Google’s advertising revenue is increasing day by day.

Watermelon Video announces 2 billion support for China Video

Watermelon Video announces 2 billion support for China Video

In other words, instead of letting the anchors of Douyin, Kuaishou, and Station B take the content of the long video platform to engage in secondary creation and traffic, it is better to contract this process by the long video platform.

After all, as the source of copyright, there will not be too much controversy at the level of law and public opinion. This is why it is more like a “second creation center” officially created by iQiyi than to be a “Chinese YouTube” at any time. , As for the extra PUGC content that is generated, it is the icing on the cake.

From this perspective, The synergy between Tencent Video and Weishi has become clearer. The former can provide a large amount of film and television copyright content, while the latter is more flexible than Tencent Video, and can quickly transform these content into a form that short video users love to hear.

It is worth noting that this “online video business unit”, in addition to Tencent Video and Weishi, also joined the application treasure, which was originally an application and game distribution department.

It can be said that this kind of back-end provides content and IP, and the front-end determines the form of distribution, almost once again re-enacting the “troika” form of China Reading Group, Xinli Media and Tencent Pictures. Obviously the latter has been in the past year or so. The integration of has begun to bear fruit.

2021 “Troika” masterpiece “Zui Son-in-law”

2021 “Troika” masterpiece “Zui Son-in-law”

Perhaps it is in this context, as a whole to consider the video content business, Tencent COO Ren Yuxin chose to copy this organization and business form to the video content again, in order to generate sufficient synergy.

Lin Songtao joins, can Tencent Video’s “absolute lead” KPI go further

The final implementation of any business still needs people. Therefore, in addition to the integration of the organizational structure, another major focus of the PCG adjustment this time is the appointment of personnel.

Especially in terms of online video business, in the past Tencent Video was basically completely dominated by Sun Zhonghuai. Although Tencent Video is still operating independently today, after Lin Songtao, who is also the vice president of Tencent, joined the business unit, Tencent’s video business has obviously changed from one word to another. Transformed into a “two-person turn”.

For a long time, Tencent Video has been regarded as good at content, but in this era where entertainment and technology are increasingly intertwined, it is difficult to gain a foothold in fierce competition by relying solely on content.

One Entertainment Observation (ID: yiyuguancha) In the previous analysis of streaming media, it has been mentioned many times, Nowadays, video streaming media platforms are increasingly dependent on technology If you look at Tencent Video’s biggest competitor, iQiyi, it’s not difficult to find that whether it is using AI to optimize or adopting delivery formats such as IMF, they dare to try new things in technology, and use this to improve production efficiency and delight users .

In terms of new technology applications, Tencent Video has rarely been seen for a long time. , Basically, only after a competitor launches a certain function will you see its corresponding follow-up action.

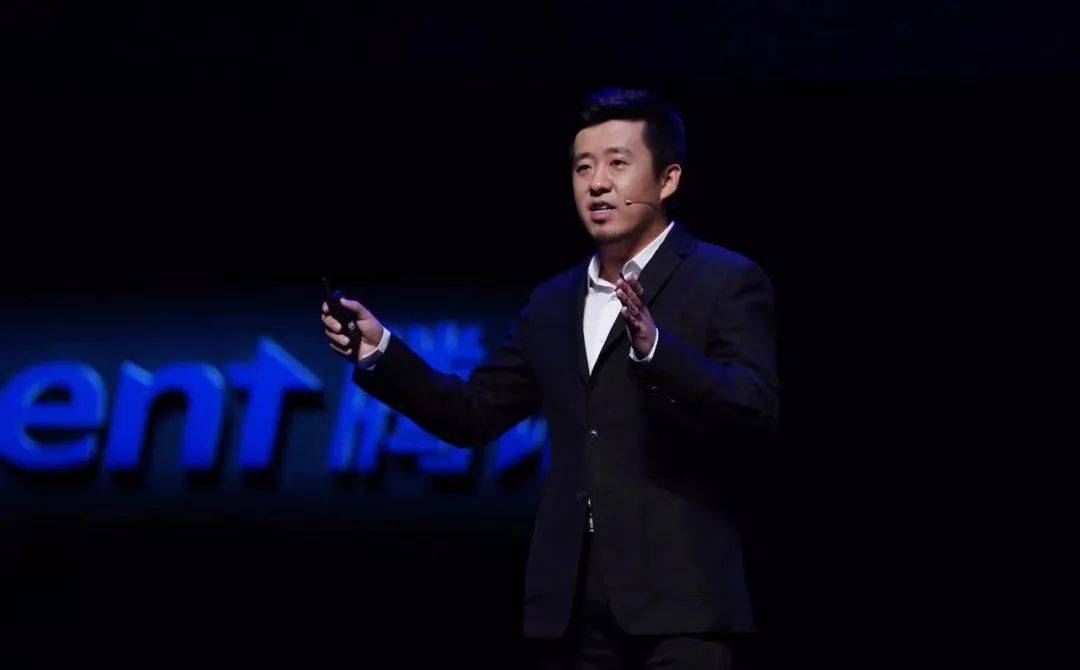

According to a report by “LatePost” last year, Sun Zhonghuai, the person in charge of Tencent Video, is obviously not a manager who is highly sensitive to technology. Perhaps based on this, in the newly established business unit, Lin Songtao, vice president of Tencent Group and former head of Microvision, will serve as the president, in charge of the technology and products of the two platforms, while Sun Zhonghuai will serve as the CEO and continue to be in charge of members. System, content operation and content production.

Lin Songtao, Vice President of Tencent

Lin Songtao, Vice President of Tencent

For short videos, the recommendation algorithm has always been a core technology, which is also one of the elements for Douyin and TikTok to remain invincible for a long time. therefore, Lin Songtao, who has been in charge of the micro-vision business for a long time, is obviously also an executive who understands that technology can bring experience bonuses to video content. The combination of him and Sun Zhonghuai will undoubtedly make up for Tencent Video’s long-term technical shortcomings to a certain extent.

At the same time, there are higher-level technical guidance, which can also allow Tencent Video and Weishi to collaborate and differentiate at the product level. At least for now, Weishi is more like a Tencent Video in addition to the original short video function. Too many overlapping functions also cause a lot of waste of resources.

Tencent Video’s internal plan to transform to “Netflix + YouTube” was rejected by Ren Yuxin. Instead, it was to build a comprehensive video platform with long, medium and short content, forming the so-called “rainforest ecology”.

But just after last year, how effective this transformation has achieved is actually a question mark. In fact, it is difficult to find a video streaming platform that can really include all video types in the world. YouTube has tried I did this, but the final result proved that it is too difficult to become an “all-rounder”.

For Weishi, after letting go of the burden of becoming a challenger to Douyin and Kuaishou, it may be able to pack lightly and relocate around movies, games, and micro-dramas. The first two have already been established through the use of Tencent’s massive internal resources. A bit higher than the capital of the opponent.

In 2020, Weishi’s continuous efforts in micro-drama have finally seen that it has finally found a track suitable for platform development.

Betting on micro dramas has to a large extent also produced a broader business connection and intersection with Tencent Video. At last year’s “2020 Tencent Video Content Ecological Conference”, Tencent Video also divided the layout of “China Video” into two types: plot and non-story. The plot category includes micro-drama, micro-animation and other types, while the non-drama category includes short programs of various types such as micro-variety, micro-recording, and MV.

Weishi micro-drama “Psychic Concubine”

Weishi micro-drama “Psychic Concubine”

If you can further take advantage of Tencent Video’s long video platform, on the one hand, it is of course the most basic conventional backward flow. According to Tencent’s latest financial report, Tencent Video already has more than 120 million paying users. On the other hand, it is the tilt of film and television resources and production capabilities. Compared with Douyin and Kuaishou, Tencent Video clearly has extensive network resources and production experience in the film and television industry, and it has returned to the track of industrial film and television production, with abundant resources and Experience can undoubtedly better help Weishi to grasp the trend of this time.

If the two parties can reach further collaboration and cooperation in micro content, it will undoubtedly quickly establish a moat on this new popular category.

For Tencent, which has a big business, every internal adjustment requires some courage.

However, from the external environment, streaming media and broader entertainment video content competition has come to the second half. Even Tencent Video, which has a luxurious background and massive resources, cannot achieve its “absolute lead” by simply relying on money. The goal of intensive cultivation of content and operation is bound to be carried out quickly, and all this just starts with a drastic adjustment of the organizational structure.

You must log in to post a comment.