Image source: Internet

Image source: Internet

Produced|Sohu Finance

Author|Wu Ya

On the evening of June 14th, Juran Zhijia (SZ:000785) issued multiple announcements in a row, disclosing various contents such as “Adjustment of Beijing Juran Zhijia Home Furnishing Chain Co., Ltd. (hereinafter referred to as “Home Chain”) related performance commitments.

Jiaranzhijia said that in view of the comprehensive impact of various factors such as the sudden outbreak of the new crown epidemic in early 2020, the listed company plans to adjust the performance commitments of the home chain after consultation with the performance pledger.

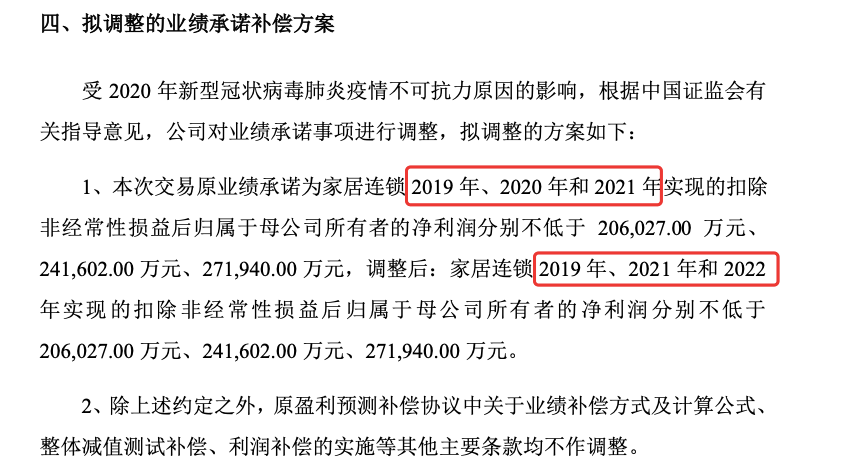

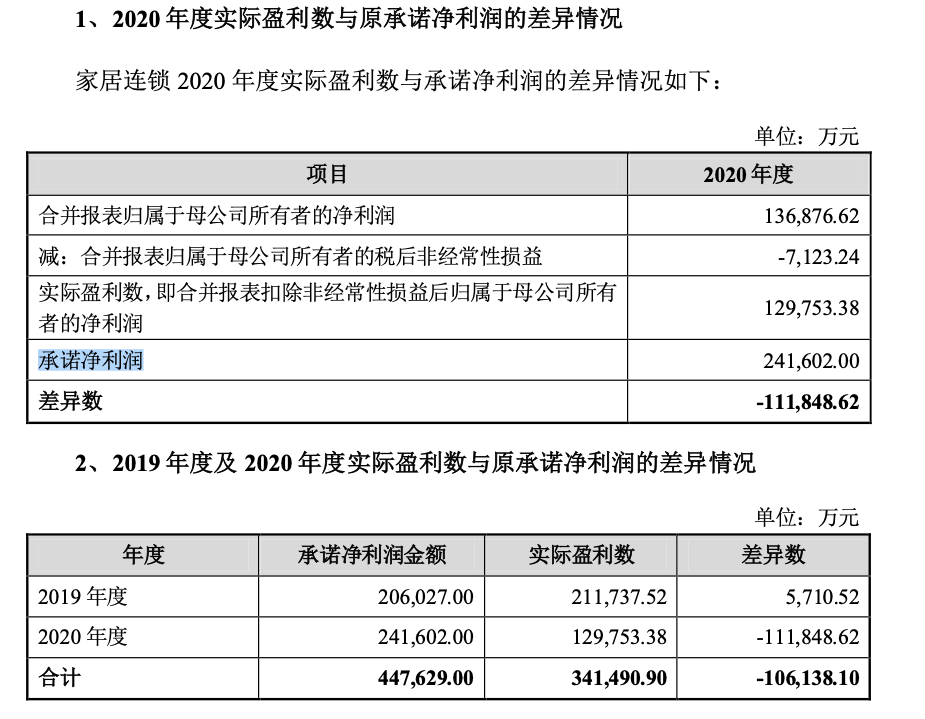

In the original performance promise, the net profit attributable to the owners of the parent company after deducting non-recurring gains and losses (hereinafter referred to as “net profit deducted from the parent company”) realized by the household chain in 2020 should not be less than about 2.42 billion yuan; and financial data Shows that this indicator for the household chain in 2020 is about 1.297 billion yuan, which is 1.118 billion yuan less than the original performance commitment, and the performance completion rate is 53.59%.

The announcement shows that after this adjustment, the household chain will no longer assume the performance indicator of deducting non-parent net profits in 2020; the original performance commitment will be postponed to the next fiscal year, that is, 2021; in addition, other performance compensation The method and calculation formula, the implementation of profit compensation and other original terms are not adjusted.

Photo source: “Announcement of Juran Home New Retail Group Co., Ltd. on Adjusting Beijing Juran Home Furnishing Chain Co., Ltd.’s Performance Commitments”

Photo source: “Announcement of Juran Home New Retail Group Co., Ltd. on Adjusting Beijing Juran Home Furnishing Chain Co., Ltd.’s Performance Commitments”

Jia Ranzhi was established in 1999. In December 2019, it backdoor Wuhan China Merchants reorganization and listing and landed on the A-share capital market. At that time, Jia Ranzhi signed a performance betting agreement with Wuhan Zhongshang, the holder of Shell Resources.

In 2019, the first annual report after listing, home furnishing chain achieved 2.117 billion yuan of net profit deducted from the parent company, fulfilling the first performance period commitment; but in the first year after backdoor, the home furnishing chain performance was unqualified for gambling.

In the first quarter of this year after the epidemic, the business of Jia Ranzhi ushered in a rebound. According to the plan of Jiaranzhijia, in 2021, it will have breakthroughs in the development of six self-service modes, and the establishment of its first overseas store outside the country.

Home furnishing chain deducts only 1.297 billion yuan in net profit from non-returned parent in 2020, “unqualified”

The result of “the first year of backdoor performance is not qualified for gambling” has been reflected in the 2020 annual performance forecast announcement. At that time, Jiaranzhijia had announced that in 2020, the non-net profit will be reduced by up to 30% to only 1.45 billion yuan; and that “preliminary estimates that the home chain will not be able to complete the 2020 annual performance forecast”.

Judging from the statement of the announcement, the new crown epidemic is the main factor that has caused such a predicament for home furnishing chains. Jiaranzhijia stated that “the household chain’s operating income was directly reduced by 2.161 billion yuan due to the impact of the epidemic, and the net profit attributable to the parent company will be reduced by 1.277 billion yuan after deducting non-recurring gains and losses in 2020.”

Among them, home furnishing chains reduced rents, property fees, market management fees, and advertising and promotion fees for a total of 1.569 billion yuan (72.6%); during the epidemic period, the leased area was reduced, and the rent was also reduced by 259 million yuan; Signing of franchise stores has been significantly reduced compared with the same period and plan, and the loss of household chain stores is 152 million yuan.

However, due to multiple factors such as preferential policies and property owners’ rent reductions, the household chain will save 443 million yuan in operating costs in 2020.

The home furnishing business is mainly engaged in home furnishing products retail, home improvement services, home store business, decoration business and other pan-furniture businesses. In December 2019, after nearly a year, the home actually backdoored Wuhan Zhongshang to land in the A-share market (issued by Wuhan Zhongshang) The shares purchased 100% of the home furnishing chain) and became another home furnishing store giant that has landed on the A-share market after Macalline (SH: 601828).

At that time, from the book assets alone, the transaction consideration of 35.65 billion yuan between the two parties was not cheap; compared with the net asset value of 11.199 billion yuan involved in the transaction, the premium rate was 218.54%.

As a result, this also left the sword of Damocles hanging over the head of the unexpected house-the gambling agreement. At that time, the two parties made performance commitments for the home furnishing chain: from 2019 to 2021, the home furnishing chain will achieve a net profit of no less than 2.06 billion yuan, 2.42 billion yuan and 2.72 billion yuan, respectively.

The agreement signed by the two parties also clarified that “if a force majeure event occurs that causes part of the original profit forecast compensation agreement to be unfulfilled or delayed, neither party is required to bear any liability for breach of contract due to the unfulfilled part or delayed performance caused by the force majeure event.” .

The first annual report after listing is the first performance commitment period. The net profit of household chain deductions from non-parents is approximately 2.117 billion yuan, far exceeding the commitment target of 2.06 billion yuan, and the performance completion rate is 102.76%.

In the first year after the backdoor, that is, the second performance commitment period, the final result showed that the net profit attributable to the owners of the parent company in the consolidated statement of the household chain was 1.368 billion yuan; the actual profit is the net profit after the deduction of the non-parent company after the consolidated statement. 1.297 billion yuan; and 2.42 billion yuan of performance commitments, there is still a gap of 1.118 billion yuan.

Photo source: “Special Verification Opinions of CITIC Securities Co., Ltd. on the Realization of the 2020 Performance Commitments and Performance Commitment Adjustments of Beijing Juranzhijia Home Chain Co., Ltd

Photo source: “Special Verification Opinions of CITIC Securities Co., Ltd. on the Realization of the 2020 Performance Commitments and Performance Commitment Adjustments of Beijing Juranzhijia Home Chain Co., Ltd

In view of this, Zhiranzhijia said that it intends to adjust the performance commitments: After the adjustment, the net profit of the home chain in 2019, 2021 and 2022 will not be less than 2.06 billion yuan, 2.42 billion yuan and 2.72 billion yuan, respectively. ; In addition, the original performance does not make adjustments to other major terms in the gambling agreement.

In other words, after this adjustment, the 2020 performance commitment of the home furnishing chain will be postponed to the next fiscal year, 2021.

According to the announcement, the new crown epidemic is an unforeseen and insurmountable force majeure event that was unpredictable and insurmountable when the original performance betting agreement was signed, and it is directly related to the failure of the household chain to achieve the 2020 performance promise, so this adjustment plan is reasonable.

“This adjustment plan is conducive to further urging home furnishing chains and companies to increase the speed of performance recovery, increase the rate of performance improvement, and essentially improve the quality of listed companies, which is conducive to the long-term interests of all shareholders, especially small and medium shareholders.” Jiaran said.

This year’s GMV may exceed 100 billion yuan, and plans to open no less than 70 new stores

The annual report shows that due to the impact of the epidemic, the total revenue of the house in 2020 was 8.993 billion yuan, a year-on-year decrease of 2.56%; the net profit attributable to the parent was 1.363 billion yuan, a year-on-year decrease of 56.81%.

During the period, the operating cost of the house was 5.36 billion, a year-on-year increase of 9.3%; the expense ratio was 18.2%, a year-on-year increase of 4.6%, which was a drag on the company’s performance. In addition, in 2020, the annual sales (GMV) of Jia Ranzhi was 65.7 billion yuan, a year-on-year decrease of 17.87%.

In addition to the sharp decline in performance, from 2018 to 2020, the interest-bearing liabilities of the house were 258 million yuan, 3.104 billion yuan, and 4.131 billion yuan respectively, which increased by about 16 times in three years; of which, the long-term interest-bearing debt was 1.32 respectively. Billion yuan, 2.305 billion yuan, 2.587 billion yuan, 5.1 times in three years, accounting for more than 51%.

In May 2020, Ranzhijia, which was listed on the backdoor for only half a year, launched a fixed increase, issuing stocks to no more than 35 specific investors, raising funds no more than 3.595 billion yuan for store renovation and upgrading, and smart retail construction of Zhongshang Supermarket And replenish working capital and other matters.

In December of the same year, the unexpected home announced that it had completed a fixed increase of 3.5 billion, and companies such as Xiaomi, Ali, and Centennial Life Insurance appeared in the list of subscription targets, which brought a great “blood-tonifying” effect to the unexpected home affected by the epidemic.

Among them, Xiaomi Technology (Wuhan) Co., Ltd., furniture listed company Gujia Home Furnishing (SH: 603816), and Centennial Life Insurance each subscribed for 14.1643 million shares, each with a shareholding ratio of 0.22%; Alibaba (Chengdu) Software Technology Co., Ltd. subscribed 28,329,600 shares, with a shareholding ratio of 0.43%.

The latest financial report shows that in the first quarter of 2021, the house of unexpectedly realized revenue of 3.34 billion yuan, a year-on-year increase of 39.05%; realized a net profit of 630 million yuan, a year-on-year increase of 144.58%. Compared with the same period in 2019, the growth rates have also reached 61% and 43% respectively.

In this regard, Jiaranzhijia said that during the reporting period, the investment rate of the company’s direct-operated stores has overcome the impact of the epidemic and returned to a high level, and the expansion of franchise stores has also resumed rapid growth.

It also predicts that the company’s GMV is expected to exceed 100 billion yuan in 201, and it plans to open no less than 70 new stores throughout the year.

For Jia Ranzhi, 2021 is the second fiscal year after listing, and it is also a crucial year for its digital strategy. In December last year, Jia Ranzhi held a new retail achievement and digital strategy press conference, and for the first time disclosed in detail the new strategy of “building a home improvement and home furnishing industry service platform in the digital age”.

Wang Linpeng, chairman and chief executive officer of Juran Home, said that Juran Home is no longer a traditional home furnishing store, a traditional home retail enterprise, and a real estate-style property service provider. It must become an enterprise with long-term value.

At that time, Ranzhijia launched six self-operated IPs, covering design, decoration, auxiliary materials, logistics and distribution, smart home and after-home services, covering all the upstream and downstream tracks of home improvement and home furnishing, including lying flat designer home, digitalization Six platforms including smart home improvement service platform.

According to the plan of Juranzhijia, these six IPs have the profitability to run wildly along their respective tracks; they can also be interconnected and empowered with each other. It is estimated that “every track can contribute more than 10 billion in revenue within 5 years after it runs through.”

In terms of the main business, Jia Ranzhi predicts that in the next 5 years (2025), offline stores will strive to exceed 1,000, with GMV exceeding 150 billion yuan; within 10 years (2030), offline stores will strive to exceed 1,500, GMV More than 300 billion yuan.

However, the performance of the house in the stock market is not optimistic. On June 11, the stock price of Jiaranzhijia hit 6.31 yuan, the lowest since December 28, 2018; it closed at 6.73 yuan, down 0.16%.

On June 15th, the first trading day after the announcement of the adjustment of the performance commitment compensation plan, the stock price of Jiajiao reached the bottom again at intraday, to 6.22 yuan; it closed at 6.29 yuan, down 1.26%.

You must log in to post a comment.