The price of live pigs has dropped for nine consecutive weeks, and only one place has been firm! When can pig prices rebound?

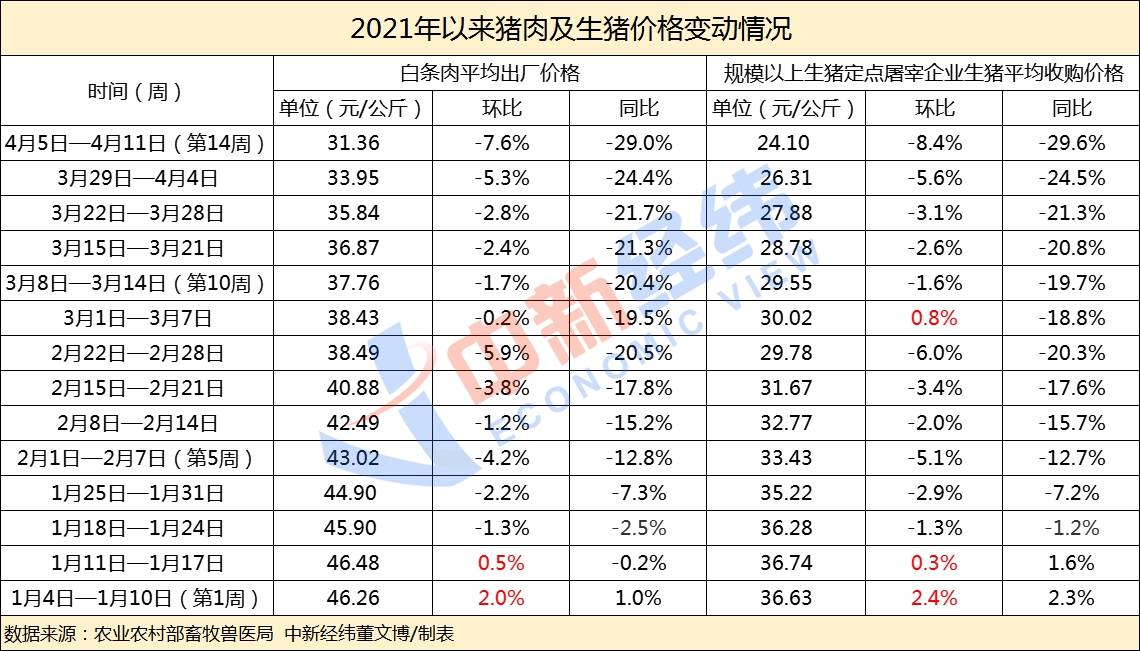

China-Singapore Jingwei Client, April 22 (Dong Wenbo) “Pork prices have fallen for 12 consecutive weeks.” This is the latest data released at the press conference of the Ministry of Agriculture and Rural Affairs. Consumers cheered, investors trance. On the evening of the 21st, the first quarter report of Wen’s shares disclosed that so far the operating conditions of major A-share pig farmers have been released. From the data point of view (including the forecast), since the beginning of this year, as the price of pigs has continued to fall, many pig companies that once stood on the vent to banquet guests from Zhulou have “collapsed”. The new hope will drop by over 90% In the A-share market, there are more than 20 listed companies that have been included in the pig industry chain, among which there are many meat products processing, poultry breeding, and feed production. Those who can truly be called “big pig farmers” include the current market value of “Pigmao” Muyuan shares with a market value of more than 400 billion yuan, Wen’s shares with a market value of about 100 billion yuan, New Hope with a market value of 80 billion yuan, and Zhengbang Technology with a market value of more than 40 billion yuan. And Tianbang shares with a market value of 20 billion.  In the first quarter of this year, except for the net profit of Muyuan shares, which bucked the market, the net profit increased by more than 60%. The deepest decline is New Hope. During the reporting period, the net profit is expected to drop by 88.94%-92.62% year-on-year; the net profit of Zhengbang Technology is expected to drop by 66.32%-77.36% year-on-year in the same period. The first quarterly report of Wen’s shares showed that the net profit achieved during the reporting period fell by 71.28% year-on-year to 544 million yuan. It is Tianbang shares that staged a big “face change”. Its net profit in 2020 has surged 3131.98% year-on-year, and by the first quarter of this year, it is expected to fall by 50%-60%. Regarding the reasons for the decline in performance, these four companies all pointed the “culprit” to the pig price. Both New Hope and Wen’s said in their announcements that the sales price of live pigs during the reporting period decreased compared with the same period last year, and the increase in feed material prices and other factors added to the increase in breeding costs, resulting in a decline in the profitability of the pig industry. Zhengbang Technology bluntly stated that the main reason was that the price of live pigs during the reporting period declined compared with the same period last year. Tianbang shares said that the performance decline during the reporting period was that the price of live pigs decreased compared with the same period last year, and the second was that the slaughter structure of live pigs was different from the same period last year, which further reduced the gross profit margin of live pig sales. The pig price “falls endlessly” How much has the price of pigs dropped this year? According to the monitoring data released by the Ministry of Agriculture and Rural Affairs, as of the 14th week of 2021 (April 5-April 11), the national average ex-factory price of white striped meat (hereinafter referred to as “pork”) is 31.36 yuan/kg, which is a month-on-month and year-on-year basis. It has fallen for 12 consecutive weeks, from 46.26 yuan/kg at the beginning of the year to 31.36 yuan/kg. The average purchase price of live pigs (hereinafter referred to as “live pigs”) at designated hog slaughter companies above designated size has also fallen for 12 consecutive weeks year-on-year. Although the month-on-month increase slightly increased during the week from March to March 7th, the overall price still showed a downward trend. 36.63 yuan/kg, currently 24.10 yuan/kg.

In the first quarter of this year, except for the net profit of Muyuan shares, which bucked the market, the net profit increased by more than 60%. The deepest decline is New Hope. During the reporting period, the net profit is expected to drop by 88.94%-92.62% year-on-year; the net profit of Zhengbang Technology is expected to drop by 66.32%-77.36% year-on-year in the same period. The first quarterly report of Wen’s shares showed that the net profit achieved during the reporting period fell by 71.28% year-on-year to 544 million yuan. It is Tianbang shares that staged a big “face change”. Its net profit in 2020 has surged 3131.98% year-on-year, and by the first quarter of this year, it is expected to fall by 50%-60%. Regarding the reasons for the decline in performance, these four companies all pointed the “culprit” to the pig price. Both New Hope and Wen’s said in their announcements that the sales price of live pigs during the reporting period decreased compared with the same period last year, and the increase in feed material prices and other factors added to the increase in breeding costs, resulting in a decline in the profitability of the pig industry. Zhengbang Technology bluntly stated that the main reason was that the price of live pigs during the reporting period declined compared with the same period last year. Tianbang shares said that the performance decline during the reporting period was that the price of live pigs decreased compared with the same period last year, and the second was that the slaughter structure of live pigs was different from the same period last year, which further reduced the gross profit margin of live pig sales. The pig price “falls endlessly” How much has the price of pigs dropped this year? According to the monitoring data released by the Ministry of Agriculture and Rural Affairs, as of the 14th week of 2021 (April 5-April 11), the national average ex-factory price of white striped meat (hereinafter referred to as “pork”) is 31.36 yuan/kg, which is a month-on-month and year-on-year basis. It has fallen for 12 consecutive weeks, from 46.26 yuan/kg at the beginning of the year to 31.36 yuan/kg. The average purchase price of live pigs (hereinafter referred to as “live pigs”) at designated hog slaughter companies above designated size has also fallen for 12 consecutive weeks year-on-year. Although the month-on-month increase slightly increased during the week from March to March 7th, the overall price still showed a downward trend. 36.63 yuan/kg, currently 24.10 yuan/kg.

By comparison, in the first week of 2020 (December 30, 2019-January 5, 2020), the price of pork is 44.33 yuan/kg, and the price of live pigs is 34.72 yuan/kg. In the last week of the first quarter of 2020 (March 23-March 29), the price of pork is 45.77 yuan/kg, and the price of live pigs is 35.43 yuan/kg.

Affected by factors such as the African swine fever epidemic and the “pig cycle”, since the second half of 2019, the domestic supply of live pigs has tightened, and the price of pigs has continued to be at a high level for a time.

Driven by a series of policies to promote the recovery of live pig stocks, according to statistics from the National Bureau of Statistics, as of the end of the first quarter of this year, the country’s reproductive sow population was 43.18 million, which was restored to 96.6% at the end of 2017; the live pig population was 416 million, which was restored to 2017. 94.2% at the end of the year; pork production was 13.69 million tons, a year-on-year increase of 31.9%.

Regarding the recent sharp drop in pig prices, Chen Guanghua, deputy director of the Animal Husbandry and Veterinary Bureau of the Ministry of Agriculture and Rural Affairs, said at a press conference on agricultural and rural economic operation in the first quarter that the price of pigs has indeed fallen a bit fast in recent months, and the price of pork has now fallen to this round. The lowest point since the recovery of pig production capacity.

Chen Guanghua pointed out that the main reason was the obvious increase in slaughter of live pigs, and the decline in pork consumption after the Spring Festival. Two factors, one increase and one decrease, met; in addition, there were also farmers who panic slaughter and formed a “stomping effect.” Chen Guanghua predicts that, on the whole, the most tight period of pork supply has passed. According to the current production recovery momentum, in June and July this year, the pig stock is expected to return to the level of normal years.

Follow-up rise or fall?

Pig prices are closely related to people’s livelihood. Will they rebound in the future? Is there still room for further decline?

New Jingwei Wan Keyi in the data map

In this regard, Chen Guanghua said that according to the trend of pig prices throughout the year, before and after the Dragon Boat Festival, as pork consumption increases, pig prices may rise. However, extrapolating from the number of newborn piglets in the previous period, it is expected that the year-on-year increase of fat pigs on the national scale pig farms in the second quarter will reach 50%. The market supply is generally abundant, and the price is unlikely to exceed the previous high.

National Bureau of Statistics spokesperson Liu Aihua said at a press conference on April 16 that pork prices have been the major factor that has pushed up food prices in the past two years, and pork prices have been declining year-on-year for several months. At present, the production capacity of live pigs has been significantly restored. The live pig inventory increased by 29.5% year-on-year at the end of the first quarter. The live pig inventory has increased sequentially for six consecutive quarters. The production capacity of live pigs has recovered relatively quickly. From this perspective, there is a basis for the continued decline in pork prices.

It is worth mentioning that starting from the second quarter (April 1), in order to prevent the risk of African swine fever spreading in the transportation link, the country has gradually restricted the transportation of live pigs. Except for breeding pigs and piglets, other live pigs will not leave the region in principle. Live pigs in the district must be selected and transported through designated routes “point-to-point” after passing the sampling inspection according to regulations.

At present, Sichuan, Hunan, Hainan, Guangxi, Shandong, Jiangsu and other places have successively issued “New Regulations for Live Pig Relocation.”

Zhongyuan Securities pointed out in the research report that the transfer of live pigs is gradually restricted, and the transportation of pigs from the north to the south has decreased, which has aggravated the pessimism of northern farmers, and superimposed slaughter companies to lower the price of pigs, leading to an increase in the decline. In the short term, pork prices are expected to be weak and volatile; as consumer demand picks up in the later period, pig prices are expected to stop falling and stabilize, showing signs of a slight rebound. (Zhongxin Jingwei APP)

You must log in to post a comment.