Since the end of March, the global capital market has undergone a major reversal. After the end of a three-month rebound, the U.S. dollar index began to peak downward. The 10-year U.S. Treasury yield has also fallen from a high of 1.75%. Looking at the foreign exchange market, this trend has accelerated since late April. In just a few days, the U.S. dollar index has been falling and falling. It pierced the 60-day moving average and the 120-day moving average on April 19 and went straight to the 91 mark again. , Basically gave up all the gains since March, and the renminbi exchange rate took the opportunity to regain the 6.5 mark. We can’t help asking, what is the key driver for the RMB to regain the 6.5 mark? Why has the U.S. dollar index been declining recently, and will it continue? Will the outlook for the RMB exchange rate reverse?

1. Why can the RMB regain the 6.5 mark again?

At present, after the CNY regained the 6.5 mark again, there is a certain degree of suppression at the 60-day moving average on the technical level, that is, short-term or strong shocks below 6.4982. We disassemble the fluctuations of CNY for internal and external reasons. The difference between the closing price of the day and the midpoint of the day is regarded as the part of the day trading, and the difference between the midpoint of the day and the closing price of the previous day is regarded as the external shock. The fluctuation of CNY from the past week In terms of factors, the appreciation of the onshore renminbi is mainly caused by external shocks, and considering that the recent dollar index is highly synchronized with onshore and offshore renminbi exchange rates, we believe that the breaking down of the dollar index is a direct result of the recent renminbi’s regaining the 6.5 mark. drive.

Figure 1: From the perspective of internal and external factors, the fluctuation of CNY is mainly due to the fall of the US dollar index (as of April 21)

Source: iFinD South China Research

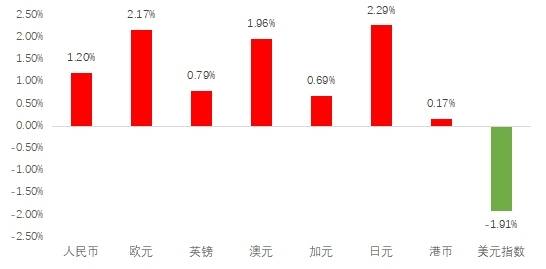

In fact, relative to the dollar index and the rise and fall of most non-US currencies, the recent appreciation of the renminbi is actually relatively restrained. Since the U.S. dollar index peaked at 93.2860 on March 31, the U.S. dollar index has fallen back by 1.91%. At the same time, most non-U.S. currencies have appreciated against the U.S. dollar. As of April 21, the onshore RMB exchange rate has appreciated by 1.20. %, the appreciation of non-US currencies such as the euro and the yen against the US dollar was 2.17% and 2.29%, respectively. It can be seen that the recent increase in the renminbi has been relatively small. We believe that there may be two reasons for this: 1. We have observed a slight increase in the degree of tension in Sino-US relations since the beginning of April, which may have restricted the recent appreciation of the renminbi. 2. In addition, since the closing of the foreign exchange purchase window in the first quarter, the recent strong performance of the RMB exchange rate may lead to an increase in short-term foreign exchange purchase demand by importing companies, which in turn suppressed the appreciation of the RMB.

Figure 2: The appreciation and devaluation of major international currencies in April (as of April 21)

Source: iFinD South China Research

- How to understand the continuous decline of the U.S. dollar index since the beginning of April?

This wave of decline in the U.S. dollar index began at the end of March and early April. This point in time also corresponds to the recent peak and fall of U.S. Treasury yields, and we believe that the decline in U.S. Treasury yields is the primary reason for the continuous decline of the U.S. dollar index since early April. the reason.

First, the nominal and real interest rates of U.S. bonds fell simultaneously, and the difference between U.S. and German bond yields fell rapidly. At the beginning of April, the U.S. Treasury yield fell from a high of 1.75% for the second time. As of April 21, the U.S. Treasury yield has fallen below 1.6%. At the same time, the actual yield based on inflation has also begun to fluctuate lower, that is, nominal. Interest rates and real interest rates have both fallen. Although inflation expectations are still fluctuating above the 70% quantile, which is similar to the level at the end of March, both nominal and real interest rates have fluctuated and fell, and the market’s response to inflation expectations is no longer as good. As anxious at the end of March. Observing the fluctuations in the yields of 10-year Treasury bonds in various countries since April, the yields of 10-year U.S. Treasuries have fallen by 15bps since April. In comparison, with the exception of the United Kingdom, major European economies such as France and Germany have fallen for 10 years. U.S. bond yields are still showing a continuing upward trend. The current US-German spread has significantly declined compared with the end of March, and is basically close to the level of early March.

Figure 3: Since April, the difference between the US and major non-US Treasury bond yields has dropped significantly (as of April 21)

Source: iFinD South China Research

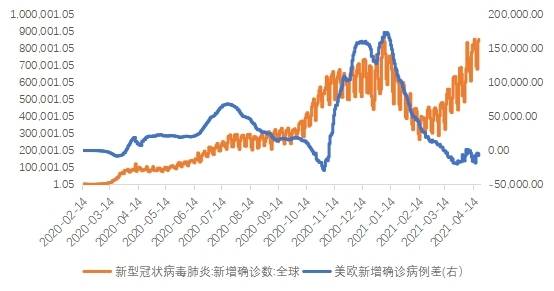

The decline in U.S. bond interest rates is mainly due to the expected reversal of global capital markets, and has nothing to do with the fundamentals of the U.S. economy. From the retail, CPI, and employment data released by the United States last week, various economic data exceeded expectations, and the tone of the U.S. economy continued to improve temporarily. Therefore, the decline in U.S. bond interest rates is only short-lived. We believe that the decline in U.S. Treasury interest rates is mainly due to the decline in market panic over the reduction of easing policies following the rise of new confirmed cases worldwide. The basic logic behind this lies in the fact that the uncertainty of the global epidemic has increased — the need for easing monetary policies to continue to stimulate the economy still remains — policy reductions and panic decline — demand for U.S. debt allocation is improving — U.S. interest rates have fallen. According to the latest 20-year U.S. Treasury auctions announced by the U.S. Treasury Department on April 21, the demand for U.S. debt allocation has indeed rebounded again since April, leading to a decline in U.S. Treasury yields.

Table 1: The latest U.S. Treasury auction shows rising demand for U.S. debt allocation

Data source: South China Research of the U.S. Department of the Treasury

Secondly, in addition to the fall in U.S. bond yields, the improvement of the epidemic in Europe and the acceleration of vaccine progress are also reasons for the decline in the US dollar index. We know that there is a strong correlation between the gap in newly diagnosed cases in the United States and Europe and the US dollar index, and the bottom out of the gap in newly diagnosed cases in the United States and Europe and the recent rebound of the euro against the dollar also started at the end of March. Since the Eurozone implemented the epidemic lockdown measures on March 18, judging from the new confirmed cases, the new cases in Europe have been well controlled. Except for France, the new confirmed cases in Germany, Spain, Italy and other countries have dropped, and recently The distribution of vaccines in Europe has also begun to accelerate, which supported the euro and caused pressure on the dollar index.

Figure 4: Newly diagnosed cases around the world are on the rise again, and epidemic control in Europe has improved (unit: person)

Source: iFinD South China Research

Furthermore, short-term dollar liquidity is relatively abundant under the dovish statement of the Federal Reserve. Judging from the dovish statements made by Fed Chairman Powell last week, he mentioned that he will wait until the inflation rate continues to reach 2% and the labor market fully recovers before considering raising interest rates. These two conditions are unlikely to be met by the end of 2022. Powell reiterated to allow inflation to be higher than 2% for a period of time. In addition, Powell did not mention the recent QE reduction roadmap mentioned by Fed officials, but pointed out that the time for the reduction may be much earlier than the interest rate hike. In fact, although this statement only conveys a basic concept, it has greatly eased the market’s expectations of shrinking. This statement made the market believe that the Fed will indeed remain accommodative in the short term, and that the time gap between reducing debt purchases and raising interest rates may be larger than market expectations. The current market expects that the Fed will formally discuss the reduction in July, or at the earliest in May and June, and the actual implementation of the reduction may not be until the end of the year. The U.S. Treasury Department has stated that it will halve the balance of its huge so-called Treasury General Account (TGA) by April and reduce it to 500 billion U.S. dollars by the end of June. Judging from the latest trends in the Fed’s balance sheet, the TGA account Indeed, it has fallen rapidly in the near future, which means that the financial market has injected a lot of liquidity in the short term. Therefore, the short-term U.S. dollar index has undergone a certain correction when the U.S. dollar liquidity is abundant, and the possibility of a large-scale rebound before policy expectations shifts is low.

Figure 5: Quick release of TGA account balance of the US Department of the Treasury (unit: millions of dollars)

Source: South China Research on the Federal Reserve’s official website

How will the RMB exchange rate go in the future?

From the current point of view, since the US dollar index fell below 91, the downward movement seems to have slowed down, and the renminbi has moved strongly, rising above 6.49 after regaining the 6.5 mark. In the short term, before the U.S. is guided by shrinking expectations or the global capital market is expected to shift, it is expected that the US dollar index will not be able to get out of a large-scale rebound, and the renminbi will also likely follow the US dollar index in the current central two-way fluctuations. However, in the medium and long term, U.S. Treasury yields will continue to rise as the U.S. economy continues to improve. The current corrections in the U.S. dollar index and U.S. Treasury yields are only temporary. Therefore, we need to pay attention to the Fed’s tightening expectations or the medium-term renminbi. Cause a certain depreciation pressure.

Author: Ma Yan Nanhua Futures Institute

Investment consulting qualification certificate number Z0012651

(Editor in charge: Chen Zhuang)

[Disclaimer]This article only represents the views of the co-contributor, not the position of Hexun.com. Investors operate accordingly at their own risk.

You must log in to post a comment.