In the midnight of April 22, the stock bar of Houpe (300471.SZ) was extremely lively, and a large number of shareholders were waiting for how the company would respond to the letter of concern from the Shenzhen Stock Exchange. As the zero point approaches, stockholders become more anxious, saying that if there is no announcement, “I will sue you for losses tomorrow.”

At 9 a.m. on April 23, Times Finance called the Office of the Secretary of the Board of Hope Co., Ltd. The other party stated that the reply has been submitted to the Shenzhen Stock Exchange, and the specific content is not convenient for disclosure at present. However, as of press time, the content of Houpu’s response has not yet appeared on the Shenzhen Stock Exchange website.

On April 21, the Shenzhen Stock Exchange issued a letter of concern and an annual report inquiry letter to Hopu within one day. The serial follow-up questioning by the Shenzhen Stock Exchange revealed its eagerness, requiring Houpu shares to respond to the letter of concern before April 22.

The Shenzhen Stock Exchange’s attention to Houpu shares stems from the 15 billion yuan project agreement disclosed by Houpu shares on April 20.

On the evening of April 20, Houpu shares announced that the company and Chengdu Xindu District Government signed the “Hopu International Hydrogen Energy Industry Cluster Project Investment Agreement” (hereinafter referred to as the “Agreement”), and plans to invest 15 billion yuan in construction Hopu International Hydrogen Energy Industry Cluster Project.

Hydrogen refueling station. Image source: L.Willms

It seems to be a major positive news for the company, but when it is placed on Houpu shares, it makes people suspicious. Its annual report shows that in 2020, its operating income will be only 478 million yuan and a loss of 168 million yuan.

Where did the poor performance of Houpu shares to complete the 15 billion yuan project?

In the letter of concern sent by the Shenzhen Stock Exchange to Houpu, it not only questioned the feasibility of the 15 billion project, but also asked whether it involved real estate development and operation. In the annual report inquiry letter issued on the same day, the Shenzhen Stock Exchange further inquired about Hopu’s operating conditions and asked for an answer within a week.

Affected by this, Houpe shares closed down 5.59% on April 22; it fell below 3% at the opening on April 23, but then quickly rose. As of the morning’s close, Houpe shares rose 5.74%.

Image source: Houpu shares it

Where does 15 billion come from?

The financial situation of Houpu shares in recent years is not optimistic. The two letters issued by the Shenzhen Stock Exchange on April 20 focused on one question: Where does the 15 billion come from?

According to the financial report, Houpu’s revenue in 2019 is 543 million yuan, which is nearly cut in 2015 compared with the revenue at the beginning of listing, and the net profit in 2019 is only 20,827,600. In 2020, the performance of Houpu shares further declined. The total annual operating income was 478 million yuan, a year-on-year decrease of 11.87%, and the net profit attributable to the parent was 168 million yuan, a year-on-year decrease of 905.35%.

According to the “Agreement”, the first phase of the Hydrogen Energy Equipment Industrial Park project uses about 300 acres of land. The Xindu District Government will only use about 300 acres of land for the first phase of the project’s fixed assets (excluding land) investment amount to 4 million yuan per acre or more. Land supply for the second phase of the project will be initiated; similarly, the first phase of the Hopu International Hydrogen Energy CBD project covers an area of about 118 mu, and the investment in fixed assets (excluding land) reaches 7.5 million yuan/mu or more before the second phase of land supply will be initiated.

Based on this data, Times Finance estimates that the first phase of the hydrogen energy equipment industrial park project needs to invest at least 2.085 billion yuan.

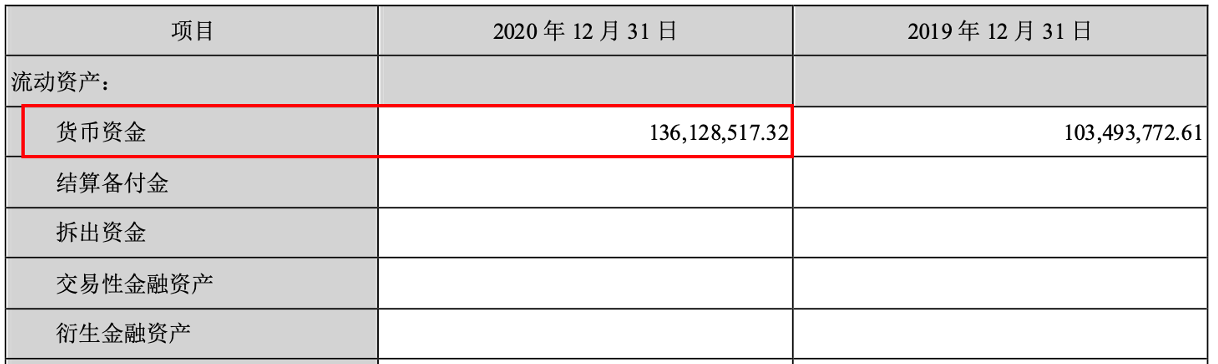

However, as of the end of 2020, Houpu’s total assets were 1.912 billion yuan, and the balance of monetary funds was only 136 million yuan; during the same period, its current liabilities were 750 million yuan, including 116 million short-term loans.

Image source: Houpu shares 2020 annual report

The Xindu District Government stated in the “Agreement” that it supports and encourages district-owned platform companies to participate in the clean energy industry fund initiated by Houpu. The first phase of the industrial fund scale is 500 million yuan, of which the district-owned platform company invests 200 million yuan. Two batches of investment; in addition, the district government also encourages and supports district state-owned enterprises to participate in equity investment in the project under this agreement, and the total investment amount does not exceed 200 million yuan.

In addition, the “Agreement” requires Hopu Co., Ltd. to register relevant project companies with independent legal personality in Xindu District, and at least one project company has a registered capital of 500 million yuan. On April 16, Yanxin Holding Group Co., Ltd. (referred to as “Yanxin Holdings” in the text) and Houpu’s subsidiary-Beijing Houpu Hydrogen Technology Co., Ltd. registered in Xindu District to establish Chengdu Houpu Hydrogen Technology Co., Ltd. , Registered capital of 500 million yuan, of which Beijing Hopu Hydrogen Energy subscribed 400 million yuan, and Yanxin Holdings subscribed 100 million yuan.

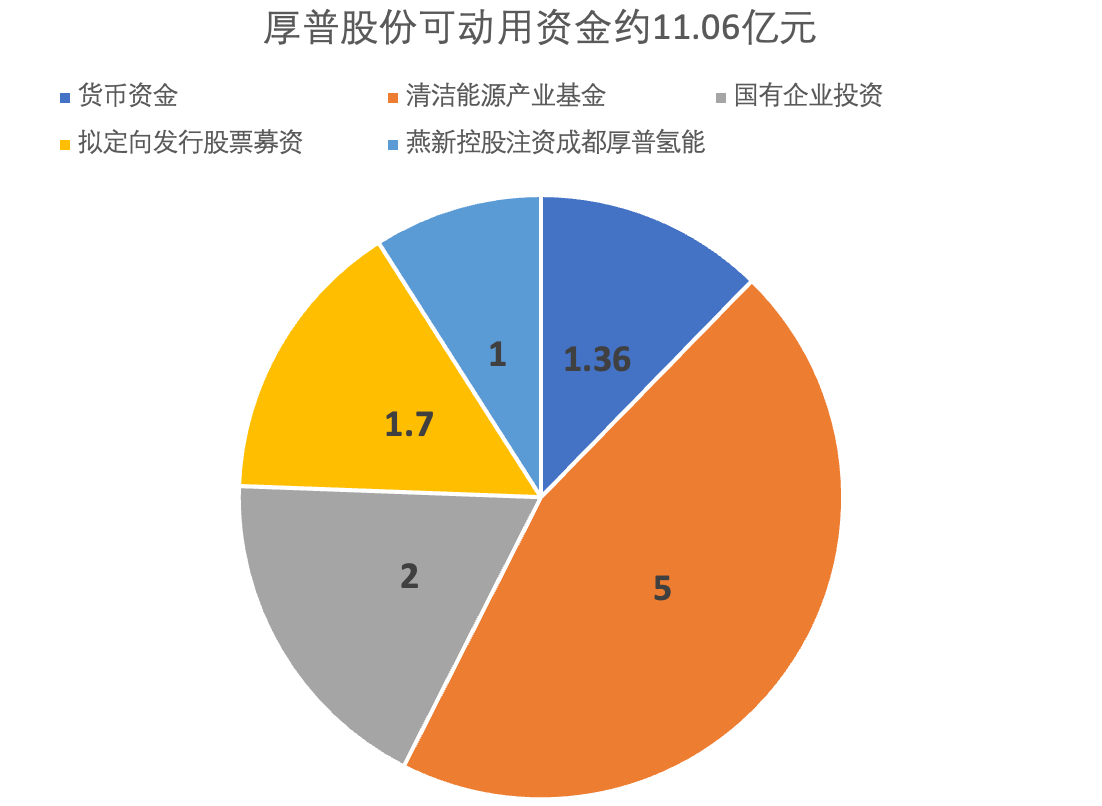

Even without considering the liabilities, according to Times Finance’s estimates, plus the 170 million yuan that Houpu shares planned to raise from Wang Jiwen in February 2021, and the 100 million yuan that Yanxin Group invested in the establishment of Chengdu Houpu Hydrogen Energy, Houpu has made every effort to spend about 1.106 billion yuan in international hydrogen energy industry cluster projects, and there is still a big gap between the 2.085 billion yuan required for the first phase.

Picture source: Times Finance

Hope shares may choose to seek external financing. Times Finance found that in the signing of the 15 billion project issued on the official website of Hopu Co., Ltd. on April 21, the world industrial gas giant-French Air Liquide (Air Liquide) Chairman of the Board of Directors in Greater China, Lu Yuebing, also attended the signing ceremony. . In 2019, Air Liquide Group and Houpu Co., Ltd. jointly established Air Liquide Houpe Hydrogen Energy Equipment Co., Ltd. (hereinafter referred to as “Air Liquide Houpe”).

On April 22, Times Finance called Jin Jing, the media liaison of Air Liquide Group, who stated that the cooperation between Air Liquide Group and Houpe is limited to the previously established joint venture company-Liquid Air Houpe. Recently, Houpe shares and Xindu District Government The project has nothing to do with Air Liquide.

Times Finance also contacted Chengdu Xindu District Investment Promotion Bureau and Xindu District Modern Transportation Industry Functional Zone Management Committee on the same day, trying to inquire about the details of Hopu International’s hydrogen energy industry cluster project. The staff of the other party said that they would record the problem and give feedback to the relevant person in charge, but as of the time of publication, no response has been received.

At the 2020 online performance briefing meeting of Houpe shares held on the same day, Times Finance asked Huang Yaohui, general manager of Houpu shares, on issues such as “whether it will introduce other investors to join the projects in Xindu District”. The other party said that the specific situation will await the company’s response to the “Letter of Concern”.

Cement boss enters hydrogen energy

At the end of 2020, Houpu shares only changed the actual controller. Another identity of Wang Jiwen, the current actual controller of Houpu shares, is the chairman of Yanxin Holdings.

According to its official website, Yanxin Holdings is a diversified group company integrating building materials, environmental protection, metallurgy, finance, investment, logistics, real estate, and equipment manufacturing, with total assets of more than 4 billion yuan. Its building materials sector can produce 4 million tons of cement and 2.25 million tons of clinker each year. Its leading products include “Diamond” and “Jun” cement.

Cement boss Wang Jiwen entered Houpu shares back three years ago.

In November 2018, in order to alleviate the pledge of shares held, Jiang Tao, then chairman, general manager and actual controller of Houpu Co., Ltd., planned to raise funds from Beijing Xingkai Investment Co., Ltd. (hereinafter referred to as “Beijing Xingkai”). According to Tianyan Check, Wang Jiwen and Yanxin Holdings own 99.02% of Beijing Xingkai.

At the beginning of 2019, the senior management of Hopu Co., Ltd. carried out intensive mobilization. First, in January 2019, Jiang Tao resigned as general manager and was replaced by Huang Yaohui, the former vice president of Yanxin Holdings; then in March 2019, Wang Jiwen succeeded Jiang Tao and was elected chairman of Houpu Co., Ltd.; on April 1, 2019, Houpu The shares completed the change of legal representative and changed from Jiang Tao to Wang Jiwen.

However, it was not until the end of 2020 that Wang Jiwen truly became the “master” of Houpu. On November 17, 2020, Houpu shares announced that Jiang Tao would transfer 20% of his shares to Wang Jiwen and Beijing Xingkai. After the completion of the transaction, Wang Jiwen and Beijing Xingkai controlled by Wang hold 25.51% of Hopu’s shares and are the actual controllers of the company.

Soon after Wang Jiwen took office as chairman, he changed the company name from “Chengdu Huaqi Houpu Electromechanical Equipment Co., Ltd.” to “Houpu Clean Energy Co., Ltd.”.

A relevant person of Houpu said in public that the new boss Wang Jiwen is optimistic about the development of hydrogen energy.

The name change may have demonstrated Wang Jiwen’s confidence in hydrogen energy and other clean energy businesses, but it failed to help Houpu shares to reverse the decline in performance.

Transition to hydrogen energy for 7 years, revenue accounted for less than 1%

In recent years, the hydrogen energy industry has become hotter and hotter.

Kaiyuan Securities believes that in the context of “carbon peak” and “carbon neutrality”, hydrogen is expected to play an important role in promoting energy transition and improving the flexibility of the energy system. The governments of Sichuan, Beijing, Jiaxing, Zhejiang and many other places have also launched their own “14th Five-Year Plan” for the hydrogen energy industry.

On April 21, the China Hydrogen Energy Alliance revealed at the “14th Five-Year” Hydrogen Energy Industry Development Forum that as of the end of 2020, China has built 128 hydrogen refueling stations and the cumulative number of hydrogen fuel cell vehicles has reached more than 7,000.

The “China Hydrogen Energy and Fuel Cell Industry White Paper 2020” released on the same day shows that China’s current hydrogen production capacity is about 41 million tons per year, and the output is about 33.42 million tons, making it the world’s number one hydrogen producer; by 2060, under the carbon neutral scenario, it can be The scale of hydrogen production from renewable energy is expected to reach 100 million tons.

Wanlian Securities analyst Jiang Wei told Times Finance on April 22 that in the future, with the reduction of fuel cell costs, the layout of hydrogen refueling stations, and the promotion of photovoltaic hydrogen production, hydrogen energy is expected to become the preferred alternative energy source in the non-electric field. Can be used on a large scale.

In order to catch up with this round of hydrogen energy boom, Houpu has been preparing for 7 years.

The prospectus submitted by Houpu in 2014 did not mention that the company has any hydrogen energy projects. However, in its 2015 annual report, there was a message that “the hydrogen charging device has achieved phased results, and the research and development prototype has been tested on site”. Every year since then, Houpe has announced its progress in the field of hydrogen production and hydrogenation.

But so far, hydrogen energy has not yet become Hopu’s main business. In its announcement on April 8th, Houpu shares mentioned that in 2020, the company’s main operating income will still be the natural gas refueling equipment and parts business, and the company’s hydrogen energy business recognized operating income in 2020 is less than total revenue. 1%.

Perhaps in order to break through this 1%, Houpu shares will spend a lot of money to invest in the hydrogen energy industrial park. But with 1.106 billion funds to leverage 15 billion projects? difficult.

You must log in to post a comment.