“Collective” refinancing of securities firms, another 7 billion fixed increase of securities firms was approved by the China Securities Regulatory Commission. Last year, 15 securities firms decided to increase and 11 alloted shares

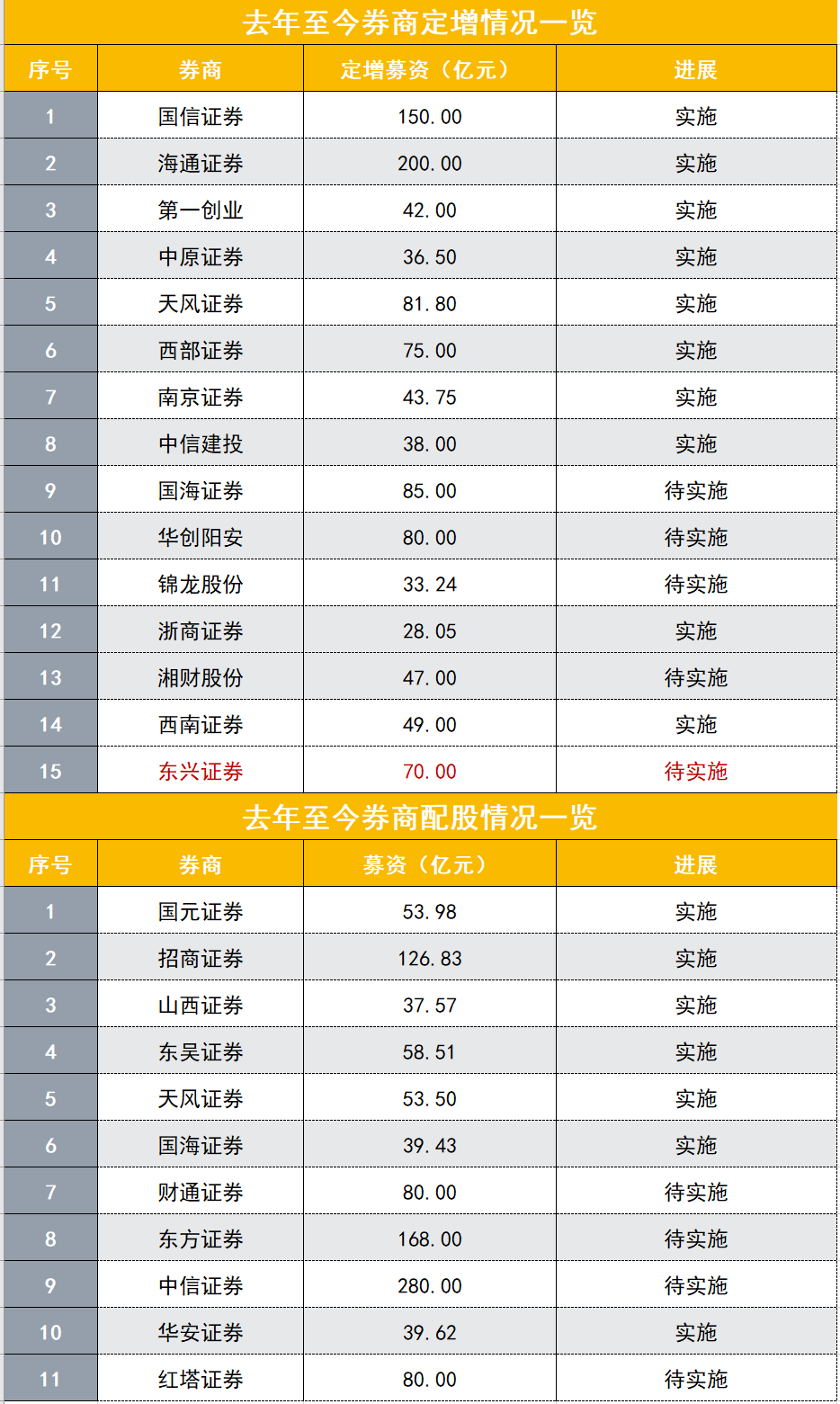

From the Financial Association (Shenzhen, reporter Zou Chenhui), Dongxing Securities has ushered in the latest progress in its fixed increase in fundraising, and this is also the 15th listed securities firm to launch a fixed increase since last year. In addition, there are already 11 brokerages that have refinanced through allotment.

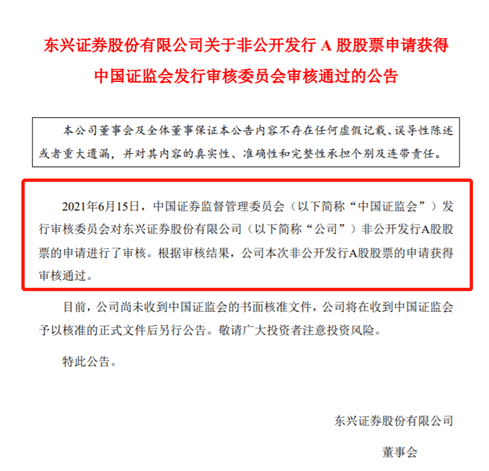

The latest announcement of Dongxing Securities stated that the fixed increase application has been reviewed and approved by the China Securities Regulatory Commission, and the company will make another announcement after receiving the official documents reviewed by the China Securities Regulatory Commission.

In February of this year, Dongxing Securities issued a fixed increase plan, which plans to issue no more than 474 million additional shares, and the total amount of funds raised is expected to not exceed 7 billion yuan. In May of this year, Dongxing Securities’ fixed increase application was accepted by the China Securities Regulatory Commission.

Behind the fixed growth of Dongxing Securities is closely related to the current capital market development entering a period of strategic opportunities. Regulatory authorities clearly support securities companies in multiple channels and forms to enhance their capital strength, encourage market-oriented mergers and acquisitions and reorganization, and support the securities industry to become better and stronger. At present, the 8.5 billion fixed increase of Guohai Securities and the 8 billion fixed increase of Huachuang Yangan are on the way. The parent company of Zhongshan Securities also launched the latest fixed increase plan earlier this month.

Dongxing Securities will increase by RMB 7 billion, and invest RMB 6 billion in investment and trading business and expand the business of financing and financing

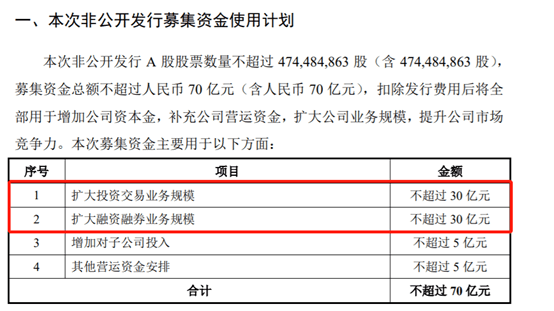

Dongxing Securities’ previously announced fixed-increasing plan announcement shows that the number of non-public issuance of A shares does not exceed 474 million shares, and the capital raised does not exceed 7 billion yuan. After deducting issuance costs, all will be used to increase the company’s capital and supplement the company’s operations. Capital, expand the company’s business scale, and enhance the company’s market competitiveness.

Specifically, no more than 3 billion yuan is used to expand the scale of investment transaction business; no more than 3 billion yuan is used to expand the scale of margin financing and securities lending business; no more than 500 million yuan is used to increase investment in subsidiaries; no more than 500 million yuan For other working capital arrangements.

Dongxing Securities said that through this fixed increase, the company’s equity capital will be enriched, total assets and net assets will increase correspondingly, and the asset-liability ratio will correspondingly decrease, the company’s capital structure will be further optimized, and the financial structure will become more stable. In addition. The company will increase the scale of net capital, accelerate the development of related businesses, and enhance the company’s overall profitability and risk resistance.

Net profit attributable to the parent in the first quarter fell nearly 20% year-on-year

As the first domestic AMC brokerage listed on A-shares, Dongxing Securities’ controlling shareholder, Orient Asset Management Co., Ltd. (holding 52.74% of the shares), is strong, and the actual controller is the Ministry of Finance.

From the perspective of recent performance, Dongxing Securities in the first quarter of this year showed that during the reporting period, the company achieved revenue of 886 million yuan, a year-on-year increase of 0.71%; realized net profit of 250 million yuan, a year-on-year decrease of 19.01%.

Last year’s annual report showed that the company achieved revenue of 5.687 billion yuan, a year-on-year increase of 27.10%; realized net profit of 1.54 billion yuan, a year-on-year increase of 26.13%. Among them, securities brokerage business accounted for 34.77%; securities investment business accounted for 24.07%; investment banking business accounted for 19.35%; other businesses accounted for 12.53%; asset management business accounted for 9.28%.

According to the ranking data of various securities firms in 2020 released by the China Securities Association, Dongxing Securities ranked 22nd in the industry last year in total assets, 25th in net assets, 23rd in operating income, 22nd in net profit, and 22nd in brokerage business income. Ranked 28th, investment banking income ranked 13th, asset management business income ranked 19th, overseas subsidiary securities business income ranked 22nd, and self-operated business income ranked 57th.

As of June 15, Dongxing Securities’ stock price closed at 10.67 yuan, with a total market value of 29.4 billion yuan.

Many small and medium-sized securities companies are trying to increase their capital strength through fixed increase

According to a reporter from the Cailian News Agency, in recent years, regulators have implemented risk control index management for securities companies with net capital and liquidity as the core. The China Securities Regulatory Commission has successively revised the Measures for the Management of Risk Control Indexes for Securities Companies and the Risk Control Indexes for Securities Companies. The Regulations on Calculation Standards have further improved the risk control index system of securities companies with net capital and liquidity as the core, and has put forward higher standards for the risk management of securities companies.

In the face of liquidity pressure and changes in the operating environment, many securities firms are increasing their capital strength through further fixed increases, reducing liquidity risks, and improving the company’s overall risk management capabilities and risk resistance capabilities.

On June 4, Zhongshan Securities’ parent company Jinlong shares issued a fixed increase plan. This time the proposed additional issuance of no more than 264 million shares (including the number), the issue price is 12.59 yuan, and it is planned to raise no more than 3.324 billion yuan.

In March of this year, Huachuang Yang’an disclosed the fixed increase plan stated that the planned number of non-public issuance of A shares will not exceed 522 million shares, and the raised funds will not exceed RMB 8 billion (including the number). After deducting the issuance costs, it will be used for all Increase capital to Huachuang Securities to increase the capital of Huachuang Securities, supplement its working capital, optimize business structure, expand business scale, and enhance market competitiveness and risk resistance.

In January this year, Guohai Securities announced that the company’s 8.5 billion fixed increase has been approved by the board of directors. The issuance still needs to be approved by the state-owned asset management unit, the company’s shareholders meeting, and the China Securities Regulatory Commission. The 8.5 billion fixed increase, China Sea Securities plans to invest 4 billion yuan in investment and trading business.

It is worth noting that whether securities firms can successfully raise funds in full is also attracting market attention. A reporter from the Financial Associated Press previously reported that many brokerages have seen a decline in their planned additional funds raised.

On May 21, Zheshang Securities announced that after the completion of this non-public offering, the company has added approximately 264 million new shares, and the total amount of funds raised is approximately 2.805 billion yuan. Last year, Zheshang Securities announced that it planned to raise 10 billion yuan.

On April 29, Tianfeng Securities issued a fixed increase announcement stating that the company’s final fundraising amount was 8.18 billion yuan (including issuance costs). Prior to this, the company announced that it planned to raise a total of no more than 12.8 billion yuan.

On December 29 last year, China Securities Construction announced that the company had issued 110 million A shares, raising a total of 3.883 billion yuan. Prior to this, China Securities Construction Investment announced that it planned to raise 13 billion yuan in additional funds.

According to a reporter from the Financial Associated Press, some of the securities firms’ fixed increase and decrease are related to the company’s own stock price changes and capital replenishment. China Securities Investment Corporation previously stated that there are two reasons for the company’s fixed growth and shrinkage: one is that the company’s A-share share price in 2020 has risen sharply compared with January 2019, and the forecast basis has changed; the second is that the company has achieved a certain amount of profit through rollover in the past two years. Capital replenishment.

Large brokerages have also raised funds through refinancing

In addition, large securities companies have also raised funds through fixed increase, allotment and other methods. On the evening of February 26 this year, CITIC Securities announced a 28 billion yuan allotment plan, which is to be used for the development of capital intermediary business, subsidiaries, and information system construction.

In August last year, Haitong Securities planned to raise 20 billion yuan in additional funds. Specifically, Haitong Securities’ fixed increase of 20 billion this time, of which no more than 6 billion will be used to develop capital intermediary business and further enhance financial service capabilities; not more than 10 billion will be used to expand the scale of FICC investment and optimize the asset-liability structure.

Also in August last year, Guosen Securities raised an additional 15 billion yuan. The net proceeds raised this time will be used to supplement the company’s capital, working capital and repay debts to expand the business scale and enhance the company’s ability to resist risks and market competitiveness.

You must log in to post a comment.