At the time of HNA Group’s bankruptcy and reorganization, its biggest weight-loss action-the sale of its Ingram Micro International to a US investment institution-is causing market controversy.

HNA Technology (600751.SH) acquired Ingram Micro for approximately US$6 billion a few years ago, but at the end of last year decided to sell this company with annual revenue of US$49 billion. According to HNA Technology’s plan, Ingram Micro’s sale and delivery will be completed at the end of June this year. However, this plan is now full of variables.

A few days ago, HNA Technology suddenly decided to postpone the extraordinary general meeting of shareholders originally scheduled to be held on June 14 to June 24. Whether Ingram Micro’s sale plan can be passed by a vote at the general meeting of shareholders is the key to determining the success of the transaction.

Morgan Stanley Finance noted that opposition has been brewing before the convening of this shareholder meeting. The resolution of the board of directors disclosed by HNA Technology on May 31 showed that the relevant proposal to sell Ingram Micro International was voted against by a director when the board of directors passed a vote. This director is Zhu Yingfeng, the representative of HNA Technology’s second largest shareholder Guohua Life Insurance. .

Guohua Life Insurance is also a joint investor in HNA Technology’s acquisition of Ingram Micro International, holding more than 30% of Ingram Micro’s equity. Zhu Yingfeng believes that Ingram Micro has “continued and stable growth in profits in recent years, which is a rare and valuable high-quality asset” and listed companies should “further seek buyers with high-quality quotations and better safeguard the interests of listed companies.”

The implication is that Guohua Life Insurance feels that Ingram Micro is now being “sold at a low price.” The sale of Ingram Micro International is valued at 5.891 billion yuan, slightly lower than the purchase price that year, but Ingram Micro’s net profit in 2020 has more than tripled compared to a few years ago.

Small and medium investors of HNA Technology also continue to express their opposition in online communities such as “Stock Bar”. In addition to their dissatisfaction with the price of Ingram Micro, they also have concerns about the future of HNA Technology. Ingram Micro is the entire source of HNA Technology’s revenue. After the sale, the listed company will become a “shelf company”. Although major shareholders promised to inject new assets within this year, they experienced the injection of poor quality Yanjing Hotel The miscarriage turmoil, combined with the current situation of HNA Group, is not unreasonable for the concerns of small and medium investors.

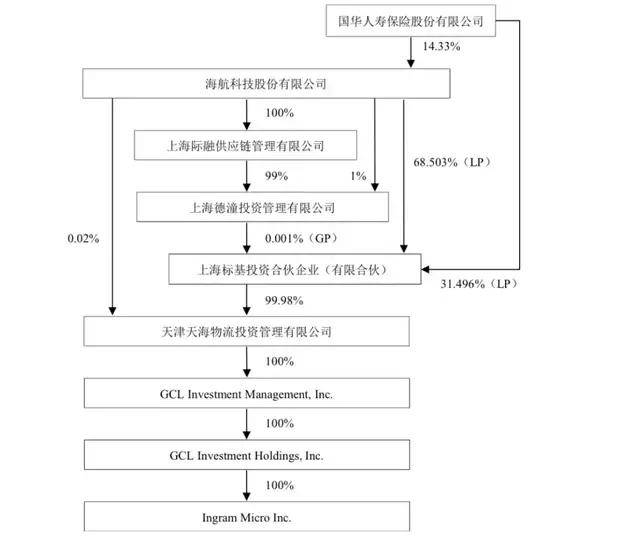

HNA currently holds nearly 30% of HNA Technology, while Guohua Life holds 14.33%. Other shareholders hold very scattered shares. This also means that if the two parties engage in a game at the level of the general meeting of shareholders, whether small and medium investors “group together” will be the biggest variable affecting Ingram Micro’s sales transaction.

Ambition

Ten years ago, the HNA Group, which had just exceeded 100 billion in annual revenue, took advantage of the global economic downturn and frantically bought overseas assets. One of the goals was to reach 600 billion in revenue in 2016, and another goal. It will be in the top 100 of the world’s top 500 in 2020.

By 2016, HNA Group has successfully entered the world’s top 500, but the revenue scale is about 200 billion yuan, which is still far from the ambitious goal. In December of that year, HNA Group under Wang Jian’s presidency acquired Ingram Micro International, the world’s largest IT distribution and supply chain service provider, through its listed company HNA Technology (then Tianhai Investment) for US$5.982 billion (approximately 41.3 billion yuan).

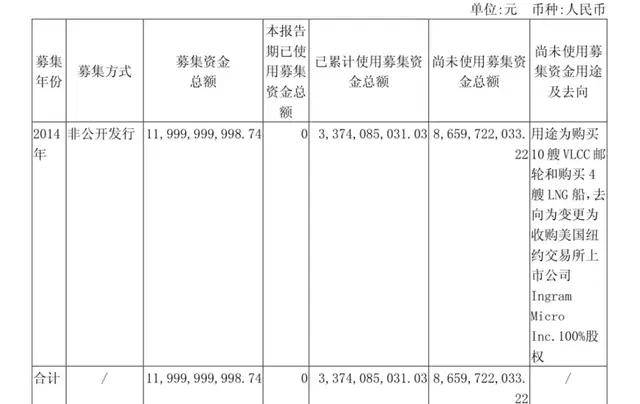

The predecessor of HNA Technology was Tianjin Shipping, a listed company engaged in shipping. In 2008, the HNA Department became the master, and in 2015 it was renamed Tianhai Investment. The shipping business of Tianhai Investment has been sluggish for a long time and is small in scale. After completing a fixed increase of 12 billion yuan at the end of 2014, it was almost a “cash company”. The funds were originally planned to acquire shipping assets such as oil tankers and LNG ships, but the shipping industry was in a downturn. , Tianhai Investment turned to seek “industrial upgrading” and acquired Ingram Micro International in 2016.

Ingram Micro has a global supply chain and channel network, and has strategic synergies with the logistics supply chain and HNA cargo that HNA was trying to develop at that time. Ingram Micro’s annual revenue reached more than 40 billion U.S. dollars. This transaction helped HNA Group’s revenue hit 600 billion yuan. The following year’s Fortune 500 ranking also soared to 170.

After Ingram Micro was acquired by HNA Technology, it accounted for more than half of HNA Group’s revenue for a long time. If the main aviation business of HNA Group is airframes, Bohai Leasing, with the largest assets, and HNA Technology, with the largest revenue, are the two “flanks” that support HNA’s take-off.

HNA also demonstrated brilliant financial skills in the acquisition of Ingram Micro. Among the 12 billion yuan fixed increase at the end of 2014, HNA Logistics (later renamed HNA Technology Group) invested 3.6 billion yuan, leveraging the 8.4 billion yuan of external funds from four institutions-Guohua Life Insurance participated in this fixed amount of 2.5 billion yuan. Increased and became the second largest shareholder of a listed company. The 8.4 billion yuan invested by the external fixed increase agency was originally planned to be used to buy oil tankers and ships, and later became the main fund for the acquisition of Ingram Micro.

The investment structure of HNA Technology’s acquisition of Ingram Micro International shows that HNA Technology used its own funds of 8.7 billion yuan (that is, the remaining funds in 2014), Guohua Life Insurance invested 4 billion yuan, and the rest were bank loans (7-year period). The scale is US$4.27 billion. This means that the HNA Department used almost all other people’s money in this blockbuster acquisition of nearly 6 billion U.S. dollars.

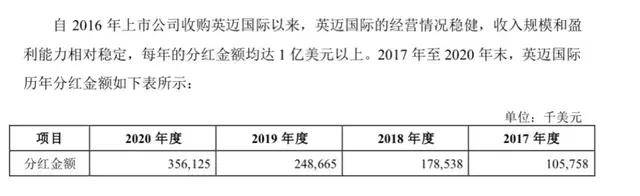

The calculation of HNA Technology’s acquisition was to use Ingram Micro’s profits to cover interest expenses. At that time, it was estimated that the annual interest expenses would be between US$128 million and US$171 million. In fact, Ingram Micro’s business performance has been stable since then, and profits and dividends have increased year by year. A total of US$880 million has been distributed from 2017 to 2020. In the same period, the actual interest expenses of M&A loans paid by HNA Technology totaled US$770 million.

However, HNA Group soon fell into a liquidity crisis, and there were problems in repaying the principal of the syndicated loan. At the end of 2017, it was overdue when the first maturity loan principal of USD 400 million was repaid, and the payment was completed several months later. As of the end of last year, HNA Technology’s outstanding M&A loan principal amounted to US$3.68 billion, and in March 2018, another US$500 million in convertible notes was issued for “borrowing the new to repay the old”, bringing the total outstanding liability principal to US$4.18 billion. . Among them, the principal amount of the syndicated loan of USD 1.35 billion was extended to May 5 this year, and the renewal is still proceeding after the outstanding payment.

In this case, HNA Technology can only choose to sell Ingram Micro to relieve debt pressure.

Ingram Micro

After the outbreak of the liquidity crisis of HNA Group, the overseas assets it had acquired in the past have been sold off one after another. In December last year, under the pressure of HNA Group’s difficulties to resolve risks and HNA Technology’s own difficulties in repaying the syndicated loan, HNA Technology launched a plan to sell Ingram Micro International at a valuation of US$5.826 billion. The purchaser was Platinum Capital, a US private equity investment institution. (Platinum Equity).

On May 31 this year, HNA Technology officially disclosed the “Major Asset Sale Draft”, adjusting Ingram Micro’s valuation to US$5.891 billion. The draft revealed that assuming July 2 as the delivery date, the purchaser’s cash payment consideration is estimated to be approximately US$1.588 billion.

In the transaction plan for the sale of Ingram Micro International, HNA Technology also designed a lock-box mechanism and an additional payment consideration mechanism. The cash payment consideration on the delivery day was further calculated on the basis of US$5.9 billion for value adjustments before delivery. Mechanism, if Ingram Micro’s adjusted EBITDA for the 2021-2023 fiscal year is between US$1.215 billion and US$135 million, HNA Technology can obtain up to US$325 million in additional payment consideration.

But in fact, HNA Technology’s confidence in obtaining additional consideration is not enough. HNA Technology initially predicts Ingram Micro’s adjusted EBITDA for 2021-2023 to be US$1.204 billion, US$1.211 billion, and US$1.225 billion. According to the predicted performance, HNA Technology can only get very little additional consideration.

On the surface, the sale price of HNA is not much different from the purchase price. However, if the five-year interest cost is taken into account, the actual loss between HNA’s purchase and sale is huge, which is even more unacceptable for the co-investor Guohua Life Insurance.

Regardless of the cost of capital, only the estimated cash recovered of US$1.588 billion (equivalent to 10.36 billion yuan) after the sale is calculated, the Shanghai Biaoji partnership consisting of HNA Technology and Guohua Life Insurance will lose more than 2 billion yuan in principal. Shanghai Standard Base Partnership holds 100% equity of Tianhai Logistics and then holds Ingram Micro International, while Guohua Life Insurance holds 31.496% of the LP share of Shanghai Standard Base.

In addition, when Guohua Life Insurance acquired HNA Technology in 2014, the fixed price increase was 5.98 yuan per share. It was hoped that through the acquisition of Ingram Micro International, the performance and stock price of listed companies would increase, but now HNA Technology’s latest share price is 3.43 yuan per share. Shares, Guohua Life’s 2.5 billion investment principal has also lost 42.7%.

Under this circumstance, the selling price of Ingram Micro became the focus of questions from Guohua Life Insurance and small and medium investors.

Controversy over “cheap sale”

Has Ingram Micro been “selled” at all?

As the world’s largest IT distributor, Ingram Micro has 189 logistics centers and maintenance service centers around the world, with an annual shipment volume of more than 1.5 billion pieces and operations in more than 160 countries. Ingram Micro’s IT distribution business covers most of the IT product market segments, and provides downstream customers with inventory management and supply chain financial services. In addition, it is also involved in mobile devices and life cycle services, e-commerce supply chain solutions, and cloud services. . In 2018, Ingram Micro and Microsoft jointly launched the cloud business platform CloudBlue, which provides cloud operation services to more than 150 largest service providers in the world, and has become the world’s largest cloud business platform.

HNA Technology mentioned in the reason for sale that “in recent years, the global IT distribution industry has intensified competition and increased concentration. With the changes in the global shipment pattern of IT products and the 2020 epidemic, the industry has shown certain volatility.” HNA Technology did not It is mentioned that Ingram Micro’s profitability has improved significantly after entering cloud services in recent years.

As early as the acquisition of Ingram Micro International, HNA Technology had already foreseen the boost to Ingram Micro’s profitability by the cloud service business, and pointed out at the shareholders meeting in May 2017 that the leading IT supply chain company in the industry, For example, Ingram Micro, Arrow Electronics, Avnet, Synergy, etc., have entered the cloud service market through acquisitions and other means, “which can improve profitability and avoid financial pressure caused by business expansion.”

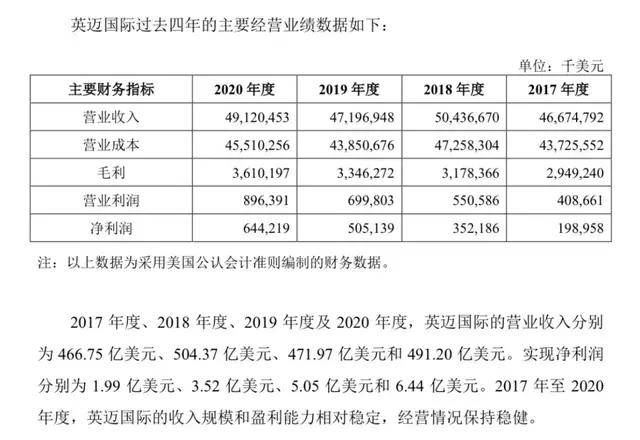

In terms of performance, Ingram Micro’s revenue scale and profitability have been stable in recent years, and its operating status has remained stable. From 2017 to 2020, Ingram Micro’s revenue was 46.675 billion, 50.437 billion, 47.197 billion and 49.12 billion US dollars, and net profit was 199 million US dollars, 352 million US dollars, 505 million US dollars, and 644 million US dollars.

It can be seen that benefiting from the outstanding performance of the cloud service business, Ingram Micro’s profit level has increased rapidly in the past two years, especially when cloud services are more widely used after the epidemic, Ingram Micro has demonstrated high-quality assets. Background color.

It should be pointed out that Ingram Micro is the entire source of HNA Technology’s revenue, but the profit performance of the two is not consistent. In 2020, Ingram Micro’s net profit hit a record high, but HNA Technology suffered a huge loss of 9.788 billion yuan. The main reason was that listed companies provided joint guarantees for HNA Group and other related parties, which resulted in a provision of 5.02 billion yuan in losses and the provision of Ingram Micro’s goodwill. The impairment affects the profit of 6.029 billion yuan.

In the first quarter of this year, boosted by the positive performance of Ingram Micro International, HNA Technology achieved a net profit of 620 million yuan, setting the best performance in recent years.

Ingram Micro’s performance continues to improve, and has improved significantly from the time of the acquisition. Why did HNA Technology sell it at a valuation loss of US$5.891 billion?

The reason given by HNA Technology is that when a listed company acquired Ingram Micro International in 2016, the transaction price was not based on the evaluation results, but was negotiated and determined after comprehensive consideration of various factors. In addition, the valuation of Ingram Micro International is reasonable. After comparing Arrow Electronics and similar companies in the same industry, according to the EV/EBITDA valuation method, the average valuation multiple of comparable companies is 6.6 times and the median value is 6.2 times. , Ingram Micro is 6.3 times.

However, opposition voices also pointed out that In Micro International and its peers Arrow Electronics (ARRW) and Synergy (SNX), the net profits of the three companies last year were US$644 million, US$584 million, and 529 million (as of 2020/11). /30), the revenue scale and profit level of the latter two are lower than Ingram Micro’s, with P/E ratios of 12 times and 14 times respectively, but Ingram Micro’s P/E ratio for sales valuation is only 9 times. If valued at a price-to-earnings ratio of 13 times, Ingram Micro is worth about 8.4 billion U.S. dollars. The current market value of Arrow and Synergy is 8.9 billion and 6.7 billion U.S. dollars, respectively.

Outsiders believe that HNA sells Ingram Micro at the current price, mainly eager to resolve debt pressure and financial risks, and promote the bankruptcy and reorganization of HNA Group, but it is unfair to the co-investors and small and medium shareholders of HNA Technology. After the board of directors voted against the transaction plan, Guohua Life Insurance appealed to HNA to continue to contact buyers with higher bids based on market principles.

It is worth mentioning that Platinum Capital, the acquirer of Ingram Micro, disclosed that the total consideration of the transaction was US$7.2 billion, which is not consistent with the transaction value disclosed by HNA Technology. Platinum Capital also disclosed that it will provide US$4.05 billion in funding for the acquisition. At the same time, JP Morgan, Bank of America, Morgan Stanley and other syndicates pledged to provide US$3.5 billion in loans to pay for the transaction consideration, and also pledged to provide US$3.5 billion in circulation. loan.

Endgame

Many small and medium shareholders are opposed to this sale because they are worried that HNA Technology will become a shell company in the future or be injected with low-quality assets.

HNA Group initially had a great strategic vision for HNA Technology, but after the acquisition of Ingram Micro International, the subsequent layout has been weak. In 2018, HNA Technology put out a plan of 7.5 billion yuan to acquire Dangdang. However, it will inevitably fail in the end.

As of the end of 2020, HNA Technology’s total assets are 121.6 billion yuan, and Ingram Micro’s total assets are 112.1 billion yuan, accounting for 92.17% of the total assets of listed companies. Ingram Micro’s 2020 revenue will account for 100% of HNA Technology’s revenue.

HNA Technology pointed out in the sale plan that after the IT supply chain business is placed, the listed company will relieve debt pressure and financial burden, concentrate resources on strategic and business transformation, and enhance the company’s ability to continue operating.

Just before the sale of Ingram Micro International, on December 4, 2020, HNA Technology decided to increase its assets such as 91.6% equity in Tianhai Shipping and 90% equity in Zhuhai Beiyang Shipping, plus 2 billion yuan in capital increase, and through the Haichuang Baichuan Fund with HNA Group 100% of the shares held by Yanjing Hotel will be replaced.

The net assets of Yanjing Hotel are -870 million yuan, with an estimated value of 2.13 billion yuan and an appreciation of up to 3 billion yuan. In addition, there are three cases of Yanjing Hotel using its own houses and land use rights to provide HNA Aviation Group and related party HNA Tourism Group with a total amount of 2 billion yuan. Beiyin Financial Leasing has seized the corresponding assets in 2019 , So it’s not a “clean” asset.

After being subject to regulatory inquiries and external doubts, on May 19, 2021, HNA Technology announced that it would cancel the proposal to submit the asset replacement proposal to the first extraordinary general meeting of shareholders for consideration.

HNA Technology promises to continue to inject new assets. In the major asset sale draft disclosed by HNA Technology on May 31, HNA Technology and the directors, supervisors and senior executives of listed companies except Zhu Yingfeng promised that the listed company will complete the asset placement by December 31, 2021. HNA Technology Group, Grand China Logistics, and HNA Group promised to assist listed companies in completing asset placement.

However, given the current situation of the HNA system, whether there is still the ability to inject high-quality and clean assets into HNA Technology is a big question mark. On January 30, 2021, HNA Group was filed for bankruptcy and reorganization; on March 15, HNA Technology’s controlling shareholder HNA Technology Group, NPC Xinhua Logistics and related shareholder Shanghai Shangrong Supply Chain were ruled by the court for reorganization. A total of 29.45% of the shares of listed companies are held.

After the bankruptcy and reorganization of HNA Group, it is introducing strategic investors for its three core businesses (aviation, airport and commercial retail), corresponding to HNA Holdings (ST HNA 600221.SH) and HNA Foundation (ST Basis 600515.SH). And supply and marketing big set (*ST big set 000564.SZ) three listed companies. This is also the highest quality asset of HNA Group.

It is worth mentioning that when HNA Technology acquired Ingram Micro in 2016, the shipping industry was in a downturn. However, due to the impact of the epidemic on global inventories last year, the shipping industry is re-entering the business cycle. However, the shipping business of HNA Technology is currently very weak. Only in the first half of 2021, it purchased two 176,000-ton Cape-type bulk carriers (145.5 million yuan each), with a total capacity of only more than 300,000 tons.

After the sale of Ingram Micro, how to revive the main business of HNA Technology will obviously be another big problem.

You must log in to post a comment.