introduction

KPMG’s tax management reform service team launched the “ Science and Technology Empowerment Tax Comes Away A series of articles to share our experience and insights with our clients on various tax management improvement and informatization construction projects. In the previous article, we have shared with readers on the exploration road to improve the tax control of real estate enterprises, the construction of tax management system, tax information planning, demand analysis, and tax-related data governance. After completing the above work, the system development and implementation work can be carried out in accordance with the planned path and steps, and the phased goals of each stage can be implemented. It should be said that in the entire process of tax informatization construction, development and implementation is the link with the longest cycle, the most complicated process, the most involved parties, and the most difficult management and control. It is also the most challenging link. This article will focus on sharing the relevant development and implementation Work experience and insights.

The main work of development and implementation

The main work of development and implementation can generally be divided into the following figure. If the construction is divided into multiple phases, except for the one-time work of the first phase of product selection, other work needs to be carried out in each phase.

Figure 1: The main work of development and implementation

product model

Product selection is a very critical task. To a certain extent, it determines whether the subsequent construction process can proceed smoothly and whether the expected goal can be successfully completed.

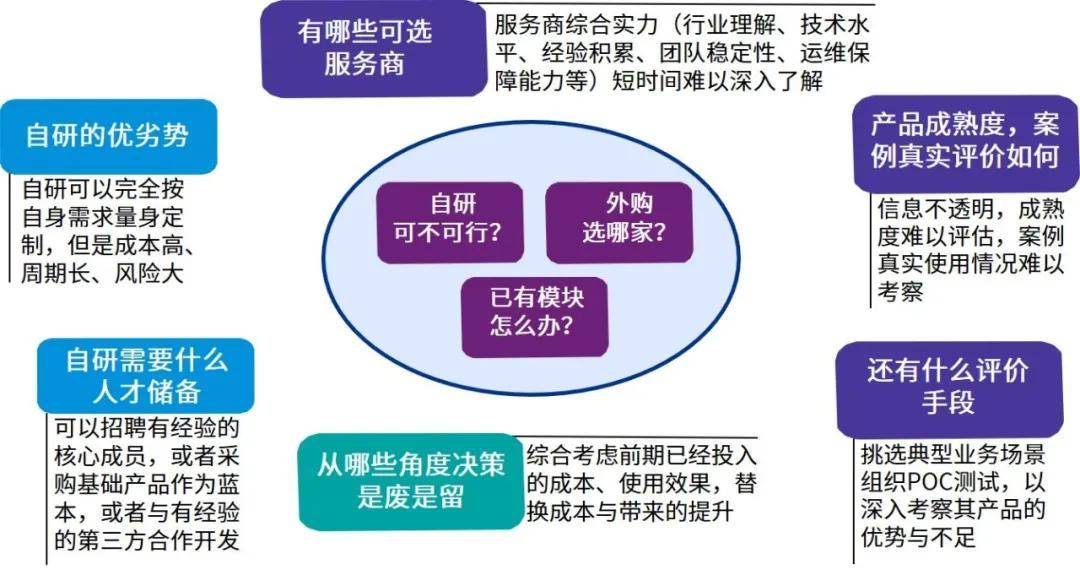

Figure 2: Difficulties in product selection

Product selection requires a comprehensive review of the comprehensive strength of the service provider, including visibility and reputation, understanding of tax informatization, product technology level and maturity, implementation experience accumulation, continuous operation ability and follow-up operation and maintenance guarantee ability, and the structure of assigned project team personnel And stability, etc. Unfortunately, in addition to the mature value-added tax invoice management products on the market, there are no standardized products that can well meet the tax declaration and management needs of large group companies. It can even be said that there are mixed good and bad, which undoubtedly increases the selection work. It has become more difficult, so that there are many failure cases, such as:

- An enterprise had a lack of understanding of the tax business by the service provider, and the designed technical solution had defects, and it could not be promoted after the first phase of trial operation, and the second phase had to be re-selected;

- Due to problems in data sorting, business plan, system architecture, etc., a certain company did not achieve the expected construction results of the system, and the project construction was difficult to proceed normally;

- An enterprise seems to go online successfully, but for each collection period, the tax handler calculates the result offline and then sends the result to the service provider’s operation and maintenance personnel to check and modify the data. Once the operation and maintenance personnel withdraw, the system cannot operate normally;

- An enterprise lost its operation and maintenance guarantee due to the failure of a service provider, and was unable to respond to the tax bureau’s revision of the declaration form, and the system lost its vitality.

For companies considering self-research, if the IT team has zero foundation and zero experience in tax industry products and solutions, the risk is also high, and full evaluation and prudent decision-making are required.

In addition, some companies may have built some tax modules in the early stage. If it is not clear in the informatization planning stage whether these early-built modules will continue to be used or discarded, the candidate products can be combined in the product selection stage to further demonstrate the decision.

System scheme design, development and testing

The system scheme design is to design the overall architecture of the system according to business requirements, determine the realization method of each function, and form a knowledge document of the specific realization of the system to guide the subsequent development and implementation work. The system plan design should focus on tax characteristics, such as the different principles of tax laws of various tax types, the differences in tax calculation rules of each business segment, the rapid changes in tax policies, and the differences in local policy implementation calibers, so as to improve the flexibility, ease of use and maintainability of the system.

Development testing is to write specific code and verify whether the business requirements are correctly and completely realized. Development and testing is a stage prone to delays and quality risks. Enterprises must strengthen the management of schedule and quality.

Online preparation, pilot operation, promotion

The focus of online preparation, pilot and promotion includes: formulating business specifications, writing operation manuals, organizing user training; collecting initialization data, making system initialization configuration; formulating pilot and promotion implementation plans, transitional plans, and orderly organizing and promoting the pilot and promotion work.

At the same time, after the system is online, it is necessary to actively follow up user feedback, and comprehensively collect, organize records and respond to the problems encountered in the use process and the opinions and suggestions put forward.

Evaluation item

After a period of operation and use, the system summarizes the work of each stage of design, development, and implementation, evaluates whether the project construction results meet the planned target requirements, and conducts inventory, liquidation, and filing of the assets formed by the project.

Common misunderstandings in development and implementation

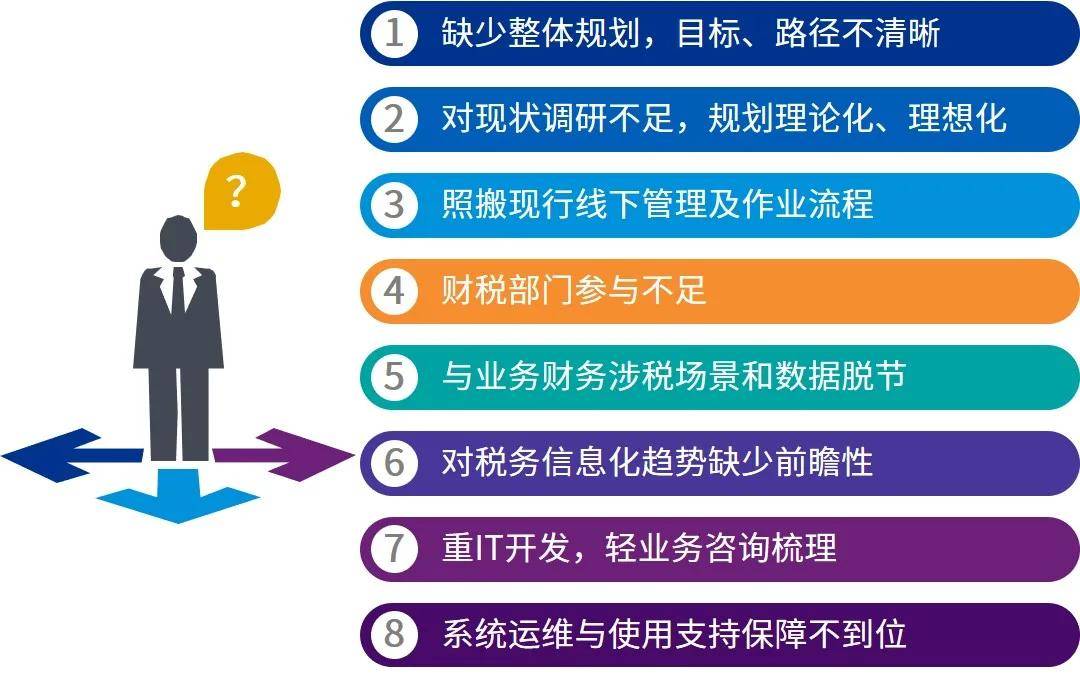

In recent years, many large enterprises have been exploring the construction of tax informatization and have achieved good results. However, there are also some unsuccessful cases. Generally speaking, they still have insufficient understanding of the characteristics and difficulties of tax informatization and accidentally stepped on them. Pit.

Figure 3: Common misunderstandings in the construction of tax informatization

Specific to the development and implementation stage, the most common and most influential three misunderstandings are as follows:

Information construction is a matter for the IT department, and the taxation department is insufficiently involved: Some corporate tax departments lack the right to speak in the information construction work, or they rarely participate because they don’t understand IT technology, which ultimately leads to the fact that the selected products, design schemes, and developed functions do not meet business needs and are not easy to use. Series of questions. We suggest that the tax department must take the initiative and actively participate in the whole process, proceed from its own needs, and control the pace and quality of construction.

Don’t pay attention to the system scheme design, no design documents: We often hear voices such as “The project is tight and there is no time to design”, “The design document is useless, there is time to write the document, and the development is over long ago.” We also encountered the IT team in a case and even said ” Refusal to disclose the system scheme on the grounds of “patent secrecy”, the result was that the system had been developed for half a year, but it was a “four dissimilarity” and had to be overthrown and restarted. We suggest that the design plan and the written document must be taken seriously, and full discussion, confirmation and review should be done with related parties. For example, tax declaration, how the system can be parameterized, configurable, and expandable to flexibly cope with the aforementioned difficulties must be clearly thought out and explained before starting to write code.

Once the system is online, you’re done: The online system does not mean that the informatization construction task is completed. The key to whether the informatization construction achieves the target effect depends on whether it is used well after it is online. Therefore, the follow-up system operation guarantee and optimization are also key tasks. In addition, in the process of development and implementation, sometimes some difficult problems are temporarily put on hold. After the system is online, these remaining problems should be continued to be solved. Don’t selectively ignore and plant a mine on the system.

KPMG’s tax information services

In order to better help companies develop tax informatization work, while considering the needs of different companies, KPMG can provide flexible and diverse tax informatization services, including informatization planning, informatization business consulting, tax-related data governance, system development and implementation or Provide business support and project supervision to the company’s own/third-party IT team.

Figure 4: KPMG tax information services

to sum up

The construction of tax informationization is a big project. It will not only cost a lot of money, but also the process will be complicated and the cycle is long. Among them, development and implementation are the most difficult. It is recommended that enterprises manage the entire construction process as a project, invest superior resources, and use scientific The project management method carries out comprehensive management and control, including planning, organization, command, coordination, and control to better achieve the planned goals and ensure the best overall effect.

The content of this article is for general reference only, and is not provided for any individual or specific situation of any individual or group. Although we have endeavoured to provide accurate and timely information, we cannot guarantee that the information will remain accurate when you receive it or in the future. No one should act in accordance with the content contained in it without carefully considering the relevant circumstances and obtaining appropriate professional advice. All the content provided in this article should not be considered as formal audit, accounting or legal advice.

©2021 KPMG Huazhen Certified Public Accountants (Special General Partnership), KPMG Consulting (China) Co., Ltd. and KPMG Certified Public Accountants are all associated with KPMG International Limited (“KPMG International”), a private UK company limited by guarantee. KPMG International does not provide any customer service. Each member firm is its own independent legal subject, and so is its description of itself. KPMG Huazhen Certified Public Accountants (Special General Partnership)-a Chinese partnership accounting firm; KPMG Consulting (China) Co., Ltd.-a Chinese limited liability company; KPMG Certified Public Accountants-a Hong Kong partnership firm. All Rights Reserved. KPMG’s name and logo are trademarks or registered trademarks of KPMG International.

You must log in to post a comment.