Decoding the Hong Kong stocks, the original trump card column of the Hong Kong Caihua News Agency, and financial experts gathered. After reading, remember to subscribe, comment, and like.

According to data from the Ministry of Commerce, there are currently 1,128 Chinese time-honored brands in China, which are mainly involved in industries such as pharmaceutical manufacturing, wine making, food and beverage.

There are as many as 60 listed companies involved in these time-honored brands, such as Kweichow Moutai (600519.SH) for brewing, Yunnan Baiyao (000538.SZ) and Pien Tzehuang (600436.SH) in the field of traditional Chinese medicine, and Gui Faxiang (002820.SZ) in the field of catering and food. ) And Quanjude (002186.SZ).

Recently, another time-honored brand in the food and beverage industry, Wufangzhai, has set the time. On the occasion of its 100th anniversary and the Dragon Boat Festival approaching, Wufangzhai knocked on the door of the Shanghai Stock Exchange with rice dumplings. On June 8, the official website of the China Securities Regulatory Commission showed that Wufangzhai’s listing application was accepted, and it was getting closer and closer to the “first share of rice dumplings”.

Wufangzhai is known as the “Jiangnan Zongzi King”, and is famous for being glutinous but not rotten, fat but not greasy, tender and fragrant, and moderately salty and sweet. As Wufangzhai, which focuses on the traditional Chinese food culture, can it chase the stars and the sea in their respective fields like Kweichow Moutai and Yunnan Baiyao, and become a “potential stock” sought after by investors?

The market is small and there are many disruptors

Zongzi products are Wufangzhai’s most important source of revenue. In 2020, Zongzi will bring revenue of 1.644 billion yuan, accounting for more than 70% of total revenue. In order to broaden the source of revenue, Wufangzhai also involved in moon cakes, meals, egg products, pastries and other products.

Can Wufangzhai, who relies on the zongzi market, run well on the zongzi track? Is there much room for future growth?

From the perspective of consumption, although Zongzi is an important traditional delicacy in my country, except for a few festivals such as the Dragon Boat Festival, how many times do we eat Zongzi a year? Moreover, people who are used to eating zongzi for breakfast are mainly in the south, but their consumption demand is far less than that of breakfast staples such as steamed buns and steamed buns. So it seems that even if my country’s population base and consumer market are huge, the zongzi market cannot be compared with the more powerful liquor and the more rigid Chinese medicine. This means that the scale of my country’s zongzi market will not be much.

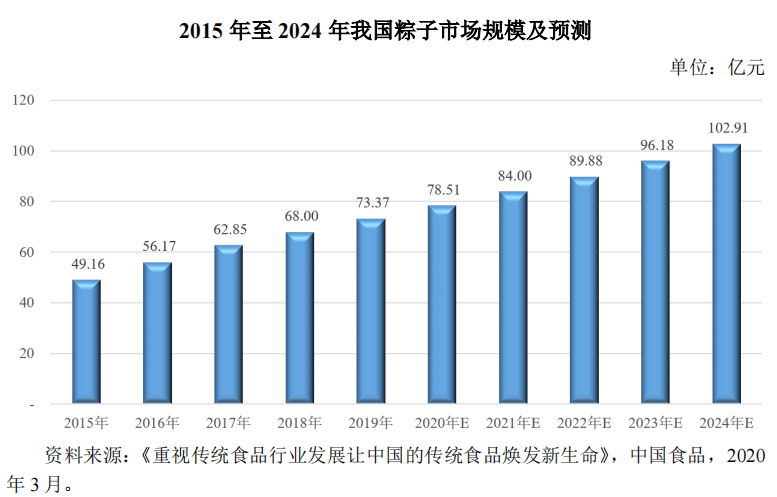

The data also illustrates this point. According to the data of “Attaching importance to the development of traditional food industry to bring China’s traditional food to new life”, although the growth space of my country’s zongzi market is stable, the market size is not large, less than 8 billion yuan in 2019.

In 2019, my country’s liquor consumption reached 600 billion yuan, and the Chinese medicine market exceeded 500 billion yuan. The zongzi market is not comparable to the previous two. In 2020, my country’s steamed buns market will also have a market size of 60 billion, and Wufangzhai’s fourth largest source of revenue, moon cakes, will have a market share of about 20 billion.

Judging from the industry’s market size of 7.337 billion in 2019, Wufangzhai’s market share is 21.94%, which is the industry’s first prize. But at the same time, the zongzi market, which has a small market size, is a red sea, which is another difficulty for Wufangzhai.

In addition to the competition from Beijing Daoxiangcun, Zhenzhen Lao Lao, Zhiweiguan and other companies whose main products are rice dumplings, Wufangzhai is also facing challenges from more and more companies in other fields, such as the domestic bread leader Taoli Bread (603866. SH), quick-frozen food leader Sanquan Foods (002216.SZ), chain restaurant brand Guangzhou Restaurant (603043.SH), etc. The latter three also pose challenges to Wufangzhai in areas such as moon cakes.

In view of the fact that zongzi is a seasonal food and insufficient consumption rigidity, many food companies will not regard zongzi as a key category, as is the case with the three listed companies mentioned above. During traditional holidays such as the Dragon Boat Festival, these food companies concentrated their production some time before the holiday. During the holidays, they flowed into the market and grabbed the position of Wufangzhai in the category display of supermarkets and e-commerce platforms.

Therefore, it is not easy for Wufangzhai to rely solely on a few categories such as rice dumplings and moon cakes to achieve growth in the market. For this reason, Wufangzhai also wants to try to get rid of its dependence on Zongzi products. It stated on its official website that it should focus on “glutinous rice food” and build a high-value product line to form a brand reputation of “Wufangzhai = Chinese seasonal food”. . But what are the high-value products? Wufangzhai did not mention it.

According to the analysis of professionals, the high-value products referred to by Wufangzhai should be upgraded around the main business of Zongzi, taking the high-end route to increase product power and price. However, the threshold for producing high-value zongzi is not high, and it is not difficult for other competitors to increase the value of zongzi. Therefore, brand influence and optimization of sales channels are the key.

Poor sales, raise prices to make up?

Judging from the above-mentioned market size and competition pattern, Wufangzhai may face greater difficulties in growth. Let’s take a look at the sales and income of Wufangzhai Zongzi.

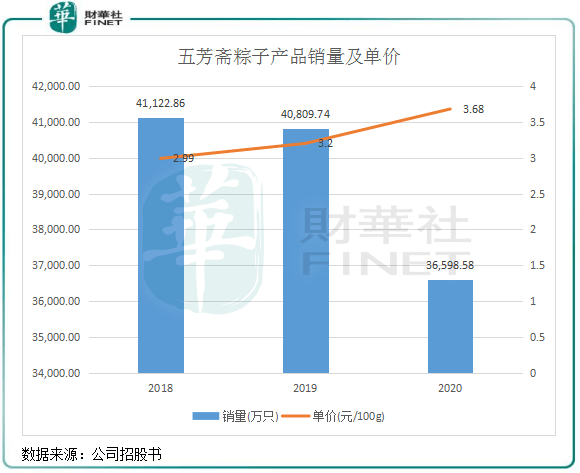

According to the prospectus, the sales of Wufangzhai’s Zongzi series products have been declining year by year, reaching 366 million in 2020, a decrease of 11% from 2018.

Although Wufangzhai’s e-commerce channel has performed well, it is still difficult to conceal the awkward situation of declining sales. The company’s declining sales are undoubtedly taken up by other brands.

Sales decline, raise prices to make up. Wufangzhai increased the revenue of these two types of products by increasing the prices of Zongzi series products and moon cake series products. Among them, the unit price of the company’s zongzi series products in 2020 is 3.68 yuan/100g, an increase of 23.1% over 2018, and the increase is much higher than the decline in zongzi sales during the same period. Therefore, Wufangzhai’s Zongzi series products have maintained a small increase in revenue. From 2018 to 2020, the revenue of this product will be 150 million yuan, 161 million yuan and 164 million yuan, respectively.

But at the same time, due to the poor performance of the company’s meal series, egg products, cakes and other products, the company’s revenue growth last year stalled. From 2018 to 2020, the company’s revenue was 2.267 billion yuan, 2.375 billion yuan and 2.323 billion yuan; net profits were 97 million yuan, 163 million yuan and 142 million yuan, respectively.

From this point of view, when the company is facing growth difficulties, raising prices can only ease the pace of the company’s revenue and net profit decline, but cannot fundamentally drive the company to achieve growth. Moreover, price increase is a double-edged sword. If the price increase is greater than the increase in raw materials, then consumers may choose other products with higher cost performance, which is not conducive to boosting the company’s sales.

Why are the time-honored food brands not rivaling rising stars?

In recent years, time-honored brands in the food industry have gradually stepped into the abyss abandoned by the times. They have closed down, their performance has fallen sharply, they have suffered losses, and have been complained. Many time-honored brands are facing growth difficulties, which makes people embarrassed.

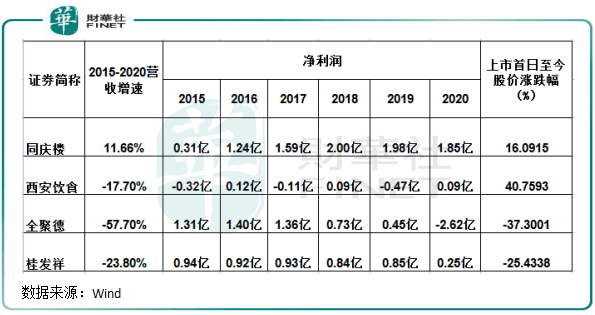

In addition to the growth quagmire of Wufangzhai, the four food-related old brands of Quanjude (002186.SZ), Tongqing Building (605108.SH), Xi’an Food (000721.SZ), and Gui Faxiang (002820.SZ), which are listed on the market, have also encountered Various problems, including performance decline or loss, stock price slump, and transformation difficulties.

As can be seen from the above figure, from 2015 to 2020, only Tongqing Building has achieved revenue growth for the four time-honored listed companies in the food sector, while the revenue of the remaining three companies has declined to varying degrees. In terms of net profit, Xi’an Catering has suffered losses for many years. Quanjude will turn from a profit to a loss of 265 million in 2020, and the net profit of Tongqinglou and Gui Faxiang will decline.

Since the listing of Quanjude and Gui Faxiang, the share prices have both fallen below the issue price, with a cumulative decline of more than 20%. Tongqinglou and Xi’an Food have double-digit growth.

Compared with KFC, Haidilao (06862.HK), Jiumaojiu (09922.HK), Xiabuxiabu (00520.HK) and other emerging catering brands that are rapidly expanding and gaining consumer trust, time-honored brands seem to be extra lonely.

The success of these emerging catering brands have many things in common, such as:

- Actively embrace online, successfully use online to narrow the distance with consumers, and enhance operational efficiency through the Internet, save consumers time, and obtain more traffic from it;

Almost the ultimate in innovation and service. For example, KFC is working hard on “based on China, infinite innovation” and constantly innovating, while Haidilao has won the meticulous service and supply chain system;

Be good at grasping the stomachs of young people and their yearning for “beauty”. Take Nayuki’s tea, which will be listed on the Hong Kong stock market as an example. Nayuki’s tea is high-end freshly made tea, which integrates fashion, culture, and Social and delicious are all in one. In just 6 years, shops have blossomed all over the country, with annual revenue exceeding 3 billion, leaving Wufangzhai and the above four time-honored brands behind in 2020 revenue.

Obviously, time-honored brands lag far behind emerging brands in these aspects. In terms of products, brands, diversification, and overall operations, many time-honored brands have fallen behind the times. Relying solely on the traditional feelings of authenticity, authenticity, and service to consumers to achieve sustainable development is obviously out of date.

Wufangzhai has also seen this. In recent years, he has also been actively embracing new consumption in the new era, striving to become an Internet celebrity in the field of e-commerce. The online sales network has covered major e-commerce companies such as Tmall, JD.com, and Douyin. The platform tries to promote the brand to be younger and more fashionable. In addition, the company has also tried to develop high-end, healthy and light food products in recent years, and built the Wufangzhai Digital Industry Smart Park to explore the digital industry.

Whether Wufangzhai can usher in the second spring remains to be verified.

Author: Yuanyuan

Author: Yuanyuan

Edit: lala

You must log in to post a comment.