Two years ago, I wrote about the company Zhangtongjiayuan. They are homegrown and cultivated and claim to be the industry leader. Home Education is actually an industry where a complete set of equipment such as cameras and access cards are installed in kindergartens. Parents can pay to watch their children’s performance in the kindergarten (camera live broadcast).

This kind of equipment is sold well in first- and second-tier cities with large floating populations, as well as kindergartens in areas where the parents work. For one or two hundred yuan, you can remotely see children frolicking, eating and playing in the kindergarten. This is actually a typical scene where technological advancement benefits ordinary workers. It is a very good thing.

It is said that the industry is very good, and the room for growth is large enough, but when it comes to the company Zhangtongjiayuan, it is a bit weird.

As early as August 2018, I wrote an article “Thousands of Parents of Pre-paid Parents of Zhangtong Jiayuan’s “Forced Demolition” of Agents”. In Sichuan, Chongqing and other places, after disputes between Zhangtong Jiayuan and agents, I jumped The agent directly contacted the kindergarten and used “delete data” to coerce users to pay in advance. At that time, there were thousands of parents of young children involved.

Later, I heard that Zhangtong Jiayuan sued the agent Xia at the time, claiming that it spread false information and harmed the company’s reputation. However, I did not find the judgment of the case on the trial documents website, so the two parties should have settled it in private. But how the affected parents resolved it, and I didn’t find any public information online, I don’t know.

All disputes are actually explained from the perspective of “replenishing liquidity”, which may be better understood.

Recently, Zhangtongjiayuan (Shenzhou Eagle is its company name and Zhangtong is the name of its main product) has been tossing its own agents. Heiqishi has received a copy of the April channel policy of Zhangtongjiayuan. The whole plan has two main points: 1 , All agents need to pay a deposit, according to the difference in market fat and thin, the amount of the deposit ranges from 20,000 to 50,000; 2. Break the market segmentation and set up a “partner agent”. The partner agent can develop users all over the country. Restricted by the original agent, the follow-up service is still borne by the original agent.

In response to this policy, the agent’s original words were “fried the pot.”

The agent insider interviewed by Hekist said that this should be due to the company’s financial pressure, and it is trying to draw blood from the agent to supplement its liquidity. Next, Hakist will review this case, which can help readers understand the real business logic.

It’s been nine years since I got VC investment, the capital story can’t go

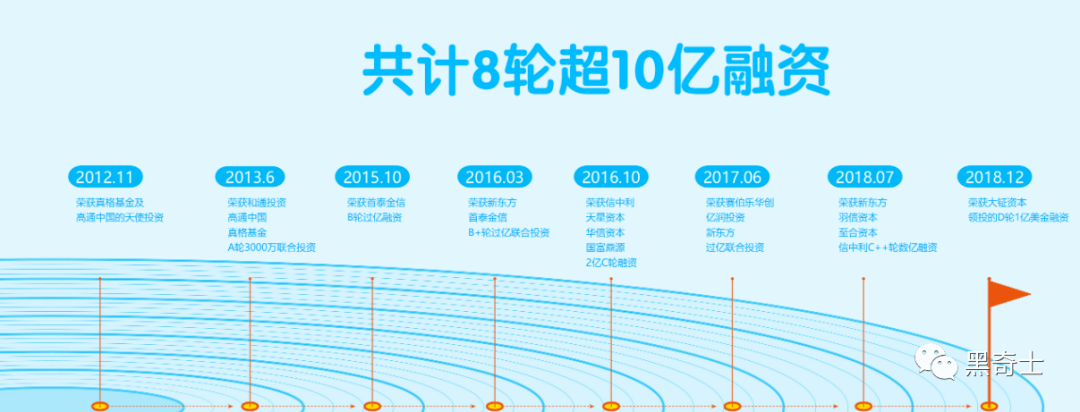

According to the information on its official website, Shenzhou Eagle was established in January 2011 and received angel investment from Zhen Fund and Qualcomm China in December of the following year. In June of the third year, it received a round of financing of 30 million yuan from Hetong Investment, Zhenge and Qualcomm.

Until this time, the company’s main product “Zhangtongjiayuan” was still not online.

Before the product went public, it received a huge amount of financing of more than 30 million yuan from a well-known VC. I have to say that the entrepreneurial story of Shenzhou Eagle has made a good start, but no one knows what the end of the story looks like.

It’s April 2021. I really want to ask Zhenge and Qualcomm, who voted for his angel round and A round, and can’t withdraw after nine years of investment. What kind of experience is it?

In terms of capital operation, Shenzhou Eagle is really a master. Since 2012, it has raised 8 rounds and raised more than 1 billion yuan. The ABCD round, the letters are almost used up by him…have not been listed yet, so I can’t start the Sun Hongbin round.

Capital telling stories is nothing more than a few tricks: Before the B round, talk about how big the market space is, how the company has the advantages of technology and talents, and how high the realization efficiency is. After the C round, you have to prepare to go public and expose the financial statements. Generally, companies with flaws in their business models or teams will be planted at this node.

Calculated by one letter in each round, Shenzhou Eagle’s financing has reached the G round, which is the Dazheng Capital in December 2018, which raised 100 million US dollars. (Of course the official announcement is D round, he actually has C round, C+ round and C++ round, hahaha, capitalist’s alphabet game)

It is worth mentioning that Dazheng Capital is also the largest institutional shareholder of Ruixing Coffee. (Everyone knows Luckin’s financial fraud, hehe)

Equity crowdfunding, performance gambling, Zhangtongjiayuan’s cash flow is not abundant

In June 2018, “China Business News” published an in-depth article about Zhangtongjiayuan’s flashing and moving technique in two financings in June 2017 and July 2018. (The link is here: https://www.chinaz.com/news/2018/0611/900484.shtml)

In June 2017, China Eagle finalized a C+ round of financing that was said to be over 100 million yuan. Investors included Shenzhen Cyberspace Huachuang Investment Co., Ltd. According to its equity filing information, Cyberspace Huachuang Investment Zhangtongjiayuan invested in shares in the form of a fund and established Shenzhen Qianhai Saida Investment Partnership (Limited Partnership) (hereinafter referred to as “Saidah Partnership”) for this purpose.

The funds for the fund of Seda Partners’ investment in Shenzhou Eagle come from equity crowdfunding, and Chuangfuzhi, as the lead investor, released the Zhangtongjiayuan equity financing project on the Zhongtoubang platform.

It is reported that the equity crowdfunding project actually signed performance gambling and equity repurchase terms with investors. Zhangtongjiayuan promises that if the company does not complete the listing before the end of 2018 (the market value before financing is not less than 1.68 billion yuan, and the financing amount is not less than 100 million yuan, it will be listed on the Shanghai Stock Exchange, Shenzhen Stock Exchange, GEM, NASDAQ Stock Exchange, Hong Kong Stock Exchange or New Third Board listing), its founding shareholders will repurchase equity investments at a compound annual rate of return of 15%.

To put it in human terms: In the June 2017 round of financing, the part of Cyberspace Huachuang has a gambling clause. If the listing is not completed at the end of the year, the founding shareholders of Zhangtongjiayuan need to add 15% interest to repurchase these shares.

Based on this calculation, there should be similar terms for the funds invested by the remaining shareholders, except that this part of the crowdfunding website is open to the public to raise funds.

It is precisely because of the existence of the gambling clause that there is huge pressure on the cash flow of the company, so Zhangtongjiayuan had to take the big money in December 2018 (remember this time, you need to pay back the money in June 2017) Capital’s $100 million Series D financing.

What if profit is hopeless, no one listens to storytelling, and can’t be marketed?

I have counted all the media reports since the establishment of Shenzhou Eagle, and none of them mentioned his profitability. This is an example for a “unicorn company” that has been established for ten years and has obtained well-known venture capital for nine years. Very unusual thing.

Only in the equity crowdfunding in June 2017, Zhangtongjiayuan ever disclosed its profitability. According to the information disclosed by the equity crowdfunding project, from 2014 to 2016, Zhangtongjiayuan lost 10.54 million yuan, 22.71 million yuan, and 48.23 million yuan respectively.

At this point, I manually calculated the amount of financing of Zhangtongjiayuan over the years, and found a very interesting thing: according to the algorithm of “over 100 million is calculated as 100 million, hundreds of millions is calculated as 300 million”, his total financing has reached 15.34. 100 million yuan, and only “over 1 billion” is written on the website. This is obviously too much bragging in the past few rounds of financing to tell the story.

According to the operating rules of general enterprises, if there is no major change in their profit model, there will be no big difference in their profit. In 2016, Zhangtong Jiayuan has been established for the sixth year, and its market share and competitiveness will not change significantly. Calculated based on the loss of that year of 48.23 million yuan, its cumulative loss will be at least 200 million yuan from 2017 to 2020. More than RMB (actually, as the scale of the enterprise expands, the amount of loss will often increase).

For the US$100 million of Dazheng Capital, after removing the money from the two rounds of financing and gambling in June 2017 and July 2018, there may only be God knows how much money will be left after two years.

With so much financing, it has not been able to go public for a long time.

In December 2018, Zhangtongjiayuan, which received a financing of US$100 million, once stated to the media with confidence that “within two years, it will be listed overseas.”

It is April 2021, and this “two-year agreement” is obviously not fulfilled.

Continue to want to go public, continue to toss money

Shenzhou Eagle is indeed working hard to promote the listing plan.

In September 2020, the relevant departments of Fujian Province issued a “List of Key Listed Reserve Companies in Fujian Province in 2020”, among which Zhangtongjiayuan was listed.

It seems that the so-called “overseas listing” is actually a fake shot, and the real purpose is to list in A shares.

However, there are more than 300 companies on this list. The A-share market cannot accommodate so many Fujian companies in a short period of time. Therefore, the listing of Zhangtongjiayuan still needs to wait.

At least it is impossible to go on the market within 6 months to 1 year.

During this time of waiting, continuing to “make money” is the biggest event in the palm of the home.

So in April, Zhangtongjiayuan came up with such a channel reorganization plan to “make money”:

Let me translate for you:

- All agents must pay, a deposit of 50,000 for a new area (county), 20,000 for the original county, and 10,000 for halfway withdrawal. According to the coverage rate stated on its official website, in 2408 counties, a deposit of 120 million will be collected.

In addition to local agents, there are also so-called “promotion partners”. When a partner signs a contract, he will pay 20,000 yuan, and withdraw 10,000 yuan. This money is in addition to 120 million yuan. It can fool a partner to join. There are 20,000 yuan. (This policy is obviously aimed at certain people with “backstage”. If I have a sister-in-law who runs a kindergarten, but I am not an agent, what should I do if I want to make money? If I pay 20,000 yuan to join this partner, I will continue to receive energy from Zhangtongjiayuan takes money)

However, this policy seriously harmed the interests of the principal and agents. At present, most of the principals and agents in this market are locals. They belong to the kind of “you can’t run to the temple even if you run away from the monk”. If there is a problem in the process of using Palm Communication, the first thing that parents face is The principal of the kindergarten, followed by the local agents, are responsible for solving the problem immediately, whether it is a software problem or a hardware problem.

And this “promotion partner” directly signed a contract with the headquarters, and the money went to him, but the dean and the agent were left to solve the problem. They belong to the kind of “monks who can run freely”. When something goes wrong, the user is looking for a temple that can’t run away—that is, kindergarten. This invisibly magnifies the risk that the kindergarten takes (for example, when a child has a problem in the kindergarten, is the headquarters or your kindergarten anxious?)

Regarding the risks brought about by this channel policy, all agents understood. Some agents said, “Don’t sign the contract. He’s got a wave of capital in his hand to the homeland. If he doesn’t have any money, he will come to us.”

Agent turbulence cannot affect the interests of users

All in all, it’s all for profit, all for money.

However, as an important part of the home-education market, agents bear the important responsibility of linking the kindergarten users with the Zhangtongjiayuan company.

Once the agents are in turmoil, there may be an adverse event of June 2018 where agents and Zhangtongjiayuan grabbed users from each other and used “delete data” to coerce users to pay.

I hope that this turmoil can also be passed safely, and not “the gods fight, and the users suffer.”

References for this article:

The financing game of “Zhangtongjiayuan” from the beginning: equity crowdfunding, related operation, performance gambling

https://www.chinaz.com/news/2018/0611/900484.shtml

You must log in to post a comment.