Author: Alicia McElhaney

Compiler: ziyiZ

Source: InstitutionalInvestor

Source: GPLP Rhino Finance (ID: gplpcn)

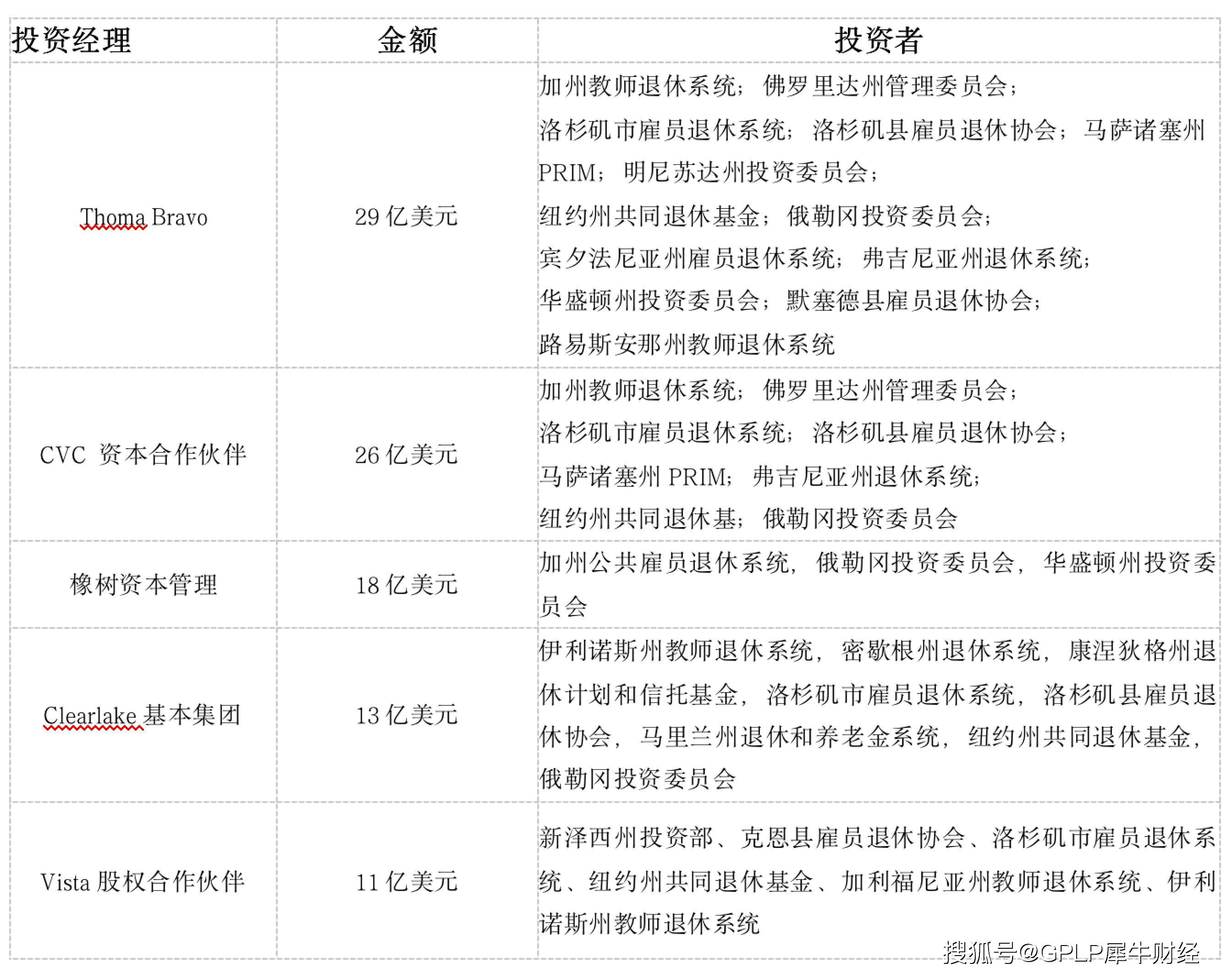

Among the companies that pension funds will allocate funds to private equity companies in 2020, Thoma Bravo, which focuses on software and technology, is the most popular. According to new data, in terms of private equity investment, pension funds will invest the most in Thoma Bravo in 2020 , Followed by CVC Capital.

According to a report commissioned by Vidrio Financial, an alternative investment technology provider, in 2019, the California State Teachers’ Retirement System, the Florida State Board of Administration and the Massachusetts PRIM The 13 public pension funds in China have allocated a total of US$2.9 billion to the three Thoma Bravo funds.

As of March 31, 2021, Thoma Bravo manages $78 billion in assets.

In this regard, Vidrio founder and CEO Mazen Jabban said: “2020 brings new challenges, and allocators are looking for new options to cope with continued market volatility, cost pressures and diversification of alternative asset investments.”

The report stated that in 2019, investors allocated $103 billion in alternative investments among 600 different commissions. Most of the funding came from the second half of the year, after the worst economic slowdown.

CVC Capital Partners’ private equity fund ranked second in the survey, receiving $2.6 billion in funding from eight pension funds.

Among them, Oaktree Capital Management (Oaktree Capital Management) ranked third, invested 1.8 billion US dollars in three funds; Clearlake Capital ranked fourth, invested 1.3 billion US dollars in eight funds.

Vista Equity Partners received $1.1 billion from investors, and these funds flowed into six funds.

Overall, the surveyed pension funds invested US$46 billion in private equity investments in 2020. Among the funds included in the data set, CalSTRS had the highest allocation of private equity investments last year, reaching $31 billion.

Asset allocation reflects changes in the fortunes of companies under the lockdown

The investment of distributors reflects the impact of the big trend on the economy and emerging industries. People work from home, avoid travel and go to entertainment venues.

Vidrio found that “the role of the big trend in strategic choices cannot be ignored, because as consumers have delivered basic goods such as groceries to their homes, real estate managers have seen the attractiveness of unique logistics funds. It turns out that real estate investment trusts (Reit) Grocery store investment is as popular as laboratory real estate, as is investment in streaming entertainment service studio space.”

Vidrio also assessed the real estate, private business, and hedge fund companies with the highest commitments in 2020. The results show that pension funds allocated a total of 28 billion US dollars in physical assets in 2020, of which Stonepeak Infrastructure Partners received a maximum of 1.5 billion in five pension funds. The configuration of the dollar. PGIM received $1.2 billion from two pension funds-Massa Reserve PRIM and New York State Common Retirement Fund.

Private debt-20 billion U.S. dollars in capital inflow in 2020 is one of the areas that has boomed in recent years.

The report said: “Credit investment in private institutions is not suitable for those who cannot afford some lack of liquidity.” “People must be willing to bet and allow it to change within 5 to 10 years.”

In 2020, Ares Management received the highest private credit grant of $1.3 billion from the Alaska Permanent Fund, the Texas County and Territory Retirement System, and the Virginia Retirement System.

According to the report, although hedge funds have gone through a difficult few years, they have “made a comeback” with newly authorized investments of US$9 billion. The ever-popular Bridgewater Associates received the highest grant this year.

$900 million from the Oregon Investment Council. The fund is the highest allocator of hedge funds in 2020, injecting a total of US$1.4 billion into Bridgewater, quantitative fund management companies FORT and GMO.

Jabban said that Vidrio “saw many hedge fund managers entering the private investment field. On the contrary, there are also precedents for listing after investing in private fund managers.” He expects this trend to continue to move forward.

He said: “The convergence of public and private investment will pose challenges for operational due diligence and risk management, and changes need to be made so that organizations can control new opportunities and avoid falling into endless data and technical challenges.”

The most popular private equity company based on pension fund data

(The top five investment managers based on the amount of increase in 2020)

You must log in to post a comment.