As we all know, Jack Ma is an outstanding entrepreneur. It took more than 10 years to build Alibaba’s huge business empire, making “there is no hard business in the world” a reality, and now it took another 6 years to pass Huabei and Bibai has helped hundreds of millions of users solve the financial dilemma, making it possible that “there is no hard-to-borrow money in the world”.

As an old rival, Ma Huateng, seeing Ma Yun’s success in Internet finance, he was naturally unwilling to lag behind. In the same year that Ma Yun launched Huabaiboraibai on Alipay, he launched the WeChat version of “boraibai”-particles on WeChat. loan. Nowadays, many WeChat users have opened the micro-daily, enjoying the convenience of micro-daily. Compared with borrowing, the microfinance loan can obtain a higher amount and the installment time is longer.

Although Weixindai is easy to use, it is beyond reach for most WeChat users. This is because Weixindai uses a whitelist invitation system, and only WeChat users who have received the invitation are eligible to activate it. Regrettably, there are only tens of millions of users with invitation quota, which is really pitiful compared to the 1.2 billion people on WeChat.

However, I want to tell you a good news. Even if you have not received the invitation of Moto Loan, you can still enjoy the loan service in WeChat. Because the new function of WeChat is online, you can easily get 20,000 yuan without Moto Loan. Blessed are those who borrowed money. Below is a summary of the applications for borrowing money in WeChat.

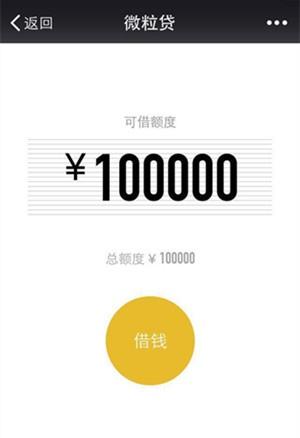

First, micro-finance loans. This is an official WeChat loan application, and it is a loan product of Tencent WeBank. However, it has higher requirements for users. Users who need to receive official invitations can be activated. You cannot apply for it yourself.

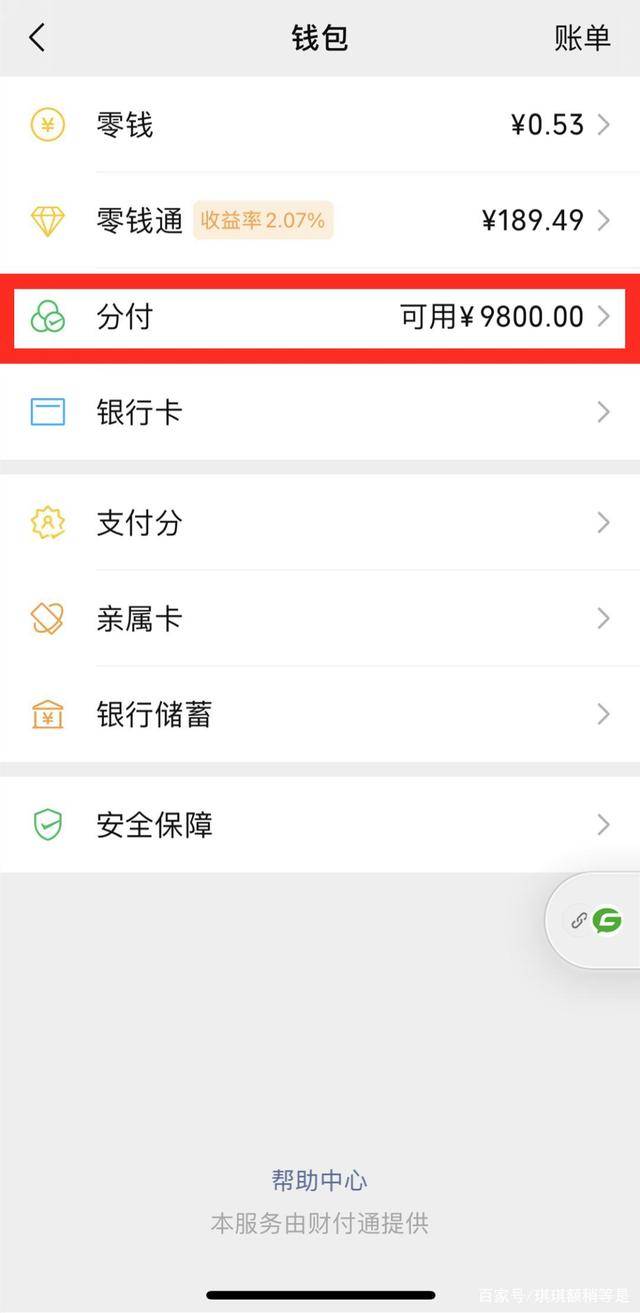

Second, pay separately. This is also the official credit product of WeChat, known as the WeChat version of Huabei. In the future, when using WeChat Pay, you may be able to use “individual payment” to pay first, and then extend the payment within the billing period or pay the bill in installments.

Third, sesame has rice. It is an Internet loan service launched on the WeChat public platform. The function is the same as that of Micro Loan, but the advantages are obvious. No invitation is required. After paying attention, you can get a good amount after opening. Generally, you can get more than 20,000 for the first time, and the credit is very good. If it is 100,000, it is very possible, and it also supports installment, up to 12 installments, up to 200,000, which is very friendly to users who need turnover.

Distributed payment is a new feature of WeChat. It is a credit payment product. Like Huabei, it supports payment after payment. Red envelopes and transfers are not available for the time being. WeChat orders that there is no interest-free period, and interest is calculated on a daily basis, and the amount of the loan is repaid. The amount is comprehensively evaluated by the system. The repayment situation will affect the WeChat payment points.

Many users have heard of split payment, but do not know where to activate, then you can follow the steps below to check.

Step 1: After opening My WeChat, click “I”, “Pay” and “Wallet” in turn, and then you can see the “Payment” icon on the wallet page, just above the bank card.

Step 2: Click on this icon. If it is approved, the quota will be given to you. If it is not approved, the following picture will be displayed.

If it is activated, it is naturally a very happy thing. It can be used when the capital turnover is required, but it does not matter if it is not activated. Maintain good credit and use WeChat more. You can also activate it.

So, is your split payment activated? What’s the quota? Welcome to share.

You must log in to post a comment.