“Technology is the only force that can subvert the business model of commercial banks.” Tian Huiyu, President of China Merchants Bank, engraved this statement in the 2019 China Merchants Bank’s annual report, and it has been shining.

Tian Huiyu attaches great importance to the development of financial technology. In the more than 2,000 words of the “President’s Address” in the China Merchants Bank’s 2019 annual report, he mentioned a total of 6 “technology”, 9 “transformation”, and 14 “digitalization”.

Since taking office in 2013, Tian Huiyu has been pushing China Merchants Bank to “run wildly” on the road of technology.

“We have made a clear-cut proposal to build a financial technology bank, and take the exploration of digital business models as the main direction of the second half of the transformation.” Tian Huiyu said in the 2019 annual report.

Thanks to the efforts of Tian Huiyu and other people from China Merchants Bank, China Merchants Bank’s “technological strength” has been at the forefront of the industry.

- At the end of 2019, CMB’s investment in information technology was 9.361 billion yuan, an increase of 43.97% year-on-year, which was 3.72% of the company’s operating income; in 2020, CMB’s investment in information technology reached 12 billion yuan

- In December 2020, China Merchants Bank and JD.com jointly won the second direct banking license in China. China Merchants Topology Bank will fully adopt an online business model and explore new forms of banking in the future

- As of January 10, 2021, the CMB App has accumulated 145 million users and 60.25 million monthly active users

The emergence of the epidemic will bring more complicated situations and tests to banks in 2020, and China Merchants Bank’s performance last year was relatively stable. According to the performance bulletin published on January 14, China Merchants Bank achieved operating income of 290.508 billion yuan in 2020, an increase of 20.805 billion yuan, or 7.71%, over the same period last year.

Recently, Tian Huiyu also said in an interview with a reporter from the Financial Times that the epidemic has isolated physical contact between people, but thanks to a higher level of digital service system, the relationship between China Merchants Bank and its customers has become closer. It also strengthened China Merchants Bank’s determination to promote digital transformation.

Create “Digital Merchants Bank”

Create “Digital Merchants Bank”

China Merchants Bank, founded in 1987 and headquartered in Shenzhen, China, is the first joint-stock commercial bank in China that is wholly owned by a corporate legal person.

China Merchants Bank adheres to the strategic direction of “light banking” and the strategic positioning of “one body and two wings”.

“Light Bank” The strategic direction of China Merchants Bank requires light management, light assets, light business model, etc. For example, light management refers to a light organization structure, which is manifested in the head office and branches going hand in hand; light asset refers to less asset consumption and more controllable risks. At present, China Merchants Bank and ICBC have joined the ranks of light banks. In its annual report, China Merchants Bank pointed out that it is necessary to closely focus on the transformation direction of “light banking” and strive to achieve a breakthrough in the qualitative change of financial technology banks.

At the same time, China Merchants Bank also insisted “One body and two wings” Strategic positioning, Retail “One” takes MAU as “North Star” (North Star is the most important direction, and all indicators serve this indicator) , Wholesale “Two Wings” take specialization as the direction, focus on building wholesale business systemization capabilities, and accelerate the advancement of digital transformation.

With MAU as the most important indicator, the number of APP users of China Merchants Bank continues to rise. At the end of 2019, the cumulative number of CMB App users exceeded 100 million; in mid-2020, the cumulative number of CMB App users reached 129 million; as of January 10, 2021, the cumulative number of CMB App users had reached 145 million. The number of active users is 60.25 million.

China Merchants Bank also directly pointed out that it must pass Benchmarking financial technology companies , Vigorously carry out the construction of financial technology banks, use financial technology as the nuclear power of transformation and development, and fully empower business development .

Currently, China Merchants Bank has built three software centers in Shenzhen, Hangzhou, and Chengdu, and two data centers in Shenzhen and Shanghai to support the business development of the entire bank.

China Merchants Bank’s “AI Actual Combat”

Digital risk control

China Merchants Bank’s intelligent risk control platform “Libra System” covers online and offline transaction channels, and can intercept telecom fraud in real time.

As of the end of 2019, the “Libra System” can intercept suspected fraudulent transactions within 30 milliseconds, reduce the proportion of counterfeit and embezzled amounts of non-cardholders to five ten million, and help customers intercept 27,900 telecommunications fraud transactions. The interception amounted to 493 million yuan, which provided a strong guarantee for the safety of customer funds.

As of mid-2020, China Merchants Bank has reached 75.60% of the early warning accuracy of potential risky corporate customers; it has helped customers intercept 80,000 telecommunications fraud transactions, with an intercepted amount of more than 1.8 billion yuan, which provides a strong guarantee for the safety of customer funds.

Now, the intelligent risk control platform “Libra System” can intercept most suspected fraudulent transactions within 20 milliseconds, reducing the proportion of counterfeit and embezzled amounts by non-cardholders to six ten millionths.

In addition, in terms of external cooperation, China Merchants Bank is also actively cooperating with digital technology companies such as Huawei, Tencent, and Suoxinda.

According to an article published on Huawei’s official website in 2018, after the China Merchants Bank credit card unified risk control platform based on Huawei’s FusionInsight big data solution was launched, the number of risk cases was reduced by 50%, and the loss in half a year was reduced by more than 100 million yuan. The credit card issuance time has been reduced from about 15 days. Shorten it to 5 minutes.

In November 2017, Tencent and China Merchants Bank formally signed a cooperation agreement to reach a cooperation in the field of financial big data anti-fraud: Tencent Financial Cloud and Tencent Security Anti-fraud Laboratory opened up anti-fraud capabilities to China Merchants Bank through AI technology to help China Merchants Bank Better identify fraud in financial services and jointly build a financial security ecosystem.

According to news in April 2020, Tencent and China Merchants Bank jointly launched the “Lingshield Plan” to create a new model of anti-fraud through technology.

Digital marketing

In the field of intelligent marketing, the characteristics of China Merchants Bank are personalized recommendation, precise identification and electronic channel construction.

Beginning in 2015, China Merchants Bank has cooperated with Suoxinda Holdings, a global financial AI big data and integrated intelligent marketing solution manufacturer, from the customer group marketing stage 1.0, to the personalized marketing stage 2.0, to the real-time marketing 3.0 stage, to AI Marketing 4.0 stage, comprehensively build China Merchants Bank’s leading digital smart marketing system. It is reported that through the generation of 1,726 customer portrait tags for retail customers, the number of marketing customer contacts has increased by 6.56 times, the marketing success rate has reached 17.42%, and the personalized recommendation of “thousands of people” has begun.

Digital Customer Service

In 2016, under the technological wave of AI + big data, China Merchants Bank’s credit card service started the application of intelligent services with the palm life app as the core, from AR customer service, to AI-core intelligent customer service, and then to small recruitment assistants. Every new technology exploration and application has brought users a better interactive experience, and has become a more personalized and portable intelligent assistant for users step by step.

At present, the “Xiao Zhao Miao Smart Assistant” launched by CMB Credit Card on the Pocket Life App uses AI technologies such as voice conversion and semantic recognition to perform intelligent intent analysis of natural language, making the service “visible” and “heard” “. At the same time, the intelligent voice navigation function is implanted in the telephone voice IVR, the recognition accuracy rate reaches 94%, and the interaction volume is nearly 80,000. In addition to voice recognition technology, face recognition has also been used in the image, which greatly shortens the security authentication time.

In 2020, an interim report issued by China Merchants Bank pointed out that the automatic response accuracy rate of China Merchants Bank’s intelligent customer service reached 96.7%.

Digital investment advisory

In 2016, China Merchants Bank launched a robo-advisory service-“Capricorn Intelligent Investment”, which is also the first domestic commercial bank to launch robo-advisory services.

“Capricorn Smart Investment” mainly uses machine learning algorithms to incorporate more than ten years of wealth management experience of China Merchants Bank, and builds an asset allocation portfolio based on public funds, so as to achieve the purpose of diversifying investment risks with investors.

In 2018 alone, the cumulative sales scale of CMB Capricorn Smart Investment reached 12.233 billion.

Digital Middle Office

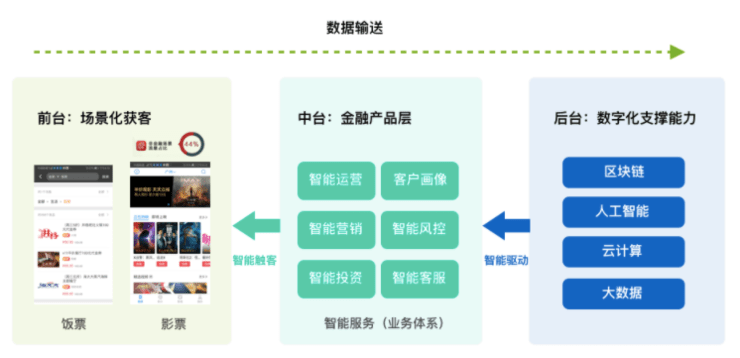

In the 2019 annual report, China Merchants Bank pointed out that it will build a unified digital middle-station for enterprises-China Merchants Bank’s open platform, explore the transformation of business models supported by standardized and modular services, and quickly respond to customer needs.

Prior to this, Leifeng.com (Public Account: Leifeng.com) had reported on China Merchants Bank’s data center in detail. For example, China Merchants Bank has built a middle-office system for customer acquisition and operation across the entire chain, such as the Rubik’s Cube activity operating platform and the red envelope platform. Like the Rubik’s Cube event platform, branches can quickly configure an online event within 5 minutes and reach target users through the China Merchants Bank App.

China Merchants Bank also proposed Strengthen the construction of data center and promote data connection. Strengthen data governance, improve the convenience and ease of use of data, build a data application tool platform, and lower the threshold of data application. Promote the integration and opening of the system, open up the work flow and information flow of each system, and realize one entrance to the whole line. Decoupling the system with open thinking, micro-service and productization of functional modules, Precipitate various general capabilities as the middle stage of the system.

The 2020 Interim Report of China Merchants Bank pointed out that China Merchants Bank will accelerate the iterative development of its customer relationship management system (CRM), and use the CRM system as a medium- and Taiwan-based capability precipitation carrier to form a customer information center, information case center, business processing center, marketing support center and a series of scenarios. Five core functions such as the team building center.

The CRM4.0 system is a key platform for the transformation of the “China Merchants Bank” financial business model. It is a smart marketing platform and a digital operation platform based on the business system, as well as a customer service system and a customer manager management system platform.

smart robot

China Merchants Bank relies on big data and artificial intelligence to create intelligent service robots, traffic distribution decision-making robots, intelligent agent assistant robots, service analysis robots, quality inspection robots, etc., covering user insights, traffic distribution, service interaction, demand re-excavation, management improvement, etc. Five modules, and moved the call center to the Pocket Life App to provide users with audio-visual multimedia interactive services, which has achieved the upgrade of service efficiency and user experience.

In June 2020, Tian Huiyu pointed out that China Merchants Bank relies on big data and artificial intelligence to create a large number of intelligent service robots. The cost of robots used for retail credit collection is 1/10 of labor, and the output is 9 times that of labor. The above is to increase production capacity.

RPA (Robot Process Automation)

As of October 2020, the financial industry accounted for the highest proportion of domestic RPA companies at 54.55%, of which 77.78% of financial institutions are banks. Among them, Shanghai Pudong Development Bank and China Merchants Bank were the first banks to use RPA. They were the first to introduce RPA technology in the domestic financial industry in 2016 and 2017, respectively, in order to improve the level of operation automation. The effect is very impressive.

In December 2018, China Merchants Bank used intelligent robots to participate in business processing in the new version of its online custody banking system, which was the first to realize the application of RPA technology in the asset custody field.

In 2020, China Merchants Bank has innovatively integrated the RPA shared pool technology on the basis of the original CBS7.0 platform, and launched CBS-RPA, which can quickly help companies build a complete treasury management system, build a comprehensive treasury management system, and solve treasury management Problems and perplexities. The product became very popular after it was launched, and it has been successfully launched in nearly ten large group companies across the country within only half a year of its launch.

In the 2020 interim report, China Merchants Bank pointed out that it applied RPA, OCR and NLP (natural language processing) and other financial technology technologies in 24 middle and back-office scenarios including verification, entry, and consulting. During the reporting period, the number of alternative businesses reached 11.64 million. .

Tian Huiyu, President of China Merchants Bank, said: RPA uses machines to replace simple outsourcing, which saves a lot of costs.

cloud computing

At the end of 2019, the total number of X86 server deployments of China Merchants Bank increased by 60.67% year-on-year. The new generation of PaaS (Platform as a Service) platform expanded its use, and the proportion of the bank’s applications on the cloud reached 44%.

At the same time, China Merchants Bank continues to enhance its open banking capabilities. The “Open API Platform” for unified external services across the bank supports the safe and fast output of APIs, serving financial payment, AI, smart parking, smart medical and other scenarios, and empowering 629 cooperative enterprises. In terms of big data + AI, the big data cloud platform was upgraded, the overall capacity of the data lake was increased to 9.8PB, and the data entering the lake increased by 68% year-on-year.

Based on the integration of internal and external data, China Merchants Bank has increased the research and application of AI technology, built three AI cloud services of intelligent customer service, risk public opinion, and computer vision, and launched three major AI solutions for knowledge management, digital marketing, and risk management to support business The development of intelligence.

The 2020 mid-term report pointed out that China Merchants Bank will establish a large-scale digital infrastructure based on cloud computing technology, promote the construction of a native cloud that is more convenient for rapid construction, expansion, openness and iteration of systems and applications, and support the safe access of new applications from the head office and branches to the cloud .

As of mid-2020, China Merchants Bank has 4,015 native cloud servers, an increase of 100% over the end of the previous year; the scale of native cloud storage is 29.18PB, an increase of 92% over the end of the previous year; the number of native cloud containers is 69,080, an increase of 121% over the end of the previous year.

database

On November 27, 2017, China Merchants Bank and Huawei established a joint innovation laboratory for distributed databases to jointly develop independent and controllable financial-grade distributed database products.

In this joint creation project, China Merchants Bank mainly does three things: first, to provide advanced financial business scenarios; second, based on so many years of advanced experience in database use and operation and maintenance of China Merchants Bank, it proposes a solution for the joint creation of distributed databases. Specific requirements; third, for the key components of the Lianchuang database, such as the kernel and high-availability architecture, deeply participate in the entire link from design, coding, testing to final production. Huawei, on the other hand, has a large amount of technology accumulation in the database field, and is mainly responsible for the realization of product development and the promotion of future marketization.

After initial contact and cooperation, China Merchants Bank and Huawei conducted a pilot database application in 2018.

In the 2019 annual report, China Merchants Bank pointed out the establishment of the Kunpeng Computing Joint Innovation Laboratory and the Load Balancing Joint Innovation Laboratory to accelerate the implementation of the research results of the distributed database joint innovation laboratory.

Biometrics

As the leading brand of commercial banks, China Merchants Bank focuses on internal risk control and payment security, combined with cutting-edge technologies such as big data, cloud computing, and artificial intelligence, and continuously upgrades the risk control system, creates smart risk control, and creates convenience and efficiency for consumers. Safe and assured customer experience.

In order to strengthen the bank’s internal security management, increase the efficiency of the banking system’s authorization, and enhance the counter business risk prevention capabilities, China Merchants Bank introduced the fingerprint recognition algorithm and smart terminals of Eyes Technology as early as 2009, which were applied to the counters and smart branches of China Merchants Bank. And in mobile marketing, it has realized intelligent risk control and cost reduction and efficiency enhancement, helping China Merchants Bank to provide consumers with intelligent, convenient and safe financial services with user experience as the core, and add to the good life of users.

Blockchain

As early as 2018, China Merchants Bank issued the country’s first financial industry blockchain electronic invoice.

At the end of 2019, China Merchants Bank improved and developed the standard branch chain and BaaS (blockchain as a service) platform ecology, with a total of 25 applications.

In the 2020 mid-term report, China Merchants Bank pointed out that it is improving and developing the open permission chain and blockchain as a service (BaaS) platform. It has been developing the continuous application of blockchain and business integration in scenarios such as supply chain finance and merchant fund clearing. explore.

Online payment

In the 2019 annual report, China Merchants Bank pointed out that it will realize ecological operation with the industrial Internet as the key link. Focusing on the three major directions of account and payment system digitization, digital financing, and financial technology capability output, the industry chain is opened up, and the unified payment and settlement system is innovated to realize the collection and settlement function and the internal account settlement mode of the B2B platform.

At the end of 2019, China Merchants Bank’s comprehensive settlement solution “Cloud Bills” has provided services to 5,766 corporate customers, with a transaction volume of 287.271 billion yuan; the aggregate collection business focuses on insurance, medicine, education, and FMCG four scenarios, and the number of transactions Reached 502 million transactions, with a transaction value of 146.647 billion yuan, a year-on-year increase of 267.51%.

The “Three Times” of China Merchants Bank

China Merchants Bank started from Shekou, Shenzhen, and has been crowned as the “King of Retailing” in the banking industry for 40 years of ups and downs. Along the way, it is inseparable from the three presidents’ keen insight into market changes and their strong courage to actively reform.

Wang Shizhen He was the first president of China Merchants Bank and served for 14 years. Under his leadership, China Merchants Bank evolved from a wholly-owned bank of China Merchants into a standard joint-stock commercial bank, and gradually got rid of the restrictions of regional banks, and basically formed a national commercial bank. Pattern.

Wang Shizhen and other leaders also made the decision to quickly establish a computer system for China Merchants Bank, and set a clear mid-term goal: to complete the computerization of basic business processing within three years, and to complete the computerization of all business processing within five years. This has laid a good foundation for China Merchants Bank to carry out digital transformation in the future.

Year 1999, Ma Weihua He took over as the president of China Merchants Bank and fully started the construction of China Merchants Bank’s online banking after taking office, becoming the first commercial bank in China with online financial services. The opening of China Merchants Bank’s online banking became the starting point for its retail business.

In 2010, after realizing that the profit growth achieved by large-scale capital consumption and profit margins in the past was difficult to sustain, Ma Weihua led China Merchants Bank to implement the goals of reducing capital consumption, increasing loan pricing, and controlling financial costs. “Secondary transformation”. Like Wang Shizhen, Ma Weihua has also been at the helm of China Merchants Bank for 14 years.

year 2013, Tian Huiyu Taking over as the president of China Merchants Bank, China Merchants Bank has ushered in a new era in which it is fully embarking on the road of “finan-tech banking”.

Under the leadership of Tian Huiyu, China Merchants Bank proposed “mobile first” in 2015, consciously using APP as its main business position.

In 2016, China Merchants Bank mentioned fintech in its annual report for the first time, proposing that the bank’s “premature power” must be used to advance its fintech strategy, and in its 17-year report, it proposed to be a “finan-tech bank”.

Under the leadership of Tian Huiyu and other leaders of China Merchants Bank, at the end of 2019, China Merchants Bank invested 9.361 billion yuan in information technology, a year-on-year increase of 43.97%, which is 3.72% of the company’s operating income.

China Merchants Bank attaches great importance to science and technology investment, and its investment in information technology has far exceeded that of most banks over the years. Public information shows that the annual financial technology budget of China Merchants Bank is determined at 3.5% of the previous year’s revenue.

Recently, Tian Huiyu said in an interview that China Merchants Bank’s investment in information technology has reached 12 billion yuan in 2020. Based on this figure, Leifeng.com calculates that China Merchants Bank’s IT investment will account for more than 4% of the company’s operating income in 2020.

You must log in to post a comment.