Let’s take a look at the news page first

The A-share “NASDAQ” is coming!

The first batch of Double Entrepreneurship 50 ETF was launched, and the Wells Fargo CSI Technology Innovation and Entrepreneurship 50 ETF was approved for release. This means that investors can deploy high-quality leaders on the Sci-tech Innovation Board and ChiNext, because the Double Innovation 50 Index is from the Sci-tech Innovation Board and ChiNext Select 50 listed companies in emerging industries with larger market capitalizations as index samples, including constituent stocks of CATL, Yiwei Lithium Energy, Cambrian, and CICC.

In terms of major events, this week is about to usher in the Super Central Bank Week, including the Federal Reserve, the Bank of Japan, the Swiss National Bank, etc. will announce interest rate resolutions; of course, the market is most concerned about the monetary policy signals released by the Federal Reserve!

At 2 o’clock on June 17th, Beijing time, the Federal Reserve will announce the interest rate decision. Prudent investment friends can wait for their boots to land before making a choice.

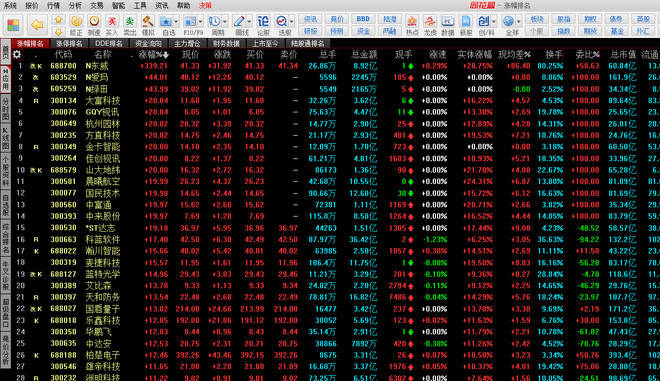

Let’s talk about the other conditions of the disk:

The index has stepped back, and there is a tendency to go down. If the volume can barely reach one trillion yuan and the transaction volume can be maintained, the market is fine. The market sentiment after the holiday was suppressed, and the link height was compressed to 2 links. The bad news affects foreign investment.

In terms of subject matter, the liquor concept, semiconductor and component sectors were active. The optical and optoelectronics sector was the top gainer. The Hongmeng concept was weaker and led the decline. The pork and three-child concepts were weaker throughout the day, and resource stocks were making up for losses.

Disassemble the subject matter of the lower board and share the opportunity to adjust the board:

By the way here: Everyone knows the recent market quotations. Not to mention that the bull market is coming, but the bull stock market is definitely coming. Therefore, the author combines the current situation and the hotspot direction,

Through various screenings, several short-term high-quality stocks were obtained. In late June, these stocks will surely be able to bring 60%-90% upside. And the sprint phase will also be around mid to late June.can

In order to say that there are not many opportunities, you can eat meat if you grasp it! The first one can be deployed in the near future. The ticket belongs to the third-generation semiconductor + SMIC + 5G + charging pile + photoresist + automotive electronics concept;

Science and technology revitalize the country, suitable for lurking investors. It is now in the early stage of the rise. Stepping back on the 5-day line is the point of opening a position. Just wait patiently for the wind to come. The focus is lurking.

Interested fans can find “ghy9496” to prepare: Fox, that’s it, everyone should remember that it is a commonly used chat software, get it! In 2021, we will turn the world together!

- The concept of Hongmeng, benign differences, cut highs and lows, there must be a compensatory rise in the back. But then the operation is more difficult, and the general rise time has passed. Runhe software is the leader of this wave, there must be repeated, appropriate T, low-suction arbitrage, should be able to eat meat.

Chips, technology stocks continue to ferment and spread. Recently, it has continued to strengthen, and some funds have increased their holdings, and many stocks have been on the rise. Rockchip, the strongest trend in the sector, accelerated its listing today. If you do the same with the trend, you can buy low if you disagree, and there is no sign of ending.

You can also go to the relatively low level by yourself. You can look at Sai Microelectronics, which is relatively low and low in price, and it is 20CM, which is in line with the speculation direction of the disk, and there are expectations behind it.

There are also organizations in Masukura that are expected to be the main source of the military industry’s abnormal changes. In the direction of 20CM, Morning Air and Xinyu Guoke both rebounded oversold. In terms of shape, Xinyu Guoke went more smoothly and the recognition of Morning Air was stronger.

In addition, lithium batteries continue to intensify differences, Yongtai Technology has made up for the decline, Tianqi Lithium once fell to the limit, China Baoan is still rising, 20CM National Technology. Participation is very difficult, and the consideration in the car gradually retreats; those who do not get in the car evade. The liquor sector has also been repaired, so I am willing to make the wine industry on the board and pay attention to the continuity of tomorrow.

It is a low tide market now, and there is a high probability that it will be adjusted for a few days, so it should not be radical. Control your position, shrink and grow!

Hot topics in the market outlook

① Huawei AR/VR

According to the news, Huawei will hold the 5G+AR Global Online+Offline Summit on June 17, uniting global operators, regulatory agencies, partners, media, analysts, etc., to promote the prosperity of the 5G+AR ecosystem.

From the disk perspective, virtual reality concept stocks are active against the trend today. The number of daily limit stocks is more than 5, and the number of stocks rising by more than 5% is more than 10. You must know the general decline in the market today. As for who the leading stock is, the market has already selected it, and the stock has gone out of two 20cm in a row.

According to IDC, a consulting agency, in 2021, global VR virtual reality products are predicted to grow by about 46.2% year-on-year, and it is predicted to maintain rapid growth in the next few years. The average annual compound growth rate from 2020 to 2024 is about 48%.

In addition, the agency believes that the inflection point of VR/AR has emerged after 5 years of technology precipitation. 10 million is an important singularity for the product to enter a new stage, and it will attract more ecological enterprises to enter to jointly enrich the ecological improvement and enrich the content, which is the beginning of the product climbing period. In the second half of 2021, global sales may reach 10 million units, which is the beginning of this singularity.

Today is strong: Jiachuang Video, GQY Video, Lante Optics, Crystal Optoelectronics, Runjian Co., Ltd., Fortune Technology, Rockchip, etc.

② Semiconductor

From the perspective of the disk, the semiconductor sector is active against the trend. Among them, the semiconductor equipment leader North China Chuang set a record high in the disk. Of course, North China Chuang can also be regarded as the leading stock in this round of semiconductor cycle. In addition to North China Chuang, today there are still many semiconductor concept stocks that have risen by more than 5%.

The semiconductor industry has entered a historic boom. Driven by digital economy smart applications such as automobiles, servers, Internet of Things, and 5G, the semiconductor market is expected to enter a three-year-old super boom cycle since 2019.

my country’s integrated circuit industry is developing healthily, and its independent strength is constantly improving. From January to April 2021, my country’s integrated circuit output exceeded 110 billion pieces, a sharp increase of 51.7% year-on-year to a new high. Looking back over the past five years, although my country’s integrated circuit imports still far exceed the export value, the average export growth rate (11%) has exceeded the import (8.8%), and the independent strength has been continuously improved.

Today is strong: Changchuan Technology, North Huachuang, Anji Technology, Guokewei, Beijing Junzheng, Rockchip, Jingce Electronics, etc.

③ Military industry

In the early trading, the military industry stocks changed. Some time ago, Aviation Power announced that it would carry out cash management of 11.7 billion yuan. In the first quarter, the company only had 4.4 billion currency funds. This gave the market some room for imagination, and the order money may have arrived. In addition, this year’s major aviation OEMs have raised their deposit limits with their respective group finance companies, indicating that the overall funding of the industry is improving.

July is almost the time to speculate on the interim report, and performance stocks will once again become the darling of the market. For companies with better performance, it is a big plus. The style of the venue will again be dominated by institutions. After all, institutions have an absolute advantage of information asymmetry. What industry has performed well, but it has not risen sharply. This is the strength of the organization and will enter the market early. The institutional model is actually very simple. In June, the institutions went in first, and then the sellers began to blow their votes, the market was concerned, and retail investors poured in. The routine is the same. Feng Shui turns around.

From the perspective of the disk, the most powerful stocks in the recent military industry sector are the small market capitalization stocks on the Growth Enterprise Market. This can be seen from my stock pool. 40% of the stocks are in line with this point. The current market funds prefer to speculate on low-value stocks on the ChiNext. Of course, the military industry sector is no exception. For example, Dawn Aviation and Tianhe Defense have once again set new highs. Today Dawn Airlines has achieved a 20cm daily limit.

Leading gains today: Dawn Airlines, Tianhe Defense, Zongheng Stock, Xinyu Guoke, Andaville, Jianglong Boats, Guanglian Airlines, etc.

You must log in to post a comment.