Author: The surplus grain of the rich man’s house

The Fed once again held an interest rate meeting.

Of course, the Fed stunned the market once again. After the Fed negotiated interest rates, U.S. Treasury yields soared and the price of gold plummeted. The market exclaimed that Taper is coming, and Taper is coming. …

Suddenly remembered a children’s story.

A papaya was ripe and fell from the tree into the lake, with a grunt, splashing white water. A rabbit heard it, thought it was a monster, and ran away, yelling as he ran, “Run away, come on!” The monkey heard it, and ran along, shouting as he ran, “Everyone, run away, come on!” At this moment, the whole forest was in a commotion, and the animals all ran up, shouting as they ran: “Run for your life, here comes Gudong!” A papaya was ripe and fell from the tree into the lake, with a grunt, splashing white water. A rabbit heard it, thought it was a monster, and ran away, yelling as he ran, “Run away, come on!” The monkey heard it, and ran along, shouting as he ran, “Everyone, run away, come on!” At this moment, the whole forest was in a commotion, and the animals all ran up, shouting as they ran: “Run for your life, here comes Gudong!”  What does “Taper” mean?

What does “Taper” mean?

It means “gradual reduction” in English, and it specifically refers to the Fed’s gradual reduction of its money printing scale (QE), which has brought the so-called “Taper Tantrum” to the financial market.

But to put it bluntly, Taper is just the “gu-dong” that papaya fell into the water.

According to the Fed’s statement and its answers to reporters, the Fed only slightly increased its forecast of economic growth figures and increased its forecast of inflation figures. It did not claim to reduce QE at all. Can’t discuss it?), and didn’t mention any interest rate hikes-but compared to the March meeting on interest rates, in the forecast, the benchmark interest rate in 2023 will be raised by 0.5 percentage points.

Since the US inflation data in May was as high as 5%, which was almost the highest level since 1992, the results of this interest rate meeting were widely interpreted by the market as:

1) To withdraw from easing soon;

2) There will be two interest rate hikes in 2023.

Well, regardless of whether it will withdraw from easing this year, or whether it will actually raise interest rates twice in 2023, the market has begun to anticipate and ferment this matter, and the result that the Fed wants has been achieved.

Because the Fed is the top master of manipulating market expectations.

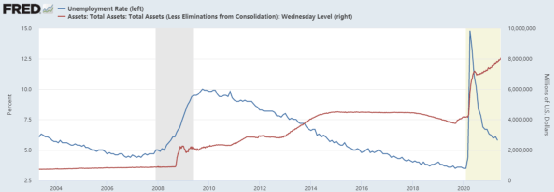

After the global financial crisis in 2008, the Fed conducted three rounds of QE in six years, and its balance sheet rose from 900 billion U.S. dollars to 4.5 trillion U.S. dollars.

The interest rate meeting in June 2013 was the same as it is now. At that time, the third round of QE was still underway. The then Fed Chairman Bernanke gave clear conditions for reducing QE: when the unemployment rate was approaching 7%.

The results of the meeting on interest rates are also very similar to the structure of this time. The Fed also raised its economic growth expectations and inflation forecasts…

Because the unemployment rate at that time was actually quite close to 7%, and the market at that time also predicted that in December 2013, the probability of the Federal Reserve reducing QE was 80%…

The results of it?

Even if the U.S. unemployment rate fell to 6.7% in March 2014, the Fed did not see a reduction in QE. By mid-2014, the unemployment rate had fallen to 6.2%, and the Fed began to reduce QE, and the Fed’s balance sheet scale was not large. More time will be added to September 2014 (see the figure below, the dark blue line and the left axis are the U.S. unemployment rate so far in 2004, and the dark red line and the right axis are the size of the Fed’s balance sheet so far in 2004).

As for the interest rate hike after the QE reduction in 2013, it was as far as two years later, and after the interest rate hike was once, there was an interval of two years before the interest rate hike again.

Expected management is greater than actual operation, and the form and sample are greater than the actual tightening.

Everyone must remember:

In today’s era of credit money, no matter which central bank, the monetary policy will always be loose but not tight. As long as it can be loose, it must be loose. Even if the economy is overheated, even if inflation is rampant, interest rate hikes and austerity are going back three steps— —On the contrary, if you see signs of economic downturn, easing and interest rate cuts, it will definitely be like a tiger going down the mountain, and it will be implemented.

Believe it or not, let’s take a look at how aggressive the Fed was in 2020 when the U.S. stock market plummeted:

Within two weeks, cut interest rates urgently;

I feel that the interest rate cut is not enough, so I cut the interest rate directly to 0+ days and the amount is loose;

The amount of easing is not enough, unlimited easing + buying corporate bonds directly.

——There is no lower limit for looseness, and tightness depends on installation.

Someone might say that the US inflation rate has now exceeded 5%. If the Fed does not reduce QE or raise interest rates, how can it be explained to the market?

Who told you that the Fed needs to explain to the market on inflation?

The task of the Fed is to guide market expectations!

As long as the market’s inflation expectations come down, inflation will not be a problem.

The Fed constantly hints to the market that the prices of major commodities plummeted from March to July 2020, so the inflation rate in the corresponding month of 2021 appears to be very serious, but this is temporary. After these few months pass, the inflation rate in the United States will Decline, and, in the future, we will have to reduce QE, we will also raise interest rates, and the inflation rate will definitely fall…

Yes, the Fed printed 100% of the base currency in the past year and increased the broad money by 25%, but the Fed firmly believes that the current inflation in the United States must be temporary!

In fact, because politics is not correct, what the Fed is embarrassed to tell everyone is–

Now, what the United States needs most is inflation!

Moreover, we must let the inflation rate exceed the U.S. Treasury bond yield!

Why do I say that?

Because of US government debt!

Think about it, if you owe one million yuan to someone, you have to pay it back, but you have been borrowing money every year, how should you pay it back?

The best way is inflation. If there is an inflation rate of 100% and the nominal price of your total debt remains the same, then your actual debt burden will be reduced by half!

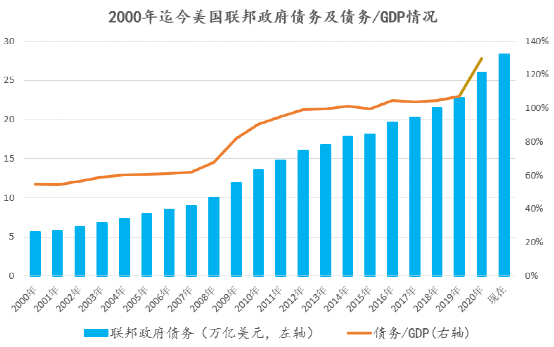

According to the latest data, the total debt of the US federal government has reached 28.3 trillion US dollars.

As long as inflation occurs, both the US GDP growth and US fiscal revenue in nominal dollars will increase significantly, and the interest that needs to be paid to the national debt is fixed when it is auctioned out. As long as the inflation comes up, the debt The burden will gradually decrease.

The benefits are not only here.

Allowing actual inflation to exceed the yield of Treasury bonds will also help the US government issue new debt and borrow more money.

For example, the U.S. government pays 2% interest on national debt, but the actual inflation has been maintained at the current 5%, which means that the real interest rate is -3%, and the U.S. government is not afraid of borrowing more money because of government debt/ GDP will fall, and America’s fiscal ability to pay is getting higher…

As for the price, the price is of course the people who use dollars all over the world are those who buy bonds.

Someone should ask, the real negative interest rate, what if there are not so many people buying U.S. Treasury bonds?

There is also the Federal Reserve, which directly prints money to buy!

This was originally one of the main purposes of the Fed’s QE!

Since the outbreak of the epidemic in 2020, under the buy-buy-buy of the Fed, by April 2021, the total amount of US Treasury bonds held by the Fed has exceeded the US Treasury bonds held by overseas investors.

Therefore, many people think that because of the recent increase in inflation, the Fed will soon withdraw from monetary easing. In fact, the Fed is eager for such inflation to continue for a period of time until the Biden administration almost runs out of borrowing money and no longer needs it. When borrowing money, the Fed will consider really reducing QE or even stopping easing.

Also, because everyone expects that the Fed will withdraw from easing and one big buyer will be missing, the market generally infers that the price of Treasury bonds will fall, so the yield will continue to rise, and many major market players are predicting that U.S. bond yields will rise in the second half of the year. To more than 2%…

However, it is likely that everyone is wrong again!

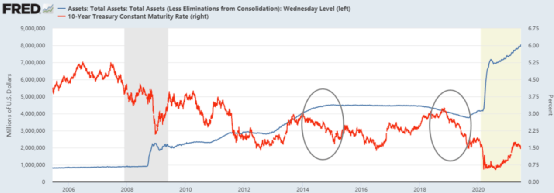

The graph below is a comparison between the Fed’s balance sheet and the yield of 10-year U.S. Treasury bonds from 2006 to date. Since the Fed reduced QE in 2014, U.S. Treasury yields have continued to fall; in 2018, the Fed really began to shrink its balance sheet. , U.S. Treasury bond yields have also fallen (see the two circles in the figure below)…

In other words, the two QE exits since 2008 have proved that each time the so-called QE is reduced or exited, the Fed is just “leading” the public’s expectations. Every time it exits the implementation of QE, either the Treasury bond yield is directly Continue to fall, or Treasury bond yields continue to fall after a short-term rise.

In short, under the manipulation of the Fed, they will definitely keep the yields of treasury bonds at a very low level, and they will surely allow the inflation rate to continue to exceed the yields of treasury bonds, and will definitely reduce the debt burden for the US government…

After all, the Federal Reserve, which claims to protect the value of the U.S. dollar, was originally the world’s largest lie maker!

You must log in to post a comment.