The appearance of the “mysterious man” once again brought Gree Electric into the eyes of investors.

After Gree Electric announced on the evening of May 26 to buy back shares for 7.5 billion to 15 billion yuan, on June 2, 8 and 10, there were mysterious buyers through Beijing Gaohua Securities’ Beijing Financial Street Securities business. The Ministry bought 4.16 billion shares of Gree Electric Appliances. Who on earth is sweeping goods so fiercely? How will this affect Gree’s stock price?

The mysterious man bought 4.16 billion in three days

Inquiry of Gree Electric’s bulk transaction records found that on June 2, June 8, and June 10, Gree Electric discovered several large-scale transactions. Moreover, the sellers are all institutional seats, and the buyers are all from a sales department. Such a large transaction comes from the same business department, and the market speculates that the buyer is likely to be the same person or organization.

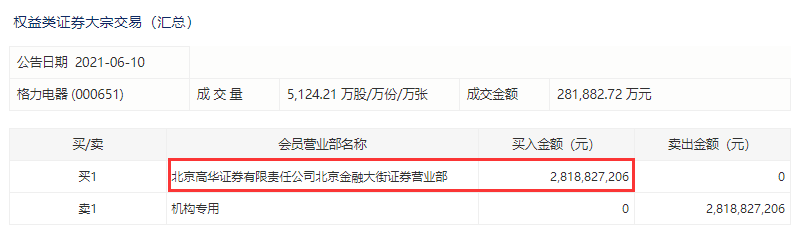

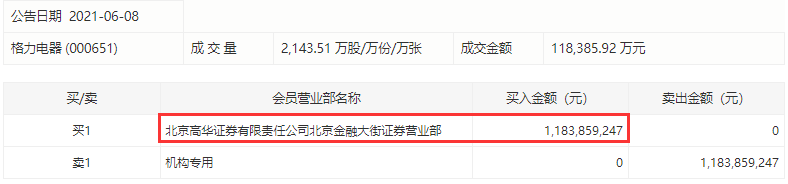

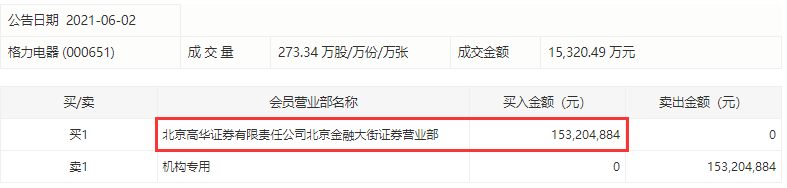

Specifically, on June 2, Beijing Gaohua Securities Beijing Financial Street Securities Business Department bought 2.73 million shares, amounting to about 153 million yuan, and the transaction price was 56.05 yuan; on June 8, the business department bought 21.435 million shares , The amount was about 1.184 billion yuan, and the transaction price was 55.23 yuan; on June 10, the business department bought 51.242 million shares again, the amount was about 2.819 billion yuan, and the transaction price was 55.01 yuan. In other words, the securities business department of Beijing Gaohua Securities Beijing Financial Street bought nearly 4.16 billion yuan in total during these three days.

Judging from these three transactions, the size of single-day purchases has increased rapidly. From the initial 153 million yuan to the final more than 2.8 billion yuan.

Gree Electric’s stock price has fallen almost continuously recently. In the last 12 trading days, except for 3 days where it closed at a flat price, all the other 9 trading days fell.

Judging from the transaction amount of 4.16 billion yuan, it is likely that it has also set a record for Gree Electric’s large transaction amount. Judging from the record of block transactions since 2014 that the exchange can query, this transaction amount is the highest.

Who is buying?

The timing of this large transaction also happened just after Gree Electric announced the repurchase. On the evening of May 26, Gree Electric announced that it plans to repurchase shares at a price of 7.5 billion to 15 billion yuan, and the repurchase price will not exceed 70 yuan per share.

On the evening of May 31, Gree also announced the progress of the repurchase. As of May 31, 2021, the company’s third phase of the repurchase plan has repurchased 490,700 shares through centralized bidding, with the highest transaction price of 56.11 yuan/ The lowest transaction price is 55.89 yuan/share, and the total payment amount is 27.458 million yuan (excluding transaction costs).

So who is buying this big deal? Judging from the current information, there is a lot of speculation in the market. For example, some investors said that this buying method is very similar to Feng Liu’s style; some investors believe that it may be Fang Fenglei behind Hopu Capital who is optimistic about Gree Electric Appliances and continues to deploy.

According to the data, in Gree Electric’s announcement of a 15% equity transfer of more than 40 billion yuan in 2019, the largest bidders include Zhuhai Mingjun Partnership (Limited Partnership) and Gewuhoude Equity Investment (Zhuhai) Partnership A consortium formed by a company (limited partnership) and GENESIS FINANCIAL IVESTMENT COMOPANY LIMITED. Behind Zhuhai Mingjun is Hillhouse’s Zhang Lei, and behind Gewuhoude’s equity investment is Fang Fenglei of Hopu Investment.

In the end Zhang Lei won the competition. According to Gree Electric’s announcement in December 2019, it was finally agreed that Zhuhai Mingjun would acquire 15% of Gree’s total equity held by Gree Group at a price of 46.17 yuan per share, with a total transfer price of 41.662 billion yuan.

Since the block trade since June 2 was carried out through the Beijing Sales Department of Beijing Gaohua Securities, according to the information from Tianyan, Fang Fenglei is both the founder of Hopu Investment and the chairman of Beijing Gaohua Securities Co., Ltd. Therefore, some investors think that it may be that the company behind Fang Fenglei is buying through the Gaohua Securities business department because it continues to be optimistic about Gree Electric.

Equity structure chart of Beijing Gaohua Securities Co., Ltd. (Source: Tianyancha)

How will Gree Electric’s share price go?

Since 2019, Gree Electric’s stock price has fallen into a stalemate, and the stock price has continued to fluctuate widely at high levels. When many white horse stocks are advancing, Gree seems to have fallen behind. Especially compared with Midea Group, Gree’s share price performance is significantly weaker.

Will the mysterious buyer’s massive purchase of Gree Electric Appliances stimulate the stock price to rise? Although the buyer is very mysterious, and it is still possible to continue to buy Gree Electric. But after all, it is a large-scale transaction, and it is difficult to affect the secondary market stock price. In addition, the sellers of large transactions are also institutions.

In addition, Gree Electric recently launched a large-scale repurchase, but the secondary market has not responded much to this. After the repurchase announcement was issued on May 26, Gree Electric’s share price showed a trend of opening higher and lower prices on May 27. Since then, it has fallen continuously. In 12 trading days, it has fallen from the highest of 59.27 yuan to 54.35 yuan, a cumulative drop of 8%. .

Why is Gree Electric’s repurchase difficult to support the stock price? Some investors believe that the weakening of share repurchase support for stock prices is related to market conditions on the one hand. On the other hand, it is also related to the nature of share repurchases.

Since white horse stocks like Gree Electric have experienced years of rising, they are currently in the stage of valuation digestion, and even repurchases are difficult to drive stock prices. For example, Midea Group is also a frequent visitor to share repurchases, but its impact on stock prices is also limited.

In addition, most of the share repurchases of listed companies are for the purpose of employee stock ownership or equity incentives. Employee shares and equity incentive shares will eventually be sold on the market, and after repurchase, they will only be locked in a short period of time. It will neither affect the size of the total equity, nor increase its performance. Therefore, the share repurchase used for employee stock ownership plans and equity incentives has only a short-term stimulus effect on the shares.

However, there are still institutions optimistic about Gree Electric. The latest research report of Dongguan Securities believes that the company’s large-scale repurchase and employee stock ownership plan will protect the company’s performance. The shares obtained from the repurchase will be used to implement the company’s equity incentives or employee stock ownership plans to further improve the company’s governance structure and build a long-term incentive and restraint mechanism for the management team’s shareholding. The previous 2020 annual report showed that in order to stimulate the enthusiasm and creativity of employees and retain core talents, the company will implement the employee stock ownership plan in 2021 to achieve the binding of employee interests and company interests.

Caixin Securities believes that in the short term, Gree Electric has a single business structure, slow diversification, and short-term performance pressure. However, in the long run, the company will continue to sort out its internal governance structure, actively carry out channel reforms, and accelerate diversified layout. The future development can be expected after the successful implementation of reforms. Comprehensive considerations, the company’s current valuation is attractive, short-term reform implementation and equity incentive catalysis, optimistic about the company’s development potential, give the company 14-16 times PE valuation in 2021, corresponding to a reasonable range of 62.10-70.38 yuan.

In terms of operation, since the beginning of this year, the price increase of raw materials has also brought a lot of impact on the performance of the home appliance industry. In the first quarter of this year, Gree Electric’s gross profit margin was 24.43%, while last year’s gross profit margin was 26.14%; Midea Group’s gross profit margin was 23% in the first quarter and 25.11% last year. The two white power giants Both experienced a decline in gross profit margin of about 2%.

A home appliance dealer told reporters that compared with several major home appliance giants, smaller home appliance companies do not have much brand premium capabilities, and their gross profit margins are relatively meagre. They are more passive in this turbulent wave of raw material price increases. Home appliance industry analyst Hong Shibin also believes that generally for head appliance companies, price increases have little effect on performance. In addition, leading companies can relieve pressure through the advantages of large-scale procurement.

In addition, the upcoming Gree Electric Shareholders’ General Meeting has also attracted much attention. Gree Electric will hold its 2020 Annual General Meeting of Shareholders at 15:00 on June 30. In order to strictly prevent the spread of the novel coronavirus pneumonia epidemic and ensure the safety of participants, the company encourages shareholders to participate in this general meeting of shareholders through online voting.

Millions of users are watching

Top 10 news affecting the market during the Dragon Boat Festival holiday (new stocks + comments)

The bull market flag bearer has a heavy signal! “Stabilizer” warms up for two consecutive weeks, the market will start soon? The three major events were staged this week, how much impact did they have on A shares?

Too arrogant! Blackmailing billionaires, hacking McDonald’s, is the Russian hacker organization “hands”?Bitcoin has become the biggest “accomplice”, many places encircle and suppress mining

A shares have fallen sharply for 3 months and are now calming down. Who has handed in valuable chips? When the stock market panics and plummets, why pay attention to the “bigger picture”?

It’s sold out! The issuance of this type of fund hit a 9-year high, and the highest profit this year was over 59%! Invest in 34 markets, including the United States, the United Kingdom, Vietnam…

what’s the situation? The U.S. made a big move and the Bitcoin ransom was recovered! The logic is broken? Cryptocurrency plummeted!Trump: This is a scam

Brokerage China is a new media under the securities market authoritative media “Securities Times”. Brokerage China has the copyright to the original content published on the platform. Unauthorized reprinting is prohibited, otherwise the corresponding legal responsibility will be pursued.

ID: quanshangcn

Tips: Enter the securities code and abbreviation on the brokerage China WeChat account page to view the stock market and latest announcements; enter the fund code and abbreviation to view the fund’s net value.

You must log in to post a comment.