Summary : It may take a while to solve the current big troubles. As for the listing… (Welcome to pay attention to the leverage game)

Author|Zhang Yinyin&Editor|Xin Xinran

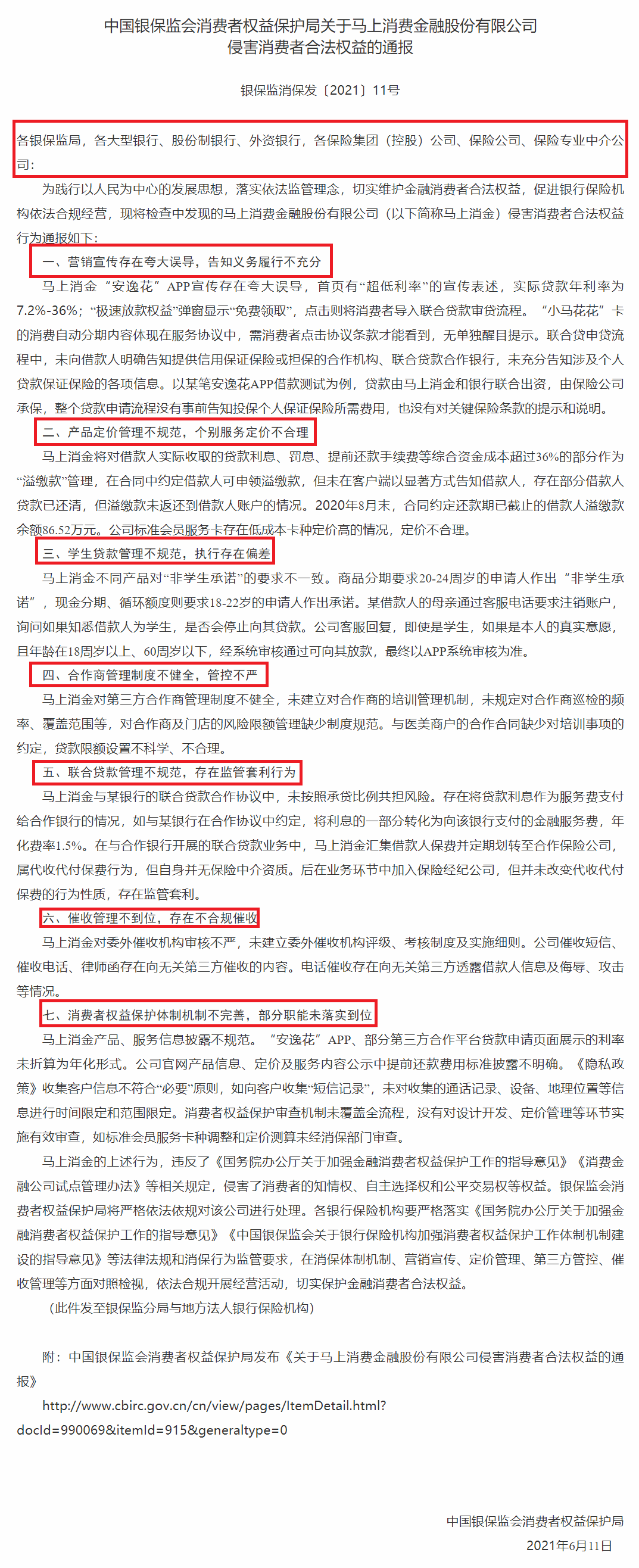

A few days ago, the Consumer Protection Bureau of my country Banking and Insurance Regulatory Commission issued the “About Now Consumer Finance Co., Ltd.

Notification of infringement of the legitimate rights and interests of consumers.

According to the report, the leveraged game found that there are 7 major aspects of violations of the legitimate rights and interests of consumers in the immediate consumption of gold.

Today, I will talk about these 7 aspects on the one hand; on the other hand, based on the annual audit report of Immediately Consumers, I will start with this company.

1. How does the immediate consumption of money infringe the rights and interests of consumers? What’s the signal behind?

Supervision has improved compared with before.

In recent months, there have been interviews, public exposures, fines, anti-monopoly investigations, etc. There are various forms of non-compliance of the platform economy, illegal collection of user information, various forms of monopoly, and behaviors that infringe on consumer rights and interests. Unprecedented punishment.

At the Dragon Boat Festival in 2021, it will be the turn of the technology and financial giants to consume money immediately. According to the report, there are mainly 7 major problems:

First, there is exaggeration and misleading in marketing and publicity, and inadequate performance of the obligation of notification. For example, for example, the publicity of the “Anyihua” APP of Immediately Consumer Money is exaggerated and misleading. There is a publicity statement of “ultra-low interest rate” on the homepage, and the actual loan interest rate is 7.2%-36%.

Also, if the pop-up window of “Quick Loan Rights” displays “Free Collection”, click it to lead consumers into the joint loan review process.

Take a loan test of Anyihua APP as an example. The loan is jointly funded by Immediately Consumer Finance and the bank, and underwritten by the insurance company. The entire loan application process does not inform the insured individual of the cost of guarantee insurance in advance, and there is no reminder of key insurance clauses. Description.

Second, product pricing management is not standardized, and individual service pricing is unreasonable. For example, Immediately Consumer Finance will manage the portion of the comprehensive capital cost exceeding 36% of the borrower’s actual loan interest, penalty interest, and early repayment handling fee as an “overpayment” management, and it is stipulated in the contract that the borrower can claim the overpayment. Payment was made, but the borrower was not notified in a significant manner on the client side. Some borrowers’ loans have been paid off, but the overpayment was not returned to the borrower’s account.

Third, the management of student loans is not standardized, and there are deviations in implementation. For example, the mother of a borrower requested to cancel the account through the customer service phone, asking whether she would stop lending to her if she knew that the borrower was a student.

The company’s customer service replied that even if it is a student, if it is their true wish and they are over 18 years old and under 60 years old, they can be released after the system review, and the final review of the APP system shall prevail.

Fourth, the partner management system is not sound, and the control is not strict. For example, there is a lack of institutional standards for the risk limit management of partners and stores. The cooperation contract with the medical aesthetics merchant lacks the agreement on training matters, and the loan limit setting is unscientific and unreasonable.

Fifth, the management of joint loans is not standardized, and there is regulatory arbitrage. There are cases where loan interest is paid to cooperative banks as service fees. For example, it is agreed with a bank in a cooperation agreement that part of the interest will be converted into financial service fees paid to the bank at an annualized rate of 1.5%.

In the joint loan business with cooperative banks, the borrower’s premiums are immediately consumed and transferred to the cooperative insurance company on a regular basis. This is the act of collecting and paying insurance premiums, but it does not have the qualifications of insurance intermediary. Later, he joined an insurance brokerage company in the business link, but it did not change the nature of the collection and payment of insurance premiums, and there was regulatory arbitrage.

Sixth, the collection management is not in place, and there are non-compliant collections. Telephone collections may disclose borrower information to unrelated third parties, insults, and attacks.

Seventh, the consumer rights protection system is not perfect, and some functions have not been implemented. For example, the “Anyihua” APP of Immediately Consumers, and the interest rates displayed on the loan application pages of some third-party cooperation platforms are not converted into annualized forms.

The disclosure of the early repayment fee standard in the announcement of product information, pricing and service content on the company’s official website is not clear. The collection of customer information in the “Privacy Policy” does not comply with the “necessary” principle. For example, the collection of “SMS records” from customers does not limit the time and scope of the collected call records, equipment, geographic location and other information.

In addition, the leverage game pays attention to 3 details.

First, this notice was sent to the China Banking and Insurance Regulatory Bureau and the local legal bancassurance institution at the same time.

Second, the report said:

The infringement of consumers’ legal rights and interests by Immediate Consumer Finance Co., Ltd. (hereinafter referred to as Immediate Consumer Finance) discovered during the inspection is hereby notified as follows…

This sentence, and combined with various previous news, we know that there may be many more consumer finance companies and technology finance companies that will be notified next.

Third, not only that, but the notification also stated that the Consumer Protection Bureau of the China Banking and Insurance Regulatory Commission will deal with the company in strict accordance with laws and regulations-which means not only notification but also punishment.

Prior to this, several Internet companies were fined.

2. Many indicators of gold consumption immediately decline

According to the 2020 audit report of Immediately Consumer Gold, many indicators of Immediately Consumer Gold declined.

For example, revenue dropped from 8.953 billion yuan in 2019 to 7.604 billion yuan in 2020.

Looking at the details of the above figure, the main reason for the revenue decline of 1.3 billion yuan is that there are more handling fees and commission expenses and the decline in revenue.

For example, leveraged games found that the renewal and commission expenses in 2019 will be 1.8 billion yuan, and the expenses in 2020 will be close to 3.4 billion yuan.

In terms of fee and commission income, it will be more than 2.8 billion yuan in 2019, and it will drop by more than 1.6 billion yuan in 2020.

This increase and decrease will cause the net fee and commission income in 2020 to turn negative, and it will be negative more than 1.7 billion yuan. In 2019, this figure will be more than 1 billion yuan.

This change may be closely related to the changes in the regulatory situation in 2020.

At the same time as revenue declines, the profit index for immediate consumption of gold also decreases.

As shown in the figure below, both operating profit and total profit have declined compared with 2019. The final net profit fell from 853 million yuan in 2019 to 712 million yuan in 2020.

At the same time, leveraged games also noticed that the total assets of Immediately Consumer Gold will be 52.5 billion yuan in 2020, slightly lower than the 54.8 billion yuan in 2019.

The accounts receivable for immediate consumption rose from 479 million yuan at the end of 2019 to 624 million yuan in 2020.

As shown in the figure above, it is mainly due to the increase in joint loan receivables from over 200 million yuan at the end of 2019 to over 600 million yuan at the end of 2020.

How much can be recovered, and how much can never be recovered?

3. Can it still hit the market?

In September 2020, the official website of the China Banking and Insurance Regulatory Commission announced a news that the Chongqing Banking and Insurance Regulatory Bureau agreed in principle to immediately issue A shares by consumer finance companies. After deducting the issuance costs, all the proceeds from the issuance should be used to supplement the company’s core tier one. capital.

Immediately consumer finance was one of 26 consumer finance companies approved by the China Banking and Insurance Regulatory Commission at that time. According to its official website, it officially opened in June 2015 and completed three capital increase and share expansion in 2016, 2017, and 2018, with a registered capital of 4 billion yuan.

Shareholders include Chongqing Department Store Co., Ltd., Beijing Zhongguancun Kejin Technology Co., Ltd., Wumart Technology Group Co., Ltd., Bank of Chongqing Co., Ltd., Sunshine Property Insurance Co., Ltd., Zhejiang China Commodity City Group Co., Ltd., and a new round of strategy Investors CICC, CITIC Construction Investment and Chongqing Liangjiang New District and other central enterprises and local state-owned assets background capital.

In the camp of consumer finance companies, the consumption of money is the first echelon. The registered capital is second only to the newly approved Ant Financial, and the already opened Home Credit and Ping An Consumer.

Previously, the industry big brother Home Credit Consumer Finance originally submitted a listing application to the Hong Kong Stock Exchange in July 2019, but withdrew the application in November 2019.

In 2020, Immediately Consumer Gold was awarded the road of Chongqing Banking and Insurance Regulatory Commission, which gave people a lot of reveries. The valuation of Immediately Consumer Gold also ranks among the top unicorns.

Later, we learned that the Ant Group was suspended at the last minute of its listing, and then launched an in-depth rectification of Internet giants and Internet finance.

Since the birth of technology finance companies, there have been many questions and complaints.

In addition to this naming notification, in 2019, 17 financial apps were named for collecting personal information, and the Anyihua under Immediately Consumer Gold was among them.

According to the current situation, it may take a while to immediately eliminate the current major troubles.

As for listing…

Copyright and disclaimer: This article is a leveraged game creation, unauthorized reproduction is prohibited! If you need to reprint, please obtain authorization. In addition, please indicate the source and author at the beginning of the article when authorized to reprint, thank you! The opinions in any article of leverage games are for learning, communication and discussion purposes, not investment advice. Please be responsible for all investments made by users accordingly. Any omissions or errors in the article are welcome to criticize and correct.

You must log in to post a comment.