On April 22, Kuaishou held the “2021 Photosynthetic Creators Conference” in Guangzhou.

At the meeting, Yan Qiang, senior vice president of Kuaishou and head of content operations, announced two news:

- There will be 1 billion yuan in cash and tens of billions of flow to subsidize creators.

The main goals of Kuaishou in 2021 will be around three levels: constructing a live broadcast 2.0 era, promoting pan-life services, and enhancing the community and social value of the platform.

Kuaishou’s “de-familyization”: the lotus is broken and it is difficult to give up

After the accident of the head anchor Simba, in order to solve the crisis of trust, Kuaishou tried his best to get rid of the influence of the “family” during the months when Simba was blocked. At the Kuaishou Gravity Conference, although Kuaishou kept emphasizing private domain traffic and anchors, it didn’t mention the “Simba” and other Kuaishou families that took the lead on the path of anchors. In the event of the day, the Kuaishou flashlight Xiao Gu, the person in charge of the business, said three times in his speech, “Don’t lie to the old iron.”

In order to reduce the influence of the Kuaishou family, Kuaishou kept vocalizing during the Simba ban. The Kuaishou executives once stated that the total annual cumulative GMV of all the anchors of the Simba family may only account for 10% of the Kuaishou GMV. At the same time, Kuaishou is also constantly supporting small and medium businesses and pushing new anchors at official events. However, Simba’s influence on Kuaishou is still hard to ignore. On the day of the rebroadcast, Simba’s popularity rushed to the top of the selling list, far surpassing the new anchors who had high hopes from Kuaishou officials.

For fast-handed families like Simba, fast-handed wants to give up, but it is difficult to let go completely. According to media reports, when Simba was re-broadcasting, Kuaishou internally opened a green channel for it, and also conducted a small survey on shopping experience.

In order to reduce the head “family influence”, Kuaishou chose to continue to increase “private domain traffic” and support anchors with 100,000-1 million followers. Zhang Yipeng, head of the marketing center of Kuaishou e-commerce, said: “I may not be able to sell a mid-waist anchor. Simba, Li Jiaqi and Wei Ya, my 10 anchors will bring it together, and the amount will definitely be larger than in the past.”

The live broadcast e-commerce 2.0 era described by Kuaishou e-commerce is when the cost of public domain traffic is getting higher and higher, through the platform to gather exclusive private domain traffic for content creators. For example, anchors rely on their live broadcast features to create sales. People design, produce high-quality content and establish a strong trust relationship with users, and guide users to consume. Regarding the results of creating private domain traffic, Yan Qiang revealed: “In 2020, the private domain traffic income of creators of Kuaishou platform has reached 40 billion yuan.”

In the face of increasingly fierce competition, in order to tell investors more imaginative stories. In addition to stabilizing the basic market of live e-commerce, Kuaishou is gradually increasing its content marketing. The 2020 financial report shows that the annual revenue of Kuaishou online marketing business is 2019 billion yuan, a year-on-year increase of 194.6%. In the fourth quarter, it surpassed Kuaishou live broadcast e-commerce and set a new record for Kuaishou’s single-quarter revenue. The online marketing business is also defined by Kuaishou as “one of the core strategic businesses that support our long-term development.”

Ma Hongbin, senior vice president of Kuaishou, revealed that Kuaishou magnetic engine is expected to help creators achieve 10 billion advertising revenue in 2021.

The magnetic engine that Feng Hongbin said is a commercial marketing service platform under Kuaishou, which is a bit like a giant engine of byte beating. In terms of function, the magnetic engine is like a giant engine of the Kuaishou version, which can push open-screen advertisements and information. For streaming advertisements, advertisers can also promote through the magnetic engine and the “old irons” under Kuaishou, and content creators can also target them through the “kuaishou vermicelli” in the magnetic engine, and their accounts can grow rapidly.

Kuaishou and Douyin are more and more similar at first glance, but they are not the same when you look closely.

Kuaishou’s branded merchant strategy may not necessarily satisfy merchants

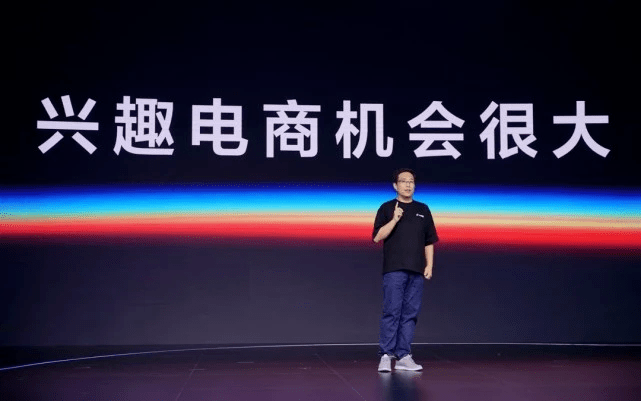

Coincidentally, not long after Kuaishou proposed the live broadcast e-commerce 2.0 era, Douyin announced the next step at the first Douyin E-commerce Ecological Conference on April 8. Different from Kuaishou’s main private domain, the “interest e-commerce” selected by Douyin is somewhat similar to interest recommendation. Douyin uses user portraits and other methods to tag users and then target users to push the other party. Interested in live streaming and short evaluation videos.

Kuaishou and Douyin continue to increase their e-commerce, but for now, there is still a certain gap between Kuaishou live broadcast and Douyin live broadcast.

According to data from iiMedia Consulting, the GMV of Douyin live e-commerce in 2020 will exceed 500 billion yuan, even surpassing Taobao’s 400 billion yuan, while Kuaishou’s GMV will only exceed 330 billion yuan in 2020. Judging from the 2021 target, according to media reports, Kuaishou has set the GMV target for this year’s e-commerce at between 750 and 800 billion yuan, while Douyin plans to achieve a total GMV of more than 1 trillion yuan in 2021.

Although there is still a gap between Kuaishou and Douyin in total GMV, both sides have similar troubles.

From the perspective of the supply chain, Kuaishou hopes to rely more on its own or partner’s supply chain to control user transactions on external platforms. For this reason, Kuaishou signed a contract with JD.com in May 2020. Users can directly enter JD’s self-operated stores from Kuaishou’s stores without jumping to external links. The anchors can also choose JD’s self-operated products when they bring goods. Among Douyin’s 500 billion GMV in 2020, about 60% are completed through third-party links in live broadcast rooms and short videos, and the remaining 40% are controlled in Douyin’s own channels such as Douyin stores.

From a brand perspective, Kuaishou also hopes to increase the proportion of branded products in GMV and reduce the proportion of white-label products. It plans to increase the proportion of branded products to 70% in 2021. More branded products mean better product quality and user experience. Kuaishou founder Su Hua said that he hopes to increase the repurchase rate of users.

In terms of brand merchants, Kuaishou still has a certain gap with Douyin. There are obviously more brand merchants on Douyin. Douyin continues to build closed-loop e-commerce and brand merchants. It not only strongly supports brand merchants to settle in, but also goes online. The Douyin Store. Feigua Data’s report shows that starting from February 2021, live broadcast sales of Douyin brand stores accounted for 50% of total sales, and more and more merchants began to choose to build their own live broadcast operation team.

In addition, brand merchants may not be satisfied with their experience on the Kuaishou platform. From the specific data, the new Douyin data shows that the number of fans of Li Ning Sports Tik Tok is 3.098 million, 573 works have been released, and 49 live broadcasts, but the live broadcast of Li Ning Sports’ Kuaishou account has reached 87 games and the number of works is 561. There are only 788,000 fans.

A similar situation has occurred with brands such as Mengniu, OPPO, and Yili. For example, OPPO Douyin has 3.2124 million fans, released 724 works and 32 live broadcasts, but Li Ning Sports’ Kuaishou has 26 live broadcasts and 340 works, but only 364,000 fans.

According to the official statement of Kuaishou, the logic of Kuaishou e-commerce is to improve platform GMV by optimizing content, conversion rate, customer unit price, and repurchase frequency. However, it is still unknown whether Kuaishou e-commerce companies improve the functional experience of e-commerce products from the perspective of users. It is still unknown whether more brand merchants can be convinced to settle on the platform.

You must log in to post a comment.