Produced | Sohu School of Business

Editor | Wang Zhen

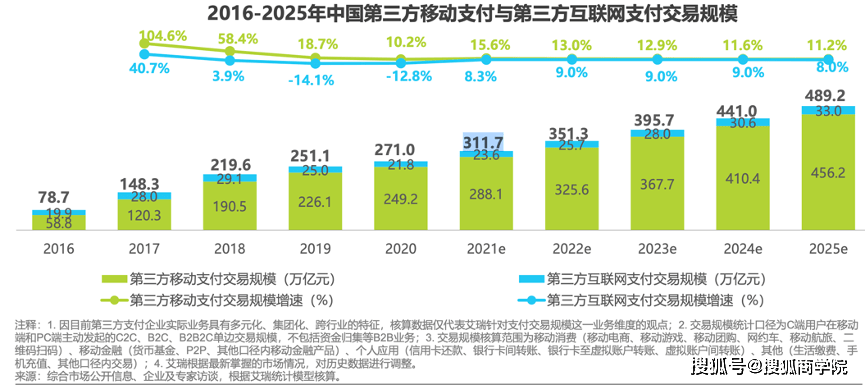

According to the “Research Report on China’s Third-Party Payment Industry in 2021”, according to the statistical data of iResearch, The third-party payment market has experienced rapid development, and the total scale of mobile payment and Internet payment will reach 271 trillion yuan in 2020. Third-party payment has made China’s payment market one of the world’s leading payment markets with its convenient, efficient and safe payment experience.

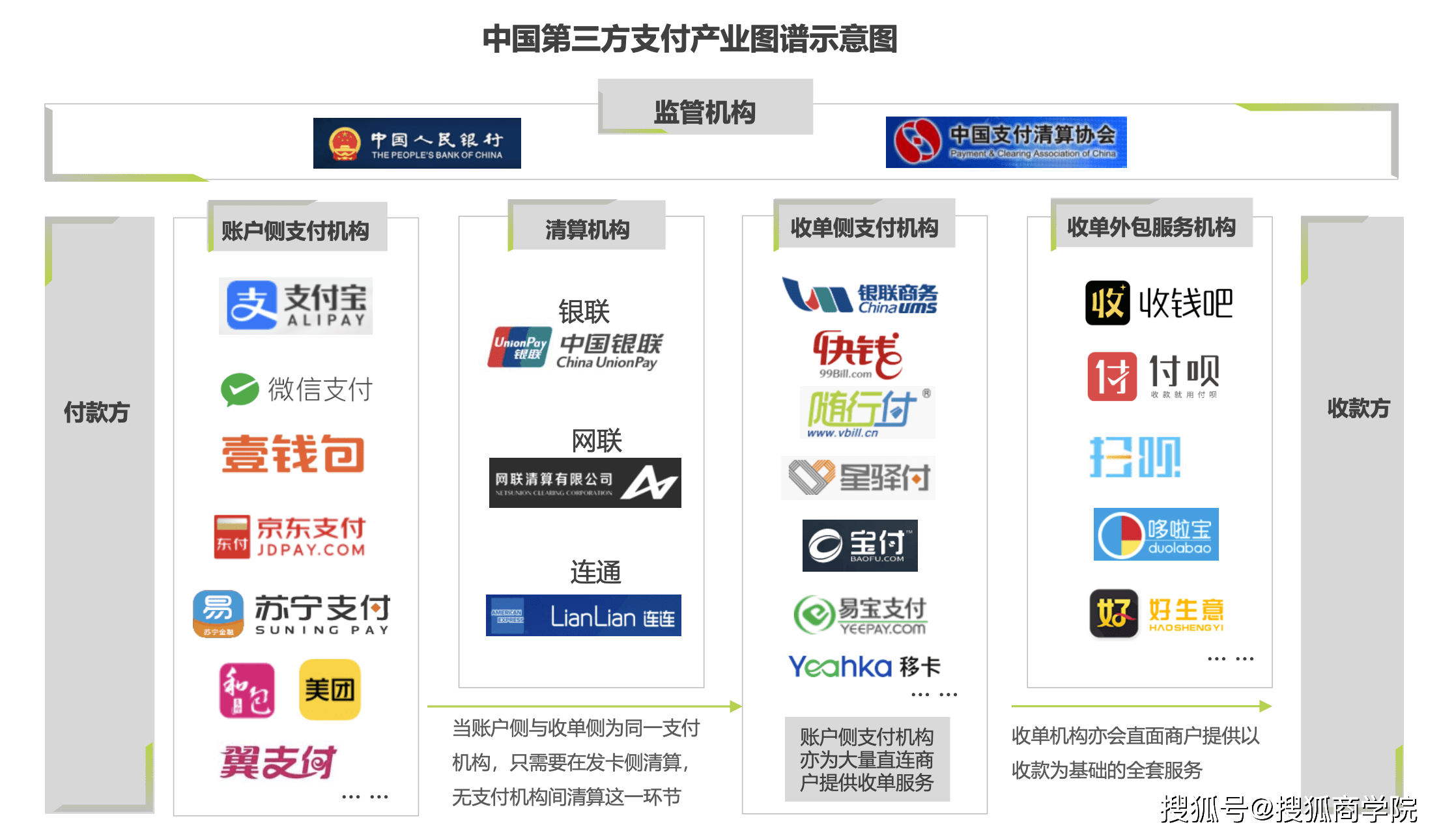

As early as 1998-2005, third-party payment institutions such as Capitel, Alipay, Lianlian Pay, Kuaiqian and Tenpay were established one after another to provide payment channels for online commercial activities. In 2010, the People’s Bank of China issued the “Measures for the Administration of Payment Services for Non-financial Institutions” and issued payment business licenses to eligible institutions. These measures confirmed the legal status of payment services for non-financial institutions and adopted them as regulatory standards. To ensure the long-term and orderly development of the business and ensure the long-term development of the industry.

Looking back on the growth path of third-party mobile payment in my country, it originated from e-commerce, which has experienced explosive growth due to social red envelope transfers, and offline QR code payment has entered a new offline-driven track. With the rapid growth of scale, the penetration rate of third-party mobile payment has gradually increased, and the growth rate of the industry scale has stabilized. Even in the special year of 2020, only the first two quarters of offline QR code payment has been affected to a certain extent, and the industry as a whole can still maintain a stable growth trend.

From the perspective of changes in the structure of mobile payment itself, the emergence of offline QR code payment has changed the form of offline mobile payment, which has steadily increased the proportion of consumer transactions. In the financial and personal application trading sectors, with the exception of the early social red envelopes and baby currency fund products, there has not been a leap-forward product form since 2016. The growth of the business scale of these two sectors mainly comes from the mobile payment itself. Increasing penetration rate, increasing user stickiness, and the development of Internet wealth management and consumer finance businesses.

Comparing the structure of bank card transactions, we have also experienced an increase in the proportion of consumer transactions, but in 2020, bank card transfer transactions accounted for 85.5%, and third-party mobile payment personal applications and mobile finance accounted for the total proportion. It’s still not enough, so in large-amount financial services, personal application transfer services, and B-end transfer services, third-party mobile payment companies still have room for power and have growth potential.

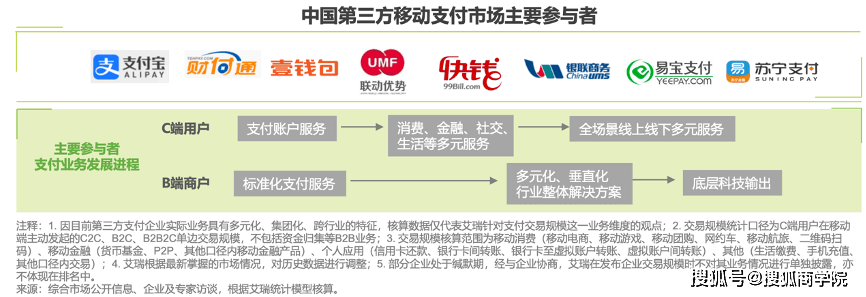

In 2020, the first echelon Alipay and Tenpay will occupy the leading position in the market with a relatively large lead. . Payment companies in the second tier are working hard in their respective subdivisions.

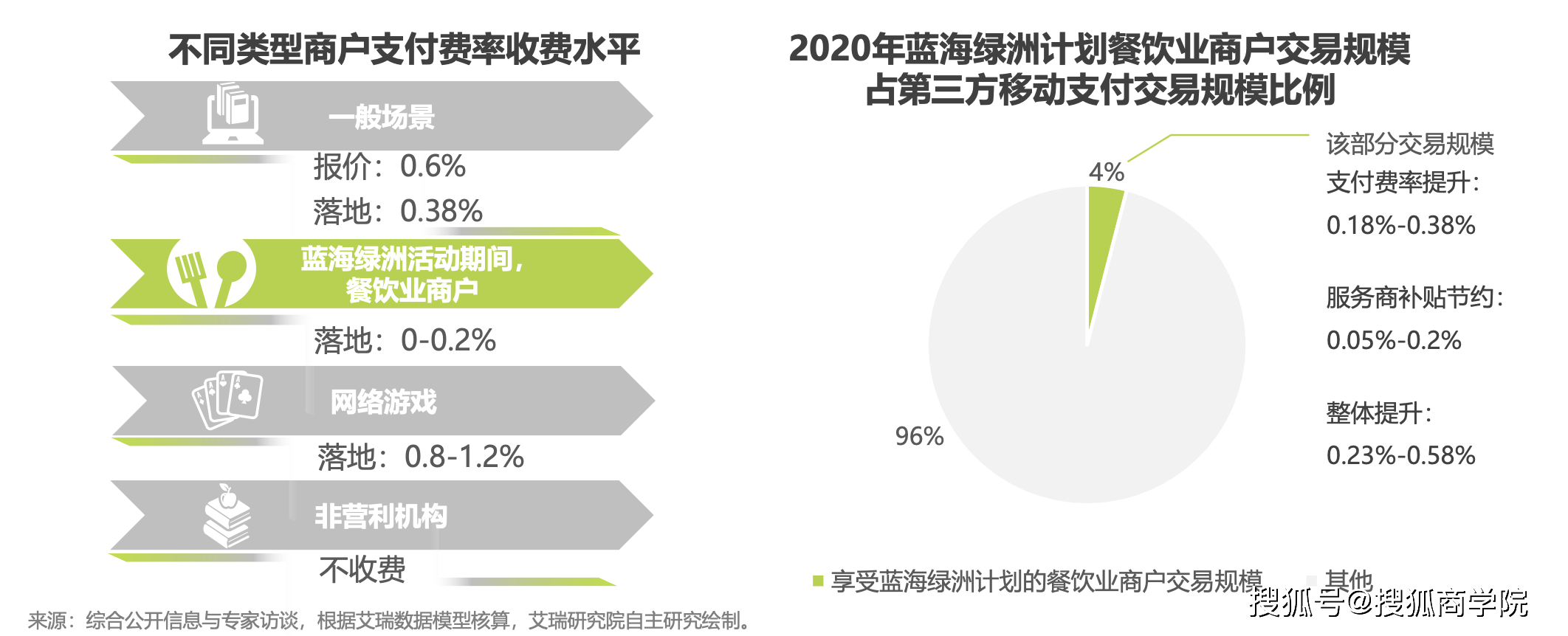

The blue ocean oasis subsidy for the catering industry has temporarily come to an end, and the monetization rate of the payment business rebounds

In 2017, WeChat and Alipay successively launched the “Oasis Plan” and the “Blue Ocean Plan” for merchants in the catering industry. At the beginning of the event, merchants in the catering industry enjoy low or even zero rates for receiving payments, and service providers who promote merchants can also receive a 0.2% rebate based on the transaction amount. As the penetration of catering merchants continues to increase, the rebate ratio of Alipay WeChat to service providers will be reduced to 0.1% in the later stage. Until 2020, the Blue Ocean Oasis plan will gradually adjust merchants’ payment rates to the normal rate of 0.38%. The service provider rebate ratio was further reduced to 0.05%. At the same time, Alipay has launched the “New Blue Ocean Plan” for some merchants that are equipped with designated IoT operating equipment. But overall, the subsidy for the traditional blue ocean oasis will officially end in 2021, which means that this part of the transaction scale can not only get the normal payment fee, but also reduce the 0.05%-0.2% subsidy for service providers. The analysis believes that the phased end of the Blue Ocean Oasis Plan means that the benefits of this part of the transaction can be increased from -0.2% to 0.15% of the transaction scale to 0.38% of the transaction scale, and the overall transaction scale is increased by 0.23% -0.58%.

The party in the new scenario enters, forming a closed loop of the payment business, and increasing the compliance requirements for the realization path

For Internet giants such as Meituan, Toutiao, and Pinduoduo that have entered third-party payment in recent years, the consideration of starting payment services is usually for three reasons: One is to form their own business closed loop to prevent user transaction information and payment information from being out of the system. Other third-party payment companies can obtain the advantages of their own business; the second is that with the expansion of the business scale in the system, the total amount of payment transaction fees continues to increase, and the establishment of free payment channels can save this part of the cost; the third is to pass After the transaction flow in the system is converted into payment flow, services such as credit and wealth management are further superimposed to earn financial service fees.

Return to the nature of payment business, with core capabilities in user operations and merchant operations

Looking back at the development history of third-party payment, whether it is the “guaranteed payment model” in the e-commerce field, the red envelope in the social field or the offline QR code payment, every increase in growth rate comes from the innovative products provided to users and merchants. Unique value. Therefore, although the current anti-monopoly regulatory compliance measures facing the industry have caused some business development expectations to be different from before, However, it is precisely these anti-monopoly compliance measures that enable industry participants who have gradually shown to rely solely on the advantages of scenarios to expand their business scale to re-think about the new payment business value they can provide. With the implementation of anti-monopoly compliance measures, it is foreseeable that the concentration of the third-party mobile payment market will decline to a certain extent. In this process, a complete user and merchant operating system will maintain the stickiness of users and merchants. Providing unique value is the key capability of payment institutions.

Barcode payment provides a window for the digital upgrade of offline merchants, and diversified value-added services further facilitate digital transformation

For many online, small, medium and micro businesses, offline barcode payment is one of the first digital methods they contacted. In the process of continuous penetration of barcode payment, offline small, medium and micro merchants have also established a certain connection with their service providers. In terms of the classification of barcode payment, it can be divided into three methods: the payment code and personal code directly connected to the head payment agency, and the aggregate payment that requires other acquirers or acquirer service providers. While providing merchants with the integration of multiple payment channels, the provider of aggregate payment further superimposes services such as cashier terminal sales and maintenance, marketing diversion, etc., while increasing their own business income, further improving the stickiness of merchants and deepening the degree of digital transformation of merchants.

Increased demand for equipment upgrades in downstream systems, with less impact on mid- and upstream companies

The central bank’s digital currency replaces M0 and belongs to cash currency. According to the idea of digital currency positioning as cash currency, we review the provisions of the “Provisions for Deposit Management of Non-bank Payment Institution Customers” issued this year: “Non-bank payment institutions passed the regulations in accordance with the regulations. If the customer is to redeem the provision in cash, it should be processed through the filing own fund account first, and then the corresponding amount of the client provision fund should be transferred to the filing through the main supervision agency of the provision fund from the central storage account of the provision fund. Own funds account”.

It can be seen that the digital wallet service of third-party payment institutions and the merchant-side acquiring service are still one of the important carriers of their circulation. The promotion of digital currency and the application of third-party payment are complementary and not a substitute for each other. At the same time, the clearing institution, which is an important infrastructure of the payment chain, will still play a clearing role in the digital currency era. In the downstream of the payment chain, acquiring service providers and machine tool manufacturers need to upgrade their original equipment and systems in order to allow digital currencies to have a wider range of payment scenarios. This certainty will be for downstream companies. Business income brings special growth drivers.

Service providers are facing transformation challenges and orderly integrate diversified corporate services

The emergence of offline QR code payment is the first contact between many offline merchants and digitization. With the sweeping wave of digitization and the upgrade of payment-related services, QR code ordering and merchant mini programs have become the entry point for further digitization of merchant business.

With the promotion of QR code ordering, small program takeaway, and ordering applications, it not only means savings in operating costs for merchants, but will also be accompanied by digital upgrades in the pre-payment link, which will make merchants’ operating information more complete, which is conducive to further progress. Analyze and improve their own operating efficiency and obtain external financial support.

For payment companies, the distinction between online and offline scenarios will be broken. Merchant services will still focus on offline attributes, but the services provided for them will not be limited to offline payments, which raises the overall technical capabilities of service providers. Requirements.

You must log in to post a comment.